What Is Exeedme (XED) Crypto Coin? A Deep Dive into the Gaming Token

Exeedme (XED) Token Value Calculator

Exeedme (XED) Overview

XED is an ERC-20 token on the Ethereum blockchain designed for gaming tournaments and NFT rewards. Current market cap: $1.6 million, Total supply: 100,000,000 XED

Your Investment Summary

Historical Performance

XED price has been highly volatile between October 2024 and October 2025:

• Early 2025: ~$0.0129

• Mid-year peak: ~$0.0153

• End of 2025: ~$0.0142

24-hour trading range: ~$0.0164 to $0.0164

Current trend: Downward (volatile)

If you’ve ever wondered whether you can turn your gaming wins into real crypto, you’ve probably heard the name Exeedme. Launched in late 2020, Exeedme (tickerXED) tries to fuse competitive e‑sports tournaments with the Ethereum blockchain so players can earn token rewards and NFTs for their skill. Below you’ll get a clear picture of how the platform works, what the XED token actually is, and whether it’s worth a second look in today’s crowded gaming‑crypto space.

Defining Exeedme and the XED Token

Exeedme is a blockchain‑powered tournament platform that lets gamers, developers, and organizers monetize competitive play through cryptocurrency and non‑fungible token (NFT) rewards. The ecosystem revolves around its native token, XED, which is an ERC‑20 token on the Ethereum network. Because XED lives on Ethereum, it can be stored in any compatible wallet (MetaMask, Trust Wallet, etc.) and traded on decentralized exchanges.

Technical Specs at a Glance

- Blockchain: Ethereum

- Token Standard: ERC‑20

- Total Supply: 100,000,000 XED (fixed, no further minting)

- Initial Funding: Private sale on Polkastarter with a $75,000 goal

- Current Market Cap (Oct2025): ≈$1.6million

- All‑Time High Price: $0.6802 (≈97.6% down from peak)

How the Platform Works for Players

- Sign up on the Exeedme website and connect an Ethereum‑compatible wallet.

- Browse open tournaments - ranging from casual 1‑v‑1 matches to large‑scale e‑sports events.

- Pay the entry fee (if any) in XED or a supported stablecoin.

- Compete. Winners receive XED tokens, NFTs representing in‑game assets, or a mix of both.

- Use the built‑in Decentralized Exchange (DEX) to swap earned XED for other cryptocurrencies or cash out via a fiat gateway (if the exchange supports it).

Because the rewards are on‑chain, they can be transferred, sold, or held just like any other crypto asset. The platform also offers a “Play‑to‑Earn” mode where lower‑skill players can still earn modest rewards by completing daily challenges.

Comparing XED to Other Gaming Tokens

| Metric | XED (Exeedme) | ENJ (Enjin) | AXS (Axie Infinity) |

|---|---|---|---|

| Blockchain | Ethereum (ERC‑20) | Ethereum (ERC‑20) | Ethereum (ERC‑20) |

| Supply | 100M (fixed) | 1B (capped) | 270M (capped) |

| Market Cap (Oct2025) | $1.6M | $250M | $620M |

| All‑Time High Price | $0.6802 | $4.50 | $165.00 |

| Primary Use‑Case | Tournament rewards & NFT drops | In‑game asset creation & trading | Play‑to‑Earn battles & land ownership |

| Daily Trading Volume | ≈$2,500 | ≈$30M | ≈$45M |

The table shows why XED feels like a niche player. Its market cap and daily volume are tiny compared with ENJ or AXS, but that also means entry barriers are lower for early adopters who want to focus on tournament‑centric gaming.

Price Trends and Analyst Outlook (2024‑2025)

Between October2024 and October2025, XED’s price has been highly volatile. According to CoinGecko, the token traded around $0.0129 in early 2025, climbed to $0.0153 in the middle of the year, and settled back near $0.0142 by October. The 24‑hour trading range is narrow-roughly $0.0164 to $0.0164-reflecting limited liquidity.

Analyst sentiment is mixed:

- TradingBeast projects a modest range of $0.0115‑$0.0119 for the remainder of 2025, citing low volume and strong competition.

- PricePrediction.net is more bullish, forecasting a possible breakout to $0.034 by the end of 2025 if the platform lands a few high‑profile tournament partners.

- Technical indicators (Moving Averages, RSI, and Pivot points) hover around neutral, suggesting neither a clear uptrend nor a downtrend.

Bottom line: XED is a speculative asset. Expect price swings, and treat any upside potential as high‑risk, high‑reward.

