Global Blockchain Exchange Crypto Exchange Review 2025

Blockchain.com Trading Fee Calculator

Calculate Your Trading Fees

Blockchain.com charges fees based on your 30-day trading volume. Enter your details below to see your potential fees.

Estimated Trading Fee

Based on your trade and 30-day volume

When you're looking for a crypto exchange that feels reliable, not flashy, Blockchain.com stands out-not because it’s the biggest, but because it’s one of the few that’s been around long enough to prove it can survive crashes, regulatory storms, and user distrust. As of November 2025, it serves over 100 million users globally and handles more than 1.2 million trades daily. But is it right for you? Let’s cut through the noise.

What You Get: A Simple, Secure Trading Experience

Blockchain.com started as a Bitcoin wallet. That’s still its core identity. Unlike exchanges that feel like stock trading platforms with 50 charts and 200 buttons, Blockchain.com keeps things clean. You log in, see your balance, and trade. No overwhelming interfaces. No confusing menus. That’s why beginners keep coming back. The wallet and exchange are built into one system-so when you buy Bitcoin, it lands directly in your wallet. No need to transfer funds between accounts. That cuts out a whole layer of risk and delay.

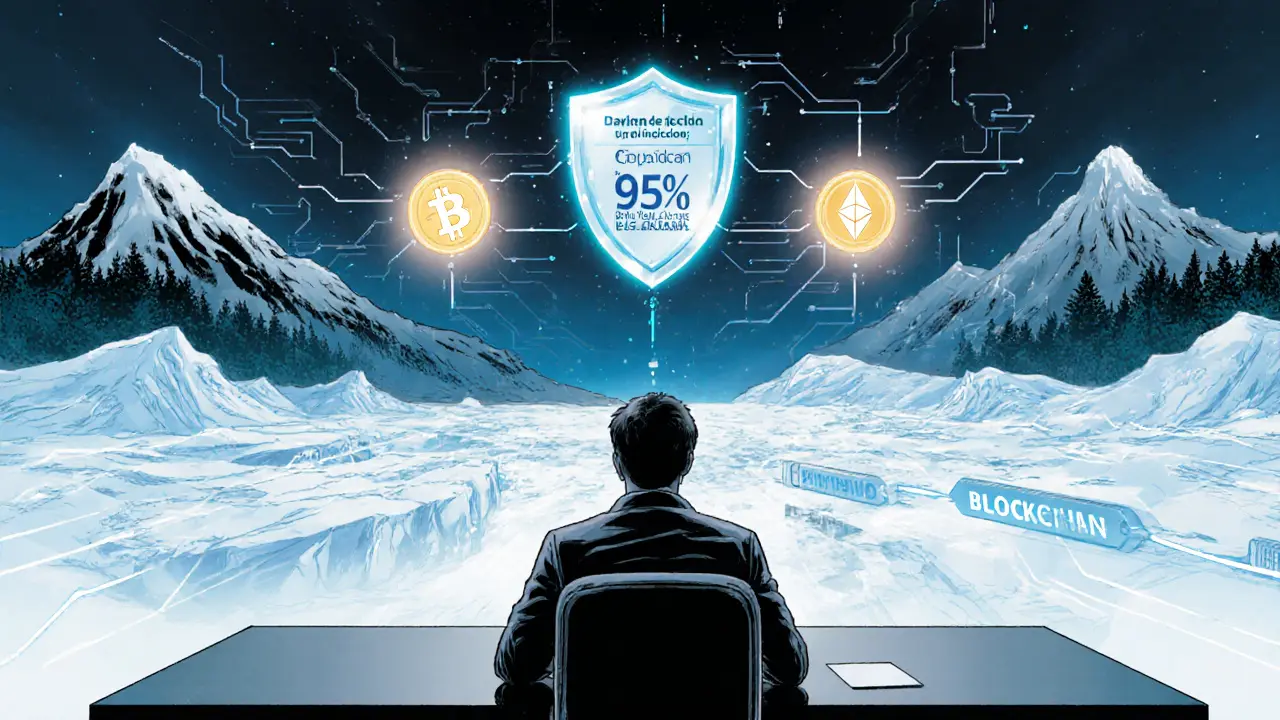

Security is where Blockchain.com shines. 95% of user funds are stored in cold wallets across secure locations in Switzerland, Iceland, and Canada. That’s not marketing fluff-it’s verified by Armanino LLP’s February 2025 proof-of-reserves audit. The remaining 5% in hot wallets is just enough to keep trades flowing. This setup makes it one of the safest exchanges for holding crypto long-term. If you’re not a day trader, this matters more than low fees or high leverage.

