How Russian Banks Block Crypto-to-Fiat Withdrawals in 2026

When you try to turn your Bitcoin or Ethereum into cash in Russia, your bank doesn’t just process the request. It investigates you. Since September 2025, Russian banks have been given sweeping powers to freeze withdrawals, demand proof of where your crypto came from, and even lock your account for two full days - all without a court order. This isn’t about stopping crime. It’s about controlling how money moves in a country under sanctions, where crypto has become a lifeline for ordinary people and a threat to the state’s financial monopoly.

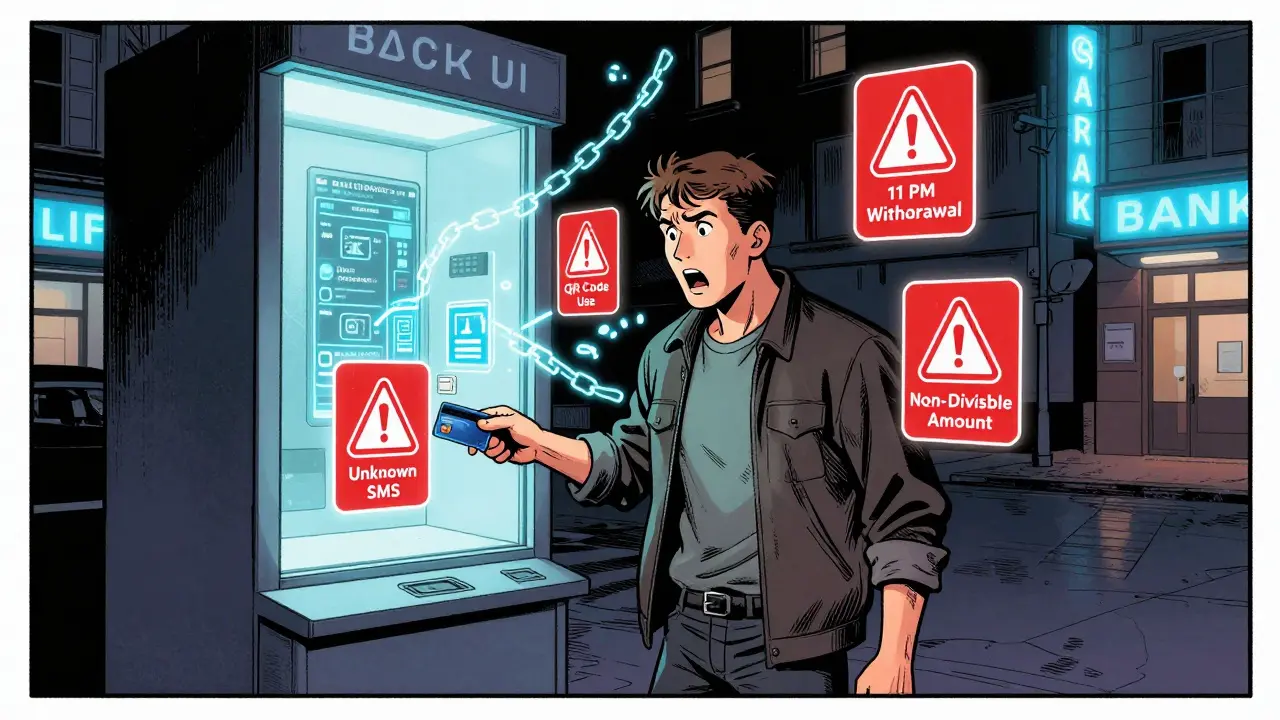

What triggers a bank block?

It’s not enough to just deposit crypto and ask for cash. Russian banks watch for 12 specific red flags in your transaction history. If even one shows up, your daily withdrawal limit drops to 50,000 rubles - about $600 - for 48 hours. Here’s what sets off the alarm:- Withdrawing cash between 11 PM and 5 AM

- Using an ATM more than 50 kilometers from your registered address

- Getting a transfer over 200,000 rubles and withdrawing cash within 24 hours

- Using QR codes or virtual cards instead of a physical debit card

- Receiving three or more unknown SMS messages in six hours before the withdrawal

- Transaction amounts that aren’t divisible by 1,000 rubles (like 47,300 instead of 48,000)

- Device signs of malware or fake apps

- Using peer-to-peer platforms like Paxful or LocalBitcoins to get cash

These aren’t guesses. They’re based on internal CBR documents that track how scams actually work. In the second quarter of 2025, 273,100 fraud cases were linked to crypto-to-fiat conversions - totaling 6.3 billion rubles. The bank says this justifies the crackdown. But if you’re just cashing out from a legitimate trade, you’re still caught in the net.

What happens when your account gets flagged?

You’ll get an SMS within 15 minutes. Then your mobile banking app will show a warning: "Your withdrawal limit has been temporarily reduced." You can’t withdraw more than 50,000 rubles per day. No exceptions. No appeals. Not even if you’ve been a customer for 10 years.After the 48-hour hold, the bank starts its real investigation. You’ll be asked to prove where your crypto came from. That means:

- Exporting your full transaction history from your wallet

- Providing screenshots of trades from exchanges

- Submitting notarized documents if you used a decentralized platform like Uniswap

Here’s the catch: most decentralized wallets don’t keep records. If you swapped ETH for USDT on a DEX and then cashed out, the bank has no way to verify it. So they reject your proof. And your account stays frozen - sometimes for days.

