Liquidity on DEXs vs Centralized Exchanges: What Really Matters for Traders

When you trade crypto, you don’t just care about the price-you care about whether you can actually buy or sell at that price without it slipping away. That’s liquidity. And it’s the quiet force that decides whether your trade executes smoothly or turns into a nightmare of slippage and delays. On centralized exchanges (CEXs), liquidity feels like a well-stocked supermarket: everything’s there, prices stay steady, and you get in and out fast. On decentralized exchanges (DEXs), it’s more like a farmers’ market-sometimes you find exactly what you need, other times you’re stuck waiting, or paying way more than you expected.

Why Liquidity Matters More Than You Think

Liquidity isn’t just a buzzword. It’s the difference between buying 10 ETH at $3,200 and ending up paying $3,350 because the order book dried up halfway through. High liquidity means tight spreads, low slippage, and fast execution. Low liquidity? You’re guessing what the market will do after you hit ‘confirm’. On CEXs like Binance or Coinbase, liquidity comes from millions of users, institutional traders, and professional market makers. These platforms aggregate orders from all over the world and match them internally. No blockchain needed. That’s why a $500,000 trade on Binance might move the price by less than 0.1%. On a DEX, that same trade could wipe out half the liquidity pool and send the price 5% higher.How Centralized Exchanges Build Deep Liquidity

CEXs don’t rely on users to provide liquidity-they hire people to do it. Market-making firms get paid in rebates to keep buy and sell orders stacked deep in the order book. These firms use algorithms that react faster than any human, constantly adjusting prices based on global market movements. That’s why you see 10,000 ETH available to buy at $3,199 and another 10,000 at $3,200-it’s not luck. It’s engineered. This system creates a feedback loop: more traders → more volume → tighter spreads → more traders. It’s self-reinforcing. Institutions love it because they can move large positions without screaming into the market. Retail traders benefit too, even if they don’t realize it. The low slippage on CEXs is why most people start trading there. And it’s not just about volume. CEXs also have better infrastructure. Trades settle in milliseconds. No waiting for Ethereum blocks. No gas fees. No failed transactions because the network is congested. That speed matters. It lets arbitrage bots jump in and correct price gaps between exchanges, which keeps prices aligned across the market.How DEXs Work-And Why Their Liquidity Is Fragile

