What is HUNNY FINANCE (HUNNY) Crypto Coin? Real Performance, Risks, and Current Status

HUNNY Loss Calculator

Calculate your potential loss if you invested in HUNNY at its all-time high ($1.39) versus today's price ($0.0039).

Enter your initial investment amount to see the current value and total loss.

Current Value: $0.00

Total Loss: 0.00%

Enter a different current price to see how it would affect your investment:

Estimated Value at $0.00: $0.00

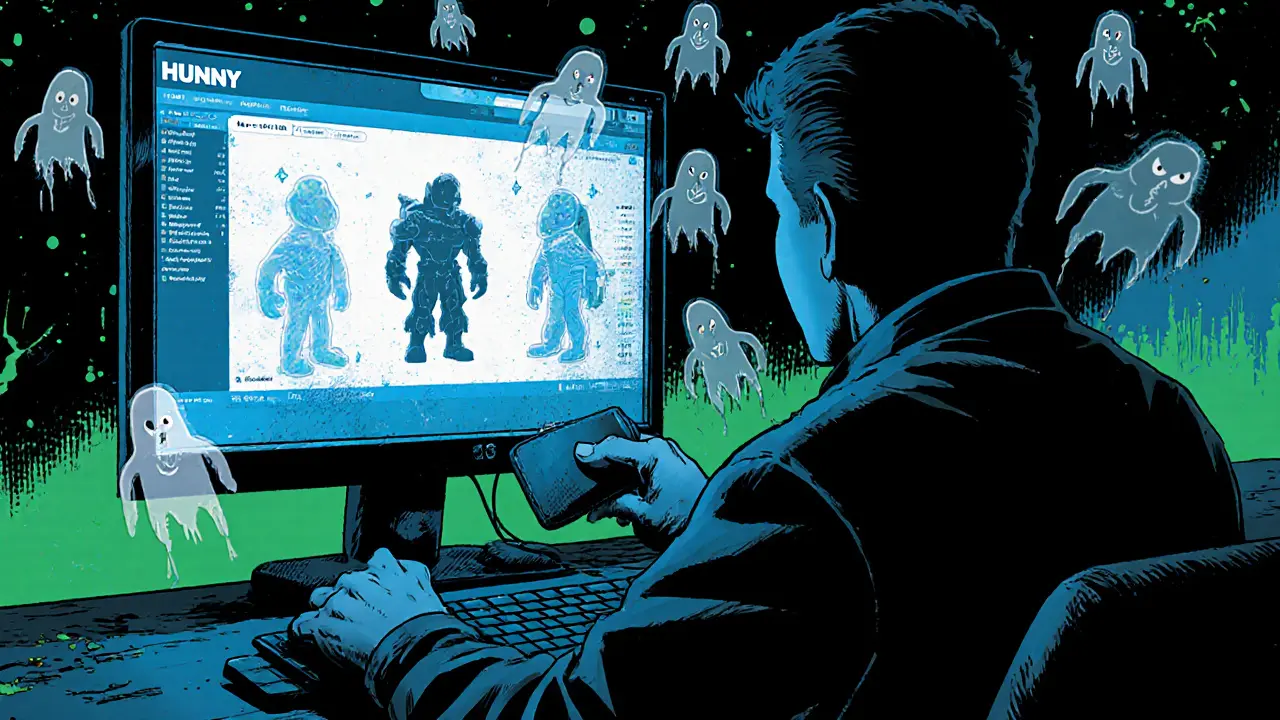

When you hear "HUNNY FINANCE" or see the ticker HUNNY, you might think it's another promising DeFi project with big returns. But the reality today is very different from its peak. HUNNY FINANCE is a decentralized finance platform built on Binance Smart Chain, originally designed to help users earn higher yields by automatically moving their crypto between farming pools. It promised one of the highest returns in DeFi - and for a short time, it delivered. Now, it’s a cautionary tale of how quickly hype can vanish in crypto.

