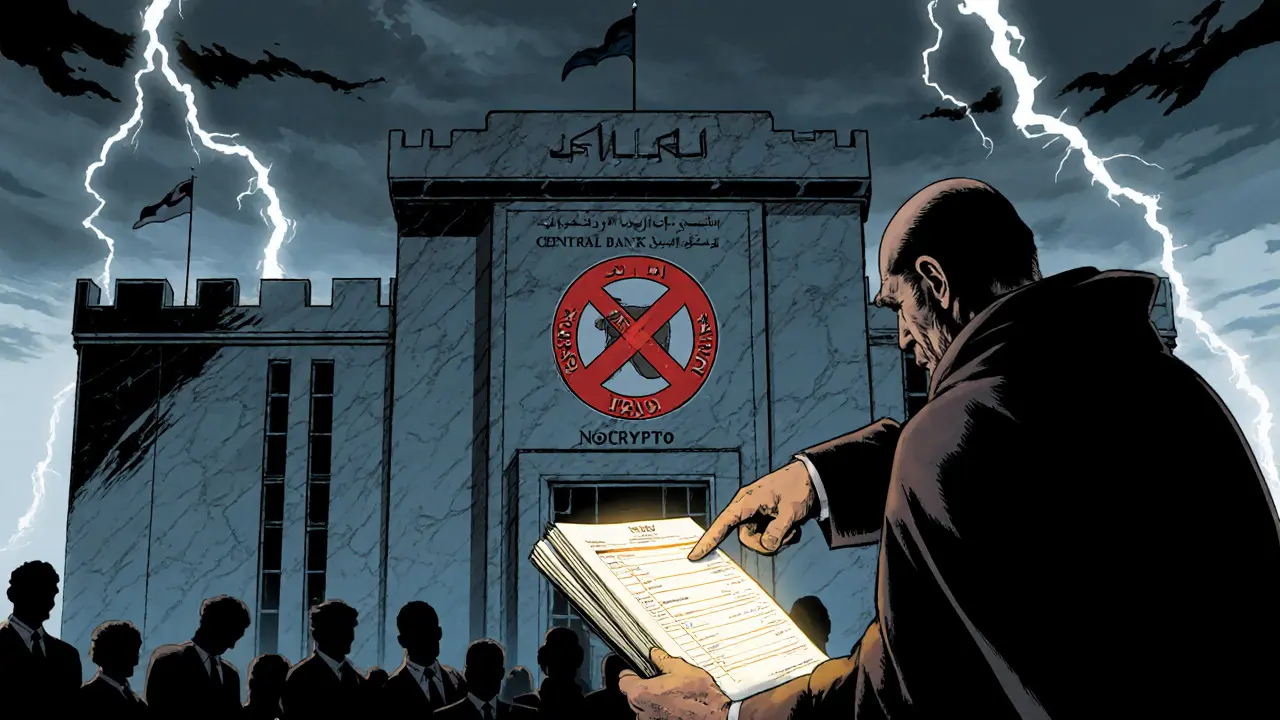

Understanding the Central Bank of Iraq's Crypto Restrictions and Future CBDC Plans

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue ReadingWhen it comes to crypto regulations in Iraq, the legal status of digital currencies like Bitcoin and Ethereum in a country with complex financial and political systems. Also known as digital asset laws Iraq, these rules determine whether you can buy, trade, or mine cryptocurrency without risking legal trouble. Unlike countries that have embraced crypto with clear frameworks—like Japan or the UK—Iraq has taken a cautious, often contradictory approach. The Central Bank of Iraq has repeatedly warned citizens against using cryptocurrencies, calling them unregulated and risky. But that hasn’t stopped people from trading. In fact, peer-to-peer crypto exchanges and Telegram groups have become the unofficial backbone of Iraq’s crypto scene.

So what’s really going on? While the government hasn’t legalized Bitcoin or any other crypto as legal tender, it also hasn’t outright criminalized private ownership. This gray zone means individuals can hold crypto in wallets, but banks won’t touch it. You can’t deposit Bitcoin into a local bank account. You can’t pay bills with Ethereum. And if you try to cash out through a licensed exchange, you’ll hit a wall—there are none. The Central Bank of Iraq, the country’s primary financial regulator responsible for monetary policy and banking oversight has made it clear: any financial institution caught facilitating crypto transactions risks losing its license. Meanwhile, crypto mining, the process of validating blockchain transactions using powerful computers, often consuming large amounts of electricity is technically not banned, but the high cost of power and unreliable infrastructure make it nearly impossible for most people to profit.

What you’ll find in the posts below are real-world examples of how people in Iraq navigate this mess. Some use offshore exchanges and P2P platforms to buy Bitcoin with cash. Others try to mine with solar power to cut electricity costs. A few have even started small businesses that accept crypto payments, knowing they’ll have to convert it immediately to dinars. There’s no official guidance, no clear rules, and no safety net. But there’s demand—especially among young people tired of inflation and banking restrictions. The posts here don’t pretend to give legal advice. They show what’s actually happening on the ground: how traders stay under the radar, what tools they use, and where the real risks lie. If you’re in Iraq and thinking about crypto, this is the practical, no-BS breakdown you need before you take a step.

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue Reading