What is Bitcoin SV (BSV)? Explained Simply in 2026

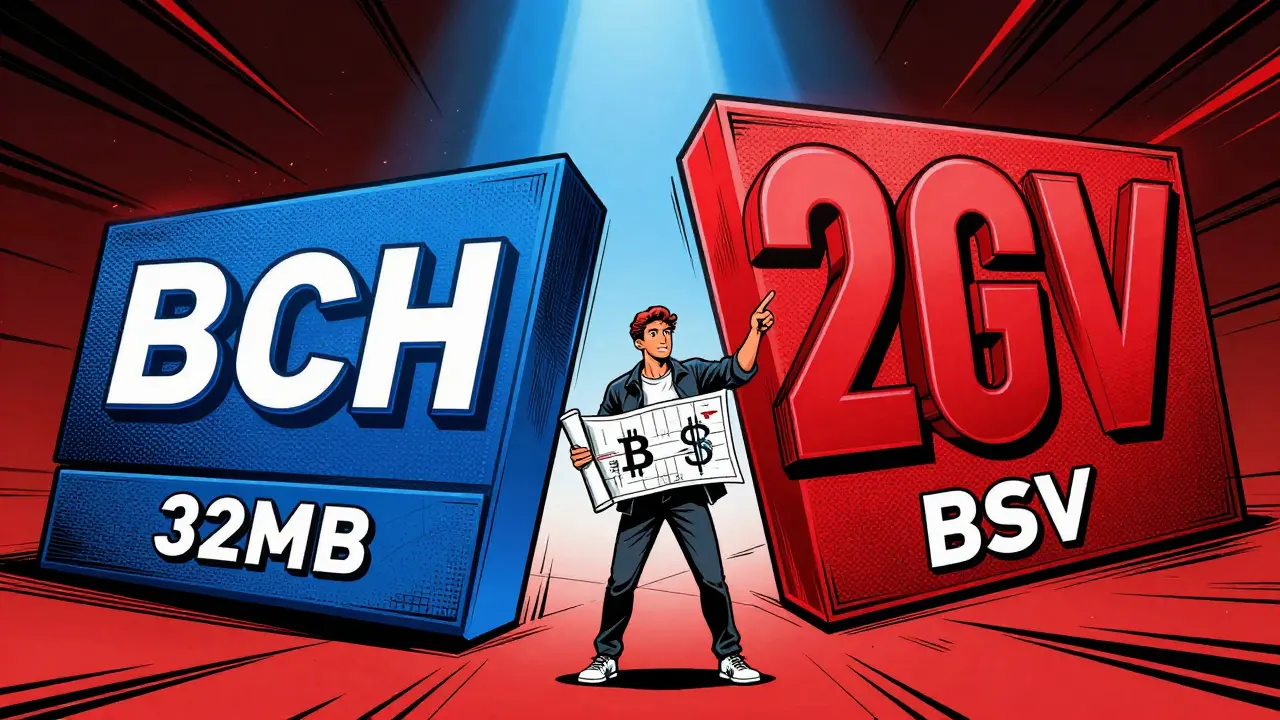

What is Bitcoin SV (BSV)? This controversial cryptocurrency claims to be the 'true' Bitcoin. Created in November 2018 as a hard fork of Bitcoin Cash (BCH), BSV's creators say it restores Satoshi Nakamoto's original vision. But many experts disagree. Let's cut through the noise.

What Exactly Is Bitcoin SV?

Bitcoin SV (BSV) emerged from a hard fork of Bitcoin Cash on November 15, 2018. Its development team, led by Craig Wright, insists he is Satoshi Nakamoto-the anonymous creator of Bitcoin. BSV's core promise? To return to the original Bitcoin protocol as described in Satoshi's 2008 whitepaper. Unlike Bitcoin or Bitcoin Cash, BSV focuses on massive scalability through huge block sizes. The goal? To become a global payment system for businesses, not just a digital gold store.

Technical Differences: Block Size and Speed

Here's where BSV stands out. Bitcoin's block size is 1MB (or 1.7MB with SegWit). Bitcoin Cash increased it to 32MB. But BSV? Its blocks can be up to 2GB. The Genesis protocol upgrade in 2020 removed all hard limits on block size. This lets BSV handle far more transactions. Current data shows BSV averages 300 transactions per second (TPS), with peaks hitting 2,800 TPS. Bitcoin? Just 7 TPS. Transaction fees on BSV are tiny-often under $0.01. During Bitcoin's 2017 congestion, fees hit $50. BSV users rarely pay more than a few cents.

Scalability vs. Decentralization Trade-Off

But there's a catch. Big blocks need serious hardware. Running a full BSV node requires 16GB RAM and 500GB SSD storage. Compare that to Bitcoin's 4GB RAM and 500GB HDD. This makes it harder for everyday users to participate. Only about 5,000 full nodes exist on BSV versus Bitcoin's 10,000+. Gemini reported in 2025: 'Bigger blocks are faster but sacrifice decentralization because fewer people can afford to run full nodes.' This centralization is a major red flag for crypto purists.

The Craig Wright Controversy

Craig Wright's claim to be Satoshi Nakamoto is the biggest controversy around BSV. Many experts call it a fraud. Dr. Garrick Hileman, Head of Research at Blockchain.com, told CoinDesk in 2019: 'BSV misunderstands Bitcoin's design philosophy-it prioritizes throughput over decentralization.' Wright's legal battles and inconsistent statements have hurt BSV's credibility. Even supporters admit the controversy limits adoption. Antoni Trenchev of Nexo said in January 2025: 'BSV's enterprise potential is real, but Wright's reputation holds it back from mainstream acceptance.'

