Cougar Exchange Review: CGX Token & CougarSwap DEX Explained

Token Liquidity & Slippage Calculator

Risk Assessment Tool

See how low liquidity affects your token trades compared to major exchanges. Input your trade amount to estimate slippage and potential losses.

Results

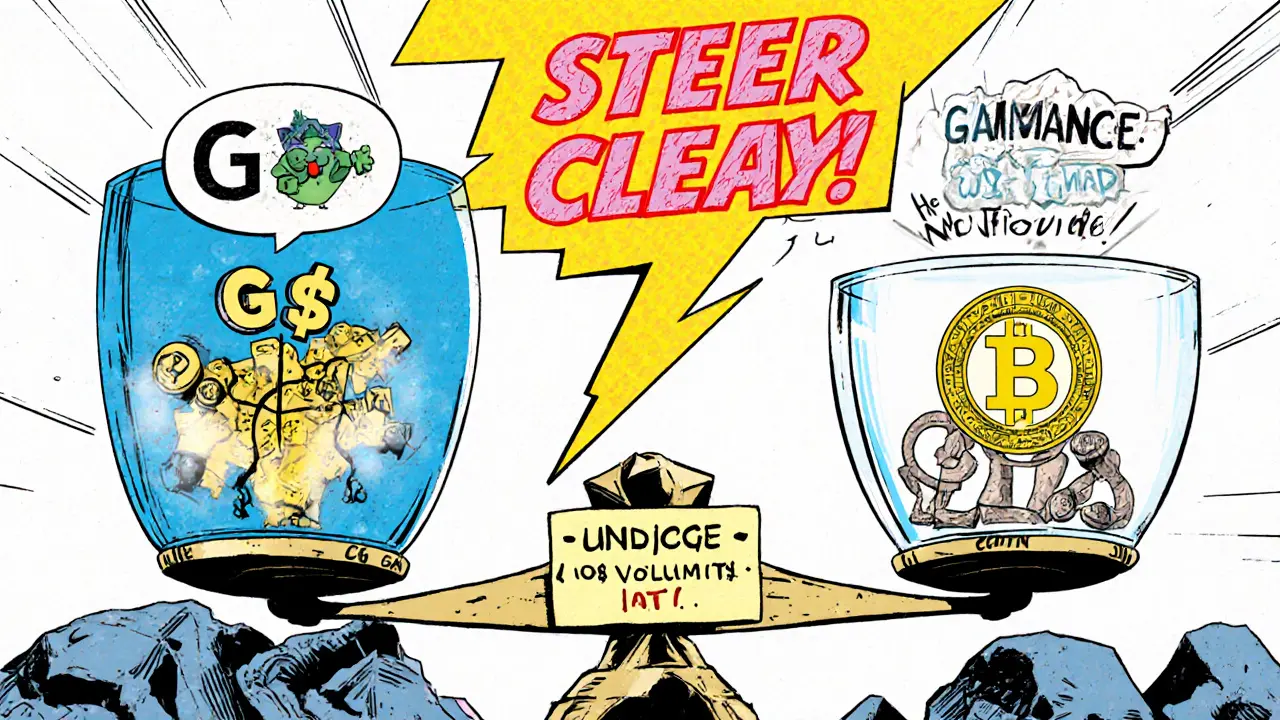

If you typed "Cougar Exchange" into Google expecting a full‑blown crypto trading platform, you probably got an odd mix of token charts and a few vague forum mentions. The reality is a bit messier: “Cougar Exchange” (CGX) is actually a token, while “CougarSwap” (CGS) is the name of a decentralized exchange that also issued its own token. This review untangles the two projects, checks what data is available, and tells you whether they’re worth a second glance.

What is Cougar Exchange (CGX)?

CGX is a cryptocurrency token listed on CoinCodex. It has a ticker symbol CGX and is marketed as a “exchange token” even though no exchange platform exists under that name. The token launched sometime before 2025, but as of October 24 2025 there is no historical price data longer than a few hours, which means price‑prediction algorithms can’t generate any meaningful forecasts. In plain English, you can’t see a price chart because there’s essentially no trading activity.