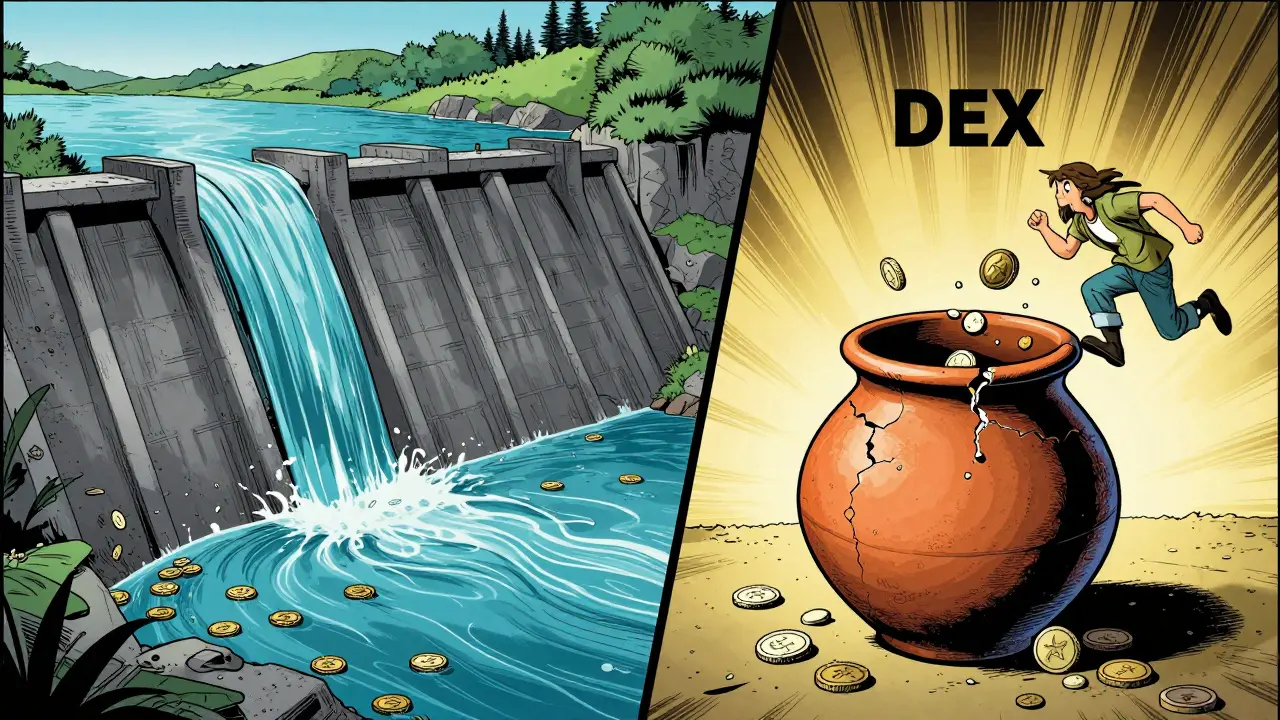

DEXs like Uniswap or SushiSwap don’t use order books. They use something called Automated Market Makers (AMMs). Instead of matching buyers and sellers, they use math. If a pool has 100 ETH and 300,000 USDC, the price of ETH is $3,000. Buy 10 ETH? The algorithm recalculates: now it’s 90 ETH and 309,000 USDC. The price goes up-not because someone bid higher, but because the ratio changed. This system is elegant. It’s permissionless. Anyone can add liquidity. But it’s also brittle. Liquidity on DEXs comes from everyday users-people who lock up their tokens to earn fees. But these users aren’t professionals. They’re yield farmers chasing 20% APY on a new token. When the reward drops, they pull their money out. Overnight. That’s why you see liquidity on a DEX pair crash by 40% in a single day. No warning. No notice. Just a smart contract update and a flood of withdrawals. And when liquidity dries up, slippage spikes. A $10,000 trade on a small DEX pair might cost you 8% in slippage. On a CEX? Maybe 0.3%. That’s not a small difference. That’s a $800 loss versus $30.

Slippage: The Silent Killer of DEX Trades

Slippage is the gap between the price you expect and the price you get. On CEXs, it’s usually under 0.5% for trades under $100,000. On DEXs, it’s a gamble. Try swapping 500 DAI for a new memecoin on a DEX with $200,000 in liquidity. You might think you’re getting a fair rate. But once your trade hits the pool, it eats up 25% of the available tokens. The algorithm recalculates: the price jumps. You end up with 10% fewer coins than you expected. That’s not a bug-it’s how AMMs work. Some DEXs now offer “limit orders” or “order routing” across multiple pools to reduce slippage. But these are still new. Most users don’t know how to use them. And even then, if the total liquidity is low, you’re still fighting the math.Who Provides Liquidity? Professionals vs. Everyone

On CEXs, liquidity is provided by firms with billion-dollar trading desks. They have teams of quants, real-time data feeds, and direct connections to exchanges. They’re paid to keep spreads tight. Their goal: profit from tiny price differences, not speculation. On DEXs, liquidity comes from you. Or me. Or someone who saw a tweet about a new token and staked their ETH to earn rewards. They’re not trying to make markets. They’re trying to make money fast. That’s why liquidity on DEXs is so volatile. It’s not anchored by professional capital. It’s anchored by incentives. And when those incentives vanish-say, a token’s yield drops from 30% to 3%-liquidity vanishes with it. That’s why you see DEX pairs die overnight. The tokens still exist. The code still runs. But no one’s left to trade them.Transparency vs. Trust

One advantage DEXs have is transparency. Every liquidity pool is on-chain. You can see exactly how much ETH and USDC is in the pool. You can watch trades happen in real time. You can check the smart contract code. No hidden order books. No front-running by the exchange. CEXs? You have to trust them. They say they have $2 billion in liquidity. But you can’t see it. They don’t show you the order book depth. They don’t tell you if they’re using their own funds to prop up prices. You just hope they’re honest. That’s why some traders stick with DEXs-even with the slippage. They’d rather know what’s happening than rely on a company’s word.

What Happens When the Market Crashes?

