DEX Trading Fees and Slippage: What You Really Pay in 2026

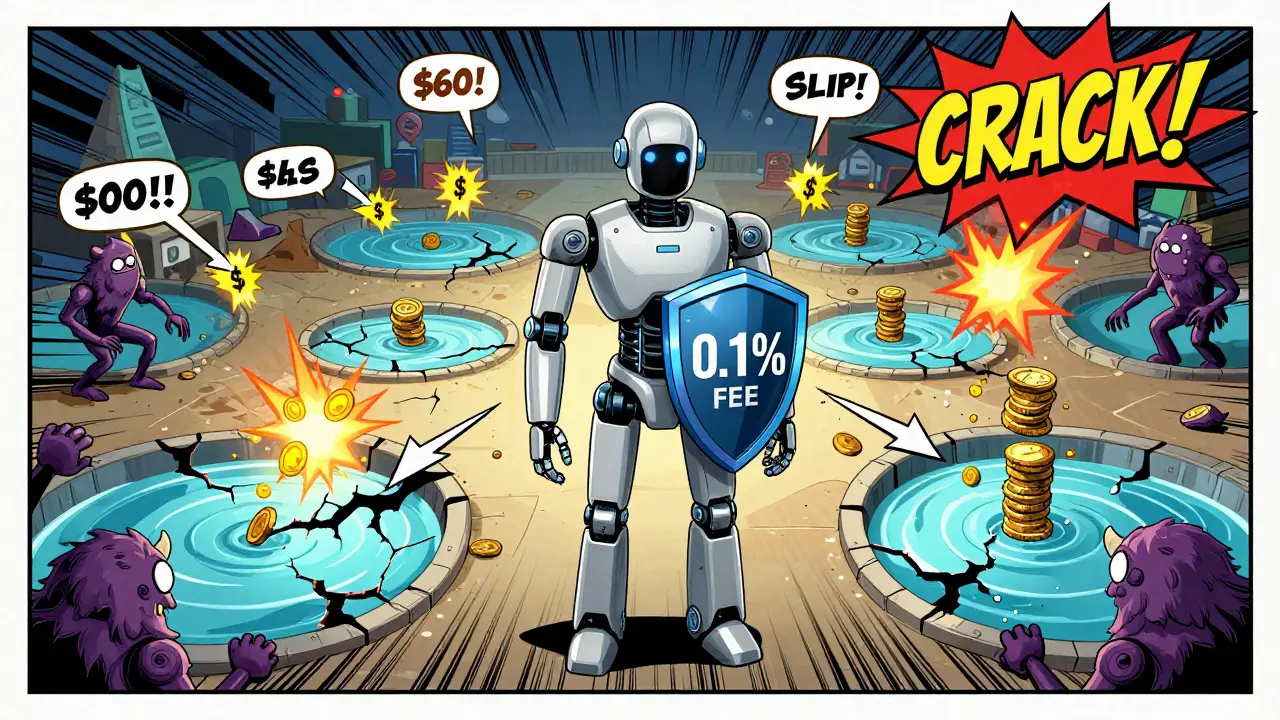

When you trade crypto on a decentralized exchange, you might think you're getting a better deal than on a centralized platform like Binance or Coinbase. After all, no middleman means no hidden fees, right? Not quite. In 2026, the real cost of trading on a DEX isn't just the 0.3% swap fee you see on the screen. It's the gas fee you didn't see coming, the slippage that eats into your profit, and the hidden price impact of trading in shallow pools. If you're losing money on every trade without knowing why, you're not alone.

What You Actually Pay: The Four Hidden Costs

Most new traders only look at the swap fee - the percentage the DEX charges to execute your trade. That’s usually between 0.02% and 0.30%. But that’s just one piece. The full cost has four parts:

- Protocol swap fee - charged by the DEX itself

- Gas fee - paid to miners or validators to process your transaction

- Slippage - the difference between the price you see and the price you get

- Routing fees - if you use an aggregator, it might charge a small cut or route through multiple pools

On Ethereum mainnet, a $500 trade might look like this:

- Swap fee: $1.50 (0.3%)

- Gas fee: $8.50

- Slippage: $3.00 (0.6%)

- Total cost: $13 - or 2.6% of your trade value

Compare that to Binance, where you pay 0.1% ($0.50) and nothing else. Suddenly, that "no middleman" advantage feels less appealing.

How Slippage Eats Your Profits

Slippage isn’t a fee. It’s a price change caused by your own trade. Imagine you want to buy 100 ETH for 3,000 USDC each. You click "swap" and the DEX shows you’ll get 300,000 USDC worth of ETH. But because the pool doesn’t have enough liquidity, your trade pushes the price up as it executes. By the time it’s done, you end up paying 3,050 USDC per ETH. That 50 USDC difference? That’s slippage.

For popular pairs like ETH/USDC or WBTC/USDT, slippage is often under 0.1%. But for new tokens - say, a meme coin with only $2 million in liquidity - a $10,000 trade can easily cause 1% to 3% slippage. That’s $100 to $300 gone before you even pay gas.

