How Bitcoin Enables Imports in Iran Amid Sanctions

When international sanctions cut Iran off from global banking, the country didn’t just wait for a solution-it built one. Bitcoin became more than a digital asset; it turned into a lifeline for importing essential goods. While the world focused on Bitcoin’s price swings, Iran quietly turned its cheap electricity and industrial scale into a powerful trade engine. Today, billions in crypto flow out of Iran every year-not for speculation, but to buy medicine, machinery, and food that sanctions otherwise block.

How Iran Uses Bitcoin to Import Goods

Iran doesn’t let citizens pay for groceries with Bitcoin. That’s not the goal. Instead, the government created a legal backdoor: miners produce Bitcoin using state-approved power, then sell it to the Central Bank of Iran (CBI) in exchange for foreign currency or trade credits. That money then funds imports. It’s a closed-loop system: electricity → Bitcoin → imports → survival.

The first confirmed import using crypto happened in August 2023, when a $10 million order for medical equipment was paid in Bitcoin. Since then, dozens of Iranian firms-some linked to the Islamic Revolutionary Guard Corps (IRGC)-have used the same method to buy industrial parts from China, Russia, and Turkey. These aren’t underground deals. They’re licensed, tracked, and approved by the CBI.

Unlike traditional banking, where U.S. sanctions freeze accounts and block wire transfers, Bitcoin moves without intermediaries. Iranian importers don’t need a U.S. bank. They don’t need SWIFT. They just need a digital wallet and a miner who’s cleared by the state. The CBI acts as the middleman: it takes Bitcoin from miners, converts it into dollars or euros on international exchanges, and then releases the funds to approved importers.

