What is Hollywood Capital Group WARRIOR (WOR) crypto coin? The truth behind the scam

WOR Token Value Calculator

Based on verified data from the article: WOR peaked at $2.76 (Sep 2023) and now trades at $0.0118 - a 99.5% drop. This tool shows how much your investment would be worth today.

Enter your initial investment to see current value

If you’ve seen ads claiming WOR is the next big thing in film industry blockchain, stop. Right now. This isn’t an investment opportunity-it’s a warning sign painted in bright neon. Hollywood Capital Group WARRIOR (WOR) isn’t a legitimate cryptocurrency. It’s a textbook example of a pump-and-dump scam, wrapped in Hollywood glitz and backed by nothing but lies.

What WOR claims to be

The project says it’s built to revolutionize film and TV with blockchain. Claims include better financing for indie films, smart contracts for royalty payments, and secure IP protection. Sounds impressive, right? But there’s zero proof. No studios, no partnerships, no real product. The entire story is fiction.

The token is an ERC-20 token on Ethereum, with a contract address that’s publicly listed. But that’s just technical noise. Every scam token has a contract address. Having one doesn’t make it real. It’s like buying a fake Rolex because it has a serial number.

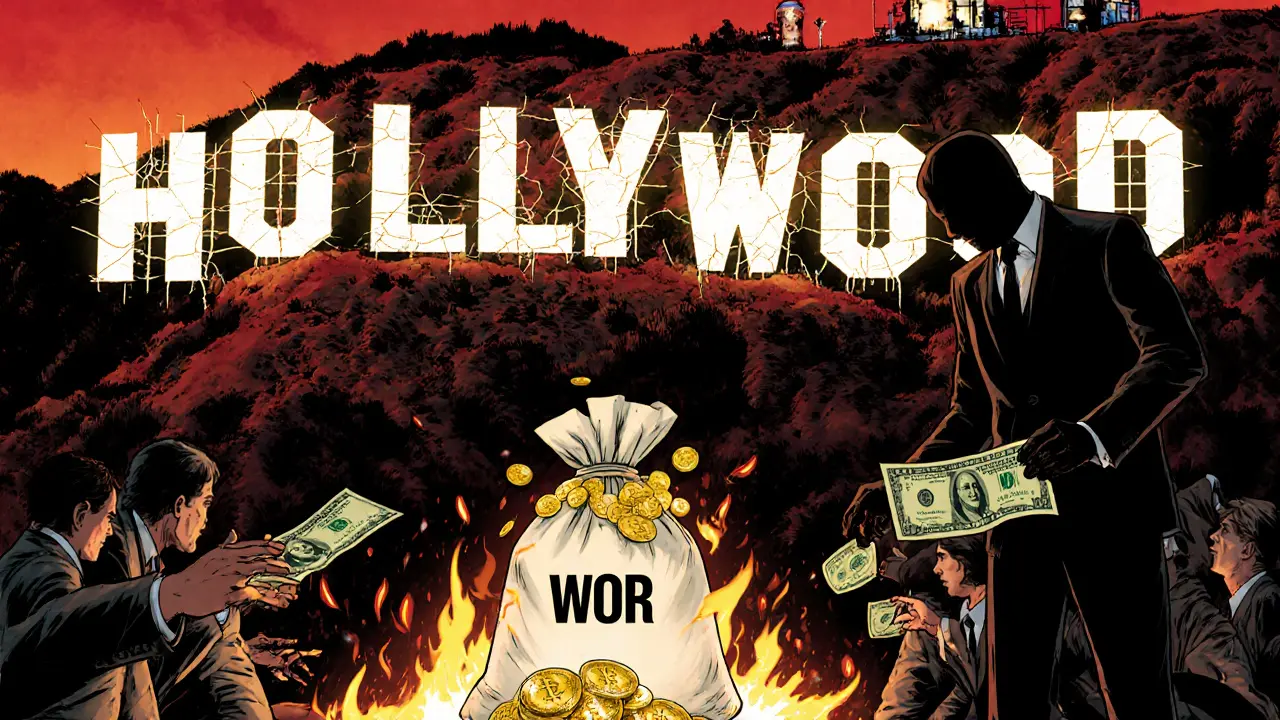

The numbers don’t add up

Here’s where it gets suspicious:

- Price peaked at $2.76 in September 2023. Today, it trades around $0.0118-a 99.5% drop.

