How to Manage Liquidity Pool Positions in DeFi for Better Returns

Managing liquidity pool positions isn’t just about depositing tokens and waiting for fees to roll in. If you treat it like a savings account, you’re leaving money on the table-or worse, losing it. Real returns come from active, smart management. In 2025, the average liquidity provider on Uniswap V3 earns 8-15% annually when managed well. Those who set it and forget it? Often lose money to impermanent loss or miss out on fees entirely.

What Exactly Is a Liquidity Pool Position?

A liquidity pool position is your share of a smart contract that holds two crypto tokens-like ETH and USDC-so traders can swap between them on a decentralized exchange. When you add liquidity, you deposit equal dollar values of both tokens. In return, you get LP tokens representing your ownership. Every time someone trades using that pool, you earn a cut-usually 0.05%, 0.3%, or 1% per trade, depending on the pool.These pools run on automated market makers (AMMs), not order books. That means prices adjust automatically based on supply and demand inside the pool. The system works great… until the price of one token moves sharply. That’s when impermanent loss kicks in.

Impermanent Loss Is the Silent Killer

Impermanent loss happens when the price of your two tokens changes after you deposit them. Say you put in $1,000 worth of ETH and $1,000 worth of USDC. If ETH doubles in price, the pool rebalances to keep the token ratio equal. You end up with less ETH than you started with-and more USDC. When you withdraw, you’re not holding the same value as if you’d just held the tokens in your wallet.On volatile pairs like ETH/USDC, impermanent loss can hit 15-25% during big price swings. On stablecoin pairs like USDC/DAI? It’s usually under 1.5%. That’s why most experienced providers put 60% of their capital into stablecoin pools and only 40% into volatile ones. It balances risk and reward.

Tools like Zapper.fi and DeFiLlama show real-time impermanent loss estimates. Check them weekly. If your loss is over 5% and the price hasn’t bounced back, it’s time to reconsider your position.

Uniswap V3 vs. Traditional Pools: Pick Your Strategy

There are two main types of liquidity pools: traditional (like Uniswap V2) and concentrated (Uniswap V3).- Traditional pools (50/50): You deposit equal amounts of both tokens across the full price range. Easy to manage. Low capital efficiency. You earn fees no matter where the price goes-but you’re spreading your money too thin. Returns are typically 60-75% lower than optimized V3 positions.

- Concentrated liquidity (Uniswap V3): You pick a price range-say $1,900 to $2,100 for ETH/USDC. All your capital works only within that range. If ETH stays inside, you earn up to 4,000x more fees per dollar than a V2 pool. But if ETH moves outside your range? You earn zero fees until it comes back.

Most beginners should start with traditional pools. They’re forgiving. But if you’re willing to spend 15-20 hours a month monitoring prices, V3 is where the big returns live. According to Gauntlet Network’s January 2025 study, positions left outside their price range for more than 30 days lost 65-80% of potential fees.

Fee Tiers Matter More Than You Think

Uniswap and other DEXes offer different fee tiers: 0.01%, 0.05%, 0.3%, and 1%. Don’t pick the default. Match the tier to the token pair.- Stablecoins (USDC/DAI, USDT/USDC): Use 0.01% or 0.05%. These tokens don’t swing much, so high fees don’t make sense. Curve Finance dominates here, offering 2-4% APY with near-zero slippage.

- Volatile pairs (ETH/USDC, SOL/USDC): Use 0.3%. This is the sweet spot. Higher fees (1%) only make sense for extremely risky tokens like meme coins, where trading volume is high but impermanent loss is brutal.

Curve’s stablecoin pools are the safest bet for passive income. Uniswap V3’s 0.3% ETH/USDC pool can hit 10-15% APY-if you keep your range tight and rebalance often.

Gas Fees Can Eat Your Profits

Adjusting your liquidity position on Ethereum costs money. During peak hours, a single transaction can cost $30-$50. That’s more than your monthly fee earnings if you’re only managing $2,000.Here’s how to save:

- Wait for off-peak times: Sundays between 2-5 AM UTC are cheapest.

- Use Etherscan’s Gas Now tool to track real-time prices.

- Batch your actions: If you need to adjust range and withdraw a little, do both in one transaction.

- Consider Layer 2s: Arbitrum and Polygon have gas fees under $0.10. Many major pools now support them.

