Turkey crypto regulation: how the 2024 law reshaped the market

Turkey Crypto Licensing Calculator

How Turkey Compares

Compared to other major jurisdictions:

- European Union (MiCA): €5M minimum

- United States: No fixed minimum

- China: Ban on all crypto activity

Turkey's Crypto Regulation Framework is a comprehensive set of rules introduced between 2021 and 2025 that governs crypto‑asset activities in Turkey. It combines licensing, AML/KYC, and technical standards to balance innovation with monetary stability.

The rise of Turkey crypto regulation has reshaped how traders, exchanges, and even ordinary citizens interact with digital money. What started as a permissive environment in early 2021 quickly turned into one of the world’s most structured oversight systems. Below, we break down the timeline, the legal backbone, the institutions involved, and what the future might hold for anyone dealing with crypto in Turkey.

From a Payment Ban to a Full‑Scale Legal Architecture (2021‑2022)

In April 2021 the Central Bank of Turkey (TCMB) banned crypto payments for goods and services while keeping trading legal. The move aimed to protect the Turkish lira from volatility and curb inflation‑driven crypto buying sprees. Although the ban stopped merchants from accepting Bitcoin or Ether at checkout, it left the door open for individuals to own and trade crypto on unregulated platforms.

During 2021‑2022 the government issued a series of advisory notes, but no formal licensing regime existed. This “grey zone” encouraged a surge of domestic exchanges-many operating without clear oversight. By late 2022, officials warned that the lack of supervision could fuel money‑laundering and tax evasion, setting the stage for a legislative overhaul.

The Legal Cornerstone: Law No. 7518

Law No. 7518 is the “Law on Amendments to the Capital Markets Law” enacted on 26 June 2024. It formally defines “cryptoasset”, “wallet”, “cryptoasset service provider” and sets licensing rules. The law introduced three key concepts:

- Cryptoasset: any digital token that can be transferred, stored, or traded.

- Wallet: a software or hardware tool that holds private keys for cryptoassets.

- Crypto Asset Service Provider (CASP): entities offering exchange, custody, brokerage, or related services.

The legislation mandates that every CASP obtain an operating licence from the Capital Markets Board (CMB) Turkey’s primary regulator for crypto assets. Licences come with hefty capital thresholds-TRY 150 million (≈ $4.1 million) for exchanges and TRY 500 million (≈ $13.7 million) for custodians-ensuring only well‑funded players stay in the market.

Who Watches the Watchers? The Tri‑Party Oversight Model

Turkey’s framework splits oversight among three bodies:

- Capital Markets Board (CMB) - sets licensing standards, monitors compliance, and can levy fines or revoke licences.

- Financial Crimes Investigation Board (MASAK) enforces anti‑money‑laundering rules on crypto transactions - can freeze crypto accounts and requires detailed reporting for transactions above 15,000 TRY (≈ $425).

- Scientific and Technological Research Council of Türkiye (TÜBİTAK) ensures technical compliance of crypto service providers - sets infrastructure standards and audits security implementations.

This division mirrors the EU’s MiCA approach but centralises decision‑making more tightly under the CMB, avoiding the fragmented U.S. model where multiple agencies can clash over jurisdiction.

Licensing, Capital Requirements, and Day‑to‑Day Compliance

Getting a licence is a six‑to‑twelve‑month process. Applicants must submit:

- A detailed business plan outlining services, target markets, and risk‑management procedures.

- Proof of the required capital held in a Turkish‑registered bank.

- Comprehensive AML/KYC policies that include identity verification for any transaction exceeding 15,000 TRY.

- Technical audit reports approved by TÜBİTAK, covering cold‑storage procedures, encryption standards, and incident‑response plans.

Once licensed, CASPs face ongoing obligations:

- Monthly transaction reports to the CMB, including canceled and unexecuted orders.

- Quarterly AML audits by MASAK, with the power for on‑site inspections.

- Annual technical compliance reviews by TÜBİTAK, focusing on software updates and vulnerability scans.

Non‑compliance can trigger fines up to TRY 10 million, licence suspension, or forced asset freezes.

Enforcement Wave of 2025: From DEX Shut‑downs to High‑Profile Detentions

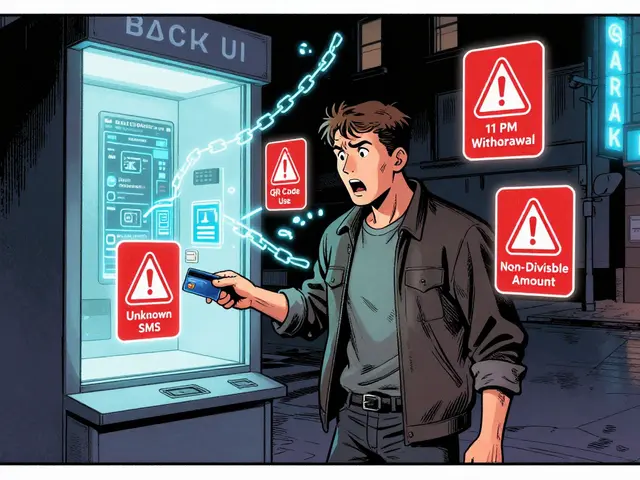

February 2025 marked the rollout of full AML enforcement. All crypto firms were required to update their KYC modules and submit real‑time transaction monitoring tools. The crackdown accelerated in July 2025 when authorities blocked 46 unlicensed exchanges, including major decentralized platforms like PancakeSwap a decentralized exchange blocked for operating without a Turkish licence. Users attempting to access these DEXs from Turkish IP addresses were met with ISP‑level blocks.