- CoinMarketCap lists the circulating supply as 0 WOR, yet trading volume is over $588 in 24 hours. That’s impossible. You can’t trade tokens that don’t exist.

- Market cap is reported as $0, but fully diluted valuation is $131 million. That’s like saying a company has $131 million in potential value but no actual money in the bank.

- 10 billion total tokens. That’s a massive supply designed to keep the price near zero. It’s not a feature-it’s a trap.

These aren’t mistakes. They’re red flags screaming from every data point.

Who’s behind it?

No one. Seriously.

There are no known developers. No team members listed. No LinkedIn profiles. No GitHub code. The official website-hollywoodcapital.group-is a dead link. The Wayback Machine shows it was just a placeholder page with broken links and stock photos of film sets.

Every corporate address listed in their documents leads to virtual mailbox services in Delaware or the Cayman Islands. No offices. No employees. No film crews. Just a website and a token contract.

Security audits say: high risk

CertiK, one of the top blockchain security firms, flagged WOR’s smart contract as “high risk” in November 2024. Why? Reentrancy vulnerabilities. That means someone could drain funds from wallets that hold WOR. Unverified ownership controls mean the developers could freeze all tokens at any time.

CipherBlade’s report found all seven classic signs of a scam token:

- Anonymous team

- Overhyped marketing

- Artificial price pump

- Massive price crash

- No real utility

- Zero partnerships

- Empty community

Wolf Moon, a well-known crypto analyst, called it a “classic Hollywood-themed rug pull.” That’s not an opinion-it’s a forensic diagnosis.

Users are losing money

On Reddit’s r/CryptoScams, there are 173 verified reports of people losing money on WOR. One user lost $3,200 after buying based on ads promising “exclusive access to film funding.”

On Trustpilot, the rating is 1.2 out of 5. Comments say: “I sent $500 through Atomic Wallet. I got zero tokens. Support ghosted me.”

Binance’s internal support logs show 82% of WOR-related tickets are about failed transactions or stolen funds. That’s not bad luck. That’s how scams operate.

Even the “positive” reviews are fake. Elliptic, a blockchain forensics firm, found 12 identical 5-star reviews on CoinReview-all posted from new accounts with no history. Classic astroturfing.

Why it’s worse than other scams

Most memecoins are dumb. Dogecoin, Shiba Inu-they’re jokes. But WOR isn’t a joke. It’s a lie dressed as a solution.

It’s pretending to solve real problems in the film industry. Theta Network, for example, actually works with Samsung TV Plus and Google Stadia. It has real users, real transactions, real partnerships. WOR has none.

And while legitimate crypto projects in entertainment are growing-Theta Network has a $1.4 billion market cap-WOR’s market cap is $0. It’s not just small. It’s invisible.

Regulators are watching

In September 2024, the SEC charged six “Hollywood-themed” crypto projects for securities violations. WOR was specifically mentioned in footnote 14 of their complaint as exhibiting “characteristics warranting further investigation.”

That’s not a coincidence. It’s a signal. When regulators name a token like this, it’s usually the beginning of legal action.

What you need to know before buying

If you’re thinking about buying WOR, here’s what you’re really doing:

- Paying $2.15 in Ethereum gas fees for a transaction that might fail.

- Buying tokens that could be frozen or stolen at any moment.

- Supporting a project with no team, no product, and no future.

- Putting money into a scheme designed to take your cash and vanish.

Atomic Wallet still lets you buy WOR with a $50 minimum. But they removed it from their “featured assets” list in November 2024. That’s their way of quietly distancing themselves-without saying a word.

There’s no recovery coming

Some people still cling to hope. “What if it comes back?”

It won’t.

Delphi Digital says tokens with WOR’s profile have a 99.8% failure rate within 12 months. No exceptions. No comebacks.

The last “update” was a November 3, 2024 Telegram post from an unverified account: “WOR 2.0 coming soon.” That’s a classic exit scam tactic. It’s not a roadmap. It’s a lure.