The Mining Machine Behind the Trade

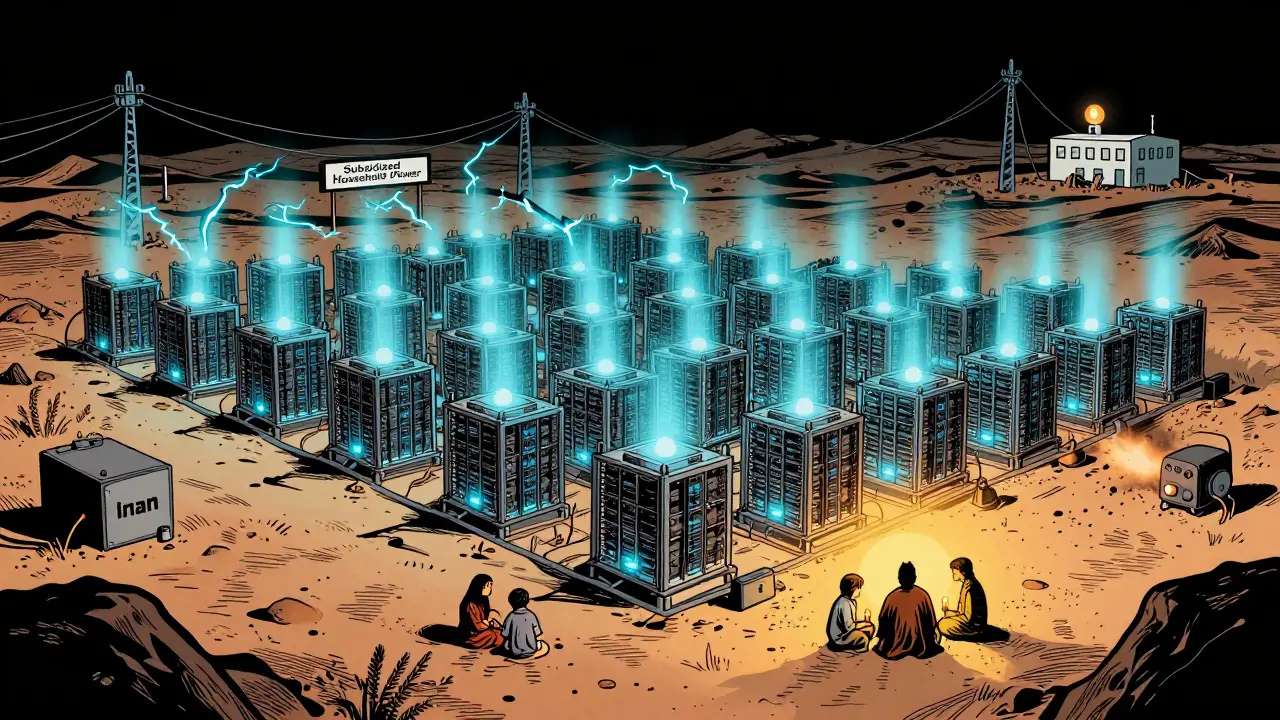

Behind every Bitcoin import is a mining farm-often massive, often hidden, always powered. Iran has over 10,000 licensed mining operations, many clustered in special economic zones or on IRGC-controlled land. The biggest, a 175-megawatt facility in Rafsanjan, runs on electricity so cheap it’s practically free. That’s because Iran pays miners using subsidized power meant for homes and factories.

These aren’t hobbyists with rigs in their garages. These are industrial-scale operations using thousands of ASIC miners-specialized computers built only for Bitcoin mining. They hum nonstop, day and night, consuming as much power as a small country. And they’re not paying the bill. Investigations show that IRGC-linked entities, including religious foundations like Astan Quds Razavi, operate these farms with impunity. They get priority grid access, ignore electricity invoices, and even protect their sites with armed guards.

By 2024, Iran was producing nearly 5% of all new Bitcoin mined worldwide. That’s more than the entire United Kingdom. The revenue? Estimated at $1 billion a year from mining alone. But the real value isn’t in the coins-it’s in what those coins can buy.

Why Bitcoin Works When Banks Don’t

Sanctions don’t just block money-they block trust. When a European supplier hears Iran is trying to pay with dollars, they fear the payment will be frozen. When they hear it’s Bitcoin, they see a direct, irreversible transfer with no U.S. bank in the middle. No one can reverse it. No one can freeze it. No one can trace it back to the buyer’s name-unless they’re on Iran’s own approved list.

Iran’s system isn’t anonymous. It’s controlled. Every miner must register with the CBI. Every transaction must be documented. Every export of Bitcoin requires approval. The government tracks everything-but it also protects its own players. That’s the key difference: Western sanctions target individuals and banks. Iran’s system targets the flow of value through state-approved channels.

Iran also signed crypto cooperation deals with Russia, China, and several European countries as early as 2019. These aren’t just symbolic. They’re operational. Iranian firms use Binance and other exchanges to settle trade with Russian suppliers, avoiding dollar-based systems entirely. Since 2018, over $8 billion in crypto transactions have flowed through Binance alone, mostly tied to sanctioned Iranian entities.

The Hidden Cost: Power Outages and Public Anger

For every Bitcoin that pays for an import, someone in Tehran or Isfahan loses power. In 2023 and 2024, Iran suffered some of its worst blackouts in decades. Hospitals ran on generators. Factories shut down. Children studied by candlelight.

Why? Because mining farms are siphoning off electricity meant for citizens. A single large mine can use as much power as 100,000 homes. And they’re not paying for it. The government claims these are industrial facilities, so they get cheaper rates. But many are operating illegally on subsidized household power. In 2021, Iran arrested hundreds of miners caught using residential electricity. Enforcement was harsh-but only for small operators. The big ones? Protected.

Public anger is growing. Citizens report mining farms running 24/7 near schools and hospitals. The government’s response? Encourage people to report illegal miners. It’s a clever distraction: blame the small fry, protect the powerful. The result? A two-tiered system: state-backed miners get free power. Ordinary citizens get blackouts.

Who Benefits? Who Pays?

The winners are clear: the IRGC, state-linked foundations, and a handful of licensed importers. They get access to global goods without touching the dollar system. They earn Bitcoin through mining, then trade it for what they need.

The losers? Iranian families. They pay higher prices for goods that are harder to import. They endure rolling blackouts. They see their currency, the rial, weaken further-not because of inflation alone, but because the state is printing value digitally and exporting it, while keeping the rial trapped inside the country.

There’s no capital gains tax on Bitcoin in Iran because trading is banned for citizens. That means ordinary people can’t buy Bitcoin to protect their savings. Only the state and its allies can. This isn’t financial inclusion-it’s financial control.

Is This Sustainable?

Iran’s crypto trade model works-for now. But it’s built on shaky ground. The power grid is breaking. The mining industry is bloated. The regulatory system is complex and inconsistent. One blackout, one cyberattack, one crackdown on exchanges, and the whole system could stall.

