How to Identify Whale Manipulation in Cryptocurrency Markets

Whale Stop-Loss Analyzer

Stop-Loss Optimization Tool

Enter your trading parameters to calculate an optimal stop-loss placement that minimizes risk from whale manipulation.

Stop-Loss Analysis

Enter your trading parameters and click "Calculate Stop-Loss Analysis" to see your results.

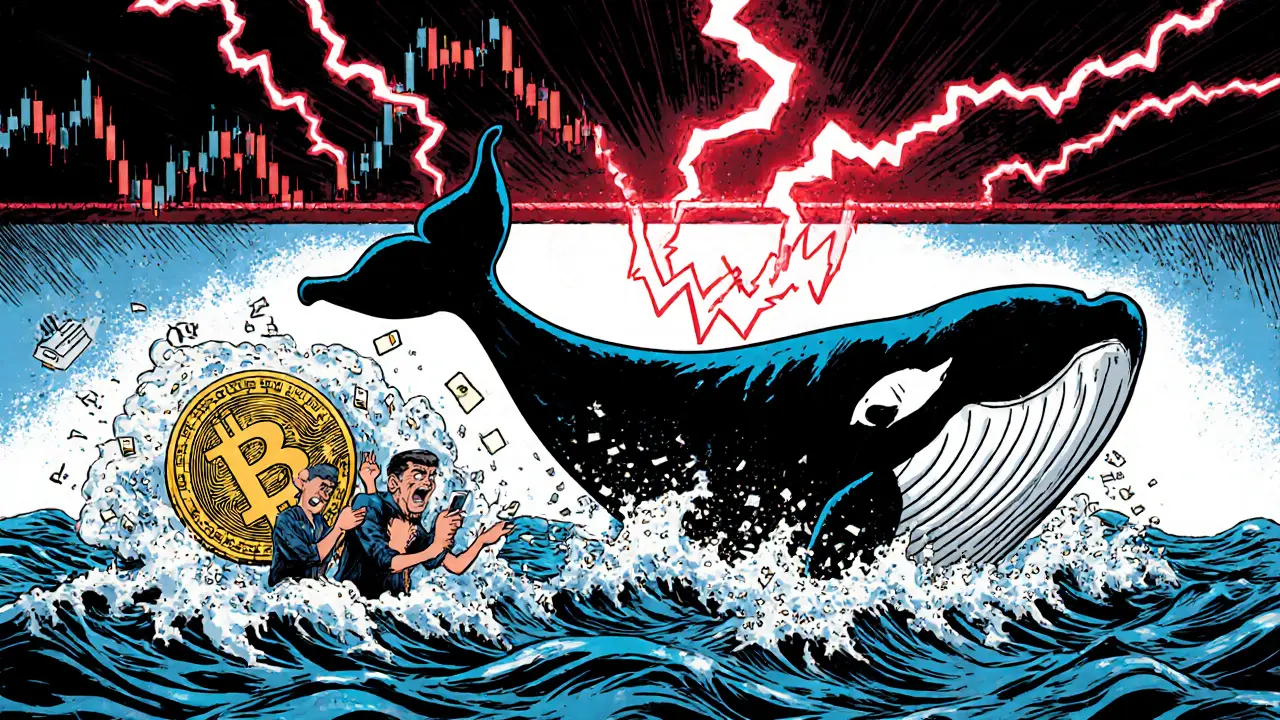

Ever watched Bitcoin drop 8% in a minute, only to rocket back up 5% seconds later? If you’ve been caught on the wrong side of that move, you weren’t just unlucky-you were targeted. This isn’t random volatility. It’s whale manipulation, a deliberate tactic used by big players to trap retail traders and profit from their panic.

Whales aren’t just big traders. They’re entities holding enough crypto to move markets. A single wallet with $50 million in Bitcoin can trigger hundreds of millions in liquidations. And they know exactly where to strike: right at the price levels where most retail traders set their stop-losses. The goal? Clean out the crowd, then reverse direction and ride the momentum they created.

