National Digital Mining Pool: What It Is and Why It Matters in Crypto Mining

When people talk about National Digital Mining Pool, a centralized group of miners operating under a national or state-backed framework to validate blockchain transactions and earn block rewards. It’s not just a technical term—it’s a shift in how crypto mining is controlled, funded, and regulated. Unlike decentralized mining pools where anyone with a rig can join, a National Digital Mining Pool is often backed by government resources, state-owned energy grids, or national infrastructure. This changes everything—from how coins are mined to who profits from them.

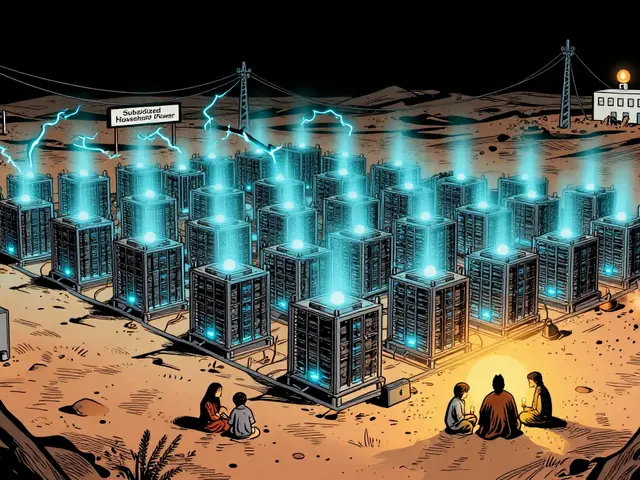

These pools are closely tied to block rewards, the cryptocurrency given to miners for adding a new block to the blockchain. Bitcoin’s halving cycles, for example, make block rewards a core part of its scarcity model. But when a nation runs its own mining pool, it doesn’t just collect rewards—it can influence supply, control hash rate, and even stabilize prices during market crashes. Countries like China used to dominate this space before the 2021 crackdown, and now places like Kazakhstan, Russia, and parts of the Middle East are stepping in. The mining rewards, the incentive system that keeps blockchain networks secure and functional become tools of economic policy, not just technical incentives.

What’s more, National Digital Mining Pools don’t just mine—they collect data, monitor network behavior, and sometimes even block certain transactions. This isn’t theoretical. In countries with strict crypto controls, state-backed pools can prioritize certain addresses, delay suspicious transfers, or even freeze assets by controlling the majority of the hash rate. It’s the opposite of decentralization. And while most retail miners think they’re just earning crypto, they’re often competing against entities with far more power—power that can change the rules overnight.

You’ll find posts here that dig into how block rewards shape inflation, how mining pools affect transaction speeds, and why some tokens fail because their mining structure is too centralized. Some cover scams tied to fake mining operations pretending to be state-backed. Others show how real mining pools in places like Iran or Belarus operate under energy subsidies. There’s no fluff—just real cases, real risks, and real outcomes.

What you’re about to read isn’t just about mining hardware or electricity costs. It’s about power—who has it, how they use it, and what it means for the future of crypto. Whether you’re mining your own Bitcoin or just holding it, you need to understand this.

Venezuela requires all crypto miners to join a government-controlled mining pool, obtain a license from SUNACRIP, and pay heavy taxes. Learn the strict 2025 requirements, risks, and why this system contradicts crypto's core principles.

Continue Reading