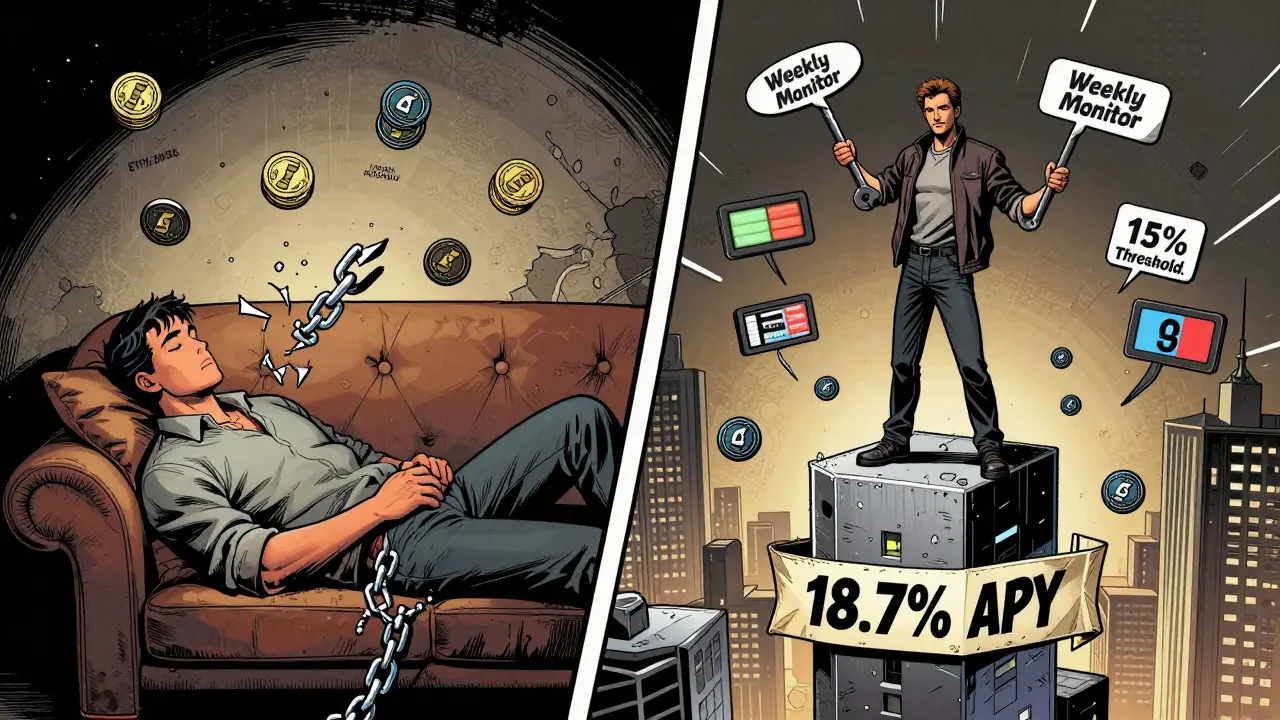

Don’t adjust your position just because the price moved $50. Wait for a 15-20% shift. That’s the threshold most pros use.

Security: Don’t Get Hacked

DeFi has lost over $2.3 billion to exploits through Q3 2024. Most of those came from sloppy permissions.Follow these rules:

- Never approve unlimited token allowances. Always set a specific amount.

- Use a hardware wallet (Ledger or Trezor) for any position over $1,000.

- Verify contract addresses. Uniswap’s official pool for ETH/USDC is always the same address. Bookmark it.

- Check audits. Look for multiple audits from firms like CertiK or Trail of Bits. Avoid new pools with no audit history.

One Reddit user lost $12,000 because they approved unlimited USDC to a fake Uniswap page. It looked identical. Always double-check the URL and contract.

How to Actually Manage Your Position

Here’s a simple, step-by-step process used by top performers:- Start small. Use 0.1-0.5 ETH equivalent. Learn before you scale.

- Choose the right pool. Use DefiLlama to find pools with at least $10 million TVL and $1 million daily volume. Thin pools = high slippage = bad returns.

- Set your price range. For Uniswap V3, pick a range within 15% of the current price. That’s where 90% of trading happens.

- Pre-swap to exact ratio. If you’re adding ETH and USDC, make sure the values match 50/50. Even a 1% imbalance can cost you 0.5-1.2% in slippage.