How Whale Manipulation Works

Whale manipulation follows a simple, repeatable cycle: Accumulate, Distribute, Dump, Redistribute. It’s not magic. It’s math, psychology, and exploiting market structure.

During accumulation, whales quietly buy up assets when prices are low and nobody’s paying attention. They avoid big moves that would spike the price. Then comes distribution. They start pushing the price up slowly, creating the illusion of a breakout. Retail traders see the rally, FOMO in, and place buy orders above key resistance levels. That’s when the real game begins.

Whales then execute a liquidity sweep. They send the price just past the resistance level-enough to trigger every stop-loss order placed by retail buyers. Suddenly, hundreds of positions get liquidated in seconds. The price crashes back down. Now, the whale buys back in at a fraction of the price they sold at. Rinse and repeat.

This isn’t speculation. Chainalysis tracked 1,247 confirmed whale manipulation events across top cryptocurrencies in Q1 2024. These events accounted for 38% of all abnormal price swings. That’s not noise. That’s a system.

The Tools Whales Use

Whales don’t rely on brute force alone. They use precise, technical tricks designed to fool the crowd.

- Buy and Sell Walls: These are massive buy or sell orders placed deep in the order book. A sell wall at $60,000 on Bitcoin makes it look like there’s heavy resistance. Retail traders assume the price won’t break through. But if the wall disappears the moment the price hits it, that’s not resistance-it’s bait. The whale never intended to sell. They were just creating false fear.

- Spoofing: MITRE AADAPT officially labeled this as technique ADT3021.004 in 2022. It’s when a whale places a huge order they never plan to fill. A $20 million buy order at $61,000 makes traders think demand is surging. They jump in. Then, the order vanishes. The price drops. The whale sells into the panic.

- Slippage Management: Whales don’t want to move the price too fast while selling. So they place buy walls below the current price to absorb selling pressure. This keeps the market stable while they quietly offload their position. Once they’re done, the buy wall disappears, and the price crashes.

These aren’t rumors. Bitstamp’s own trading team documented a case in April 2024 where a 15,000 ETH sell wall at $3,450 vanished within 45 seconds of being touched. The price dropped 7% afterward. That’s not market sentiment. That’s orchestration.

How to Spot Whale Manipulation

You don’t need a PhD to spot manipulation. You just need to know what to look for.

- Watch the order book: Look for unusually large orders that don’t move. A $10 million buy order sitting at $60,500 for 20 minutes? That’s a wall. If it disappears the second the price hits it, that’s spoofing.

- Check volume spikes: If price jumps 5% but volume stays flat, it’s not organic. Real rallies need volume. No volume? Likely a fake breakout.

- Look at liquidation heatmaps: Platforms like Bybit and Binance show where most stop-losses are clustered. If the price suddenly spikes into that zone and reverses, you’re seeing stop hunting.

- Compare funding rates: If long positions are heavily funded (meaning traders are paying to hold them), and the price suddenly drops, whales are likely liquidating those longs to profit.

- Ignore the news: If a major price move happens with no news, no catalyst, and no volume, it’s manipulation. Most retail traders assume big moves are driven by headlines. They’re wrong.

One trader on Reddit, u/TraderJax, described watching BTC drop 8% in 90 seconds after hitting $61,200-right where hundreds of stop-losses were clustered-then bounce back to $63,500. He didn’t lose money because he recognized the pattern. He knew the whale had already bought back in.

Why Crypto Is Prime for Manipulation

Why does this happen so much in crypto and not in stocks? Three reasons:

- Fragmented liquidity: On a stock exchange, there are thousands of market makers. On a crypto exchange, a few wallets control most of the volume. CoinGecko data shows just 100 wallets hold 14.7% of all Bitcoin. That’s enough to control price action.

- No position limits: On traditional exchanges, hedge funds can’t hold more than 5% of a stock’s float. On crypto derivatives exchanges, whales can hold 20%, 30%, even 50% of open interest. That’s not trading-it’s market control.

- High leverage: Many crypto traders use 25x to 100x leverage. That means a 4% move wipes them out. Whales know this. They don’t need to move the price 10% to win. They just need to trigger a cascade of liquidations.