BSV's Role in Today's Crypto Market

As of February 2026, Bitcoin SV has a market cap of $589 million and ranks #67 among all cryptocurrencies. Only 43 exchanges list BSV, compared to Bitcoin's 700+. Most BSV transactions are for enterprise use-like supply chain tracking and digital content monetization. Deloitte's 2025 report found 37 Fortune 500 companies testing BSV for specific applications. However, individual users account for only 38% of network activity. This is very different from Bitcoin, where 85% of users are regular people. Gartner's 2025 analysis predicts BSV will find a niche in enterprise solutions but won't become a consumer payment system due to ongoing controversies.

Pros and Cons of Bitcoin SV

Here's what BSV does well:

- Extremely low transaction fees-often under $0.01

- High transaction speed (up to 2,800 TPS)

- Designed for enterprise use cases like supply chain management

- Stable protocol with fewer updates than Bitcoin

But there are serious downsides:

- Centralized mining-72.3% of hash power controlled by three mining pools

- Controversial leadership with Craig Wright's disputed claims

- Limited exchange support (only 43 exchanges)

- Higher hardware requirements for full nodes

Is Bitcoin SV the real Bitcoin?

No. Bitcoin SV claims to restore Satoshi's original vision, but the broader Bitcoin community disagrees. Bitcoin Core developers and most miners support Bitcoin (BTC) as the true Bitcoin. BSV is a separate blockchain created through a hard fork of Bitcoin Cash. While its creators argue it follows the whitepaper, critics say it deviates from Bitcoin's decentralized ethos.

How is Bitcoin SV different from Bitcoin?

Bitcoin SV uses much larger blocks (up to 2GB) compared to Bitcoin's 1MB. This lets BSV process 300+ transactions per second versus Bitcoin's 7 TPS. Fees on BSV are fractions of a cent, while Bitcoin fees can hit $50 during congestion. However, Bitcoin maintains stronger decentralization with more full nodes and miners. BSV also has a controversial leader in Craig Wright, while Bitcoin's development is decentralized.

Can I buy Bitcoin SV on Coinbase or Binance?

No. BSV is only available on 43 exchanges total. Major platforms like Coinbase and Binance don't list it. You'll need to use smaller exchanges like Bittrex, Kraken, or Bitfinex. Always check exchange availability before buying-some platforms restrict BSV trading due to its controversial reputation.

What are the main risks of using Bitcoin SV?

The biggest risk is centralization. Over 72% of BSV's mining power is controlled by just three mining pools, making the network vulnerable to attacks. Craig Wright's legal issues and disputed claims also create regulatory uncertainty. Plus, BSV's limited exchange support makes it harder to buy or sell quickly. For businesses, the controversy could harm adoption-many companies avoid BSV due to its association with Wright.

Is Bitcoin SV a good investment?

It depends. BSV has clear technical strengths for enterprise use cases like supply chain tracking. But its market cap is tiny ($589 million) compared to Bitcoin's $1.2 trillion. The controversy around Craig Wright and limited exchange support make it risky. Most financial advisors recommend only small allocations for speculative investors. Always do your own research before investing in any cryptocurrency.

20 Comments

Kieren Hagan

February 6 2026Bitcoin SV's scalability is impressive for enterprise use cases, but the centralization concerns are valid.

It's a trade-off between speed and decentralization.

While it has potential, the controversy around Craig Wright is a major hurdle.

Still, for specific business needs, BSV's low fees and high throughput make sense.

Brittany Novak

February 6 2026BSV is a government-backed scam designed to undermine Bitcoin's decentralization.

Craig Wright is a CIA agent trying to control crypto.

The whole thing is a fraud.

laura mundy

February 8 2026BSV is a joke. Big blocks mean centralization. Simple as that.

Jacque Istok

February 9 2026Oh sure, 'true Bitcoin'-because nothing says 'Satoshi's vision' like 2GB blocks and a single leader. Classic.

Mendy H

February 11 2026BSV is a vanity project for Wright. No real adoption, just hype. Ignore it.

sabeer ibrahim

February 11 2026BSV's scalability is key for global enterprise adoption.

Centralization is a necessary trade-off for speed.

Bitcoin's 7 TPS is obsolete.

BSV is the future of payments.

Deeksha Sharma

February 13 2026Conspiracy theories about government control are unfounded.

BSV has real-world applications.

It's about innovation, not manipulation.

Taybah Jacobs

February 13 2026While centralization is a concern, BSV's enterprise use cases are valid.

It's not about replacing Bitcoin but serving specific needs.

Paul Gariepy

February 14 2026BSV's low fees and speed are real!!!

It's not for 'digital gold' but for business transactions!!!

It's a different beast!!!

I think it's useful for specific cases!!!

Udit Pandey

February 14 2026BSV's technical merits are undeniable despite Wright's controversies.

Many enterprises find value in it.

Sharon Lois

February 15 2026BSV is a scam run by Wright.

Brendan Conway

February 16 2026BSV's scalability is great for business, but the centralization is a problem.

It's a trade-off.

James Harris

February 18 2026BSV has potential for enterprise use.

Low fees and high speed make it useful for specific applications.

Ajay Singh

February 18 2026BSV's tech is solid.

Low fees, high speed.

Future of payments.

Shruti Sharma

February 19 2026BSV is useless.

Wright is a fraud.

No adoption.

Mrs. Miller

February 20 2026BSV's niche is conspiracy theories.

Not for real use.

Michael Sullivan

February 21 2026BSV is perfect for businesses! 🚀 Bitcoin's slow fees are a joke.

Reda Adaou

February 21 2026BSV has real applications.

Deloitte reports Fortune 500 companies using it.

perry jody

February 23 2026BSV's speed is great for businesses. 😊

mahikshith reddy

February 24 2026BSV is the future.

Bitcoin is dead.