How Venezuela Uses Crypto to Bypass U.S. and EU Sanctions

When Venezuela’s economy collapsed under hyperinflation and U.S. sanctions, the government didn’t just look for help-it built its own financial system. And it used cryptocurrency to do it. Not as a side experiment. Not as a hobbyist trend. But as a full-blown, state-run workaround to cut off the financial noose tightening around its oil exports and government funds.

The PETRO: A Sanctions-Busting Experiment

In 2018, Venezuela launched the PETRO, the world’s first national cryptocurrency backed by oil reserves. Officially, it was sold as a way to fight inflation and attract foreign investment. But behind the rhetoric, the goal was clear: bypass U.S. and European sanctions that had frozen Venezuela out of the global banking system. The U.S. Treasury’s Office of Foreign Assets Control (OFAC) didn’t buy it. They called the PETRO an extension of Venezuelan government debt-something U.S. citizens and companies were banned from touching. That didn’t stop the regime. The PETRO became less a currency and more a tool: a digital token used to move value between allies, hide oil revenue, and avoid detection. The PETRO never took off as a public currency. Few people outside Venezuela trusted it. But inside, it became a bridge. It connected state-owned companies like PDVSA (the national oil giant) to crypto exchanges that operated under government control. And those exchanges? They weren’t just businesses. They were enforcement arms.State-Controlled Exchanges: The Real Infrastructure

Venezuela authorized seven crypto exchanges to operate legally. One of them, Criptolago, is owned by the state of Zulia and run by Governor Omar Prieto-who’s personally sanctioned by the U.S. for blocking humanitarian aid. That’s not a coincidence. It’s the design. These exchanges aren’t like Coinbase or Binance. They don’t require KYC. They don’t report to international regulators. They’re gateways. Oil gets sold. Money gets turned into Bitcoin or USDT. And then it flows out. The U.S. Department of Justice exposed this in October 2022. Five Russian nationals were indicted for helping PDVSA launder money through crypto. Their method? Ship-to-ship oil transfers in international waters, then crypto payments routed through Venezuelan exchanges. No bank accounts. No paper trail. Just blockchain addresses. The key? Stablecoins. Specifically, Tether (USDT). Because Bitcoin’s price swings too much for a government trying to move millions. USDT, pegged to the U.S. dollar, acts like digital cash. It’s easy to send, hard to trace, and widely accepted-even on platforms that claim to block sanctioned users.How Ordinary Venezuelans Got Caught in the Crossfire

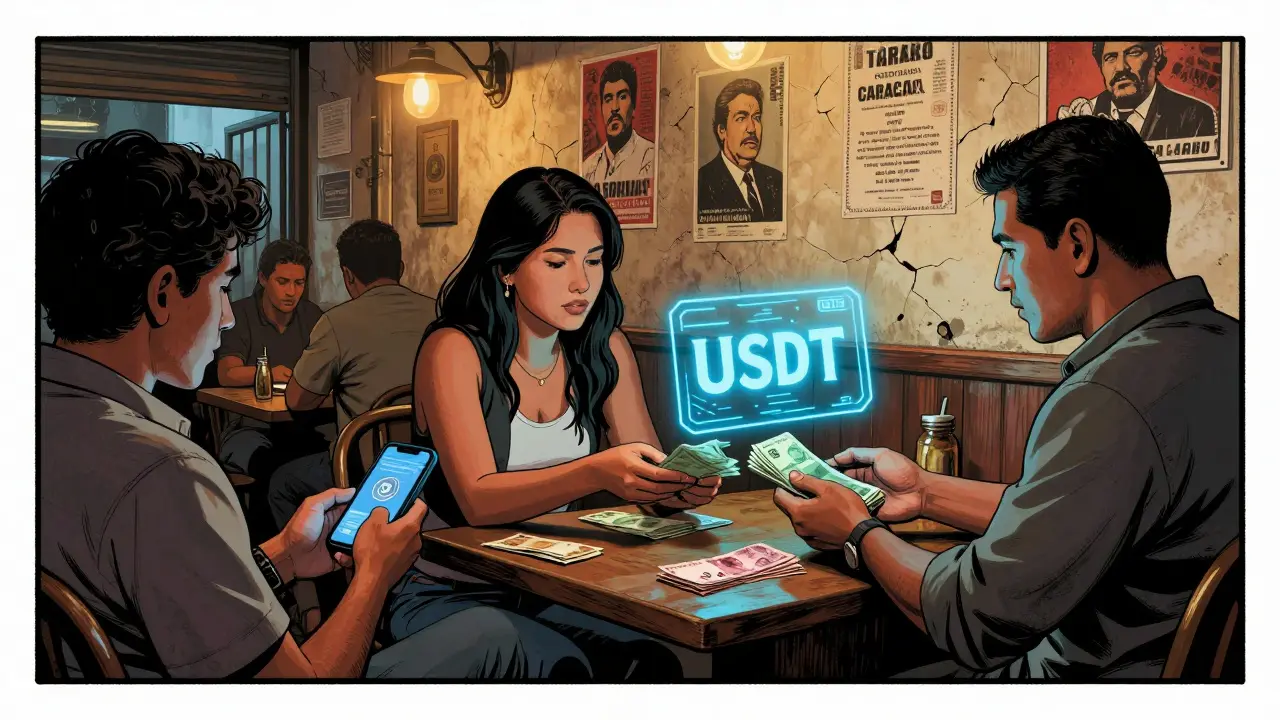

It’s not just the regime using crypto. Millions of ordinary Venezuelans are using Bitcoin and USDT to survive. When your salary is worth less than a loaf of bread after a week, you don’t wait for the government to fix it. You find a way. Many turned to crypto. They use local OTC brokers-people sitting in cafes or storefronts in Caracas-to swap cash for Bitcoin. They send money to family abroad. They buy medicine online. They preserve what little wealth they have. But here’s the catch: the same system that helps a mother buy insulin also helps a general move oil profits. And that’s what makes it so hard for banks and crypto platforms to tell the difference. Financial institutions now avoid any transaction linked to Venezuela. Even if the sender is a student in Maracaibo sending $50 to a cousin in Miami, the risk is too high. One flagged transaction can mean a multi-million dollar fine. So many platforms just shut down Venezuelan accounts entirely.