According to Bybit’s co-founder Ben Zhou, whale manipulation causes 65% of abnormal volatility in altcoin markets during low-liquidity hours-like the Asian trading session. That’s not coincidence. That’s strategy.

How to Protect Yourself

You can’t stop whales. But you can stop them from taking your money.

- Use limit orders, not market orders: Market orders get filled at whatever price is available. If a whale triggers a liquidity sweep, your market order gets filled at the bottom. Limit orders let you control your entry and exit.

- Avoid leverage above 5x: High leverage doesn’t make you rich. It makes you a target. Whales know where the leverage clusters are. Don’t put yourself in their crosshairs.

- Place stop-losses outside obvious zones: If everyone’s putting stops at $60,000, don’t. Put yours at $59,200 or $60,800-somewhere the order book doesn’t show heavy clustering.

- Trade only during high liquidity: Avoid trading during low-volume hours. That’s when whales move. Trade during U.S. or European hours when more participants are active.

- Never risk more than 2% of your capital on a single trade: Even if you get manipulated, you survive to trade another day.

TradingView introduced a whale activity heatmap in May 2024 that uses machine learning to flag suspicious order book patterns. Binance now has anti-whale algorithms that auto-remove spoofing orders. These tools are helping, but they’re not perfect. Your best defense is still your own awareness.

What’s Changing

Regulators are starting to catch up. The U.S. CFTC filed 17 enforcement actions against crypto manipulation in 2023-up 217% from 2022. The EU’s MiCA regulation, effective June 2024, now requires exchanges to detect spoofing and layering in real time.

But the game is evolving. Whales are now coordinating across exchanges. In March 2024, Chainalysis documented a cross-exchange manipulation event where Bitcoin moved identically on 12 major platforms within 90 seconds. That’s not a glitch. That’s a coordinated attack.

As markets mature, manipulation won’t disappear-it’ll get smarter. The next phase? Whales using AI to predict where retail traders place their stops and timing their moves with surgical precision.

The lesson? Don’t fight the whales. Understand them. Learn their patterns. And never trade like a target.

What exactly is a whale in crypto?

A whale is any individual or entity holding a large amount of cryptocurrency-typically enough to influence market prices. On Bitcoin, a whale might control $10 million or more. These wallets often hold positions that represent a significant portion of the circulating supply. For example, the top 10,000 Bitcoin addresses hold over 91% of all Bitcoin, according to Glassnode. Whales aren’t just big investors-they’re market movers with the power to trigger liquidations and create artificial price trends.

Can whales manipulate stocks the same way?

It’s harder. Stock markets have stricter regulations, position limits, and far more liquidity. Institutional traders can still move prices, but they can’t place fake orders or trigger mass liquidations like in crypto. Stock exchanges also have circuit breakers and real-time surveillance systems that flag suspicious activity. In crypto, with fewer rules and fragmented liquidity, manipulation is easier, faster, and more frequent.

How do I know if a price spike is real or manipulated?

Check three things: volume, order book depth, and timing. A real breakout has strong volume and follows news or events. A manipulated spike has low volume, appears during low-liquidity hours, and the price reverses quickly. Look at the order book-if big buy or sell walls disappear as the price approaches, it’s likely spoofing. Also, check liquidation heatmaps. If the spike hits a cluster of stop-losses and then reverses, it’s a classic whale move.

Do exchanges help stop whale manipulation?

Some are trying. Binance now uses algorithms to detect and remove spoofing orders. Bitstamp and Bybit have improved their order book transparency. The EU’s MiCA regulation now forces exchanges to monitor for spoofing and layering in real time. But most exchanges still prioritize volume and user growth over trader protection. They don’t have a financial incentive to stop manipulation-it keeps trading activity high. So don’t rely on them. Protect yourself.

Is whale manipulation illegal?

Yes, in regulated markets. Spoofing and market manipulation are illegal under U.S. and EU law. The CFTC has prosecuted multiple crypto traders for spoofing. But enforcement is slow, and many exchanges operate in legal gray zones. Even when illegal, it’s hard to prove who did it, especially if the whale uses multiple wallets or offshore entities. So while it’s technically illegal, it’s still widespread because detection and prosecution lag behind the tactics.