And it’s not foolproof. Some importers still rely on intermediaries in Turkey or Dubai to convert crypto into cash. Others use fake invoices or overpriced goods to move value. The system is clever, but it’s not clean. And it’s not scalable beyond a certain point.

Still, Iran has proven something the world didn’t believe: sanctions can be bypassed. Not with evasion. Not with lies. But with a state-run, energy-powered, Bitcoin-based trade network. It’s not the future of global finance. It’s the future of survival under pressure.

What’s Next for Iran’s Crypto Trade?

As of early 2025, Iran is tightening its crypto rules. The CBI is shutting down rial payment gateways for exchanges. Only licensed platforms can operate. Miners must report every coin movement. The goal? More control. Less leakage.

But the pressure is mounting. The power grid can’t handle more mining. The world is watching. And Iran’s neighbors-Russia, China, Turkey-are building their own crypto trade networks. Iran isn’t alone anymore.

Whether this model lasts depends on two things: how long Iran can keep its power grid from collapsing, and whether the world lets it keep trading this way. For now, Bitcoin keeps Iran alive. But at what cost?

Can ordinary Iranians use Bitcoin to buy imports?

No. Iranian citizens are not allowed to use Bitcoin for any payments, including imports. Only state-approved importers and licensed mining operations can legally trade crypto, and only through the Central Bank of Iran. Regular people can’t buy Bitcoin to pay for goods abroad. The system is designed to keep control in the hands of the government and its allies.

Why does Iran allow Bitcoin mining but ban its use as currency?

Iran allows mining because it turns cheap electricity into a valuable export-Bitcoin. But it bans personal use to prevent capital flight. If people could buy Bitcoin and send it overseas, the rial would collapse faster. By controlling mining and limiting transactions to state-approved channels, the government turns energy into foreign currency while keeping its population locked into the national economy.

How much Bitcoin does Iran mine each year?

Iran produces nearly 5% of all new Bitcoin mined globally, which translates to roughly 7,000-8,000 BTC annually. That’s worth over $400 million at 2025 prices. Most of this Bitcoin is sold to the Central Bank of Iran, not traded on open markets. The revenue funds imports and helps stabilize the economy under sanctions.

Are Iran’s crypto imports legal under international law?

Technically, no. U.S. and EU sanctions prohibit transactions with Iranian entities, even if they use crypto. However, enforcement is difficult. Bitcoin transactions are hard to trace, and many imports are routed through third countries. The U.S. Treasury has sanctioned several Iranian crypto exchanges and mining operators, but the scale of the system makes complete blocking nearly impossible.

Is Bitcoin helping Iran’s economy or hurting it?

It’s both. Bitcoin helps Iran import essential goods like medicine and spare parts, keeping industries running. But it also deepens inequality, worsens energy shortages, and undermines the rial. The state benefits. The people pay in blackouts, inflation, and lost power. It’s a survival tactic, not a solution.

22 Comments

Tracey Grammer-Porter

January 8 2026This is wild. I never thought Bitcoin could be used like this. It's not about getting rich-it's about keeping hospitals running. I'm kinda in awe.

jim carry

January 9 2026So let me get this straight-Iran is literally mining Bitcoin to buy medicine while its own people are freezing in the dark? That’s not innovation, that’s a dystopian horror show. And you’re calling this clever? 🤡

Mollie Williams

January 11 2026It’s a tragic paradox, isn’t it? The same technology that was supposed to liberate individuals is now being weaponized by the state to maintain control. Bitcoin becomes a tool of survival, but only for the few who already hold the keys. The rest? They’re just collateral in the energy equation.

Ritu Singh

January 11 2026This is all a CIA psyop to destabilize the global financial system and make crypto look bad so they can push CBDCs next... the IRGC is just a puppet... they're not even real miners... the whole thing is a distraction from the real agenda which is the New World Order and the deep state controlling the grid through quantum AI surveillance... you think this is about medicine? No... it's about control... always control...

kris serafin

January 12 2026Fascinating stuff 🤯 The mining farms are basically state-run crypto power plants. Iran’s turning energy waste into economic lifelines. Smart, if brutal. 🇮🇷⚡

Caitlin Colwell

January 13 2026The people paying the price aren't the ones making the decisions. That’s the real story here.

