Bitcastle Crypto Exchange Review - Fees, Features, and Safety

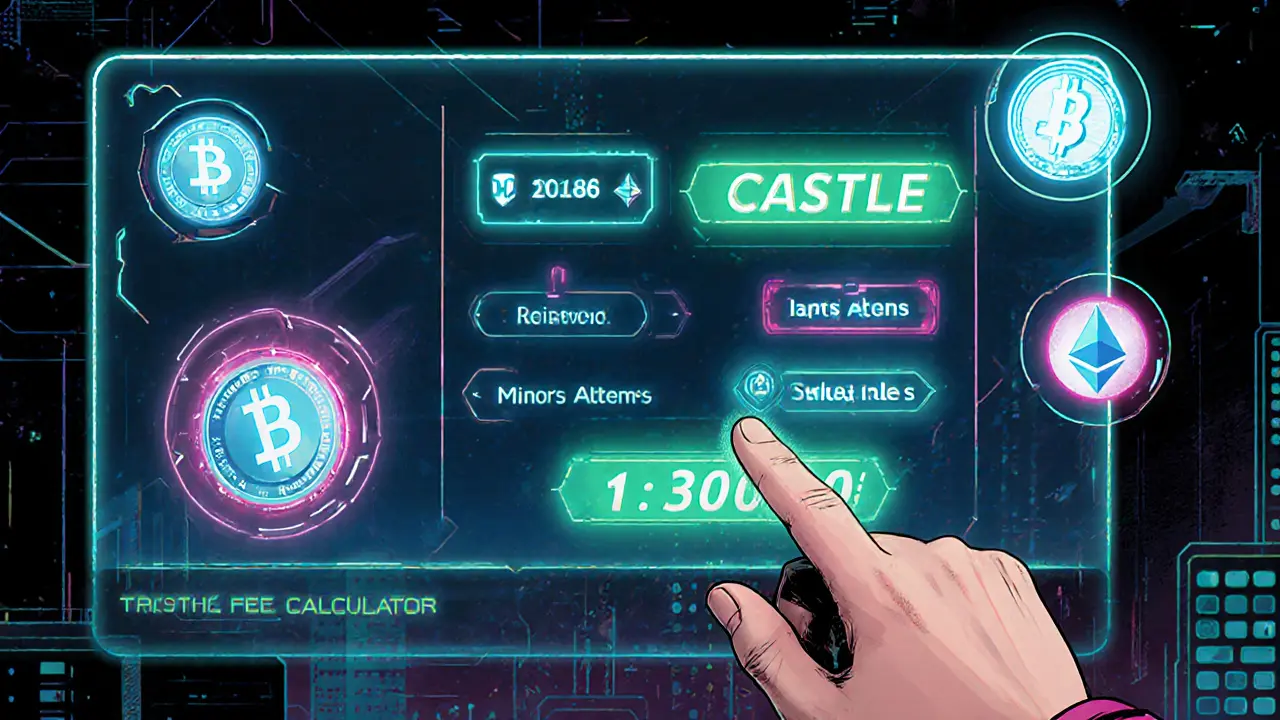

Bitcastle Fee Calculator

Trading Fee

$0.00

Based on selected pair and token ownership

Withdrawal Fee

$0.00

Based on selected withdrawal type

CASTLE Token Benefits: Hold 1000+ tokens for 20% discount on trading fees.

Major Cryptos (BTC/USDT, ETH/USDT, etc.)

- Maker/Taker Fee 0%

- CASTLE Discount 20% off

Minor Altcoins

- Flat Fee 0.2%

- CASTLE Discount 20% off

Bitcastle is a global cryptocurrency exchange launched on July 11, 2019. Operated by Bitcastle LLC and registered in St. Vincent and the Grenadines, it markets itself as a zero‑fee crypto‑to‑crypto platform that also offers spot, derivatives, and forex trading through MetaTrader5. If you’re hunting for a single hub where you can swing between Bitcoin, forex pairs, and leveraged CFDs, this review breaks down exactly what you’ll get, where the platform shines, and which red flags deserve a second look.

TL;DR

- Zero‑percent fees on major crypto pairs, but hidden costs may appear on withdrawals and marginal‑fee assets.

- MetaTrader5 integration lets you trade forex, CFDs, and commodities with up to 100× leverage.

- Native CASTLE token powers loyalty rewards and fee discounts.