- Monitor weekly. Check price movement. If ETH moves 15% outside your range, adjust it. Use tools like SWAAP’s Autopilot or Uniswap’s Position Manager to automate this.

- Rebalance quarterly. Shift 10-20% of your capital between stablecoin and volatile pools based on market conditions. More volatility? More stablecoins.

- Withdraw in tranches. Don’t pull all your liquidity at once. Take out 25% at a time during big rallies to lock in gains.

Real Results: What Works in 2025

A user named DeFiDegen42 on Reddit managed a $5,000 ETH/USDC position on Uniswap V3. They set a $1,850-$2,150 range, adjusted it every time ETH moved 18%, and used Zapper.fi to track impermanent loss. After six months, they earned 18.7% APY net after losses. The average passive provider on the same pool made 6.2%.Another user, CryptoNoob1987, left a LINK/USDC position on SushiSwap for three months during a price surge. When they checked, their range was completely out of bounds. They earned zero fees and lost 32% to impermanent loss.

The difference? One treated it like a business. The other treated it like a lottery ticket.

Where to Go Next

If you’re ready to level up:- Try Balancer for multi-token pools (e.g., 60% ETH, 30% LINK, 10% WBTC). Great for diversification, but harder to manage.

- Explore cross-chain pools. Over 32% of LPs now use Arbitrum, Polygon, or Base to reduce gas. But be careful-bridging has cost users $412 million in 2024.

- Watch for EIP-7288 in Q2 2025. It will cut gas costs for liquidity adjustments by 35-45% on Ethereum.

The future of liquidity provision isn’t passive. It’s professional. Institutions are pouring in. Tools are getting smarter. If you want to keep up, you need to treat your liquidity position like a portfolio-not a side hustle.

What’s the safest liquidity pool for beginners?

The safest option is a stablecoin pair like USDC/DAI on Curve Finance. These pools have low volatility, minimal impermanent loss (under 1.5% annually), and consistent 2-4% APY. Start here before moving to volatile pairs like ETH/USDC.

How often should I rebalance my liquidity position?

Check your position weekly. Rebalance your price range on Uniswap V3 whenever the asset price moves 15-20% outside your set range. Do a full portfolio rebalance-shifting between stable and volatile pools-every 3 months.

Can I lose more than I deposited?

No, you can’t lose more than your initial deposit in a liquidity pool. But you can lose a significant portion of your value due to impermanent loss or missed fees. If you leave your position outside the price range for weeks, you might earn nothing while the market moves-effectively losing opportunity cost.

Are liquidity pool returns taxed?

Yes. In most jurisdictions, the fees you earn are treated as income when received. If you withdraw and sell tokens at a profit, capital gains tax may apply. Keep detailed records of deposits, withdrawals, and fee claims. Use tools like Koinly or TokenTax to track taxable events.

What’s the best tool to manage liquidity positions?

Zapper.fi is the most popular for beginners-it shows impermanent loss, APY estimates, and lets you manage multiple pools in one place. For advanced users, SWAAP’s Autopilot and Uniswap’s Position Manager (released Jan 2025) automate range adjustments and save hours of manual work.

Is it better to use Uniswap or Curve for liquidity?

Use Curve for stablecoin pairs-its algorithm is built for low slippage and steady returns. Use Uniswap V3 for volatile pairs like ETH/USDC if you’re willing to actively manage price ranges. Curve is safer and simpler; Uniswap V3 is more profitable but requires attention.

25 Comments

Sammy Tam

December 16 2025Man, I started with just $500 in USDC/DAI on Curve and now I’m pulling in $15 a month in fees with zero headaches. Seriously, if you’re new to this, don’t even look at ETH/USDC yet. Stablecoins are the gateway drug to DeFi that doesn’t make you cry at 3 AM.

And yeah, gas on Ethereum is a joke - switched to Arbitrum last month and my transactions cost less than my morning coffee. Game changer.

Jonny Cena

December 18 2025Love this breakdown. So many people treat LP like passive income when it’s really a part-time job. I used to just drop funds and forget - lost 18% on a SOL/USDC pool because I didn’t check for two months. Learned the hard way.

Now I set weekly reminders to check my ranges. Tools like SWAAP Autopilot saved me 10+ hours a month. Not sexy, but it works.