Charlotte Parker

January 13 2026Oh wow, so the Iranian government is using Bitcoin to survive sanctions... and you’re impressed? Let me guess-next they’ll be using TikTok to run their nuclear program. This isn’t ingenuity, it’s desperation dressed up as innovation. The only thing this proves is that when you’re cornered, you’ll do anything-even turn your citizens’ electricity into a currency.

Sarbjit Nahl

January 14 2026The notion that Bitcoin bypasses sanctions is fundamentally flawed. Sanctions target entities, not protocols. If the state controls the mining and the conversion, then it is still a state-sanctioned financial mechanism. The term 'bypass' is misleading. This is not decentralization. This is centralization with a blockchain facade.

Emily Hipps

January 15 2026This is actually kind of inspiring if you think about it-people finding a way to survive against impossible odds. Yeah, the system’s messed up, but look at the resilience. They’re not waiting for permission. They’re building their own lifeline. That’s powerful. 💪

Frank Heili

January 15 2026The 5% global hash rate stat is real. Iran’s mining capacity is comparable to small European nations. What’s more interesting is how the CBI acts as a crypto exchange with regulatory teeth. They’re not just mining-they’re monetizing energy policy. It’s a crude but effective model. And yes, it’s unsustainable long-term, but it’s working now.

Natalie Kershaw

January 16 2026This is peak crypto real-world use case. We keep talking about DeFi and NFTs while Iran’s using Bitcoin to keep insulin in stock. The contrast is insane. We’re playing games. They’re playing survival. The real DeFi is the one that keeps people alive.

Jacob Clark

January 17 2026I CAN’T BELIEVE PEOPLE ARE ACTUALLY COMPLIMENTING THIS!!! This is like saying a thief who steals electricity to power his gaming rig is a ‘tech pioneer’!! The IRGC is running these farms with armed guards and NO ONE IS PAYING THE BILL!! This isn’t innovation-it’s state-sponsored theft on an industrial scale!! And you call this ‘clever’?!!

Jon Martín

January 19 2026You know what’s wild? This is what Bitcoin was supposed to be. Not a casino. Not a meme. A tool for people who’ve been cut off from the system. The fact that it’s being used by a regime doesn’t erase that. It just makes it more complicated. But the tech still works. And that’s the point.

Mujibur Rahman

January 20 2026The UK’s 2023 energy crisis was partly caused by the same subsidy distortions. Iran’s just scaled it up with crypto. What’s fascinating is the geopolitical ripple-China and Russia are now using similar models. This isn’t Iran’s anomaly anymore. It’s the new sanction-era playbook.

Jennah Grant

January 22 2026There’s a moral gray area here that can’t be ignored. The system is unjust, but the outcome-medicine reaching people-is undeniably good. It’s not a clean solution, but maybe no solution under sanctions ever is.

Dennis Mbuthia

January 23 2026This is why America needs to stop being so soft on these regimes. Iran’s a terrorist state and they’re using OUR technology to fund their death squads. Bitcoin isn’t magic-it’s a weapon. And if we don’t shut this down, the next country to do this will be North Korea. And then Venezuela. And then... we’re all just living in a crypto dystopia.

Dave Lite

January 25 2026The real tragedy? The miners aren’t even getting paid in crypto. They’re getting paid in electricity they don’t have to pay for. Meanwhile, grandma in Shiraz is using a flashlight to read her grandkid’s homework. This isn’t finance. It’s exploitation wrapped in blockchain.

Becky Chenier

January 27 2026It’s a system designed to preserve power, not people. The state benefits. The people pay. That’s not innovation. That’s governance.

Staci Armezzani

January 27 2026I’ve seen this play out in other sanctioned economies-Sudan, Venezuela. Bitcoin doesn’t fix the system. It just lets the powerful delay collapse. But it does save lives. So what’s the right answer? I don’t know. But I know we can’t just look away.

sathish kumar

January 27 2026It is imperative to note that the utilization of cryptocurrency in this manner constitutes a violation of the United Nations Security Council resolutions pertaining to financial transactions with sanctioned entities. The Iranian government's approach, while technologically sophisticated, remains legally indefensible under international law.

Don Grissett

January 28 2026so like... if iran mines btc and buys medicine... does that mean we should be cheering them on? or is this just like... the ultimate flex of a regime that steals power and then says 'look we're helping people'?? i mean... it's not like they're letting citizens use it... they're hoarding it like dragons in a cave. jesus.

Katrina Recto

January 29 2026The blackouts are the real story. Not the Bitcoin.