The most sensational case involved the founder of ICRYPEX one of Turkey’s largest licensed exchanges. On 28 July 2025 he was detained on accusations of funneling crypto funds to political opponents. While the charges remain pending, the episode sent a clear message: regulatory tools can be wielded for both financial stability and political leverage.

Impact on Market Participants

Licensed exchanges report a boost in consumer confidence. Robust KYC procedures and regular audits have reduced fraud complaints by roughly 30% according to a 2025 industry survey. However, the high capital ceiling has forced many smaller operators out of the market or into partnership deals with larger firms.

Retail traders experience mixed feelings. On the one hand, their assets are now protected under a clear legal regime; on the other, they face lengthy verification processes for any trade above 15,000 TRY and cannot use crypto for everyday purchases. The payment ban remains a sore point, especially for remittance users who wanted to bypass high‑fee traditional channels.

International platforms attempting to serve Turkish users are being systematically blocked. The government’s “geoblocking” capability, powered by MASAK’s account‑freezing authority, means that even offshore exchanges must obtain a Turkish licence or risk being cut off.

How Turkey Stacks Up Against Other Jurisdictions

| Aspect | Turkey | European Union (MiCA) | United States | China |

|---|---|---|---|---|

| Legal Status of Trading | Legal under licence | Legal under licence | Legal, fragmented oversight | Ban |

| Crypto Payments | Prohibited | Allowed with AML | Allowed | Ban |

| Licensing Authority | CMB (single) | National regulators (EU) | SEC, CFTC, FinCEN | None (ban) |

| Capital Minimum for Exchanges | TRY 150 M (~$4.1 M) | €5 M | No fixed minimum | N/A |

| AML/KYC Threshold | 15,000 TRY (~$425) | €10 000 | $10 000 (FinCEN) | N/A |

| Enforcement Tools | Account freeze, licence revocation | Fines, licence suspension | Fines, criminal charges | Criminal penalties |

Turkey sits between the EU’s balanced approach and China’s outright prohibition. Its unique mix-allowing trading but banning payments-creates a hybrid model that many emerging markets are watching closely.

Future Roadmap: What’s Coming Next?

Legislators are already drafting a bill to expand MASAK’s power to freeze crypto accounts without prior court approval. Proposed measures also include stricter limits on stablecoin transfers and heavier penalties for false AML reporting. If passed, these changes would align Turkey even more closely with FATF recommendations.

Analysts predict that the market share of licensed exchanges will grow to over 80% by 2027, as unlicensed players find it increasingly hard to operate. Meanwhile, the payment ban is likely to stay in place; officials argue that crypto could undermine the lira’s credibility during inflation spikes.

For businesses, the advice is clear: invest in compliance early, partner with local legal counsel, and build robust KYC/AML tech stacks. For traders, stay within the licensed ecosystem, keep transaction records, and avoid using crypto for everyday purchases to remain on the safe side.

Key Takeaways

- The 2024 Law No. 7518 gives Turkey a clear, licence‑based crypto regime.

- CMB, MASAK, and TÜBİTAK together form a three‑pillar oversight model.

- High capital requirements favor well‑funded exchanges; many small players have exited.

- Payment bans remain, limiting crypto’s use in e‑commerce and remittances.

- Future bills will tighten AML powers, making compliance even more critical.

Can I use Bitcoin to buy goods in Turkey?

No. The Central Bank’s 2021 ban still prohibits merchants from accepting any crypto as payment for goods or services.

Do I need a licence to trade crypto on a Turkish exchange?

Only the exchange itself must hold a CMB licence. Individual traders can sign up without a personal licence, but they must complete KYC verification.

What happens if I transfer more than 15,000 TRY in crypto?

MASAK requires detailed identity verification and a documented explanation for the purpose of the transfer. The transaction will be flagged and reported.

Are foreign crypto platforms allowed to serve Turkish users?

They can only operate if they obtain a Turkish CMB licence. Unlicensed foreign services are routinely blocked at the ISP level.

Will the payment ban be lifted soon?

There are no current legislative proposals to lift the ban. Officials cite monetary stability as the main reason for keeping it.

15 Comments

Michael Hagerman

October 25 2025Whoa, Turkey just turned the crypto circus into a full‑blown arena! The 2024 Law No. 7518 slams down capital thresholds like a heavyweight champion, and suddenly only the big‑fish can swim in the Turkish exchange pool.