Shruti Sinha

December 19 2025Actually, the 0.01% fee tier on Curve is underrated. I’ve been in USDC/DAI for 14 months and my impermanent loss is 0.8%. That’s better than most savings accounts, and I didn’t even have to think about it.

Mark Cook

December 20 2025LOL who even cares about LPs anymore? 😂

Just buy ETH and HODL. All this ‘active management’ is just Wall Street trying to sell you a subscription.

10/10 would rather lose 50% than spend 20 hours a month staring at charts.

Sally Valdez

December 21 2025Let me guess - this is the same guy who thinks DeFi is ‘free money’ because he watched a YouTube video.

Real talk: if you’re not using a hardware wallet, you’re just giving your keys to a scammer. And don’t even get me started on Layer 2s - they’re just Ethereum’s way of outsourcing their security problems to unregulated playgrounds.

Meanwhile, the Fed’s printing money like it’s 2020. Why are you risking your savings on some smart contract written by a 19-year-old in Manila? I mean, really?

Stablecoins? Please. DAI is backed by crypto. Crypto is volatile. So you’re still exposed. You’re just playing a different version of Russian roulette.

And don’t even mention ‘autonomous rebalancing’ - that’s just code running wild. What happens when the oracle fails? What if the contract gets drained? You think your ‘autopilot’ will save you? Nah. You’ll be begging for a refund in the Telegram group.

Real wealth isn’t in liquidity pools. It’s in land. Gold. Cash. Things that don’t require a private key to exist.

And if you’re still using Zapper.fi? Bro. That’s a front-end. The real danger is underneath. You think you’re safe? You’re not. You’re just one exploit away from losing everything you’ve got.

Emma Sherwood

December 23 2025As a Black woman in DeFi, I’ve seen so many guides that assume everyone has $5K to throw around. Not everyone can afford to lose 15% on a bad range. My advice? Start with $100. Use a wallet you can afford to lose. And if you’re on Ethereum, just wait for EIP-7288. No need to burn gas for nothing.

Also - Curve isn’t just ‘safe.’ It’s a community. The devs actually listen. That’s rare.

Don’t let the hype make you feel like you’re behind. This isn’t a race. It’s a garden. Water it slowly.

Kelsey Stephens

December 25 2025Thank you for writing this. I was so overwhelmed before - felt like I needed a PhD to manage a pool. This made it feel human. I started with $200 in USDC/DAI on Curve last month. Earned $0.72 in fees. Felt like a win.

Small steps. No shame in starting tiny.

George Cheetham

December 25 2025There’s a quiet truth here: liquidity provision isn’t about maximizing yield - it’s about understanding time. The people who win aren’t the ones who chase 20% APY. They’re the ones who understand that markets move in cycles, and patience is the only edge that doesn’t require code.

I’ve seen traders blow up accounts trying to ‘outsmart’ the range. Meanwhile, I just set a 10% buffer around the current price and walk away. I check once a week. I sleep better. My returns are steady. Not flashy. But real.

DeFi rewards discipline, not aggression.

Sean Kerr

December 26 2025Y’all need to chill with the gas fees!! 😅

Just use Polygon or Arbitrum - it’s $0.02 per transaction. I rebalance every 3 days and it still costs less than a soda. No cap.

Also - don’t forget to check your approvals! I had a dude in my Discord get hacked because he approved 100k USDC to some random site. Bro. Just use a limit. Always.

And yes - Curve is the MVP. No debate. 🙌

Cheyenne Cotter

December 27 2025Actually, most of this advice is dangerously oversimplified. You’re talking about Uniswap V3 like it’s a magic bullet, but you’re ignoring the fact that concentrated liquidity is a zero-sum game - every fee you earn is a fee someone else lost because they were outside the range. And the ‘15% rule’ for rebalancing? That’s based on a single Gauntlet study from January, which was funded by a VC that has stakes in DeFi analytics tools.

And let’s not forget that impermanent loss isn’t ‘impermanent’ if the price never comes back - which happens more often than people admit. Look at the LUNA collapse - people who had LUNA/UST pools lost everything. Not 15%. Not 25%. Everything.

Also, Zapper.fi? It’s a front-end. It doesn’t show you the full picture. It doesn’t warn you about token risks. It doesn’t tell you if the pool is being manipulated by whales. You think you’re safe because the APY is high? That’s the trap.