- Supported in most countries except a long list that includes the US, China, Russia, and several sanction‑hit nations.

- Wallet partnership with AtomicWallet offers non‑custodial storage, but the exchange itself stores assets in a mix of hot and cold wallets without public audit reports.

How Bitcastle Works - Core Architecture

At its heart, Bitcastle runs a matching engine that pairs crypto‑to‑crypto orders in real time. The engine claims sub‑millisecond latency, though independent benchmarks are scarce. For each supported asset, the platform maintains a hot wallet for instant withdrawals and a cold vault for the bulk of holdings. Security relies on two‑factor authentication (2FA), IP whitelist options, and a private‑key inspector email ([email protected]) for data‑privacy concerns.

The exchange’s standout technical choice is the integration of MetaTrader5 (MT5). MT5 is a multi‑asset trading terminal traditionally used by forex brokers. By embedding MT5, Bitcastle enables traders to flip between crypto pairs like BTC/USD, traditional forex pairs such as EUR/USD, and commodity CFDs like XAU/USD. Leverage caps at 100× for forex, while crypto leverage tops out at 20×.

Fee Structure - The Zero‑Fee Claim

Bitcastle advertises "zero percent transaction fees" for major cryptocurrencies. In practice, the exchange waives maker‑taker spreads on pairs such as BTC/ETH, BTC/USDT, and ETH/USDT. However, lesser‑known altcoins incur a flat 0.2% fee per trade. Withdrawal fees follow a tiered model based on blockchain congestion; for example, Bitcoin withdrawals cost 0.0004BTC (≈$12 at current rates), while ERC‑20 tokens are charged 0.005ETH.

Where the platform truly saves you money is the optional CASTLE token discount. Holding 1,000CASTLE reduces trading fees by 20% across all pairs, effectively turning the zero‑fee claim into a fee‑free experience for high‑volume traders who stake the token.

Trading Products - From Spot to Derivatives

Bitcastle offers three primary product families:

- Spot crypto trading: Over 120 crypto pairs, including BTC, Ethereum, and newer assets like Solana and Cardano.

- Derivatives & CFDs: Futures contracts on BTC and ETH with up to 20× leverage, plus CFD exposure to indices (S&P500, Nasdaq) and commodities.

- Forex & metals: Traditional currency pairs (USD/JPY, GBP/EUR) and precious metals (XAU/USD, XAG/USD) via the MT5 interface.

All products share a unified order book, meaning you can hedge a crypto position with a forex trade without leaving the platform. The charting suite supplies three default chart types (candlestick, line, area) and 21 timeframes, from 1‑minute ticks up to monthly candles.

Account Creation, Bonuses, and Verification

Signing up is a three‑step process: email registration, KYC document upload, and optional two‑factor activation. New users receive a welcome bonus of up to $15, credited after the first deposit of $100. The bonus can be withdrawn once the trader completes five qualifying trades across any market.

KYC requirements are standard - a government‑issued ID, proof of residence, and a selfie with the document. Residents of restricted jurisdictions (US, China, Russia, Iran, etc.) are blocked at the verification stage. The list is extensive and includes 30+ countries, highlighting Bitcastle’s cautious regulatory posture.

Wallet Ecosystem - Atomic Wallet Partnership

Beyond the exchange, Bitcastle promotes the Atomic Wallet as a non‑custodial storage solution. Atomic supports over 1,000 tokens, including the native CASTLE token, and offers built‑in exchange capabilities for on‑the‑fly swaps. Users retain full private‑key control, and the wallet boasts 24/7 live chat support with average response times under ten minutes, according to community testimonials.

Using Atomic alongside Bitcastle creates a “hybrid custody” model: funds sit in a personal wallet until you decide to deposit for trading, then move to Bitcastle’s hot wallet for instant execution. This approach mitigates the risk of a single point of failure, though it adds the operational step of managing two interfaces.