One user on the Russian forum BitBoom reported being locked out for 72 hours after withdrawing 65,000 rubles from a Paxful trade. He had to drive 80 kilometers to his Sberbank branch with printed blockchain records, a photo of his passport, and a signed letter explaining the trade. He still got no refund for the lost time.

Why are banks so strict?

The official reason: fighting fraud. The real reason: control.Russia’s Finance Ministry says 37.2% of all cross-border payments now go through crypto. That’s a problem for a state that wants to track every ruble. If people can bypass sanctions by buying crypto abroad and turning it into cash at home, the government loses leverage. So they’re not just blocking withdrawals - they’re making it so hard, so slow, and so humiliating that people give up.

And it’s working. Small cash exchange offices - the kind that used to let you walk in with a phone full of crypto and walk out with a wad of rubles - have lost 40-60% of their business since September. Many have shut down. The ones still open now charge 7-12% extra to handle the risk. That’s how the system survives: by pushing people into the shadows.

Meanwhile, big banks like Sberbank and VTB have hired hundreds of new analysts just to monitor crypto transactions. Sberbank alone added 217 specialists in one month. Their job? To spot patterns. To cross-reference IP addresses. To flag anyone who uses a VPN, switches devices, or withdraws more than 100,000 rubles in a week.

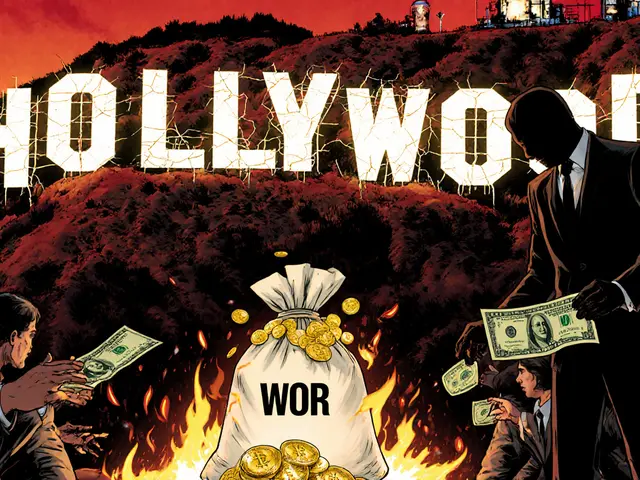

The double standard: crypto for trade, not for you

Here’s the twist: Russia isn’t banning crypto. It’s redefining who gets to use it.In October 2025, Finance Minister Anton Siluanov announced that Russia would allow banks to handle cryptocurrency for international trade - but only for state-approved companies. Think oil, grain, and weapons exporters. These firms can now settle deals in crypto, as long as they use government-monitored channels. The central bank even started testing blockchain systems for commodity exports with five major banks.

But if you’re a regular person trying to cash out your Ethereum to pay rent? You’re a threat.

Even more telling: banks are allowed to hold crypto - but only up to 1% of their capital. And they must keep 150% of that in reserve. That means they can profit from institutional crypto, but you can’t touch it. It’s not about security. It’s about power.

How are people adapting?

Some users have learned to game the system. The most successful strategy? Spread your withdrawals across multiple banks.Active crypto users now hold an average of 3.7 bank accounts. They withdraw 50,000 rubles from one, wait three days, then move to another. They use cards with long, clean histories - 3+ months of regular grocery runs, utility payments, and small online purchases. That makes their accounts look "normal."

But it’s risky. The system now watches for cross-bank patterns. If you withdraw from three different banks in a week, you trigger a new flag: "structured withdrawal activity." That means even more scrutiny.

Another tactic: avoid cash entirely. Some users now use prepaid cards issued by crypto-friendly fintechs that still operate in Russia. These cards work for online shopping or international transfers - but you can’t withdraw cash from ATMs. It’s not ideal, but it’s safer.

What’s next?

The crackdown is getting worse. By December 1, 2025, banks will be required to verify the source of every crypto withdrawal over 100,000 rubles. That’s not a suggestion. It’s the law.And legislation is moving fast. A bill in the Russian Duma proposes prison sentences of up to five years for "organized crypto conversion schemes" - which could include someone who helps a friend cash out. Repeat offenders could face 10 years.

Meanwhile, the central bank is preparing to roll out its own digital ruble in September 2026. It will be mandatory for all government payments. And it will be fully traceable. No anonymity. No bypass. No crypto.

So what’s the endgame? Russia doesn’t want to eliminate crypto. It wants to own it. Control it. Use it for trade, while locking ordinary people out. The system isn’t broken. It’s working exactly as designed.

Can I still withdraw crypto to fiat in Russia?

Yes - but with severe restrictions. Banks allow withdrawals only if they don’t trigger any of the 12 flagged behaviors. Your daily limit is 50,000 rubles ($600) for 48 hours after any suspicious activity. You may also be forced to prove the source of your crypto with notarized documents, which is nearly impossible if you used decentralized exchanges.