And don’t get me started on Layer 2s - they’re centralized. Arbitrum’s sequencer is controlled by Offchain Labs. Polygon? Controlled by a company with ties to a Chinese conglomerate. You think you’re decentralized? You’re not. You’re just trusting a different set of gatekeepers.

And EIP-7288? It’s still in draft. Don’t bank on it. And if you’re using a hardware wallet, good for you - but most people don’t. Most people use MetaMask on their phone. And that’s not a wallet. That’s a liability.

So yeah. Start small? Maybe. But don’t pretend this is safe. It’s not. It’s gambling with code. And the house always wins.

Elvis Lam

December 28 2025For real - if you’re using Uniswap V3 and not setting your range within 15% of current price, you’re just throwing money away. I had a $3k ETH/USDC position that earned $0 for 42 days because I left it at $1500-$2500. ETH went from $1800 to $2400. I was outside the range the whole time.

Fixed it. Set range to $2250-$2500. Got 14% APY in 3 weeks. It’s not complicated. Just don’t be lazy.

Sue Bumgarner

December 28 2025Oh wow, another ‘DeFi expert’ telling people to trust ‘tools’ like Zapper.fi. Who owns Zapper? Who coded it? Did they get audited? Or is this just another Silicon Valley fairy tale?

And you think Curve is safe? DAI is pegged to USD - but it’s backed by crypto. Crypto is volatile. So you’re still exposed. And what if MakerDAO gets hacked? Or the collateral gets liquidated? Boom - your ‘stable’ USDC/DAI pool goes to zero.

And Layer 2s? HA. They’re just centralized proxies. You think Arbitrum is decentralized? The sequencer is controlled by one company. The validators? Handpicked. You’re not decentralized. You’re just on a faster train to the same destination: ruin.

And you’re telling people to ‘rebalance quarterly’? What if the market crashes while you’re on vacation? Your ‘smart’ strategy becomes a death sentence.

Real wealth is in physical assets. Real freedom is in cash. Not some digital token in a contract written by someone you’ve never met.

Heather Turnbow

December 29 2025Thank you for the thoughtful, detailed breakdown. It is rare to encounter such a well-structured and empirically grounded resource in the DeFi space. I appreciate the emphasis on risk mitigation, gas optimization, and the psychological discipline required to avoid emotional decision-making. The distinction between passive and active management is critical, and your step-by-step framework offers a tangible pathway for individuals at varying levels of experience. I will be sharing this with my financial literacy group.

Jesse Messiah

December 30 2025Big respect to the OP - this is the kind of post that actually helps people. I used to be the guy who left his LPs on auto-pilot and cried when he lost money.

Now I use SWAAP Autopilot + check my position every Sunday. I don’t obsess. I don’t panic. I just move when the price shifts 18%+.

Also - gas on Ethereum is brutal. Switched to Base. Fees are 10 cents. No regrets.

Tom Joyner

January 1 2026How quaint. You speak of ‘15% ranges’ and ‘fee tiers’ as if these are objective truths. The entire architecture of AMMs is a probabilistic illusion - a casino rigged by algorithmic arbitrageurs who front-run your rebalancing transactions. You think you’re ‘managing’ your position? You’re just a data point in a quant’s backtest.

And you cite Gauntlet? The same firm that advised the protocol that collapsed last year? Please.

Real liquidity provision doesn’t exist on-chain. It exists in the dark pools of centralized exchanges, where the real fees are harvested. You’re paying gas to feed the machine.

And yet - you still believe in the myth of decentralization. How poetic.

Dionne Wilkinson

January 1 2026I’ve been in USDC/DAI on Curve for over a year. I haven’t touched it. I don’t check it. I just let it sit. I earn 3% a year. I sleep well. I don’t stress. I don’t need to be a ‘DeFi guru.’ I just need to be safe.

This post made me feel like I’m doing it right - even if I’m not doing anything.

Amy Copeland

January 1 2026Oh wow. So you’re telling me I should ‘monitor weekly’? And ‘rebalance quarterly’? Like I have nothing better to do than babysit my crypto? What’s next? Should I also meditate on my wallet’s private key before bed?

And you think Curve is ‘safe’? Tell that to the 12 people who lost their life savings when the DAI peg broke last year. Or was that just a ‘rare event’?