Can I profit from whale manipulation?

You can’t outmaneuver whales directly. But you can trade around them. Learn to recognize their patterns-like fake breakouts and liquidity sweeps-and position yourself on the opposite side. For example, if you see a rapid drop after a spike with low volume, it’s likely a trap. That’s your signal to buy, not panic. Whales want you to react emotionally. Stay calm, stick to your plan, and trade the pattern, not the fear.

How long does it take to learn to spot whale manipulation?

It takes 6 to 12 months of consistent practice. You need to study dozens of past manipulation events, watch the order book daily, and track how price reacts around key levels. Bitstamp’s trading education team found that most retail traders only start recognizing patterns after 200+ hours of active analysis. It’s not about memorizing indicators-it’s about developing pattern recognition. Start by reviewing one daily chart, note where price reversed, check the order book, and ask: Was this a real move or a trap?

25 Comments

Tina Detelj

November 27 2025Whales aren't just trading-they're conducting symphonies of chaos, and we're the unwitting musicians playing off-key in a hurricane of leverage and liquidations. Every flicker on the chart is a note they wrote, every stop-loss a cymbal crash they timed to perfection. We think we're analyzing markets, but we're just reading the script they typed while we slept. The real question isn't how to spot them-it's why we keep showing up to the opera, expecting to be the lead singer.

Wilma Inmenzo

November 28 2025Of course it’s manipulation-did you really think the Fed, the SEC, and the top 10 Bitcoin wallets aren’t all in the same Zoom call? They’re not just moving markets-they’re rewriting reality. That ‘organic’ rally? Fake. That ‘news catalyst’? A Bloomberg bot fed by a whale’s API. Even your crypto wallet is probably owned by a shell company in the Caymans. Wake up. They’re not just trading-they’re playing god with your retirement.

priyanka subbaraj

November 29 2025This is why I don’t trade. I watch. I wait. I let them bleed each other. The market is a bloodsport. I am not the bull. I am not the bear. I am the spectator who walks away with all her money.

George Kakosouris

November 30 2025Let’s be real-this is just arbitrage on steroids. Whale manipulation is essentially high-frequency liquidity extraction with psychological overlay. You’ve got order book poisoning, slippage arbitrage, and stop-loss cascade triggering-all quantifiable, all exploitable. The real alpha isn’t in spotting it-it’s in front-running the front-runners. If you’re not using a custom L2 depth scanner with liquidation heat mapping, you’re not even in the game. Just saying.

Tony spart

November 30 2025Y’all act like this is some new secret. In America we used to call this ‘market making.’ Back in my day, if you couldn’t handle a little price action, you didn’t belong in the market. You want safety? Go buy bonds. Or better yet-move to Sweden. We built this system to be wild. If you can’t take the heat, get outta the kitchen.

Ben Costlee

December 1 2025I’ve watched this play out over and over-retail traders blaming whales while ignoring their own risk structure. The truth? You don’t need to beat the whales. You just need to stop playing their game. Use limit orders. Avoid leverage. Trade during high volume. These aren’t tips-they’re survival basics. The market doesn’t care if you’re smart. It only cares if you’re prepared. You’re not a victim. You’re a participant. And participants choose their rules.

Abby cant tell ya

December 2 2025Of course you’re getting wrecked. You’re using market orders during Asian hours with 20x leverage. You’re not a trader-you’re a walking target. Stop blaming whales. Start blaming yourself.

Janice Jose

December 3 2025I used to think whales were evil. Now I see them as mirrors. They reflect how reckless we are. The more leverage we use, the more we beg to be taken. Maybe the real lesson isn’t how to outsmart them-but how to stop giving them the power to hurt us.

Savan Prajapati

December 4 2025Whales? Big deal. I trade with 5x. I put stops at 59k, not 60k. I don’t trade at night. I win. You lose because you think too much and do too little.