Concentrated liquidity, like Uniswap v3’s model, helps. Instead of spreading liquidity across $1,000 to $5,000, liquidity providers focus it between $2,800 and $3,200. That means tighter price bands, less slippage, and better fills - if you’re trading within that range. But if you’re buying a token that’s jumping from $0.001 to $0.002 in minutes? No amount of concentration will save you.

Gas Fees: The Wild Card

Gas fees are the biggest variable. On Ethereum mainnet, during a NFT mint or a big price surge, a simple swap can cost $70. That’s insane for a $200 trade - you’re paying 35% in gas alone. That’s why most smart traders avoid Ethereum mainnet for small trades.

Layer-2 solutions changed everything. Polygon, Arbitrum, and Base now handle the majority of DEX volume because their gas fees are 10 to 100 times cheaper. On Polygon, a trade costs $0.10 to $0.50. On Base, it’s often under $0.05. That makes even $50 trades viable.

But here’s the catch: each chain has its own liquidity. You can’t just move funds to Arbitrum and expect to trade every token. You need to bridge your assets, and bridging has its own costs and delays. Some traders keep wallets on five different chains just to catch the best rates.

DEX Fee Breakdown: Who Gets What?

Not all DEXs are built the same. Here’s how fees break down on major platforms as of 2026:

| DEX | Swap Fee | Gas Fee (Avg.) | Liquidity Provider Cut | Protocol Treasury |

|---|---|---|---|---|

| Uniswap v3 (Ethereum) | 0.30% | $50-$100 | 0.30% | 0% |

| Uniswap v3 (Arbitrum) | 0.30% | $0.30-$1.00 | 0.30% | 0% |

| Aerodrome (Base) | 0.02% (stable), 0.20% (volatile) | $0.05-$0.15 | 0.02%-0.20% | 0% |

| ORCA (Solana) | 0.30% | $0.10-$0.30 | 0.25% | 0.05% |

| QuickSwap (Polygon) | 0.30% | $0.10-$0.40 | 0.25% | 0.05% |

Notice something? Most DEXs give 90% or more of the swap fee to liquidity providers. That’s why people stake their tokens - they’re not just speculating, they’re earning a cut of every trade. The protocol treasury (like QUICK or AERO tokens) gets the rest to fund development. But if you’re just trading, you’re not benefiting from that. You’re paying for others’ rewards.

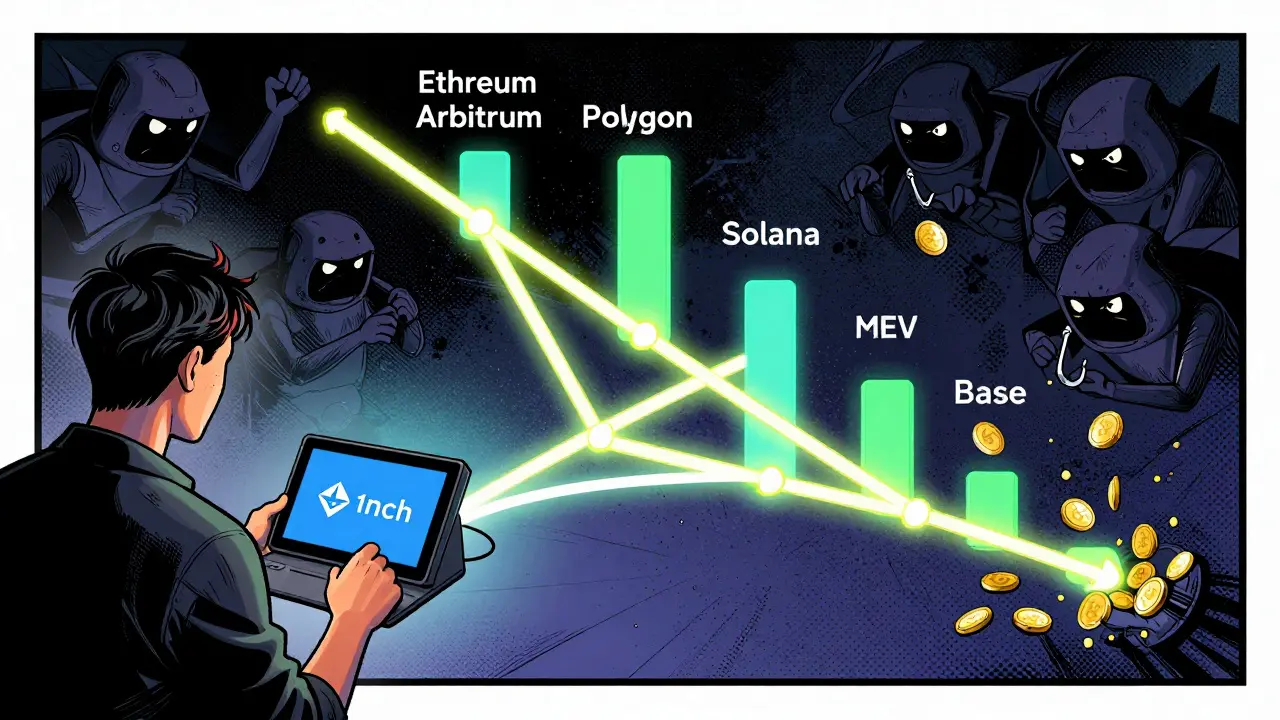

Why You Should Care About Aggregators

Aggregators like 1inch, Matcha, or Paraswap don’t just show you one DEX. They scan 50+ pools across Ethereum, Arbitrum, Polygon, and Solana to find the best price. They split your trade across multiple sources to minimize slippage. For a $10,000 trade, a good aggregator can save you 0.5% to 1.5% compared to trading on a single DEX.