Key attributes of CGX (as of the latest snapshot):

- Symbol: CGX

- Listed on: CoinCodex (no other major aggregators)

- Market cap: below $1,000 (implied by omission from CoinMarketCap)

- Liquidity: effectively nil - no order books or volume data

- Team & documentation: none publicly available

What is CougarSwap (CGS)?

CougarSwap is a decentralized exchange (DEX) that supposedly lets users trade directly from their wallets. Its native token, CGS, is listed on CoinGecko with a live price chart, yet the chart shows an almost empty trading history. The DEX itself has no publicly documented smart‑contract address, no audited code, and no clear roadmap.

Key facts about CGS:

- Symbol: CGS

- Platform type: Decentralized exchange (DEX)

- Current price range (2025 projections from BitScreener): $0.00001948 - $0.03553

- Liquidity: extremely low; price swings of over 1,800× in a single year are predicted

- Security audits: none listed on CertiK, Slowmist, or similar services

Where do they stand in the broader market?

Compare the two projects with heavyweight players like Binance and Uniswap, and you’ll see just how marginal they are.

| Project | Type | Daily Volume | Market Cap | Liquidity Rating |

|---|---|---|---|---|

| Cougar Exchange (CGX) | Token only | ~$0 | < $1k | None |

| CougarSwap (CGS) | DEX token | ~$10‑$20 | ~$5k (est.) | Very low |

| Binance (BNB) | Centralized exchange token | $11.8 B | $40 B | High |

| Uniswap (UNI) | Decentralized exchange | $1.2 B | $7 B | High |

Even the tiniest reputable DEXs process millions of dollars daily. The numbers above make it clear that CGX and CGS barely register on any volume leaderboard.

Red flags and risk factors

When a token has no price history, no audit, and no active community, most analysts raise a warning flag. Here are the common concerns that appear in the few mentions of these projects:

- Lack of verifiable team. No LinkedIn, GitHub, or corporate page can be found.

- No liquidity pools. Without a substantive pool on platforms like Uniswap or PancakeSwap, any trade would cause extreme slippage.

- Absent security audits. CertiK’s 2025 Market Integrity Report labels tokens without audit trails as “high‑credibility risk.”

- Zero community chatter. A quick search yields no Reddit threads, Discord servers, or Trustpilot reviews.

- Algorithmic price predictions only. BitScreener’s range is generated by a model that admits it’s “learning” on scant data.

CoinDesk’s head of research, Noelle Acheson, warned in March 2025 that “low‑liquidity tokens are prone to price manipulation and often disappear without a trace.” Both CGX and CGS fall squarely into that warning box.

Can you actually use these assets?

Even if you manage to buy a handful of CGX or CGS tokens on a tiny peer‑to‑peer swap, you’ll hit a wall when trying to move them. No official wallet integration guide exists, and no exchange lists them under a standard trading pair (e.g., CGX/USDT). The only way to hold them today is via a generic ERC‑20 compatible wallet where you manually add the contract address-if you can even find that address.

For CougarSwap, the DEX UI is either offline or hidden behind a non‑public site. Without documentation, you can’t add liquidity, set fees, or confirm that the smart contracts are safe. In contrast, Uniswap’s open‑source router and clear fee structure make it simple for anyone to provide liquidity.

Bottom line: should you consider CGX or CGS?

If you’re hunting for a solid place to trade Bitcoin, Ethereum, or even niche altcoins, the answer is a flat no. The projects lack the essential ingredients of a functional exchange: active markets, audit‑verified code, and a community that can signal problems before they become scams.

That said, a speculative collector might buy a few tokens just to own a “first‑of‑its‑kind” NFT‑style meme coin. If you go that route, treat the purchase as a pure gamble-don’t allocate more than you can afford to lose.

In short, the only reasonable recommendation is to steer clear of Cougar Exchange (CGX) and CougarSwap (CGS) until they publish verifiable code, open credible liquidity pools, and attract a real user base. Until then, stick with proven platforms like Binance, Kraken, or reputable DEXs such as Uniswap.

Frequently Asked Questions

Is Cougar Exchange a real crypto exchange?