Trading Options: Solid for Basics, Weak for Pros

You can trade spot, use up to 5x margin, and place limit or stop-limit orders. That covers most retail needs. But if you’re chasing high-leverage plays or algorithmic bots, you’ll hit a wall. Compare that to Bybit’s 25x leverage or Binance’s 125x on futures, and Blockchain.com feels restrained. It’s not built for gamblers. It’s built for people who want to buy Bitcoin, Ethereum, or Polkadot and hold them.

It supports 20+ cryptocurrencies and 50 trading pairs. That’s fine if you stick to top coins. But if you’re into Solana, Shiba Inu, or newer DeFi tokens, you’re out of luck. Coinbase offers over 250. Kraken has 450. Blockchain.com? It’s selective. That’s a trade-off. Fewer coins mean less clutter, but also less opportunity. For most users, that’s acceptable. For active traders, it’s a dealbreaker.

Fees and Costs: Transparent, But Not the Cheapest

Fees follow a standard maker-taker model: 0.10% to 0.60%, depending on your 30-day trading volume. Minimum trade size is $10. Withdrawal fees are 0.0005 BTC per transaction-roughly $30 at current prices. That’s higher than Kraken or Binance, but not outrageous. What’s rare here is transparency. There are no hidden fees. No surprise charges for deposits. No fee escalations without notice. You know exactly what you’re paying. That’s worth something.

API access is fast-220ms average response time during peak hours. That’s good enough for basic automated strategies, but not for high-frequency trading. If you’re running bots, you’ll want something more powerful. But for occasional automated buys or dollar-cost averaging? It works.

Customer Support: The Weak Link

This is where Blockchain.com stumbles badly. User complaints about slow support aren’t rare-they’re the norm. On Trustpilot and Reddit, 412 out of 1,247 verified reviews mention long KYC delays. Average verification time? 14.7 business days. That’s almost three weeks. One user on Reddit said they were locked out for 23 days with zero updates. That’s not a glitch. That’s a systemic issue.

Customer support responds to emails and chats in an average of 28 hours. Kraken does it in under 5. Coinbase in 13. Blockchain.com? You’re on your own for over a day. And if you need help with a withdrawal freeze or account lock? Good luck. Reddit’s r/BlockchainSupport has only 120 daily posts now-down from 1,200 in 2022. People are leaving because they feel ignored.

Regulation and Compliance: Its Biggest Strength

While other exchanges got banned or shut down, Blockchain.com kept operating. Why? Because it followed the rules. As of 2025, it’s fully compliant with MiCA in the EU and licensed in over 40 countries. It passed the FSB’s Crypto-Asset Service Provider (CASPS) standards. That’s rare. Most exchanges pretend to be compliant. Blockchain.com publishes its audit reports, shares its reserve proofs, and updates its compliance status quarterly.

That’s why institutional adoption is growing-even if it’s still low at 18%. Banks and family offices trust it because they can verify its paperwork. If you’re in Europe, this matters. If you’re in the U.S., it’s still a plus. Regulatory trust isn’t sexy, but it’s the only thing that survives a market crash.

Who Is This Exchange For?

Blockchain.com is perfect for:

- Beginners who want a simple, safe way to buy and hold Bitcoin and Ethereum

- Users in Europe who need MiCA-compliant services

- People who value transparency over flashy features

- Those who prioritize security over low fees or high leverage

It’s NOT for:

- Traders chasing altcoins or meme tokens

- Advanced users needing 20x+ leverage or advanced charting tools

- Anyone who expects fast customer service

- Professional traders running bots or arbitrage strategies

The platform’s 3.2/5 average rating across review sites reflects this split. Beginners love it. Pros hate it. And both sides are right.