Why do Russian banks care where my crypto came from?

Because the government sees unregulated crypto as a threat to financial control. If people can bypass sanctions, avoid taxes, or move money without oversight, it undermines the state’s ability to manage the economy. The bank isn’t trying to stop crime - it’s trying to stop independence.

What if I only withdraw small amounts, like 20,000 rubles?

Even small withdrawals can be blocked if they’re paired with other red flags - like using a virtual card, withdrawing late at night, or receiving a large transfer right before. The system doesn’t look at the amount alone. It looks at your entire behavior pattern.

Can I use a foreign bank to withdraw crypto from Russia?

Not easily. Most foreign banks require proof of income and source of funds. If you’re in Russia, your crypto transaction history will show Russian IP addresses, local exchanges, or P2P trades - all of which raise red flags abroad. Many foreign banks will freeze or close accounts linked to Russian crypto activity.

Are there any banks in Russia that don’t restrict crypto withdrawals?

No. All 347 licensed banks in Russia are required to follow the Central Bank’s rules. Even smaller regional banks have implemented the monitoring systems. There is no legal way to avoid it. The only difference is how strictly they enforce it - and how long they take to respond.

Is it safe to keep crypto in Russia right now?

Keeping crypto is legal - but converting it to fiat is becoming impossible. If you hold crypto, you’re not at risk unless you try to cash out. However, the government is moving toward mandatory digital ruble adoption by 2026. That could eventually make holding crypto on Russian platforms risky. For now, storing it offline is the safest option.

18 Comments

Sanchita Nahar

February 13 2026This is so ridiculous. Just let people cash out. Why make it this hard? I don't care about your red flags. I just want my money.

bala murali

February 13 2026The institutionalization of crypto for state-approved trade while criminalizing individual use is a textbook case of regulatory capture. The CBR's internal documents reveal a structural bias toward centralized control, not fraud prevention.

Desiree Foo

February 15 2026This is exactly why crypto can't be trusted. People use it to bypass sanctions, evade taxes, and fund shadow economies. If you're not doing anything illegal, why are you so afraid of a little paperwork?

Elijah Young

February 15 2026I get the state's concern, but this feels more like punishment than protection. People aren't criminals just because they use crypto to pay rent. The system is designed to break them, not catch bad actors.

Donna Patters

February 17 2026The central bank isn't regulating crypto. It's weaponizing financial infrastructure against its own citizens. This isn't policy. It's authoritarianism dressed in compliance.

Holly Perkins

February 18 2026so like... if you withdraw 47300 rubles instead of 48000 you get flagged?? like wtf is this system even doing??

Will Lum

February 19 2026Honestly the smartest move is just to spread it out. 50k here, 50k there. It's annoying but it works. I've been doing this for months. Just keep your accounts clean with small regular deposits. No drama.

Ben Pintilie

February 20 2026Lmao imagine getting locked out for 72 hours because you used a QR code 😭

Sakshi Arora

February 22 2026why do they care where the crypto came from if you just want to turn it into rubles? its just money at that point right? like you dont have to explain where you got your salary

Ekaterina Sergeevna

February 22 2026Ah yes, the classic 'crypto is bad for you but great for our oligarchs' policy. Truly inspiring governance. The fact that banks can hold crypto up to 1% of capital while citizens are criminalized for 0.0001% speaks volumes.

SAKTHIVEL A

February 23 2026The Russian state has engineered a financial apartheid. The elite trade in blockchain-backed commodities while the proletariat is shackled by 12 arbitrary red flags. This is not financial regulation. It is class-based financial terrorism.

Santosh kumar

February 24 2026I know it's hard but don't give up. People are finding ways. I've seen friends use prepaid cards and small transfers. It's slow but it works. Stay safe out there.

Claire Sannen

February 25 2026If you're trying to cash out, I'd recommend keeping a low profile. Use one bank, make small regular deposits for at least 90 days before attempting a withdrawal. Document everything. And don't use P2P platforms - they're too risky.

Christopher Wardle

February 26 2026The real question isn't whether crypto should be regulated. It's whether financial sovereignty should be a privilege reserved for the state. If money is power, then controlling its flow is the ultimate assertion of control.

blake blackner

February 26 2026Bro just use a different bank every 3 days. I did it. No one noticed. Also stop using your phone for transfers. Get a burner laptop. And don't use VPNs lol

Jeremy Lim

February 27 2026I can't believe they're doing this. It's so invasive. I mean... they're tracking your IP? Your device? Your SMS messages? This isn't banking. This is surveillance. And it's terrifying.

kelvin joseph-kanyin

February 28 2026You got this! Even if the system is rigged, you're still ahead of the game just by knowing how it works. Keep grinding. The future belongs to the ones who adapt.

Benjamin Andrew

March 2 2026The CBR's methodology is statistically sound. 273,100 fraud cases linked to crypto-to-fiat conversions in Q2 2025. The 6.3B ruble loss is not theoretical. The 12 red flags are derived from forensic behavioral analysis. To dismiss this as overreach is to ignore empirical evidence.