JF (Jswap) Airdrop Details: How to Claim, Risks & Current Status (2025)

Quick Takeaways

- The JF token belongs to the Jswap.Finance DEX on OKExchain and has a capped supply of 100million.

- Two main airdrop channels have existed: MEXC’s 2021 Kickstarter program and ongoing Bitget challenges.

- Current market data shows a $0 price, zero volume, and negligible liquidity - treat any new airdrop with extreme caution.

- Claiming a JF airdrop normally requires completing exchange‑specific tasks (voting, trading, or staking).

- Deflationary tokenomics rely on profit‑driven buy‑backs, but they’re ineffective when trading activity is near‑null.

What Is Jswap.Finance and the JF Token?

Jswap.Finance is a decentralized exchange (DEX) built on OKExchain. It markets itself as a one‑stop DeFi hub offering swap mining, liquidity mining, single‑token vaults, DAO dividends, and a cross‑chain bridge. The platform’s native governance token is JF. JF is designed to give holders voting power and a share of platform profits, which are funneled into token repurchase and burn mechanisms. The token’s maximum supply is 100million, with no official circulating supply reported as of October2025.

How the JF Airdrop Has Been Rolled Out

The most documented distribution happened in November2021 via the MEXC exchange’s Kickstarter campaign. Participants locked a total of 23,648,779MX tokens to vote for JF’s listing. Successful voters received a flat reward of 35,200JF tokens. MEXC warned participants that tokens listed in its Innovation Zone can be highly volatile.

Since then, Bitget has advertised “ongoing challenges and promotions” that promise free JF airdrops for users who complete tasks such as trading volume thresholds, staking certain assets, or engaging in community quizzes. The Bitget model is more of a continuous bounty system rather than a single‑time drop.

Step‑by‑Step Guide to Claim a JF Airdrop (If It Still Exists)

- Identify a supported exchange - currently MEXC (historical) or Bitget (active challenges).

- Create and fully verify your account on the chosen platform (KYC may be required for larger rewards).

- Participate in the specific activity:

- MEXC: Vote for JF listing by staking MX tokens during the Kickstarter window.

- Bitget: Complete the latest promotion listed under the “Airdrop” tab - usually a trade‑volume or staking challenge.

- Link your wallet address where you want the JF tokens sent. The platform typically accepts ERC‑20 compatible addresses (even though JF lives on OKExchain, many bridges exist).

- Monitor the “Airdrop History” or “Reward Center” section for the distribution date. Tokens are usually dispatched within 7‑10days after the campaign ends.

- Once received, add JF to your wallet using the contract address 0x5fAc…C85b0A (partial representation; verify the full address on a block explorer).

If any step fails, double‑check that you met the minimum activity threshold and that your wallet address matches the network you intend to use.

Current Token Economics & Market Snapshot

| Metric | Value |

|---|---|

| Maximum Supply | 100million JF |

| Circulating Supply | Data not reported (≈0) |

| Current Price | $0USD (as shown on Binance and CoinMarketCap) |

| 24‑hr Volume | $0 |

| Total Value Locked (TVL) | $60million (historical peak) |

| Annual Percentage Yield (APY) on JF/USDT | Up to 1,476% (short‑term bursts) |

| Deflationary Mechanism | Buy‑back & burn funded by platform fees |

| Fully Diluted Market Cap | $431,735.23 |

The data reveals a stark mismatch: impressive historical TVL versus a present‑day price of zero and virtually no trading activity. This suggests either a data‑feed glitch or a severe liquidity crunch.

Risks You Should Not Ignore

1. Zero price and volume - buying or holding JF now offers no clear exit route. Exchanges may delist the token without notice.

2. Tokenomics reliance on fees - the buy‑back‑and‑burn model only works if the DEX generates substantial fees. With $0 daily volume, the mechanism is effectively idle.

3. Exchange‑centric airdrop model - you must trust the exchange’s honesty and its ability to actually distribute tokens. Past airdrops have been one‑off events, not recurring streams.

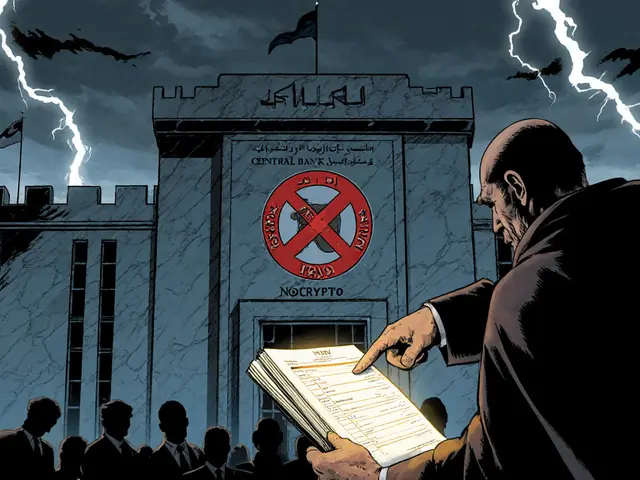

4. Regulatory uncertainty - innovation‑zone listings often attract scrutiny. Participants may face sudden trading restrictions.

