Bangladesh Bank crypto rules: What you need to know about crypto regulation in Bangladesh

When it comes to Bangladesh Bank crypto rules, the official stance from Bangladesh’s central bank that bans all cryptocurrency transactions and services. Also known as Bangladesh cryptocurrency ban, it’s one of the strictest crypto policies in South Asia. Unlike countries that try to regulate crypto, Bangladesh doesn’t allow it at all — no trading, no exchanges, no payments, no mining. The rules aren’t suggestions. They’re legal orders backed by penalties.

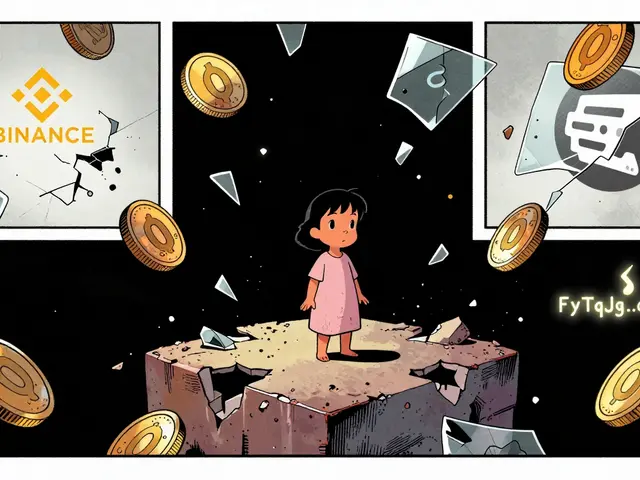

These rules aren’t new. Back in 2017, the Bangladesh Bank issued a circular declaring cryptocurrencies illegal as a medium of payment or investment. The bank’s reasoning? Protecting the national currency, preventing money laundering, and avoiding financial instability. They pointed to Bitcoin and Ethereum as high-risk assets with no central authority, no consumer protection, and no oversight. Since then, banks have been told to block transactions linked to crypto platforms. Even using Binance, Coinbase, or local P2P apps can trigger account freezes or legal action.

But here’s the twist: while the central bank says no, people still use crypto. Many Bangladeshis rely on crypto to send money abroad, avoid high forex fees, or invest when local banks offer near-zero interest. The gap between law and practice is wide. You won’t find official crypto exchanges in Dhaka, but you’ll find WhatsApp groups, Telegram channels, and local traders moving Bitcoin and USDT in cash deals. Enforcement is patchy — raids happen, but most users fly under the radar.

The Bangladesh Bank isn’t ignoring the future, though. Behind closed doors, they’ve been exploring a central bank digital currency, a digital version of the Bangladeshi taka issued and controlled by the central bank. This isn’t crypto — it’s a government-backed digital dollar equivalent. If rolled out, it could replace cash for some transactions and give the bank full control over digital payments. That’s the real goal: not to embrace blockchain, but to replace it with something they can monitor and manage. Meanwhile, other countries like India and Pakistan are moving toward regulated crypto markets. Bangladesh is doubling down on control.

If you’re in Bangladesh and thinking about crypto, you’re not just taking financial risk — you’re stepping into a legal gray zone. The Bangladesh Bank crypto rules don’t just limit access; they create fear. But if you’re watching from outside, this is a case study in how a central bank can shut down innovation — and what happens when demand outpaces regulation.

Below, you’ll find real-world examples of how these rules play out: from crackdowns on traders to comparisons with other countries’ approaches, and what the future might hold if the central bank ever changes its mind.

Bangladesh bans Bitcoin trading, but enforcement targets money movement, not ownership. Learn how authorities track users, the real legal risks, and why people still trade despite prison sentences and asset seizures.

Continue Reading