Digital Pound – The UK’s Central Bank Digital Currency

When working with Digital Pound, the United Kingdom’s official central bank digital currency (CBDC) pilot. Also known as Britcoin, it aims to give a digital, cash‑like version of the pound that can sit next to cash and bank deposits.

The CBDC, a digital form of fiat money issued by a central bank expands monetary policy tools and can improve financial inclusion by reaching people who lack traditional banking.

Implementation is led by the Bank of England, the U.K.’s central bank responsible for monetary stability, which is testing infrastructure, user experience and security protocols throughout 2025.

Why the Digital Pound Matters

One big reason the Digital Pound matters is that it lets everyday users pay instantly without relying on card networks. This digital pound can be stored on a phone app, a hardware wallet, or even a smart card, making transactions as easy as tapping a contactless card. At the same time, the Bank of England can monitor the system for illegal activity while preserving a degree of privacy through pseudonymous accounts.

Another key piece is interoperability. The digital pound is being built to work with existing payment rails like Faster Payments and emerging blockchain standards. That means merchants can accept it alongside card payments, and cross‑border transfers can be settled faster, especially when paired with other nations’ CBDCs.

From a regulatory standpoint, the Digital Pound follows the U.K.’s strict AML and KYC rules. The Bank of England’s sandbox approach lets innovators test compliance tools, such as real‑time transaction monitoring and digital identity verification, before a full rollout.

Financial inclusion is a core goal. By offering a low‑cost, accessible digital wallet, the Digital Pound can reach unbanked or underbanked communities, especially in rural areas where bank branches are scarce. The government hopes this will reduce reliance on cash and give more people a safe place to store value.

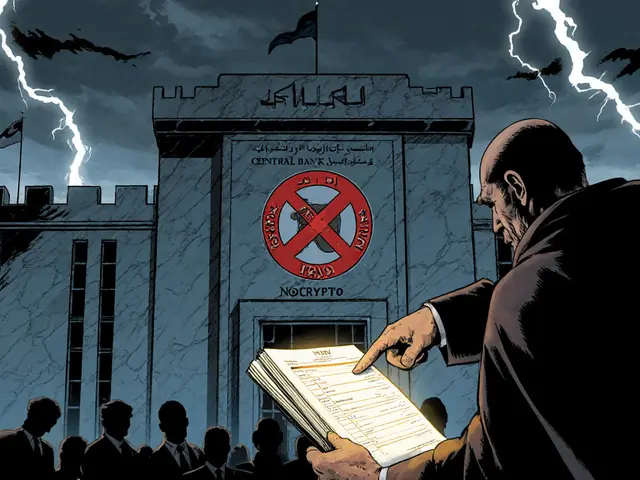

Comparisons with other CBDCs show the UK taking a cautious but tech‑forward stance. While China’s digital yuan focuses on state‑controlled wallets, the Digital Pound emphasizes user choice, open‑source code and compatibility with existing fintech services. This approach could set a template for other advanced economies.

Challenges still loom. Privacy advocates worry about potential surveillance, and critics point to the cost of building and maintaining the infrastructure. The Bank of England is addressing these concerns by publishing transparency reports and engaging with civil society to shape the design.

Overall, the Digital Pound sits at the crossroad of finance, technology and public policy. Below you’ll find a curated set of articles that dive deeper into the technical architecture, policy debates, market impact and practical how‑to guides for anyone interested in the future of money in the UK.

Explore the UK’s ambitious plan to become a global crypto hub, covering the two‑phase regulatory roadmap, key policies, political shifts, and what the changes mean for investors and businesses.

Continue Reading