Meanwhile, I’m holding physical gold. It doesn’t need a password. It doesn’t get hacked. It doesn’t rely on ‘oracles.’

And you call this ‘professional’? This is a cult. With spreadsheets.

Kayla Murphy

January 3 2026You’re right - this isn’t a side hustle. It’s a mindset shift. I used to think DeFi was about getting rich quick. Now I see it as a way to learn how money really moves.

Started with $100. Now I’ve got $800 across 3 pools. Not rich. But I’m learning. And that’s worth more than any APY.

Terrance Alan

January 3 2026Of course you're telling people to use tools. Because the system wants you to be dependent. Zapper.fi? SWAAP? They track your every move. They know your balances. They know your habits. And who owns them? Big Tech. Big Finance. The same people who crashed the economy in 2008.

You think you're in control? You're just another data point feeding the machine. They don't care if you earn 15%. They care that you're still playing the game.

And the ‘safest’ pool? USDC/DAI? USDC is backed by BlackRock. DAI is backed by crypto. Neither is real money. Neither is freedom.

Real wealth isn't in a wallet. It's in the ability to say no.

Don't participate. Don't optimize. Don't rebalance.

Just walk away.

Florence Maail

January 4 2026100% this. The whole DeFi thing is a psyop. They want you to think you’re ‘earning’ by providing liquidity - but you’re just giving them free capital to manipulate prices. Every time you adjust your range, you’re helping the whales re-balance their positions. You’re the bait.

And ‘impermanent loss’? That’s just a fancy term for ‘you got scammed.’

Remember when everyone was ‘staking’ Terra? Now it’s ‘providing liquidity.’ Same script. Different labels.

Don’t be the last one in.

...just saying 😈

Chevy Guy

January 5 2026So you're telling me I should spend 20 hours a month managing my crypto to make 15% when I could just buy BTC and sleep? And you think that's 'professional'? Bro. I work 40 hours a week. I don't need a second job managing a digital piggy bank.

Also - 'EIP-7288'? Sounds like a government backdoor to me. They're gonna tax this next. Just wait.

And Curve? Yeah right. USDC is a fiat token. You're not even in DeFi. You're in a bank with a blockchain sticker.

Real DeFi is dead. This is just a PowerPoint presentation with gas fees.

Bradley Cassidy

January 5 2026Yo this post is fire!! 😎

Just switched to Uniswap V3 with a $2k ETH/USDC pool and set my range at $2050-$2250. Rebalanced after ETH jumped 18% and now I’m earning 14% APY. No cap.

Also - gas on Ethereum is wild. Used Arbitrum and paid like 20 cents. Game changer.

Big up to the OP - this saved me from losing my shirt like that dude who left his LINK pool outside range. LMAO.

ps: if you’re new, start with Curve. no cap. 💯

Rebecca Kotnik

January 5 2026It is imperative to underscore the systemic vulnerabilities inherent in automated market-making protocols. The assumption that impermanent loss can be mitigated through periodic rebalancing presumes a level of market predictability that is fundamentally incompatible with the stochastic nature of cryptoasset price discovery. Furthermore, the reliance on third-party interfaces such as Zapper.fi introduces an additional layer of centralized trust, thereby undermining the very principles of decentralization upon which the DeFi ecosystem purports to be founded.

It is also noteworthy that the cited APY figures are derived from specific timeframes and do not account for tail risk events - such as the collapse of algorithmic stablecoins or oracle failures - which, while statistically infrequent, carry catastrophic consequences for liquidity providers.

Therefore, while the tactical advice presented may yield favorable outcomes under benign market conditions, it fails to account for the structural fragility of the underlying infrastructure. One must approach liquidity provision not as a yield-generating activity, but as a high-stakes experiment in distributed finance - one that demands rigorous risk modeling, not heuristic guidelines.

Sean Kerr

January 6 2026Wait - you said ‘start with $200’? I started with $50 on Curve. Got $0.18 in fees last month. Felt like I won the lottery 😆

Don’t need much to start. Just need to be consistent.

Kelsey Stephens

January 8 2026This. So much this. I started with $10. It’s not about the amount. It’s about learning. I made a mistake once and lost $0.40. Learned more in that moment than any YouTube video ever taught me.

Small steps. Safe space. No shame.