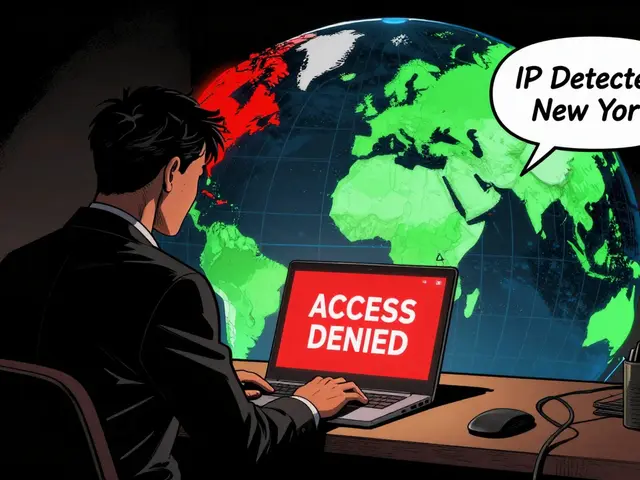

Risks and Red Flags to Watch

- Liquidity crunch - Daily volume under $5K makes large buys or sells move the market sharply.

- Limited adoption - Community chatter is sparse; the platform has not announced any major partnership since 2022.

- Regulatory uncertainty - Gaming rewards that convert to fiat could attract scrutiny in jurisdictions with strict gambling laws.

- Competition - Larger gaming tokens already have established ecosystems and developer tools.

If you’re considering a purchase, limit exposure to an amount you’re comfortable losing. Diversify with other, more liquid crypto assets.

Getting Started: A Quick‑Start Checklist

- Set up an Ethereum‑compatible wallet (MetaMask recommended).

- Buy a small amount of ETH to cover gas fees; you’ll need it to move XED.

- Visit the official Exeedme site and link your wallet.

- Deposit XED into the platform’s DEX if you plan to trade or cash out.

- Enter a low‑stakes tournament to test the reward flow.

- Keep an eye on community channels (Telegram, Discord) for upcoming events.

Future Prospects and Roadmap Hints

The public roadmap is thin, but a few signals suggest where Exeedme might head:

- Cross‑chain bridges - Rumors of a Polygon integration could reduce gas fees and attract more casual gamers.

- Partnerships with indie studios - The platform could become a default tournament layer for new titles that lack their own e‑sports infrastructure.

- Enhanced NFT marketplace - Adding more tradable in‑game skins could boost token utility and trading volume.

None of these plans are confirmed, so treat them as possibilities rather than guarantees.

Frequently Asked Questions

What is the main purpose of the XED token?

XED is used to pay entry fees, reward tournament winners, and trade on the platform’s DEX. It also serves as a governance token for future protocol votes.

Can I earn XED without playing tournaments?

Yes, Exeedme offers daily challenges and a “Play‑to‑Earn” mode where low‑skill players can earn small amounts of XED or NFTs by completing in‑game tasks.

How do I withdraw XED to fiat currency?

First, move XED from the Exeedme DEX to a personal wallet. Then use a centralized exchange (e.g., Binance, Kraken) that lists XED to trade it for a stablecoin or directly for fiat.

Is XED safe from fraud or hacks?

XED itself is a standard ERC‑20 token, so its smart contract is immutable once deployed. Security depends on the surrounding platform (tournament servers, DEX) and the safety of your private keys.

What are the tax implications of earning XED?

In most jurisdictions, crypto earned from gaming is treated as ordinary income at the fair market value on the day you receive it. Subsequent trades may trigger capital gains tax. Consult a local tax professional.

Whether you’re a casual gamer curious about crypto rewards or a seasoned trader hunting for niche assets, understanding Exeedme’s fundamentals helps you decide if XED fits your portfolio. Keep an eye on platform updates, community sentiment, and the broader blockchain‑gaming market - that’s where the real opportunity (or risk) will surface.

24 Comments

Chad Fraser

September 11 2025Hey folks, if you're curious about diving into XED, start small, test the waters, and don't forget to keep some ETH on hand for gas.

The platform is built for gamers, so you can actually earn while you play-no need to be a finance wizard.

Grab a few tournaments, see the rewards flow, and treat any gains as a fun bonus rather than a guarantee.

Remember, the community on Discord is pretty welcoming, so swing by, ask questions, and share your wins!

Jayne McCann

September 16 2025XED looks like another overhyped token that will probably flop.

katie littlewood

September 20 2025The Exeedme ecosystem, while promising on paper, presents a fascinating case study in how gaming meets blockchain.

Its native token, XED, aims to reward skill, yet the market dynamics make that ambition feel tenuous.

When you look at the liquidity numbers, the daily volume hovers around a few thousand dollars, which is hardly enough to sustain large movements.

That said, the low entry barrier does invite hobbyist gamers to experiment without risking massive capital.

From a user experience standpoint, the platform’s UI is clean, and the tournament sign‑up flow is surprisingly smooth for a decentralized app.

Rewards come in both tokens and NFTs, a dual‑pronged approach that could attract collectors as well as competitive players.

The NFT component, however, suffers from the same volatility that plagues the token itself, making its resale value unpredictable.

Developers have hinted at a possible Polygon bridge, which would dramatically reduce gas fees and could be a game‑changer for mainstream adoption.

Until that bridge materializes, players must contend with Ethereum’s often‑high transaction costs, which can eat into modest winnings.

Community engagement appears modest; the Discord server has a handful of active channels, but major announcements are infrequent.

Strategic partnerships are the lifeblood of any gaming token, yet Exeedme has yet to secure a high‑profile tournament sponsor since 2022.