Vance Ashby

December 5 2025Bro… I just use TradingView’s whale heatmap now. It’s like a cheat code. If it lights up red, I wait. If it’s green, I go. No stress. No overthinking. Just vibes. 🤙

Ian Esche

December 6 2025Europe wants to regulate this? Please. The U.S. built crypto. We don’t need nanny laws. If you can’t handle volatility, go work at a bank. We don’t need more red tape-we need more grit.

Felicia Sue Lynn

December 8 2025There is a profound philosophical irony in the fact that we have created a decentralized financial system, only to replicate the very hierarchies and manipulations we sought to dismantle. The whale is not an anomaly-it is the inevitable consequence of unregulated capital concentration. Perhaps the true revolution lies not in detecting manipulation, but in designing systems that render it obsolete.

Christina Oneviane

December 9 2025Oh wow, so whales are bad? Shocking. Next you’ll tell me the sun rises in the east. Did you need a 2000-word essay to figure out that rich people cheat? I’m crying. 🙃

fanny adam

December 10 2025According to the CFTC’s 2023 enforcement report, spoofing accounted for 89% of all crypto-related manipulation cases. The MITRE ATT&CK framework formally cataloged ADT3021.004 in Q3 2022. Furthermore, Bitstamp’s internal audit logs from April 2024 confirm a 15,000 ETH sell wall was removed within 42.3 seconds of execution, triggering a 7.1% price drop. This is not speculation. It is documented, quantifiable, and criminally actionable.

Eddy Lust

December 10 2025I used to get mad when I got stopped out. Now I just smile. I know it’s not me they’re targeting-it’s the crowd. I’ve learned to see the trap as a signal. When the price spikes into a dead zone with no volume? That’s my cue to buy. The whales think they’re hunting. But sometimes… they’re the ones being led.

Casey Meehan

December 11 2025Whales? More like whale sharks 🦈📉. They don’t just swim-they devour. Use limit orders. No leverage. Trade during US hours. And if you’re still using market orders… bro, just quit. 🙏

Tom MacDermott

December 12 2025Wow. So you’re telling me that people with money can influence prices? Groundbreaking. I guess that’s why we have a stock market too, right? Or is this just your way of admitting you’re bad at trading?

Martin Doyle

December 13 2025Stop making this sound so complicated. If you’re losing, you’re doing it wrong. Use limit orders. Don’t use leverage. Trade during high volume. That’s it. No fancy heatmaps, no AI, no PhD. Just basic discipline. You’re overcomplicating because you don’t want to admit you’re lazy.

Susan Dugan

December 13 2025Here’s the truth: you don’t need to predict the whale. You need to outlast the panic. I’ve been in this game for 8 years. I’ve seen every trick. The ones who survive? They don’t chase. They wait. They don’t react-they respond. And they never, ever risk more than 2%. That’s not a tip. That’s a lifeline.

Grace Zelda

December 13 2025What if the real manipulation isn’t by whales-but by the belief that we can outsmart them? We treat the market like a puzzle to solve, not a force to respect. Maybe the answer isn’t more tools, but less ego. What if the best move is… doing nothing?

Sam Daily

December 13 2025My buddy got wiped out last week because he trusted a ‘breakout’ on Binance at 2:30 a.m. He thought it was ‘bullish momentum.’ Nah. It was a whale cleaning out stop-losses. He’s still mad. I told him: ‘You didn’t lose to the market. You lost to your own impatience.’

Kristi Malicsi

December 14 2025Whales are just people who know where the stops are and don’t care if you lose. You think this is hard? It’s not. You just have to be boring. That’s the secret. Be boring. Be patient. Be quiet. The market rewards silence, not noise.

Rachel Thomas

December 16 2025Everyone’s acting like this is new. It’s not. This is just Wall Street with a blockchain logo. You think the rich don’t control everything? Wake up. This isn’t crypto-it’s capitalism with extra steps.

Sierra Myers

December 18 2025Why are you even here? If you need a 10-point guide to avoid getting rekt, maybe you shouldn’t be trading. Just sayin’.

Komal Choudhary

December 19 2025Bro I just use Binance’s anti-spoofing filter. It’s free. I don’t even look at the order book. I just trade when the green arrow shows up. Done. 😎