Why Crypto Works Better Than Old-School Sanctions Evasion

Before crypto, sanctioned countries relied on shell companies, third-country banks, and barter deals. It was slow. Expensive. Easy to track. Crypto changed that. It’s direct. It’s fast. It doesn’t need a bank. A Venezuelan official can receive a payment from a Russian trader, and within minutes, the money is in a wallet they control. No SWIFT code. No correspondent bank. No paper trail. Experts from Chainalysis and the Foundation for Defense of Democracies agree: Venezuela turned crypto into a systematic economic policy. Not a hack. Not a loophole. A full infrastructure. Other sanctioned nations-Russia, Iran, North Korea-have watched closely. Russia started exploring crypto for oil payments after its 2022 invasion of Ukraine. But Venezuela did it first. And they did it at scale.The Global Ripple Effect

This isn’t just a Venezuela problem. It’s a global one. Transnational criminal networks have picked up on the model. Hezbollah-linked money launderers are now using USDT to move funds between Venezuela, Syria, and Iran. The Israeli counterterrorism unit has flagged this pattern. The U.S. Treasury has added Venezuelan OTC brokers to its sanctions list. Even in Latin America, where crypto adoption is growing for legitimate reasons, Venezuela’s shadow looms large. Banks in Colombia, Peru, and Brazil are now scanning transactions for signs of Venezuelan-linked crypto flows. They’ve learned to watch for:- Large USDT transfers from Venezuelan OTC brokers

- Transactions tied to PDVSA-related addresses

- Wallets that send crypto to both personal accounts and oil-linked entities

23 Comments

Earlene Dollie

December 20 2025I just can't believe how people still act like sanctions are moral

Like you're saving lives by starving a whole country

Meanwhile the rich just laugh and buy more yachts

Dusty Rogers

December 21 2025This is the most realistic take on crypto sanctions I've seen. No fluff. Just how it actually works. The state-run exchanges are the real story.

Kevin Karpiak

December 23 2025Venezuela is a failed state. Crypto won't fix that. Stop romanticizing tyranny.

chris yusunas

December 23 2025Man this is wild. In Lagos we use crypto to dodge forex limits. But this? This is next level. A whole nation building a parallel economy. Respect the hustle

Naman Modi

December 25 2025Lmao so now crypto is evil when the bad guys use it? Funny how that works

Brian Martitsch

December 26 2025The PETRO was a joke. A poorly executed PR stunt. Real crypto is decentralized. This is just state propaganda with blockchain branding.

Rebecca F

December 27 2025It's tragic. The people are suffering. The regime is thriving. And we're all just watching while the banks freeze accounts like it's a video game

Rachel McDonald

December 27 2025I cried reading about the mom buying insulin. That’s the real crypto revolution. Not the oil deals. Not the sanctions. Just a mother trying to keep her kid alive.

Vijay n

December 28 2025This is all a deep state psyop to justify more military spending. The PETRO is fake. The USDT flows are fabricated by intel agencies. You think they want us to know this?

Alison Fenske

December 30 2025I used to think crypto was just for tech bros. Now I see it as a lifeline. Like a secret language only the desperate can speak. And we're trying to silence it

Grace Simmons

December 31 2025The use of state-controlled exchanges to launder oil revenue constitutes a direct violation of international financial norms. This must be addressed with coordinated multilateral action.

Collin Crawford

January 1 2026You're all missing the point. This isn't about sanctions. It's about the collapse of the dollar's hegemony. Venezuela is the canary in the coal mine. And you're still sleeping.

Jayakanth Kesan

January 1 2026Honestly? I'm glad someone found a way. If my country collapsed tomorrow, I'd be doing the same. No judgment. Just survival.

Aaron Heaps

January 1 2026So let me get this straight. You're okay with a dictatorship using crypto to fund repression, but mad when banks freeze accounts? That's not empathy. That's moral laziness.

Tristan Bertles

January 1 2026This isn't about good guys vs bad guys. It's about systems failing people. Crypto is just the tool that slipped through the cracks. We need better systems, not more bans.

Megan O'Brien

January 2 2026The blockchain analytics angle is underexplored. We're talking about on-chain surveillance capitalism at scale. This is the future of financial control.

Amit Kumar

January 3 2026In India we call this 'jugaad' - making do with what you have. Venezuela didn't invent crypto. They invented survival with what the world threw away. That's genius, not crime

Helen Pieracacos

January 4 2026Oh so now we're supposed to applaud dictators for being tech-savvy? How progressive.

Dustin Bright

January 4 2026this made me cry 😭 i have a cousin in venezuela. she sends me screenshots of her crypto wallet like its a diary. she says its the only thing keeping her sane

Melissa Black

January 5 2026The paradigm shift here is structural. We are witnessing the decentralization of sovereign financial power. Traditional sanctions are becoming obsolete. The architecture of control is being rewritten in code.

Mmathapelo Ndlovu

January 6 2026I'm from South Africa. We know what it's like to be cut off. Crypto isn't the problem. The world's refusal to see people as human is. 💙

Tyler Porter

January 7 2026I just don't get why people are so mad. If your country is broken, you use whatever works. That's common sense. Why is this even a debate?

Rishav Ranjan

January 8 2026Boring. We knew this already.