During the 2022 crypto winter, CEXs saw trading volumes drop-but liquidity held up. Market makers kept posting bids. Institutions still needed to hedge. Liquidity didn’t vanish. On DEXs? Liquidity pools shrank by 30-60% across the board. Yield farmers pulled out. Many tokens became nearly impossible to trade without massive slippage. Some pairs lost 90% of their liquidity in a week. That’s the hidden risk of DEX liquidity: it’s not stable. It’s emotional. It moves with sentiment.The Future: Hybrid Models Are Emerging

The gap between CEX and DEX liquidity isn’t getting wider-it’s being bridged. Some CEXs now offer non-custodial wallets and direct DeFi integration. Binance has a DEX wallet. Coinbase has a wallet that connects to Uniswap. You can trade on-chain without leaving the platform. On the DEX side, layer-2 solutions like Arbitrum and Optimism are slashing gas fees and speeding up trades. New AMM designs-like Curve’s stablecoin pools or Balancer’s dynamic weights-are making liquidity more efficient. And institutional players? They’re dipping toes into DeFi. Fidelity and BlackRock are exploring on-chain liquidity provision. That could bring real capital into DEX pools-not just yield farmers. The future isn’t CEXs vs DEXs. It’s CEXs using DEX tech. And DEXs getting CEX-level stability.What Should You Do?

- If you’re trading small amounts (<$5,000) and want low fees: DEXs are fine. Just check the liquidity pool size first. - If you’re trading over $10,000: Use a CEX. The slippage difference is too big to ignore. - If you’re providing liquidity: Know the risks. Impermanent loss is real. And if the token’s yield drops, you might lose more than you earn. - If you’re new: Start on a CEX. Learn how markets work. Then experiment with DEXs. Liquidity isn’t about decentralization. It’s about reliability. And right now, CEXs still win.Which has better liquidity, DEX or CEX?

Centralized exchanges (CEXs) have far better liquidity than decentralized exchanges (DEXs). CEXs aggregate millions of trades from institutional and retail users, creating deep order books with tight spreads. DEXs rely on user-provided liquidity pools, which are often smaller, more volatile, and can vanish quickly during market stress. For large trades, CEXs are significantly more reliable.

Why is slippage higher on DEXs?

Slippage is higher on DEXs because they use Automated Market Makers (AMMs) that calculate prices based on the ratio of assets in a liquidity pool. When you trade a large amount, you change that ratio, forcing the price to move. If the pool is small-say, $50,000 in total liquidity-a $10,000 trade can consume 20% of it, causing a sharp price shift. CEXs have deeper order books, so large trades don’t disrupt prices as much.

Can DEX liquidity be trusted?

You can verify DEX liquidity on-chain-it’s transparent. But that doesn’t mean it’s stable. Liquidity providers can withdraw funds at any time, especially when yield farming rewards drop. A pool with $1 million today might have $200,000 tomorrow. Always check the current pool size before trading. Don’t assume past liquidity equals current liquidity.

Do CEXs manipulate liquidity?

CEXs don’t directly manipulate liquidity, but they do control it. They partner with market-making firms to maintain tight spreads and deep order books. While this creates stability, it’s not public. You can’t see who’s placing orders or how much capital is backing them. DEXs are open, but less stable. CEXs are opaque, but more reliable.

Should I use DEXs for long-term holding?

DEXs are fine for holding crypto if you’re not trading often. But if you plan to sell later, consider the liquidity of the token pair. A token with low DEX liquidity might be impossible to sell without huge slippage. For long-term holding, store your crypto in a non-custodial wallet. For selling, use a CEX with deep liquidity to avoid losses.

Is it safer to trade on CEXs or DEXs?

Safety depends on what you mean. DEXs are safer from exchange hacks because you keep control of your keys. But they’re riskier from smart contract bugs and impermanent loss. CEXs are vulnerable to hacks and insolvency (like FTX), but they offer better customer support and insurance. For most users, CEXs are safer for trading. DEXs are safer for custody-but harder to trade efficiently.

17 Comments

Devyn Ranere-Carleton

January 28 2026lol i thought dexes were supposed to be the future but half the time i get slippage so bad i think the contract is haunted 😅

Sunil Srivastva

January 28 2026I've been trading on Uniswap for over a year now, and honestly? I only use it for small swaps under $500. Anything bigger and I switch to Kraken. The slippage on low-liquidity pairs is brutal. I lost $200 on a 500 DAI swap once because the pool had like $80k total. Not worth it.

