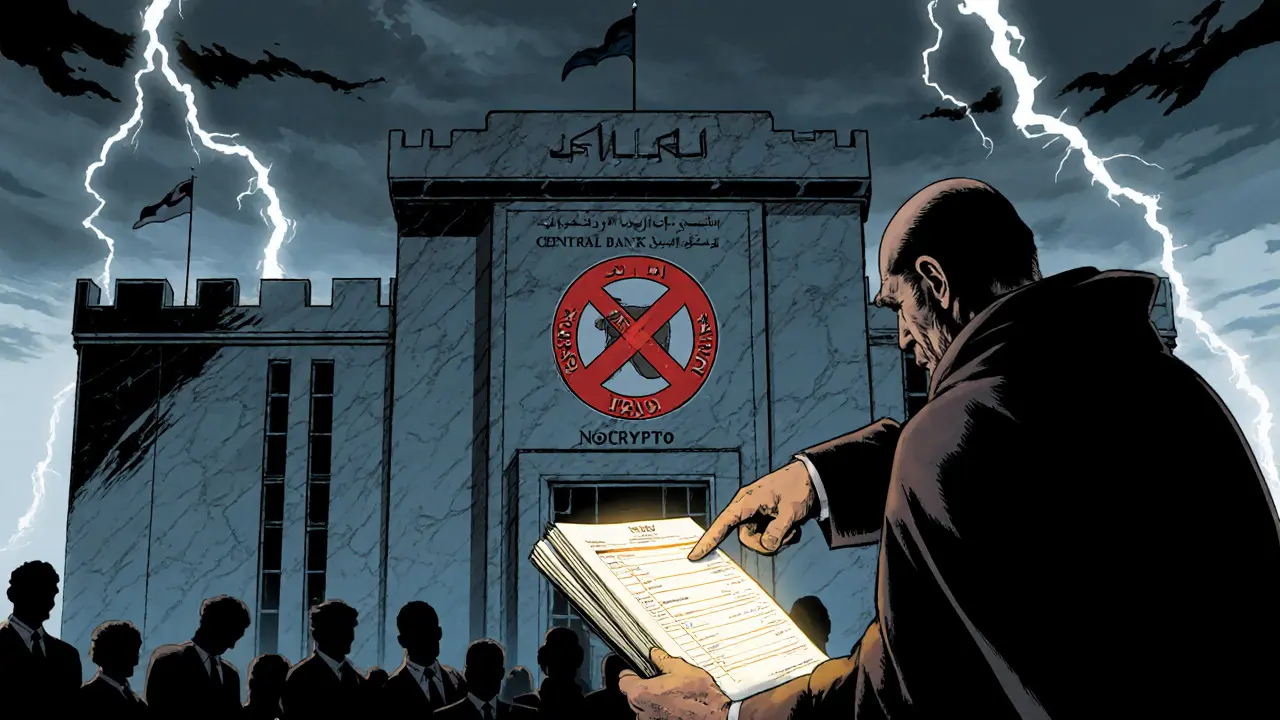

Understanding the Central Bank of Iraq's Crypto Restrictions and Future CBDC Plans

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue ReadingWhen you hear FATF, the Financial Action Task Force, an intergovernmental body that sets global standards to fight money laundering and terrorist financing. Also known as the Financial Action Task Force on Money Laundering, it doesn’t issue laws—but countries that ignore its rules risk being blacklisted. That’s why FATF Iraq matters. Iraq isn’t just another country on the list—it’s been under pressure since 2020 for weak controls over financial flows, and crypto has made that pressure worse. The FATF doesn’t target countries for having crypto—it targets them for not knowing who’s using it, where the money comes from, or if it’s funding violence.

The FATF’s Travel Rule, a requirement that crypto exchanges share sender and receiver info for transactions over $1,000. Also known as FATF Recommendation 16, it’s one of the biggest hurdles for small platforms in places like Iraq. If an Iraqi exchange doesn’t collect names, IDs, and addresses for users sending crypto abroad, it’s breaking FATF rules. That means banks worldwide might cut them off. And if Iraq doesn’t enforce this, the FATF can slap it with a gray list—or worse, a black list. That’s not just bad for exchanges. It’s bad for ordinary people trying to send remittances, buy goods online, or use crypto as a hedge against inflation.

Look at what’s happening in Turkey and the UK. Both cracked down hard on unlicensed exchanges, forced KYC checks, and made compliance part of daily operations. Iraq is at a crossroads: follow the same path, or become a haven for risky, untraceable flows. The posts below show how other countries are handling this—whether it’s the Philippines fining exchanges for skipping AML rules, or the UK’s FCA demanding full traceability. These aren’t abstract policies. They’re real rules that shut down platforms, freeze wallets, and leave users stranded.

You’ll find deep dives here on how crypto regulation works in practice—not just what the FATF says, but what it actually does to businesses and users on the ground. From exchange reviews that expose weak compliance, to breakdowns of how AML systems fail in emerging markets, this collection gives you the facts you need to understand where Iraq stands—and what’s coming next.

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue Reading