5. Smart‑contract opacity - the contract address (0x5fAc…C85b0A) is not fully verified on public explorers, making it harder to audit for hidden backdoors.

Frequently Asked Questions

Frequently Asked Questions

What is the JF token?

JF is the governance token of the Jswap.Finance DEX on OKExchain. Holders can vote on protocol proposals and receive a share of platform fees that are used for token buy‑backs and burns.

How can I claim a JF airdrop today?

The only active channel is Bitget’s promotional challenges. Sign up, complete the listed tasks (usually a trade‑volume or staking requirement), and wait for the reward distribution in the “Airdrop” section of your account.

Why does JF show a $0 price on major trackers?

Both Binance and CoinMarketCap report $0 because there is essentially no on‑chain trade activity and the price feeds have no recent data points. It could be a reporting glitch, but more likely the token lacks liquidity.

Is the JF airdrop a good way to earn crypto?

Only if you’re comfortable with high risk. The token’s market is practically dead, so any future upside depends on the DEX reviving its user base and unlocking liquidity.

What does “deflationary tokenomics” mean for JF?

It means the protocol aims to reduce the circulating supply over time by burning a portion of the tokens bought back with platform fees. The effect is negligible when fees are near zero.

Next Steps & Troubleshooting

If you’ve tried to claim a Bitget reward and haven’t seen the tokens after two weeks, first verify that you met the exact activity threshold. Then check the “Reward History” for any pending status. If the reward is still missing, contact Bitget support with your account ID and a screenshot of the completed challenge.

Should you decide to hold JF after receiving an airdrop, consider moving the tokens to a hardware wallet that supports OKExchain (e.g., Ledger with custom firmware). This reduces exposure to exchange hacks.

Lastly, keep an eye on official Jswap.Finance channels - Telegram, Twitter, and Medium - for any announcements about new airdrop rounds or platform upgrades. If the project releases a functional cross‑chain bridge or revitalizes its liquidity pools, the token’s outlook could shift dramatically.

14 Comments

emmanuel omari

September 6 2025The JF airdrop is just another gimmick that preys on uninformed investors, especially those outside the core African DeFi community that actually understands the value of native chain projects. It claims a “deflationary” model, yet with zero volume the buy‑back mechanism can’t function. The fact that the token sits on OKExchain, a chain with limited global adoption, makes it even more dubious. Anyone who hopes for a quick profit should reconsider and look at proven ecosystems instead. Remember, a token with $0 price and no liquidity is a red flag.

Andy Cox

September 6 2025Looks like they’re trying to hype a dead token but most people just ignore the details and chase the hype

Courtney Winq-Microblading

September 6 2025When you peel back the glossy marketing veneer of Jswap.Finance, you uncover a narrative riddled with paradoxes that feel almost poetic in their absurdity. The promise of governance power collides with a market that refuses to assign any value, creating a ghostly echo of participation. It’s fascinating how the tokenomics are painted as deflationary, yet the actual burn can only happen if fees flow, which is impossible without traders. This juxtaposition forces us to ask whether the project is a genuine experiment or a cleverly disguised pump‑and‑dump scaffolding. In a world where liquidity is the lifeblood of any DeFi protocol, JF appears to be a withered leaf clinging to a branch that no longer bears fruit. The airdrop, while seemingly generous, may simply be a carrot dangled before a herd that has already been led to a barren pasture. Still, for the philosophically inclined, it offers a case study in how hype can masquerade as utility. Ultimately, the decision to chase this airdrop should be guided by a clear‑eyed assessment of both risk and the true scarcity of value.

Jayne McCann

September 6 2025I don’t see the point. The token is dead. No one will trade it.

Richard Herman

September 6 2025Let’s keep things in perspective: the JF token’s current state is a textbook example of why liquidity matters. While the airdrop could hand you a few thousand tokens, without an active market you’ll struggle to convert them into anything useful. If the team can revive trading volume on OKExchain, there’s a sliver of upside, but that’s a big if. For now, treat the airdrop as a learning experience rather than a money‑making opportunity. Stay diversified and don’t put all your hope into a single, dormant token.