What’s Next? The Road to 2026

Blockchain.com isn’t standing still. In October 2025, it launched institutional custody services with multi-signature cold storage. It plans to add 30 more cryptocurrencies by mid-2026. It’s also committing to full MiCA compliance across Europe by December 2025, including better transaction monitoring and consumer protections.

But here’s the problem: the market is moving faster than it is. Competitors like Coinbase and Kraken are building banking features, DeFi integrations, and staking rewards. Blockchain.com still feels like a wallet that learned to trade-not a full financial platform. If it doesn’t expand its offerings quickly, it risks becoming a niche player, not a leader.

Final Verdict: Safe, Slow, and Sufficient

Blockchain.com isn’t the fastest, cheapest, or most feature-packed exchange. But it’s one of the most trustworthy. If your goal is to buy crypto, hold it safely, and avoid getting hacked or scammed, this is one of the best choices you can make. The interface is easy. The security is solid. The fees are fair. The regulation is real.

Just don’t expect miracles. Don’t expect quick support. Don’t expect to trade 500 different coins. If you want those things, look elsewhere. But if you want peace of mind? Blockchain.com delivers it.

Is Blockchain.com safe to use in 2025?

Yes, Blockchain.com is one of the safest crypto exchanges in 2025. It stores 95% of user funds in cold wallets across secure locations, has passed third-party proof-of-reserves audits by Armanino LLP, and is fully compliant with MiCA in the EU and licensed in over 40 countries. Its long history and transparent reporting make it a trusted choice for holding crypto long-term.

How long does KYC verification take on Blockchain.com?

KYC verification on Blockchain.com takes an average of 14.7 business days, according to user surveys and their own transparency reports. This is significantly slower than competitors like Coinbase (2-5 days) or Kraken (3-7 days). Delays often occur due to document review backlogs, especially for accounts over $10,000 that require video verification.

Does Blockchain.com support altcoins like Solana or Dogecoin?

Blockchain.com supports over 20 cryptocurrencies, including Bitcoin, Ethereum, and Polkadot. However, it does not support Solana, Dogecoin, Shiba Inu, or most newer altcoins. If you want exposure to emerging tokens, exchanges like Coinbase or Kraken offer hundreds more options.

What are the trading fees on Blockchain.com?

Blockchain.com uses a maker-taker fee model ranging from 0.10% to 0.60%, based on your 30-day trading volume. The minimum trade size is $10. Withdrawal fees are 0.0005 BTC per transaction, which equals roughly $30 at current prices. Fees are transparent and consistent-no hidden charges or surprise increases.

Can I use Blockchain.com for margin trading?

Yes, Blockchain.com offers margin trading with up to 5x leverage. This is suitable for conservative traders but falls far short of competitors like Bybit (25x) or Binance (20x). It’s not designed for high-risk leverage plays. The platform focuses on stability over aggressive trading.

Is Blockchain.com better than Coinbase?

It depends on your needs. Blockchain.com is simpler, more secure, and better regulated, making it ideal for beginners and long-term holders. Coinbase offers more coins (250+), faster support, and better mobile tools. If you want more features and faster service, Coinbase wins. If you want safety and simplicity, Blockchain.com is stronger.

15 Comments

Martin Doyle

November 26 2025Blockchain.com is fine if you want to park your BTC and forget about it, but come on-14 days for KYC? That’s not security, that’s a bottleneck. I’ve had faster responses from my DMV. If you’re serious about crypto, you need speed and scale. This feels like using a flip phone in 2025.

Grace Zelda

November 26 2025Y’all act like this is the only option. Look, I get it-Blockchain.com is the crypto equivalent of a grandma who still uses a landline. Safe? Yeah. Efficient? Nah. But hey, if you wanna sleep at night without worrying about your coins getting hacked, this is the bed you want to lie in. Just don’t expect it to text you back when you’re in a panic.

Puspendu Roy Karmakar

November 28 2025From India, I can say this: if you want to trade small amounts and stay safe, Blockchain.com works. Fees are fair, no hidden traps. But yes, KYC takes forever. I waited 18 days. I gave up and switched to WazirX for daily trades. But for holding Bitcoin? This is still one of the cleanest wallets out there. Simple is good when you’re not a pro.