This lack of marquee events limits exposure and may stifle organic growth.

On the upside, the token’s fixed supply of 100 million means no further inflation, a point of comfort for long‑term holders.

Conversely, the all‑time high price of $0.68 suggests a massive correction has already occurred, leaving little upside in the short term.

In the broader gaming‑crypto landscape, giants like ENJ and AXS dominate, making it challenging for XED to carve out a niche.

Overall, if you’re exploring play‑to‑earn opportunities and can tolerate high volatility, XED offers an entry point, but manage expectations and never invest more than you can afford to lose.

Jenae Lawler

September 25 2025From a decidedly sober perspective, the very premise of XED as a utility token is riddled with contradictions that betray any notion of genuine national technological advancement; it purports to democratize competitive gaming while simultaneously shackling participants with the burdensome gas fees endemic to Ethereum’s aristocratic architecture.

celester Johnson

September 30 2025One might argue that the allure of XED is but a modern echo of ancient alchemical pursuits-promising gold from base play, yet ultimately delivering only the illusion of transformation; the token’s volatility mirrors the fickle winds of fate, reminding us that every digital promise is shadowed by the specter of impermanence.

Prince Chaudhary

October 4 2025Take a measured step forward: allocate a modest portion of your portfolio to XED, experiment in low‑stakes tournaments, and always keep a clear horizon for gas costs; respectful boundaries ensure you stay in control while still tasting the potential upside.

John Kinh

October 9 2025I could care less about the hype, but here's a quick take 😒 the token seems stuck in a low‑liquidity rut and the price action is barely worth the effort.

Sophie Sturdevant

October 13 2025Listen up, squad: XED rewards are structured around win‑rate KPIs, so you need to optimize your in‑game meta, lock in high‑ROI builds, and leverage the token’s DEX for swift swaps-any sloppiness will bleed you dry.

Jan B.

October 18 2025The platform provides clear entry fees and transparent reward distribution; players can focus on skill development without distraction.

MARLIN RIVERA

October 23 2025XED’s market mechanics are a textbook case of low‑volume tokenitis; the price is a puppet to a handful of whales, and any genuine investor should treat it as speculative junk.

Debby Haime

October 27 2025Give XED a chance but stay grounded-start with a tiny stash, join a weekend tournament, and let the experience guide whether you scale up or pull out; optimism helps, but discipline seals the deal.

emmanuel omari

November 1 2025Honestly, anyone who thinks XED will revolutionize the gaming market simply hasn’t looked at the current adoption numbers; the platform’s reach is limited, and without a major partnership, it will remain a niche footnote.

Andy Cox

November 6 2025the vibe around exeedme feels chill but the token moves slow and the community is small yet friendly

Courtney Winq-Microblading

November 10 2025When you stare into the flickering screen of a tournament, you glimpse both the raw thrill of competition and the subtle whisper of blockchain’s promise-a paradox that invites both awe and skepticism, reminding us that every digital token carries the weight of human ambition and the lightness of fleeting fame.

Stefano Benny

November 15 2025Honestly, XED’s tokenomics are a dumpster fire 🔥-the supply‑demand dynamics are skewed, and the market cap feels like a joke for serious investors.

Bobby Ferew

November 20 2025The allure of XED may seduce the unwary, yet beneath the glossy veneer lies a stagnant pool of liquidity that offers little more than a fleeting sparkle before the darkness resumes.

Mark Camden

November 24 2025It is incumbent upon every conscientious participant to recognize that investing in a token with such negligible volume carries inherent moral responsibility; we must not be complicit in inflating a speculative bubble that ultimately harms the broader ecosystem.

Evie View

November 29 2025If you think XED is just a harmless hobby, you’re ignoring the concrete risks that can drain your wallet in minutes; push back against complacency and demand transparency.

Sidharth Praveen

December 3 2025Take heart, gamers-though XED’s price swings are wild, the platform still offers a real chance to earn while you play; stay focused, improve your skillset, and the rewards will follow.

Nathan Blades

December 8 2025Listen up, fellow adventurers: the path to mastering XED isn’t paved with guaranteed riches, but with disciplined practice, strategic tournament selection, and a willingness to adapt, you can transform modest wins into meaningful gains-think of each match as a stepping stone toward financial empowerment.

Somesh Nikam

December 13 2025Great job on making your first XED win! Keep the momentum going, stay consistent, and don’t forget to secure your assets-great things are ahead 😊.

Richard Herman

December 17 2025Let’s keep the conversation respectful and inclusive; while XED has its flaws, acknowledging both its potential and its pitfalls fosters a healthier community.

Parker Dixon

December 22 2025Honestly, the token’s volatility can be both a curse and a catalyst-on one hand, it scares off risk‑averse investors, but on the other, it provides a fertile ground for savvy traders to capitalize on price swings; my advice is to monitor the DEX closely, set clear entry and exit points, and never let emotion dictate your moves; staying disciplined will ensure you extract the most value from every tournament win.

Kate Roberge

December 27 2025Look, XED is just another fad that will fade, and anyone still hyped about it is living in a bubble.