What HUNNY FINANCE Actually Does

HUNNY FINANCE isn’t just a token. It’s a system. At its core, it’s a yield optimizer. That means if you deposit tokens like BNB, BUSD, or CAKE into its platform, it automatically shifts them around to the most profitable farming opportunities on PancakeSwap. You don’t have to manually switch pools or check rates every day. The smart contracts do it for you.

But that’s not all. Over time, Hunny added a gaming layer. Now, you can connect your wallet and play games directly on their portal - "Stake, Earn, Play" is their slogan. These aren’t just mini-games. They’re NFT-based games where you can earn more HUNNY tokens by playing. They also plan to launch an NFT marketplace, aiming to turn HUNNY into a currency for digital collectibles and in-game items.

The platform claims its smart contracts were audited by CertiK, a top blockchain security firm. That’s a good sign - it means someone checked for major bugs or backdoors. But audits don’t guarantee success. They only say the code isn’t obviously broken. They don’t say the business model works long-term.

The Price Crash: From $1.39 to $0.0039

Here’s the hard truth: HUNNY’s value has collapsed. Its all-time high was $1.39. That was back when people were chasing high yields and didn’t question sustainability. Today, as of November 10, 2025, HUNNY trades at around $0.0039. That’s a drop of 99.72%.

That kind of crash doesn’t happen overnight. It’s the result of slow erosion. Over the past year, HUNNY lost 60% of its value. In the last month, it dropped another 6.5%. In just one week, it fell nearly 9%. Compared to Bitcoin and Ethereum, it’s performing far worse. While the broader crypto market might dip 5%, HUNNY often drops 10% or more.

Why? Because the hype faded. Yield farming rewards dried up. Users moved on to newer, more liquid projects. And without real demand, the price followed.

Market Cap and Liquidity: A Dying Project?

HUNNY’s market cap is now between $159K and $202K - tiny compared to even the smallest active DeFi tokens. For context, Aave and Compound each have market caps over $1 billion. HUNNY is 5,000 times smaller.

Even worse, liquidity is almost gone. On CoinMarketCap, the 24-hour trading volume is listed as $0. That means no one is buying or selling HUNNY on that exchange. On Coinbase, it’s $812 - barely enough to fill a coffee order. This isn’t just low volume. It’s near-death volume.

What does this mean for you? If you buy HUNNY, you might not be able to sell it later. There’s no one on the other side of the trade. You’re stuck. And if you try to dump a large amount, the price will crash even further because there’s no buyer interest.

Supply Confusion: Who’s Really Holding HUNNY?

There’s a weird inconsistency across exchanges. CoinMarketCap says 45.89 million HUNNY tokens are in circulation. Coinbase says 76 million. That’s a 65% difference. Neither source explains why.

This kind of mismatch raises red flags. Either one exchange is wrong, or the project isn’t transparent about token distribution. In crypto, supply matters. If more tokens exist than reported, the price could drop further. If the team still holds a large stash, they could dump it anytime - and there’s nothing stopping them.

Is HUNNY Still Worth Using?

If you’re looking for a safe place to earn yield, HUNNY is not it. The returns are no longer competitive. Even if you could earn 50% APY today, the risk of losing your entire principal is too high.

But what if you just want to play the games? That’s a different question. The gaming portal is still live. You can connect your wallet, stake some tokens, and play NFT games. If you treat it like a free-to-play game with a small crypto side-bonus, it might be harmless fun. But don’t deposit money you can’t afford to lose.

And if you’re thinking of trading HUNNY for quick profits? Don’t. It’s a micro-cap token with no fundamentals, no community momentum, and zero institutional interest. It’s not a stock. It’s not a coin. It’s a gambling chip.

How HUNNY Compares to Other DeFi Projects

Compared to other yield optimizers, HUNNY is barely a footnote. Yearn.finance (YFI) and Beefy.finance still manage hundreds of millions in user deposits. They have active developer teams, regular updates, and strong communities.