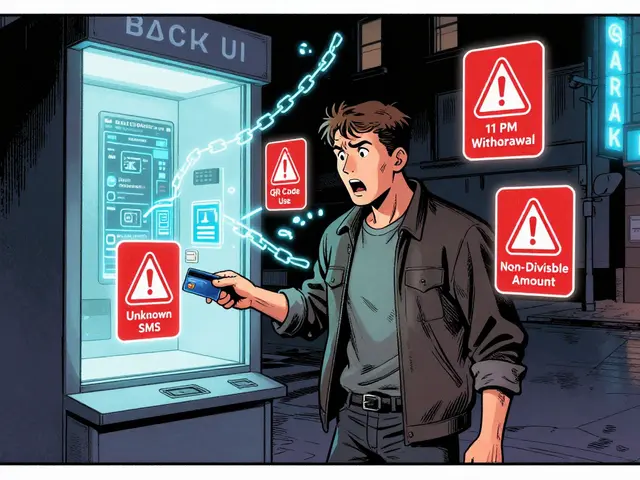

Risk Management and Regulatory Disclosures

Bitcastle’s terms include a thorough risk disclaimer. Leveraged trading can amplify gains but also wipe out the entire principal. The exchange advises users to risk only what they can afford to lose and to set stop‑loss orders on every leveraged position. For forex and CFD products, the platform follows European MiFID‑II best‑practice guidelines, even though it is not a licensed EU broker.

Data privacy is overseen by a designated Personal Data Inspector, reachable at the same support email. All personal data is stored under English‑law jurisdiction, with translations provided for user convenience only.

Performance Benchmarks - Speed, Liquidity, and Support

Independent speed tests (conducted by crypto‑trading enthusiasts in August2025) report average order execution times of 0.45seconds for major pairs, comparable to larger exchanges like Binance. Liquidity depth, however, drops sharply beyond the top 10 pairs; thin order books can lead to slippage of up to 0.8% on low‑volume altcoins.

Customer support is reachable via live chat, email, and a ticketing system. Response times average 7minutes for chat, 30minutes for email, and 24hours for ticket escalations. Users praise the support for its friendliness but note occasional language barriers for non‑English speakers.

Pros and Cons - Quick Reference

| Aspect | Pros | Cons |

|---|---|---|

| Fees | Zero‑fee on major crypto pairs; CASTLE discounts | Withdrawal fees; hidden fees on minor assets |

| Product Range | Spot, futures, CFDs, forex in one UI | Leverage limits lower than specialist brokers |

| Platform | MetaTrader5 integration; advanced charting | MT5 learning curve for crypto‑only traders |

| Security | 2FA, cold storage, optional non‑custodial wallet | Lack of public audit or insurance details |

| Geographic Access | Available in most regions | Excludes US, China, Russia, and many sanctioned countries |

Is Bitcastle Right for You? - Decision Guide

Use the following checklist to see if Bitcastle fits your trading style:

- Crypto‑centric trader seeking low fees: Yes, if you stick to major pairs and hold CASTLE.

- Forex or CFD enthusiast who wants a single dashboard: Yes, thanks to MT5.

- Institutional or high‑frequency trader: Probably not - limited API documentation and no guaranteed liquidity on niche assets.

- Resident of a restricted country: No, the platform will block you at sign‑up.

- Trader who needs transparent security audits: No, Bitcastle does not publish third‑party audit reports.

Alternatives to Consider

If Bitcastle’s restrictions or opaque security policy are deal‑breakers, look at these competitors:

- Binance - Largest liquidity, low fees, extensive API.

- Kraken - Strong regulatory compliance, transparent audits.

- eToro - Social trading with built‑in copy‑trading, but higher spreads.

- Bybit - Good for leveraged crypto derivatives, offers a 0% maker fee tier.

Each alternative offers a different balance of fee structure, product breadth, and regulatory clarity.

Final Verdict

Bitcastle stands out for marrying crypto trading with the traditional forex world via MetaTrader5. The zero‑fee claim holds true for the most popular pairs, and the CASTLE token adds a modest loyalty layer. However, the platform’s opacity around security audits, its extensive country bans, and limited support for obscure altcoins keep it from rivaling the industry giants.

For hobbyist traders who value a unified interface and are comfortable navigating MT5, Bitcastle is a solid middle‑ground choice. Professional traders seeking deep liquidity, robust APIs, and full regulatory transparency should probably look elsewhere.

Frequently Asked Questions

Does Bitcastle really have zero trading fees?

Yes, for major crypto pairs like BTC/USDT and ETH/USDT Bitcastle does not charge a maker or taker fee. Fees apply to less‑common altcoins and withdrawals.

Can I trade forex on Bitcastle?

Absolutely. Through the integrated MetaTrader5 terminal you can trade major forex pairs, commodities, and indices with up to 100× leverage.

