What Is Exeedme (XED) Crypto Coin? A Deep Dive into the Gaming Token

A comprehensive guide to Exeedme (XED) - its blockchain basics, tournament rewards, price trends, risks, and how to start earning crypto through gaming.

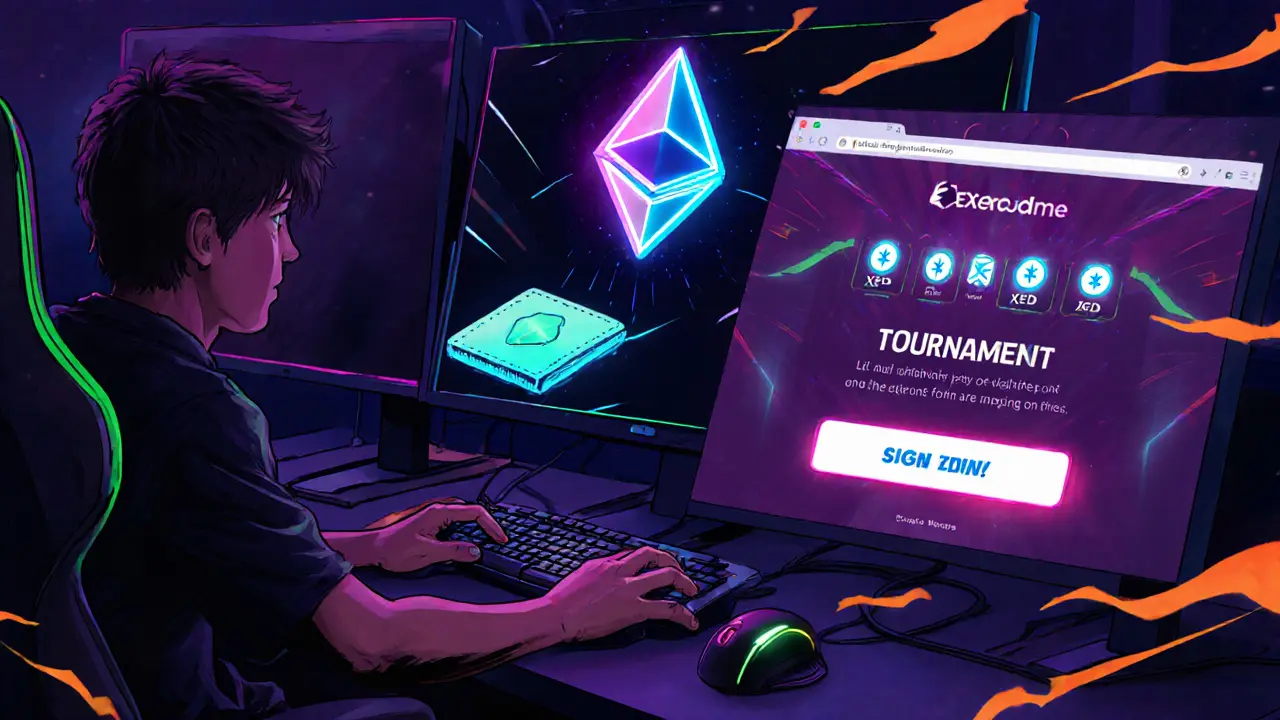

Continue ReadingWhen you hear about XED Token, a blockchain-based cryptocurrency that aims to combine fast transactions with low fees. Also known as XED, it operates on a scalable smart‑contract platform, offering utility for payments and DeFi applications. The token’s Tokenomics, supply schedule, distribution model, and incentive mechanisms are tightly linked to the Crypto Exchange, where XED is listed, traded, and provides liquidity. Early supporters also benefit from occasional Airdrop, free token distributions meant to boost community growth. Together, these elements shape the token’s price, adoption, and long‑term prospects.

The XED token’s total supply is capped at 500 million units, with 40% allocated to public sale, 20% reserved for ecosystem development, 15% for staking rewards, 15% for team and advisors (vested over 24 months), and a 10% community fund. This distribution ensures that liquidity remains healthy while rewarding long‑term holders. Governance is handled through on‑chain voting, letting token holders decide on fee structures, partnership proposals, and upgrades. Staking offers up to 8% annual yield, encouraging users to lock tokens and secure the network. Because XED runs on a Smart Contract, automated logic enforces token swaps, reward payouts, and governance proposals without manual intervention, the system stays transparent and tamper‑proof.

Liquidity provision is another key player. XED pairs with stablecoins on major Decentralized Exchanges, DEXs that let users trade without a central order book and on traditional Centralized Exchanges, platforms offering fast execution and higher volume. The token’s price often reacts to listing news, volume spikes, and regulatory updates. For example, a new listing on a top‑tier exchange can boost market cap by up to 30% within a week, while tighter KYC rules in a major jurisdiction might temporarily dampen demand. Monitoring these signals helps traders anticipate short‑term moves.

Beyond trading, XED is being integrated into DeFi Platforms, services like lending, borrowing, and yield farming that rely on smart contracts. Users can lock XED as collateral to borrow stablecoins, or provide it to liquidity pools that earn a share of transaction fees. Cross‑chain bridges also expand XED’s reach, allowing it to move between Ethereum, Arbitrum, and Binance Smart Chain with minimal friction. This interoperability widens the user base and supports use cases like micropayments in gaming or e‑commerce.

Regulatory sentiment plays a silent yet powerful role. While XED complies with AML/KYC standards on listed exchanges, it remains decentralized enough to avoid direct government control. Ongoing dialogues with regulators aim to secure a clear legal framework, which could unlock institutional adoption. Meanwhile, community initiatives such as bounty programs, developer grants, and educational webinars keep the ecosystem vibrant and attract new participants.

All these pieces—tokenomics, smart contracts, exchange listings, airdrops, and regulatory context—create a dynamic environment. Below you’ll find a curated set of articles that dive deeper into each aspect, from detailed tokenomic breakdowns to exchange reviews and practical guides on claiming airdrops. Whether you’re just hearing about XED or looking to fine‑tune your strategy, the collection offers the insights you need to navigate this fast‑moving space.

A comprehensive guide to Exeedme (XED) - its blockchain basics, tournament rewards, price trends, risks, and how to start earning crypto through gaming.

Continue Reading