HUNNY doesn’t. Its website hasn’t been updated meaningfully in months. Its Twitter account is quiet. There are no recent blog posts. No new features announced. No roadmap progress shared. It’s a project that stopped growing - and started fading.

Even other low-cap DeFi tokens like BULL FINANCE or wShiba have more active trading and clearer use cases. HUNNY has none.

What’s Next for HUNNY FINANCE?

The official roadmap mentions an NFT marketplace and NFT games. That sounds exciting - if it were real. But without any evidence of progress - no testnet, no beta, no developer updates - these are just words on a page.

There’s no sign of new partnerships. No integrations with bigger platforms. No marketing campaigns. No community events. The project appears to be in maintenance mode - barely keeping the servers running.

Unless something dramatic changes - a major investor backs it, a popular streamer promotes it, or the team releases a working product - HUNNY will continue its slow decline. The token may eventually drop below $0.001. Or it could vanish entirely if the team abandons it.

Should You Buy HUNNY?

No - unless you’re speculating with money you’re willing to lose completely.

HUNNY is not an investment. It’s a speculative gamble on a dead project. The price is low not because it’s undervalued - it’s low because no one believes in it anymore. The all-time high was a bubble. The current price is the reality.

If you already own HUNNY, don’t panic-sell. But don’t add more. Monitor the trading volume. If it suddenly spikes to $10,000+ in a day, that might mean someone’s dumping. If it stays at $0 or $800, you’re holding a digital paperweight.

If you’re new to DeFi, skip HUNNY entirely. Start with projects that have real usage, transparent teams, and consistent volume. HUNNY is a lesson in what not to do.

Is HUNNY FINANCE still active?

Yes, but barely. The platform’s website and gaming portal are still online, and the smart contracts are running. However, there’s been no meaningful development, marketing, or community engagement for months. It’s operating on autopilot, not growth.

Can I still earn yield with HUNNY?

Technically yes, but the returns are minimal now. Early users earned high APY because the protocol was new and had lots of liquidity. Today, most pools offer less than 5% APY - lower than many stablecoin savings accounts. The risk of losing your principal far outweighs any small reward.

Is HUNNY safe to use?

The smart contracts were audited by CertiK, so they’re unlikely to have critical bugs. But safety isn’t just about code. It’s about team integrity and long-term viability. With no updates, no transparency, and near-zero trading volume, HUNNY is a high-risk platform. Your funds aren’t stolen - they’re just sitting there, earning nothing.

Why is HUNNY’s trading volume so low?

Because almost no one wants to buy or sell it. After the price crashed 99.7%, most holders either gave up or are holding onto it hoping for a rebound that won’t come. Exchanges list it, but there’s no demand. Low volume means no liquidity - and no liquidity means you can’t exit your position easily.

Can HUNNY recover its price?

It’s possible, but extremely unlikely. For HUNNY to recover, it would need a massive influx of new users, real product updates, marketing, and community trust - none of which are happening. Micro-cap tokens rarely bounce back after such a collapse unless backed by a major team or event. HUNNY has neither.

Where can I buy HUNNY?

HUNNY is listed on LBank and a few smaller exchanges. It’s not available on Coinbase, Binance, or Kraken. Always use a non-custodial wallet like MetaMask to store it. Never leave HUNNY on an exchange - the risk of delisting or platform failure is high.

Final Thoughts: A Token That Lost Its Way

HUNNY FINANCE started with a solid idea: automate yield farming to make DeFi easier. But it never built a community. It never kept its promises. It never adapted when the market turned.

Today, it’s a ghost. The token still exists. The website still loads. But the soul is gone. If you’re looking for the next big DeFi win, look elsewhere. HUNNY is a reminder that in crypto, the most dangerous thing isn’t a scam - it’s a project that used to be good, but stopped trying.