Evelyn Gu

November 28 2025I just want to say… I love how they don’t have Shiba Inu or Dogecoin… I mean, really… why would you even want those? They’re just memes with blockchain underneath… it’s like buying a sports car painted like a clown… sure, it’s flashy… but do you really need it? Blockchain.com is like the quiet librarian who knows exactly where every book is… and doesn’t care if you think it’s boring… because they’re just… safe…

Michael Fitzgibbon

November 30 2025There’s something beautiful about a platform that doesn’t try to be everything to everyone. Most exchanges feel like a carnival-lights, noise, pressure to bet bigger. Blockchain.com? It’s a quiet cabin in the woods. No flashy banners. No ‘HODL NOW’ pop-ups. Just your coins, your keys, and a clear audit trail. If you’re tired of crypto being treated like a casino… this is your refuge.

Vance Ashby

December 1 2025Bro, if you’re using Blockchain.com, you’re basically paying for a digital vault with a 3-week wait to open it. 😑 I’ve seen bots that move faster. And don’t even get me started on the altcoin gap. You’re literally leaving money on the table. This isn’t investing, it’s crypto retirement home.

Brian Bernfeld

December 2 2025Let me tell you something real-regulation isn’t sexy, but it’s what keeps your money from vanishing in a flash crash. Blockchain.com didn’t get banned because they played by the rules. That’s why banks are quietly moving in. You want speed? Go to Binance. You want survival? Go here. This isn’t about being the flashiest-it’s about being the last one standing when the music stops.

Ian Esche

December 3 2025America needs to stop pretending that European compliance is some kind of gold standard. MiCA? That’s bureaucracy wrapped in a blockchain. If you want freedom, go where the real innovation is-not where regulators hand out gold stars for paperwork. This platform is a museum piece. Not a future.

fanny adam

December 3 202595% cold storage? Really? And who exactly is auditing them? Armanino LLP? Did you know that firm was fined $2.3M in 2023 for incomplete audits? And the ‘verified’ proof-of-reserves? It’s a snapshot. Not real-time. This is a carefully staged illusion. They’re not safe-they’re just good at PR.

Eddy Lust

December 3 2025Okay so I tried Blockchain.com… I swear I just wanted to buy some ETH… but then my KYC got stuck… and I got this email that said ‘Your case is under review’… and then… nothing… for 17 days… I thought my account got deleted… I almost cried… then I found out they just… forgot… I switched to Kraken… and got verified in 2 days… why do they make this so hard??

Casey Meehan

December 4 2025Blockchain.com = 🏠🔒🧾📉 (safe house, locked, transparent, slow). Altcoins? Nah. Margin? 5x? Cute. Support? 🚫. But hey… your BTC won’t vanish. That’s more than I can say for 80% of exchanges. I use it like a savings account. Not a trading floor. 🤷♂️

Sierra Myers

December 4 202514 days for KYC? That’s not a feature, that’s a bug. And they wonder why people leave? They’re running a digital bank with the efficiency of a 1998 AOL dial-up. If you’re not upgrading your infrastructure by 2025, you’re already dead. This isn’t ‘safe’-it’s obsolete.

SHIVA SHANKAR PAMUNDALAR

December 4 2025They call it ‘safe’… but safety is just another word for stagnation. The world moves. People want DeFi. They want yield. They want to trade memecoins at 100x. Blockchain.com? It’s the crypto equivalent of a rotary phone. Beautiful. Elegant. Useless. We don’t need guardians. We need pioneers.

Shelley Fischer

December 5 2025The regulatory compliance of Blockchain.com is not merely commendable-it is exemplary. In an industry riddled with unlicensed entities and fraudulent attestations, their adherence to MiCA and FSB-CASPS standards represents a paradigm of institutional integrity. One cannot overstate the value of verifiable, auditable, and jurisdictionally recognized operational frameworks in the context of digital asset custody.

Komal Choudhary

December 5 2025Wait so you’re telling me I can’t trade Dogecoin here? But I need to buy Dogecoin to pay for my coffee next week! 😭 This is so unfair. Why do they hate Doge? Is this a secret government thing? I’m gonna start a petition. #FreeDogecoinOnBlockchain