Regulatory Compliance in Crypto

When working with Regulatory Compliance, the process of meeting legal and regulatory requirements for crypto businesses and investors. Also known as crypto compliance, it shapes how tokens are issued, exchanges operate, and users report taxes. In 2025 the whole ecosystem feels the pressure: governments are tightening rules, banks are freezing accounts, and new digital currencies are being tested. If you’re wondering why a Bitcoin trade might get blocked in Russia or why an exchange needs a specific license in Indonesia, the answer lies in regulatory compliance. Below we break down the most common pillars you’ll encounter, from tax reporting to licensing, and show how they intersect with real‑world enforcement actions.

Key Areas of Crypto Compliance

One of the first things traders hit is Crypto Tax, the set of reporting and payment rules that apply to gains, losses, and income from digital assets. In the United States, the 2025 Form 1099‑DA forces platforms to share transaction data with the IRS, turning many previously hidden trades into taxable events. The difference between legal avoidance (using deductions and timing) and illegal evasion (under‑reporting) is stark, and a misstep can trigger audits that freeze your wallet.

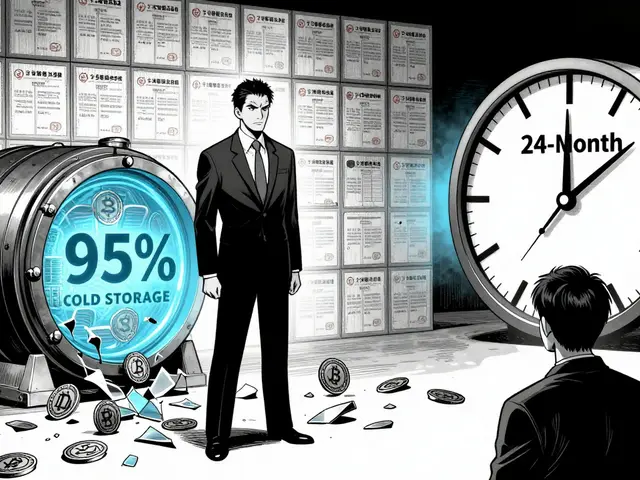

Running an exchange adds another layer: Exchange Licensing, the official permission granted by regulators that allows a platform to offer trading services. Indonesia’s OJK framework now requires a minimum capital reserve, robust AML/KYC systems, and a transparent audit trail. Similar rules appear in the UK’s new crypto hub blueprint, where the FCA demands stablecoin safeguards and a clear governance model. Without a license, an exchange can face fines, shutdown orders, or be barred from onboarding users.

Enforcement actions illustrate what happens when compliance gaps are ignored. The 2025 Crypto Exchange Enforcement Actions, government penalties imposed on platforms that breach securities, anti‑money‑laundering, or consumer protection laws have racked up billions in fines. Major players were hit for improper token listings, false advertising, and inadequate reporting. A handy checklist emerging from these cases includes: verify every listed token’s registration status, maintain real‑time transaction monitoring, and keep a public audit trail for regulators.

Cross‑border payments bring yet another twist. Russia’s new 2025 rules allow Bitcoin to settle international invoices, but only if participants register with the central bank and submit detailed transaction logs. This pilot aims to balance innovation with control, and it forces businesses to integrate KYC/KYT tools that can flag suspicious flows in real time. The same principle drives CBDC projects worldwide—countries like China and Sweden are testing government‑issued digital cash that will coexist with private crypto, demanding a hybrid compliance strategy for users and providers alike.

All these threads—tax, licensing, enforcement, and cross‑border rules—form a network of obligations that any crypto participant must navigate. The posts below dive deep into each area: you’ll find step‑by‑step guides on filing taxes, detailed reviews of exchange licensing requirements, analysis of recent enforcement fines, and practical advice on handling bank freezes under the GENIUS Act. Armed with this knowledge, you can move confidently through the regulatory maze and keep your assets safe from unexpected penalties.

Explore the clash between privacy tech and surveillance tools in cryptocurrency, covering key methods, regulatory pressure, future trends, and practical advice for users, developers, and regulators.

Continue Reading