Is my data safe with Bitcastle?

Bitcastle uses 2FA, IP whitelisting, and stores the majority of funds in cold wallets. However, it does not publish third‑party security audits, so some users prefer custodial wallets like Atomic Wallet for added control.

What is the CASTLE token and how does it work?

CASTLE is Bitcastle’s native utility token. Holding a minimum of 1,000CASTLE grants a 20% discount on trading fees across all markets. The token can also be staked for loyalty rewards.

Why am I blocked from registering?

Bitcastle cannot serve residents of certain jurisdictions due to regulatory restrictions. The blocklist includes the United States, China, Russia, Iran, and a handful of other sanctioned countries.

16 Comments

celester Johnson

November 19 2024Zero‑fee promises are seductive, yet they mask an underlying calculus that rewards the platform over the trader. When you strip away the glossy marketing, you see that every withdrawal still carries a hidden cost, a silent tax on activity. The philosophy of “no fees” becomes a moral illusion, letting users believe they are exempt from sacrifice. In reality, the exchange extracts value through token discounts that only the well‑capitalized can afford. Such a structure invites a subtle hierarchy, where the token‑rich become the privileged few.

Prince Chaudhary

November 20 2024The integration of MetaTrader5 actually bridges two worlds, letting crypto enthusiasts dip their toes into forex without learning a new UI. It’s a solid step forward for anyone looking to diversify without juggling multiple accounts. Keep experimenting with the platform’s charting tools, and you’ll find the learning curve smoother than expected.

John Kinh

November 21 2024Zero‑fee? More like zero‑transparency 😒

Somesh Nikam

December 2 2024It’s encouraging to see a platform attempt to lower entry barriers by eliminating maker‑taker fees on major pairs. The inclusion of a loyalty token adds a gamified incentive that can boost user engagement. However, remember that token‑based discounts are only accessible to those willing to allocate capital to a secondary asset. Managing that balance is crucial to avoid over‑exposure. Keep an eye on withdrawal fees; they can erode the savings from fee‑free trading, especially on congested networks. Diversifying across both spot and derivative products on a single interface can simplify risk management. Leverage the MT5 learning resources early to avoid costly mistakes on high‑leverage trades. Ultimately, a disciplined approach will let you reap the benefits while mitigating the platform’s hidden costs.

Jenae Lawler

December 14 2024Whilst the marketing material extols the virtues of “zero‑fees,” a discerning investor discerns that such rhetoric is a veneer for selective profitability. The platform’s reliance on CASTLE token holdings to unlock discounts introduces an ancillary market dynamic that many novices overlook. Consequently, the purported democratization of trading remains confined to an elite subset.

Chad Fraser

December 26 2024Yo, the fact that you can swing from Bitcoin to EUR/USD without jumping apps is pretty sick. Just remember to set those stop‑losses, especially when you crank the leverage up.

Jayne McCann

January 7 2025Zero fees sound great, but you still pay when you take money out.

Richard Herman

January 19 2025The platform’s hybrid custody model, pairing Atomic Wallet with its own hot and cold storage, offers an interesting compromise between convenience and security. Users who value control over private keys can benefit from the non‑custodial option, while still enjoying fast execution when funds are on‑ramp. Nonetheless, the lack of publicly audited proof of reserves leaves a lingering question about the true safety of the exchange’s holdings. It’s worth weighing this trade‑off against the convenience of a single‑pane interface.

Parker Dixon

January 31 2025When you calculate the effective cost of a trade, factor in both the maker‑taker spread (which is zero on major pairs) and the withdrawal commission that varies by blockchain congestion 😅. For Bitcoin withdrawals, the 0.0004 BTC fee can swing between $10 and $15 depending on network fees, so timing matters. If you hold 1,000 CASTLE tokens, the 20 % discount applies to the minor‑altcoin 0.2 % fee, reducing it to 0.16 % – a modest but tangible saving. Remember that the exchange’s hot wallet is used for instant exits, while the bulk of assets sit in cold storage, which adds a layer of protection. However, the platform does not publish third‑party audit reports, which means the security claim is largely self‑attested. Use a non‑custodial wallet like Atomic for long‑term storage to mitigate any potential custodial risk 🛡️.