Kevin Thomas

January 30 2026You guys are acting like CEXs are some holy grail. Newsflash: Binance gets hacked, freezes withdrawals, and manipulates order books all the time. You think your 0.1% slippage is free? You're paying in trust. And trust is the most expensive thing in crypto.

Robert Mills

February 1 2026DEX for the win 🚀 stay decentralized or go home!

Jerry Ogah

February 2 2026This is why people get ruined. You think you're being smart trading on DEXs but you're just feeding the machine. The market makers on CEXs? They're the real predators. They're not helping you-they're harvesting your ignorance. And you're okay with that because it's 'convenient'. Pathetic.

Andrea Demontis

February 3 2026There's a deeper philosophical question here: is liquidity a property of the market, or a construct of human behavior? On CEXs, liquidity is manufactured by incentive structures-payment for market-making, institutional capital, centralized control. On DEXs, it's emergent, organic, fragile. It's not about efficiency-it's about sovereignty versus submission. When you choose a CEX, you're choosing to outsource your economic agency. When you choose a DEX, you're choosing to participate in a fragile, beautiful, chaotic democracy of capital. And yes, sometimes that democracy votes with its feet and leaves the room. But isn't that the point? The freedom to fail?

Tressie Trezza

February 4 2026I get why people like DEXs. I really do. But I also think we're romanticizing something that's fundamentally broken. You want transparency? Cool. But transparency doesn't pay your rent. If I can trade $50k of BTC with 0.2% slippage on Binance, why would I risk 5% on a DEX just to prove I'm not a 'centralized sheep'? Practicality > ideology.

Calvin Tucker

February 5 2026The term 'liquidity' is often misused. Liquidity is not merely the volume of tokens in a pool-it is the velocity of capital exchange, the depth of the order book, and the resilience of price stability under pressure. DEXs, by design, lack the latter two. AMMs are not market makers-they are mathematical approximations. And approximations, under stress, become catastrophes.

Gustavo Gonzalez

February 6 2026You think you're safe on CEXs? Bro, they're the ones who got you into this mess. They're the ones who listed every scam token because it made them money. They're the ones who froze your funds during the FTX collapse. And now you're begging them for 'stable liquidity'? Wake up. You're not trading crypto-you're trading trust in corporations.

Mark Ganim

February 7 2026I’ve watched DEX liquidity evaporate like morning dew… one day, $12M in ETH-USDC… next day, $1.2M… and the devs? They’re already on their next 10x meme coin. The whole system is a Ponzi of incentives. And we’re the ones holding the bag when the music stops. I’m not mad… I’m just… disappointed.

Gavin Francis

February 8 2026Use both. Simple. DEX for small stuff, CEX for big moves. No drama. Just trade smart 🤝

Ramona Langthaler

February 9 2026CEXs are just the new banks. Same people. Same lies. You think Binance gives a crap about you? They're using your trades to front-run your own orders. And you're here crying about slippage like it's a bug. It's a feature.

Crystal Underwood

February 10 2026If you're still using DEXs for anything beyond meme coins, you're either a masochist or a crypto anarchist. And honestly? The market doesn't care about your ideology. It cares about execution. And execution happens on CEXs. Period.

Raymond Pute

February 11 2026You're all missing the point. The real innovation isn't CEX vs DEX-it's that DEXs forced CEXs to become less abusive. Without Uniswap, Binance would still be charging $100 in withdrawal fees and hiding their reserves. The existence of DEXs is what made CEXs 'better'. So stop pretending they're enemies. They're symbiotic. DEXs are the protest. CEXs are the reform.

Jack Petty

February 11 2026CEXs are controlled by the Fed. DEXs are controlled by code. Which one do you trust more? A faceless bank? Or a smart contract that can't lie? (unless it's a rug pull... but that's on you, dumbass)

Meenal Sharma

February 12 2026The fragility of DEX liquidity is not a flaw-it is a feature of decentralization. Centralization creates stability at the cost of autonomy. Decentralization creates volatility at the cost of control. The question is not which is better, but which you are willing to live with. Most people choose stability without realizing they have surrendered their freedom.

Brianne Hurley

February 14 2026I used to think DEXs were the future... until I lost $3k on a swap because the pool got drained by a whale and then the devs ran. Now I just use Coinbase. At least they have customer service. And a phone number. And a lawyer. You can't say that about a contract that says 'you're on your own'.