But they’re not free. Some charge a small routing fee (0.05%-0.15%), and others take a cut from the spread. Still, for larger trades, it’s worth it. One user on Reddit reported saving $220 on a $15,000 ETH trade by using 1inch instead of Uniswap. That’s more than the gas fee.

The smartest traders use aggregators for large trades and direct DEXs for small, simple swaps. It’s not about being decentralized - it’s about being efficient.

Real-World Trade-Offs: Centralized vs. Decentralized

Let’s say you want to swap $1,000 of USDC for SOL.

On Coinbase: You pay 0.6% fee + spread = $8.50 total. Instant, predictable, no gas.

On Uniswap (Ethereum): Swap fee = $3, gas = $60, slippage = $5. Total = $68.

On ORCA (Solana): Swap fee = $3, gas = $0.20, slippage = $1. Total = $4.20.

So if you’re trading on Solana, DEX wins. On Ethereum? Centralized exchange wins. The truth is, DEXs aren’t cheaper - they’re different. They’re better for privacy, self-custody, and access to new tokens. But if you just want to buy ETH or SOL without losing sleep, a centralized exchange still does it better.

What You Can Do Today

Here’s how to cut your DEX costs right now:

- Use layer-2s - Arbitrum, Base, Polygon. Avoid Ethereum mainnet unless you’re trading $5,000+.

- Set slippage tolerance wisely - 0.5% for stable pairs, 1-2% for volatile tokens. Don’t leave it at 5% - that’s a recipe for being front-run.

- Use aggregators - 1inch or Matcha for swaps over $1,000.

- Trade during quiet hours - 2-5 AM UTC, when MEV bots are asleep and gas is low.

- Check liquidity depth - Look at the pool size before trading. If it’s under $5 million, expect slippage.

Most people lose money on DEXs not because the market moved against them - but because they didn’t understand the hidden costs. You don’t need to be a programmer to trade smarter. You just need to know where the fees hide.

What’s Next?

Uniswap v4 is rolling out batched transactions, which could slash gas costs by 70% for users who trade multiple times. Account abstraction on Ethereum may let wallets pay gas in tokens instead of ETH, removing a major friction point. And new chains like Sei and Blast are launching with near-zero fees and native DEX integration.

But here’s the reality: as long as Ethereum mainnet remains the most secure and liquid chain, its high fees will keep pushing small traders to layer-2s. The future of DEX trading isn’t about being fully decentralized - it’s about being cost-efficiently decentralized.

Why is slippage higher on some DEXs than others?

Slippage depends on liquidity depth. A DEX with $500 million in ETH/USDC liquidity will have almost no slippage for a $50,000 trade. But a new token with only $2 million in liquidity will have 2-5% slippage on the same trade. Uniswap v3 reduces slippage by concentrating liquidity around current prices, but only if providers set tight ranges. If liquidity is spread too thin - like on older DEXs - slippage spikes.

Can I avoid gas fees entirely on a DEX?

Not yet, but you can reduce them dramatically. Layer-2 networks like Arbitrum and Base have gas fees under $0.10. Solana averages $0.15. Ethereum mainnet? No - you’ll always pay $50+ during congestion. Some networks like Polygon are testing gasless transactions using paymasters, but these are still experimental. For now, switching chains is your best bet.

Is it cheaper to trade on Uniswap or SushiSwap?

On the same network, they’re nearly identical. Both charge 0.30% swap fees and use similar liquidity models. The real difference is which chain you’re on. If Uniswap is on Ethereum and SushiSwap is on Polygon, the Polygon one will be cheaper due to lower gas. Always compare the total cost - not just the swap fee.

Do MEV bots increase my slippage?

Yes. MEV bots scan pending transactions and front-run them - especially large trades. If you’re swapping a big amount of a low-liquidity token, bots may detect it and buy ahead, pushing the price up before your trade executes. That’s why slippage spikes during volatile markets. Aggregators and tools like Flashbots help reduce this, but you can’t eliminate it entirely. Setting lower slippage tolerance (under 1%) reduces your exposure.

Should I use a DEX for large trades?

Only if you use an aggregator and pick the right chain. For trades over $10,000, always use 1inch or Matcha on Arbitrum or Base. These platforms split your order across dozens of pools to minimize price impact. Trading $50,000 directly on Uniswap v3 on Ethereum mainnet could cost you $2,000 in gas and slippage. On Arbitrum with an aggregator? Less than $300. The difference is massive.