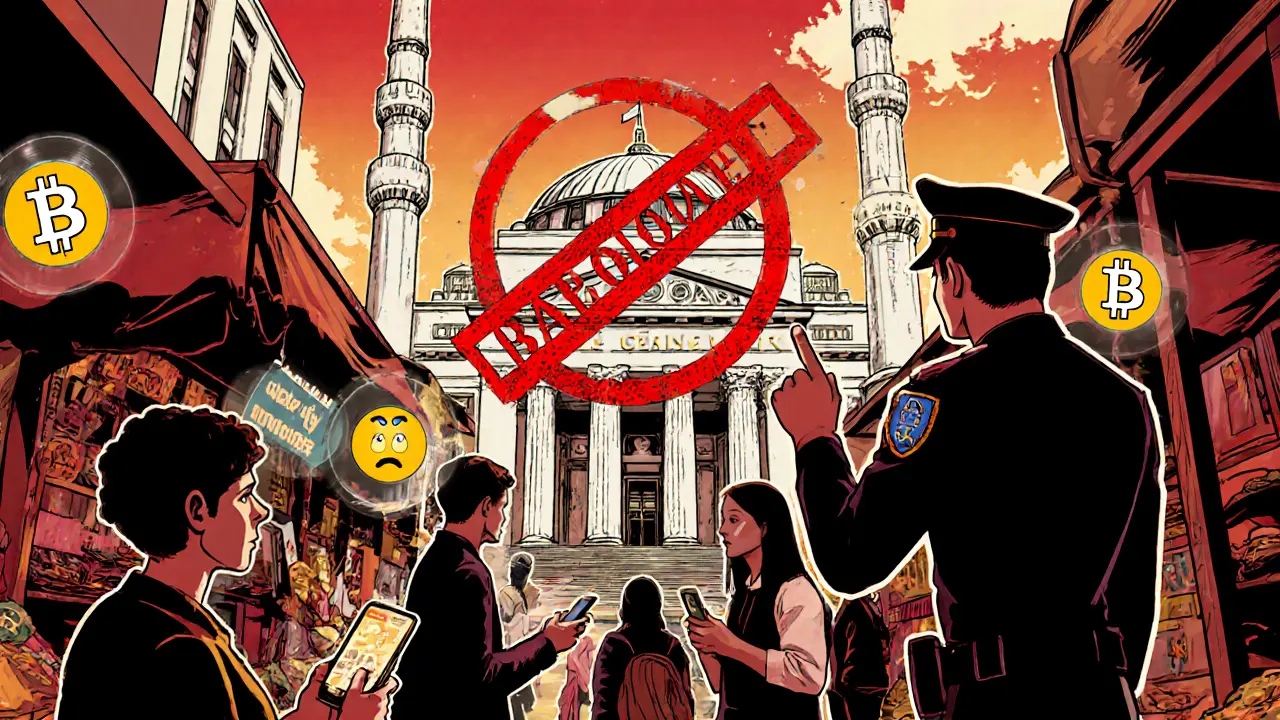

Turkey crypto regulation: how the 2024 law reshaped the market

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue ReadingWhen working with crypto asset service provider, a company or platform that offers services such as trading, custody, analytics, or airdrop distribution for digital assets. Also known as digital asset service provider, it sits at the heart of today’s crypto ecosystem, connecting users to markets, data, and secure storage.

One of the most common flavors is a crypto exchange, an online venue where traders can buy, sell, or swap cryptocurrencies. Exchanges can be centralized, meaning they run on a single company’s servers and enforce KYC checks, or they can be decentralized, which brings us to decentralized exchange, a peer‑to‑peer platform that matches orders on‑chain without a middle‑man. Both types aim to provide liquidity, but a DEX adds the twist of custody‑less trading, letting users keep private keys in their own hands. Speaking of keys, a cryptocurrency wallet, software or hardware that stores private keys and enables signing of transactions is the next essential piece. Wallets range from mobile apps that let you tap‑pay coffee to hardware devices that keep keys offline for maximum protection.

Security isn’t optional for any crypto asset service provider. Providers must implement multi‑factor authentication, cold storage for the bulk of assets, and regular penetration testing. The underlying rule is simple: the stronger the security layers, the lower the risk of hacks that can wipe out user balances. At the same time, regulatory compliance shapes how these services operate. Anti‑money‑laundering (AML) and know‑your‑customer (KYC) rules force exchanges to verify identity, while data‑privacy laws like GDPR dictate how user information is handled. In practice, compliance influences onboarding flows, reporting obligations, and even the geographic reach of a platform. The relationship forms a clear semantic triple: *crypto asset service providers require robust security protocols* and *regulatory compliance influences provider operations*.

Beyond trading and storage, many providers add analytics and airdrop tools to their suites. Blockchain analytics services sift through on‑chain data, flag suspicious activity, and offer market‑trend dashboards that help traders spot opportunities. Airdrop platforms, on the other hand, automate token distribution for new projects, letting users claim free tokens after completing simple tasks. Both services boost the overall utility of a provider, turning a basic exchange into a full‑featured ecosystem where users can trade, protect, analyze, and earn—all from one interface.

Now that you’ve got the big picture, the list below will walk you through real‑world examples, deep‑dive reviews, and practical how‑tos. From exchange risk checklists to wallet security tips, each post adds a piece to the puzzle of what makes a reliable crypto asset service provider. Dive in and see which tools and strategies fit your own crypto journey.

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue Reading