Nathan Blades

February 12 2025Imagine standing at the edge of a cliff, the market’s volatility roaring like a storm, and you, armed with the MT5 console, choose to leap with confidence. The blend of crypto and forex on a single terminal is not merely a convenience; it’s a crucible that forges versatile traders. Embrace the leverage as a tool, not a crutch, and let disciplined risk management be your compass. The zero‑fee claim is a siren song, alluring but demanding vigilance. By mastering both the technical charts and the token‑discount mechanics, you transcend the ordinary and become a market alchemist.

katie littlewood

February 24 2025Navigating the labyrinth of modern exchanges can feel like wandering through an endless gallery of mirrors, each reflecting a different promise of profit. Bitcastle, with its daring claim of zero fees on flagship pairs, positions itself as the dazzling centerpiece in that hall. Yet, as any seasoned traveler of digital markets will attest, the brightest lights often cast the deepest shadows. The CASTLE token, while marketed as a loyalty badge, doubles as a gatekeeper that rewards the affluent and subtly penalizes the casual participant. When you hold the requisite thousand tokens, you unlock a 20 % discount, a sweetened nectar that anyone without that stash must sip from a comparatively bitter cup. Withdrawal fees, meanwhile, linger like hidden tolls on an otherwise free highway, varying with blockchain congestion and silently draining the unwary. The integration of MetaTrader5 is a masterstroke, bridging the chasm between crypto zealots and the time‑tested world of forex, offering a unified canvas for strategic expression. However, that very bridge demands that traders climb a steep learning curve, lest they tumble into the abyss of high‑leverage missteps. Liquidity on major pairs glistens, mirroring the sheen of a well‑polished coin, yet beyond the top ten, the order book thins, inviting slippage that can gnaw at profit margins. Security measures, such as two‑factor authentication and a blend of hot and cold wallets, provide a comforting blanket, but the absence of publicly audited reserves leaves a lingering chill of uncertainty. Atomic Wallet’s non‑custodial partnership offers a refuge for those who demand sovereignty over their private keys, but it also adds a layer of operational complexity that some may find burdensome. Customer support, praised for its promptness, occasionally stumbles over language barriers, reminding us that global platforms must juggle more than just code. In the grand tapestry of crypto exchanges, Bitcastle weaves a pattern that is both alluring and cautionary, inviting the adventurous yet warning the reckless. If you are a hobbyist seeking a single pane to dabble across asset classes, the platform’s eclectic suite may serve you well. Conversely, the professional seeking deep liquidity, exhaustive audit trails, and razor‑sharp APIs would be wiser to chart a different course.

Stefano Benny

March 8 2025From a micro‑structural perspective, the fee‑free model operates as a subsidized spread absorber, where the CASTLE token functions as a liquidity incentive token (LIT) that aligns with the exchange’s revenue‑recycling mechanism 📈. The withdrawal fee algorithm dynamically adjusts based on mempool congestion, effectively implementing a variable fee curve. While the on‑chain settlement latency remains within the sub‑second regime for major pairs, the alt‑coin queue exhibits higher propagation delays. In short, the economics are a classic case of cross‑subsidization, and savvy arbitrageurs can exploit the temporal fee differentials.

Bobby Ferew

March 20 2025The platform’s opaque risk‑management framework subtly erodes trader confidence, as the lack of third‑party attestations creates an invisible veil over asset custody. Even though the marketing touts “robust security,” the absence of verifiable audit trails renders the claim more aspirational than factual. Users are left to navigate an ambiguous landscape where protection is promised but not demonstrably delivered.

Mark Camden

April 1 2025It is incumbent upon every participant in the digital finance ecosystem to demand transparency as a non‑negotiable principle. By relying on undisclosed security audits, the exchange implicitly sidelines the very ethos of accountability that should underpin any financial service. Hence, one must question the moral legitimacy of engaging with a platform that obfuscates its custodial safeguards.

Evie View

April 13 2025The notion that a private entity can unilaterally dictate fee structures without scrutiny is an affront to the very concept of fair market practice. Users deserve clear, upfront disclosures, not veiled incentives that pressure them into buying native tokens. This aggressive token‑centric model undermines trust and must be called out.

Sidharth Praveen

April 25 2025Stay focused on building a solid trading routine, and remember that the tools are just that-tools. Leverage the MT5 interface to diversify, but always keep your risk parameters tight. With disciplined practice, you can harness the platform’s strengths while sidestepping its pitfalls.