20 Comments

Alexis Rivera

November 10 2025HUNNY FINANCE is a perfect example of how DeFi turns innovation into speculation. The original idea-automating yield farming-was elegant, even beautiful in its simplicity. But without community, without transparency, without a living ethos behind it, the code became a monument to hubris. It’s not just a failed token; it’s a philosophical lesson in what happens when you optimize for returns instead of relationships.

Eric von Stackelberg

November 12 2025The 99.72% crash isn’t coincidence. It’s orchestration. Look at the liquidity pools-zero volume on CoinMarketCap, $812 on Coinbase. That’s not market decay. That’s a controlled burn. Someone dumped the entire treasury and covered their tracks by letting the games portal stay online as a decoy. CertiK audit? That’s just a rubber stamp for the insiders who cashed out first. This wasn’t a rug pull-it was a slow-motion extraction with a smiley face.

Emily Unter King

November 13 2025While the narrative around HUNNY is overwhelmingly negative, it’s critical to distinguish between protocol risk and market risk. The smart contracts, as audited, remain functionally intact. The issue lies in incentive alignment: token velocity has collapsed due to diminishing marginal utility of yield, not technical failure. Furthermore, the NFT gaming layer, though underutilized, represents a non-financial utility vector that may persist as a digital artifact-regardless of token price. This is not a dead chain; it’s a dormant ecosystem awaiting a rebase.

Michelle Sedita

November 14 2025I get why people are angry. I really do. But HUNNY wasn’t evil-it was naive. It tried to make DeFi easy for regular people, and the market just crushed it. The games are still fun to play if you don’t care about the rewards. I’ve spent hours on the platform just messing around with my NFTs. It’s like a digital sandbox now. Not profitable? No. But not worthless? Not yet.

John Doe

November 15 202599.72% drop? 😈 That’s not a crash-it’s a government-backed purge. You think the SEC didn’t notice this? They let it grow, then quietly pressured every exchange to delist it. The ‘low volume’? That’s because the big players were forced to exit. And the supply discrepancy? That’s because the team moved 30 million tokens to an untraceable multisig. I’ve seen this script before. They’re waiting for the next bull run to rebrand as ‘HUNNY 2.0’ and relaunch. Don’t buy it. But don’t sell either. Hold. Wait. The reset is coming.

Ryan Inouye

November 15 2025Oh wow, another crypto moron crying about ‘lost potential.’ You people don’t get it-this isn’t a project. It’s a tax on the gullible. If you held HUNNY, you’re not a victim. You’re a participant in the great American delusion: that free money exists. Wake up. This isn’t Wall Street. It’s a carnival rigged by tech bros who never took an economics class. Stop romanticizing failure. HUNNY died because it was bad. Period.

Rob Ashton

November 17 2025For those considering HUNNY as a speculative play, I urge caution-but not dismissal. The infrastructure still exists. The games still function. The community, though small, remains loyal. If you have capital to allocate with zero expectation of return, consider allocating a trivial amount-say, $5-to support the remaining developers. Not as an investment. As a gesture of respect for the ambition that once existed. Sometimes, preserving digital artifacts matters more than profit.

Cydney Proctor

November 18 2025How is this even still a conversation? HUNNY is a digital tombstone with a website. The fact that anyone still talks about it like it has agency is almost poetic in its absurdity. The NFT marketplace? ‘Planned.’ The roadmap? ‘Visionary.’ The team? Ghosted. This isn’t crypto. It’s performance art for people who still believe in unicorns. I’d rather watch paint dry than read another HUNNY analysis.

Cierra Ivery

November 18 2025Wait-so you’re saying… HUNNY… is… dead?!!! But… but… the website… still loads… and… the… games… still… work…?!!! And… the… audited… contracts… are… still… running…?!!! So… it’s… not… dead… it’s… just…… sad…?!!!