Stefano Benny

September 6 2025From a technical standpoint, the JF token suffers from a classic case of “zero‑volume syndrome” 🤦♂️. The buy‑back‑and‑burn algorithm is essentially idle, making the deflationary claim nothing more than a marketing buzzword. Moreover, the token’s presence on a niche chain limits cross‑chain arbitrage opportunities 🚫. If you’re chasing APY numbers like 1,476% you’re ignoring the underlying liquidity vacuum. In short, the token is an illiquid asset with a high‑risk profile – not a safe haven for capital.

Prince Chaudhary

September 6 2025We need to stay realistic about the risks while keeping the community motivated. Even if the airdrop seems unattractive now, completing the Bitget challenges can still teach valuable skills about DeFi interactions. Use the experience to sharpen your understanding of staking, trading thresholds, and wallet security. Remember, every small step builds competence that will serve you when better opportunities arise. Keep pushing forward, but do so with caution.

John Kinh

September 6 2025Sounds like a waste of time.

Mark Camden

September 6 2025It is incumbent upon every participant in decentralized finance to conduct thorough due diligence before allocating resources to any token, including JF. The absence of transparent circulating supply data and the zero market price constitute material information that must be weighed heavily. Engaging with a project that exhibits such opacity can be construed as imprudent and potentially detrimental to one’s financial well‑being. Moreover, the reliance on exchange‑driven airdrops places undue trust in entities that may lack fiduciary responsibility. Therefore, I advise a cautious stance, reserving capital for initiatives with demonstrable liquidity and governance clarity.

Evie View

September 6 2025The idea that anyone would chase a token that shows $0 price is absurd and infuriating. It feeds the desperation of people who think they can get rich quick without understanding the mechanics. Such scams thrive on hype and blind optimism, and it’s sickening to see them still get attention. Wake up and see the reality – this is a dead market, not a hidden treasure.

Sidharth Praveen

September 6 2025Don’t let the current bleak numbers intimidate you; every successful project faces rough patches before a breakthrough. If the Jswap team can deliver a functional cross‑chain bridge, liquidity could surge and those airdropped tokens might gain real value. Keep an eye on official announcements and be ready to act when genuine progress is demonstrated. In the meantime, use this period to experiment with the platform’s other features, like liquidity mining, to stay engaged. Stay hopeful, stay proactive.

Sophie Sturdevant

September 6 2025From a risk‑management perspective, allocating capital to a token with nil depth is a high‑beta move that lacks fundamental support. The burn‑and‑buy protocol is effectively dormant, rendering the deflationary narrative moot. Unless you’re speculating on a potential protocol upgrade, this exposure is speculative at best. Align your portfolio with assets that demonstrate robust TVL and sustainable fee structures. Otherwise you’re just chasing a mirage.

Nathan Blades

September 6 2025Let me paint a broader canvas for you, one that stretches beyond the immediate metrics of price and volume. Imagine a decentralized exchange as a bustling marketplace, each token a vendor vying for the attention of passing traders. In this metaphor, JF is the silent stall-its wares untouched, its voice unheard, yet the potential for revival remains embedded in the architecture of the platform. The current $0 price tag is not a verdict; it is a snapshot of a moment where liquidity has evaporated, leaving behind only the skeletal framework of governance tokens. If the architects of Jswap can inject fresh capital, attract liquidity providers, and perhaps integrate with larger ecosystems, that silent stall could become a thriving hub. The airdrop, in this scenario, serves as a seed-an incentive for early adopters willing to weather the drought in anticipation of rain. Such a strategy relies heavily on community patience, strategic partnerships, and transparent roadmaps. Moreover, the deflationary mechanism, while idle today, could awaken as transaction fees climb, initiating a feedback loop of buy‑backs and burns that gradually squeezes supply. Critics who dismiss the token outright may overlook the cyclical nature of crypto markets, where today’s dead weight can become tomorrow’s catalyst. It is essential, however, to balance optimism with rigorous risk assessment: evaluate the team’s credibility, audit the smart contract, and monitor real‑world adoption signals. For those prepared to navigate this ebb and flow, the potential upside-though speculative-cannot be dismissed outright. In the end, whether you view JF as a dormant phoenix or a cautionary tale depends on the weight you assign to future development versus present reality. Proceed with eyes wide open, and let data, not hype, guide your steps.

Somesh Nikam

September 6 2025In summary, the JF token currently exhibits negligible liquidity and a zero market price, which underscores the importance of cautious participation. Should you decide to pursue the Bitget airdrop, ensure you meet the exact activity thresholds and verify your wallet address carefully. Maintain a diversified portfolio to mitigate the inherent risks associated with low‑volume assets. Keep monitoring official communication channels for any updates regarding liquidity improvements or protocol upgrades. By adhering to these best practices, you can engage responsibly while staying prepared for potential future developments.