No. "Cougar Exchange" refers to a token (CGX) that markets itself as an exchange token, but there is no functional exchange platform behind it.

Can I trade CGX or CGS on major exchanges?

Currently, no major centralized or decentralized exchanges list CGX or CGS with sufficient liquidity. They appear only on niche trackers like CoinCodex and CoinGecko.

Are there any security audits for CougarSwap?

As of October 2025, no reputable audit firm (e.g., CertiK, SlowMist) has published a report on the CougarSwap contracts.

What’s the biggest risk of buying CGX?

The biggest risk is illiquidity. With virtually no trading volume, you may be unable to sell the token, or you could face extreme price slippage.

How can I check if a new token is trustworthy?

Look for a public team, audited smart contracts, listings on reputable aggregators, active community channels, and measurable daily trading volume. Absence of these signals should be a red flag.

15 Comments

Karla Alcantara

October 24 2025Even though the numbers look bleak, it’s good to see a review that actually pulls apart the details. It helps newcomers avoid the classic pitfalls of chasing low‑liquidity tokens. The clear tables make the comparison easy to digest. Let’s keep the conversation constructive and supportive.

Nick Carey

October 30 2025Looks like another dead token parade.

Laura Herrelop

November 6 2025The allure of obscure tokens often masks deeper uncertainties. When liquidity evaporates, price becomes a mere illusion, swayed by the slightest trade. Without a public roadmap, developers hide behind anonymity, leaving investors to wonder who is really pulling the strings. Trust in crypto hinges on verifiable code, and here that cornerstone is missing. The absence of audits is not just a red flag; it is a warning siren blaring in a silent market. Illiquid pools mean any attempt to sell can trigger catastrophic slippage, effectively locking your funds. Moreover, the lack of a community makes it impossible to gather collective intelligence or warnings. In the broader ecosystem, projects survive by building ecosystems, not by existing in a vacuum. The data presented shows daily volumes that barely register on a calculator, underscoring the token’s marginal relevance. Manipulation becomes trivially easy when only a handful of wallets hold the majority of supply. Regulatory bodies have repeatedly highlighted such scenarios as breeding grounds for scams. Even seasoned traders treat these tokens as speculative curiosities rather than serious assets. The psychological draw of "first‑of‑its‑kind" can cloud rational assessment, leading to impulsive buying. Ultimately, the risk–reward ratio skews heavily toward loss, making it a gamble that most should avoid. If you do venture in, treat every unit as a loss limit, not an investment.

Nisha Sharmal

November 12 2025Oh, you’re worried about liquidity? That’s cute. The market doesn’t care about your cute worries.

Petrina Baldwin

November 18 2025I’d skip this mess.

Ralph Nicolay

November 25 2025The analysis presented adheres to standard due‑diligence methodology, referencing publicly available data and reputable aggregators. It systematically addresses liquidity, audit status, and community presence, which are essential metrics for token evaluation. By juxtaposing CGX and CGS against industry leaders, the review highlights the stark disparity in market relevance. Such a structured approach provides readers with a clear framework for assessing similar low‑profile projects.

sundar M

December 1 2025Wow, great breakdown! Let’s keep the community informed and protect each other from dubious schemes.

Peter Schwalm

December 7 2025If you’re still curious, start with a tiny exposure and always verify the contract address on a trusted explorer. Monitor the transaction fees and be ready to pull out at the first sign of abnormal slippage. Remember, risk management is key when dealing with micro‑cap tokens.

Alex Horville

December 14 2025Anyone who buys this is just throwing money at a scam-stay away!

Edwin Davis

December 20 2025Seriously!!!! This is exactly why we need regulation!!!

emma bullivant

December 26 2025i think the real question is not can we trade but why we even consider it.

Michael Hagerman

January 2 2026This token story reads like a horror movie, but reality is even scarier.

monica thomas

January 8 2026In summary, the lack of audits and liquidity makes it unsuitable for investment.

Natasha Nelson

January 15 2026Stay sharp, stay safe, and keep learning!

Sarah Hannay

January 21 2026Your thorough review is appreciated; it serves as a valuable reference for the community.