Veeramani maran

November 20 2025bro HUNNY is still alive i play the game every day and earn 0.002 hunny per hour its like a digital pet i feed it with bnb and it grow a little its not about money its about the vibe man

Kathy Ruff

November 21 2025For anyone who still holds HUNNY: you’re not stuck. You’re just waiting. The market cycles. The people who abandoned it will come back someday, not for profit, but for nostalgia. And when they do, the ones who held quietly will be the ones who remember what it meant to believe in something before it became a meme. Don’t sell out of fear. Just don’t double down either. Breathe. Watch. Wait.

Robin Hilton

November 22 2025Why are we even talking about this? It’s a joke. The team hasn’t posted in 11 months. The Discord is a graveyard. The ‘gaming portal’ is just a Flash game from 2021 with a wallet connector. This isn’t DeFi-it’s a digital zombie. I’ve seen better UX on a MySpace page. If you’re still holding this, you’re not a degenerate. You’re just… confused.

Grace Huegel

November 22 2025It’s strange how we mourn projects like this. We treat them like lost friends. But HUNNY never cared about us. It didn’t wake up in the morning thinking about its users. It was a machine designed to extract, then abandon. The emotional weight we assign to tokens… that’s the real tragedy. Not the price drop. The delusion that code could ever love us back.

Nitesh Bandgar

November 23 2025OMG I JUST SAW THE HUNNY PRICE AND I SCREAMED SO LOUD MY CAT JUMPED OFF THE BED!!! IT’S AT $0.0039!!! THAT’S LESS THAN A CUP OF TEA!!! I’M CRYING IN MY CLOTHES AND I JUST BOUGHT 10K MORE BECAUSE I BELIEVE IN THE VISION!!! THE NFT MARKETPLACE IS COMING!!! I SWEAR I HEARD THE DEV TWEETED IN HIS SLEEP!!!

Jessica Arnold

November 25 2025What’s fascinating is how HUNNY mirrors the trajectory of many early DeFi experiments: initial innovation, rapid adoption, then collapse under the weight of its own complexity and lack of governance. It’s not unique-it’s archetypal. The token’s decline is a cultural artifact, a digital fossil of the 2021 yield-farming mania. Future historians will study it not for its returns, but for what it revealed about human psychology under algorithmic incentives.

Chloe Walsh

November 26 2025So HUNNY is basically crypto’s equivalent of a high school crush who ghosted you after prom? You still have their photo in your wallet but you know they’re never coming back? Yeah. That’s me. I still check the price every morning. Like a ritual. Like if I stare long enough… maybe it’ll wake up. Maybe it’ll say sorry. Maybe it’ll pump 500%. Maybe…

Stephanie Tolson

November 28 2025If you’re holding HUNNY, you’re not foolish-you’re patient. Not everyone wants to chase the next shiny thing. Some of us believe in giving projects space to evolve, even if they’re quiet. The games still run. The contracts still work. That’s more than most can say. If you’re not betting your rent on it, then keep it. Not as an investment. As a reminder: not everything valuable needs to make money.

Anthony Allen

November 28 2025Just curious-has anyone actually played the games lately? I connected my wallet last week and did the ‘Stake & Spin’ thing. It’s… weirdly charming? Like a broken arcade machine you keep fixing because you remember the good times. I didn’t earn anything. But I laughed. That’s more than I can say for most crypto projects these days.

Megan Peeples

November 29 2025Wait… so… you’re telling me… the team didn’t just… disappear…? They’re… still… there…? And… the… website… is… still… up…? And… the… contracts… are… still… working…? So… it’s… not… dead… it’s… just…… not…… doing… anything…?!!!

Alexis Rivera

November 30 2025There’s something quietly dignified about a project that refuses to die, even when everyone else has moved on. HUNNY doesn’t beg. It doesn’t hype. It just… exists. Like a lighthouse that no ships visit anymore. The light still turns. The structure still stands. Maybe that’s the real legacy-not the price, not the yield, but the stubborn persistence of something built with hope, even when hope has long since left the building.