Laura Herrelop

October 25 2025One might contemplate the ontological implications of a state imposing syntactic constraints on digital tokenomics; does the codified definition of “crypto‑asset” betray an underlying desire to shepherd collective consciousness into a predetermined fiscal narrative? Moreover, the tri‑pillar oversight resembles a microcosm of power structures that thrive on opacity, prompting the ever‑watchful eye to ask whether the true agenda lies beyond mere market stability.

olufunmi ajibade

October 25 2025Listen, the practical upshot is simple: if you want to operate in Turkey, you better lock down that TRY 150 million capital and get your AML playbook polished. Smaller innovators are being forced into partnerships or exit altogether, which is exactly the market consolidation the regulator seems to be engineering.

Sarah Hannay

October 25 2025From a regulatory standpoint, the consolidation of licensing authority within the Capital Markets Board introduces a singular point of accountability, thereby reducing jurisdictional friction. Nonetheless, the elevated capital requirements may inadvertently stifle competition and limit consumer choice, a trade‑off that warrants continuous monitoring.

Prabhleen Bhatti

October 25 2025Hey folks!!! The new framework integrates KYC thresholds of 15,000 TRY-yes, that’s roughly $425-into the AML pipeline, which means every mid‑size transaction triggers a deep‑dive audit!!! It’s a classic case of regulatory over‑engineering that could choke legitimate trade flows if not calibrated properly!!!

Chris Houser

October 25 2025Exactly, the technical audit mandated by TÜBİTAK also demands cold‑storage encryption standards that align with ISO 27001, so any exchange lacking robust key‑management will hit a compliance wall fast.

William Burns

October 25 2025It is evident that the legislative architects have endeavored to emulate the EU’s MiCA paradigm while preserving a sovereign regulatory ethos, a nuanced balance that few jurisdictions have successfully achieved.

Ashley Cecil

October 25 2025Ethically, the prohibition on crypto payments reflects a prudent stance to safeguard the national currency, yet it simultaneously curtails financial inclusion for underserved demographics.

John E Owren

October 25 2025For newcomers, the key takeaway is to prioritize thorough KYC documentation and maintain an audit‑ready posture; this proactive approach will mitigate the risk of abrupt service interruptions.

Dimitri Breiner

October 25 2025Absolutely, and coupling that with a dedicated compliance officer can streamline reporting to MASAK, ensuring that transaction thresholds are flagged in real time rather than retroactively.

Joseph Eckelkamp

October 25 2025Oh joy, another jurisdiction decides that the best way to foster innovation is by demanding multi‑million capital reserves-because nothing screams “startup-friendly” like a four‑million‑dollar entry fee.

Jennifer Rosada

October 25 2025While the regulatory rigor may appear daunting, it also establishes a trustworthy environment for investors, thereby potentially attracting more institutional capital in the long term.

adam pop

October 26 2025What they don’t tell you is that the expanded freeze powers give the state a backdoor to seize assets without judicial oversight, a tool that could be weaponized against political dissent under the guise of AML enforcement.

LeAnn Dolly-Powell

October 26 2025Stay compliant and you’ll rock the market! 🚀

Anastasia Alamanou

October 26 2025The Turkish crypto regime, inaugurated by Law No. 7518, marks a pivotal shift toward institutionalization.

By centralizing licensing under the Capital Markets Board, the state creates a clear hierarchy of authority.

This hierarchy, complemented by MASAK’s AML remit and TÜBİTAK’s technical oversight, mirrors a three‑pillar model that balances prudential supervision with technological rigor.

The capital thresholds-TRY 150 million for exchanges and TRY 500 million for custodians-serve as a gatekeeping mechanism that filters out under‑capitalized entrants.

Consequently, market consolidation is an expected byproduct, as smaller platforms either merge with larger entities or exit the Turkish landscape entirely.

For retail traders, the mandatory KYC for transactions above 15,000 TRY introduces an additional compliance layer that can slow down high‑frequency activity.

However, this same layer reduces fraud incidence, as evidenced by the 30 % dip in reported scams post‑implementation.

The prohibition on using crypto for everyday payments remains a contentious point, limiting use‑case diversity and stifling innovation in fintech payments.

International exchanges seeking Turkish market access now face a binary choice: obtain a CMB licence or be blocked at the ISP level.

This dichotomy reinforces the domestic dominance of licensed providers while aligning foreign operators with local regulatory standards.

Looking ahead, proposed legislation to expand MASAK’s account‑freezing authority could further tighten state control over digital assets.

Such measures, while enhancing anti‑money‑laundering capabilities, risk encroaching on civil liberties if not checked by robust judicial oversight.

Stakeholders should therefore invest early in compliance infrastructure, including real‑time monitoring and audit‑ready documentation.

Partnerships with seasoned legal counsel and technology firms can smooth the licensing journey and mitigate operational risk.

In sum, the Turkish model offers a blueprint of regulated growth, provided that market participants adapt swiftly to its evolving demands.