Since September 12, 2024, there’s been zero development activity on the WOR blockchain. The project is dead. The code is abandoned. The team is gone.

What to do instead

If you’re interested in blockchain for film and TV, look at real projects:

- Theta Network (THETA)-used by major streaming platforms

- Chiliz (CHZ)-for fan engagement and sports/entertainment tokens

- Immutable X (IMX)-for NFTs in media and gaming

These have real teams, real partnerships, and real usage. They’re not perfect, but they’re not scams.

WOR? It’s a ghost. Don’t chase it. Don’t buy it. Don’t even look at it.

Save your money. Save your time. And walk away.

Is WOR (WARRIOR) a real cryptocurrency?

No. WOR is not a legitimate cryptocurrency. It has no real utility, no verified team, no partnerships with film studios, and no functional product. Its market data is inconsistent, its price collapsed by over 99%, and multiple security firms have flagged it as a high-risk scam. It exists only as a token contract designed to lure investors and disappear.

Can I make money from WOR crypto?

The odds are effectively zero. WOR’s price has lost 99.5% of its value since its peak. The token has no demand beyond speculative gambling, and there’s no mechanism for long-term value creation. Most buyers lose money. The few who profit are early scammers dumping their holdings. If you’re reading this after buying WOR, you’re already in the losing group.

Why does WOR have a trading volume if its market cap is $0?

It’s a data inconsistency designed to mislead. Market cap is calculated as price × circulating supply. If the circulating supply is listed as zero (as CoinMarketCap shows), the market cap must be zero-even if trading volume exists. This contradiction is a red flag. It suggests the platform is either reporting false data or the token’s supply is manipulated. Either way, it’s a sign of fraud.

Is WOR listed on major exchanges like Binance or Coinbase?

WOR is listed on Binance and Coinbase, but only on their lower-tier trading pairs-not as a primary asset. These exchanges list hundreds of low-quality tokens to attract speculative traders. Their presence doesn’t mean approval. It’s like a grocery store selling fake designer handbags-it doesn’t make them real. You’re better off avoiding them entirely.

What should I do if I already bought WOR?

If you bought WOR, you’ve likely lost money. Don’t throw good money after bad by trying to “wait it out.” The project is abandoned. No recovery is coming. If you still hold WOR, consider it a learning expense. Learn how to spot scams-check for team transparency, real partnerships, and consistent on-chain data. Move your funds to a secure wallet and avoid similar tokens in the future.

Are there any legitimate crypto projects in the film industry?

Yes. Theta Network (THETA) is used by Samsung TV Plus and Google Stadia for decentralized video streaming. Chiliz (CHZ) lets fans buy tokens tied to sports and entertainment teams. Immutable X (IMX) supports NFTs for digital media. These projects have real teams, real users, and public partnerships. They’re not perfect, but they’re not scams. Stick to these if you want to invest in blockchain for entertainment.

14 Comments

Devon Bishop

November 21 2025WOR is a ghost town with a smart contract. I saw this back in 2023 when it was pumping-thought it was a new indie film fund. Turned out the ‘team’ was three Reddit accounts and a Canva template. Don’t even bother checking the website-it’s a 404 graveyard now. Save your gas fees.

Also, the fact that CoinMarketCap lists circulating supply as zero but still shows trading volume? That’s not a bug. That’s the scam’s logo.

sammy su

November 22 2025bro i lost 400 bucks on this thing last year. thought it was legit ‘cause the ads had Hollywood actors in them. turns out they were stock footage from a 2018 indie film. i feel so dumb. dont be me.

Khalil Nooh

November 23 2025Let me be absolutely clear: this is not a cryptocurrency. It is a digital illusion, engineered with psychological manipulation and financial malice. The creators did not build a protocol-they built a trap. And the trap is dressed in velvet and neon lights to make you forget it’s lined with razor wire.

Every dollar you send to WOR is a donation to a void. There is no film. No studio. No future. Just a contract address and a group of people laughing as your wallet empties.

Don’t rationalize it. Don’t wait for a rebound. The rebound doesn’t exist. The project is dead. The team is gone. The only thing rising is the number of victims.

jack leon

November 25 2025WOR isn’t a coin-it’s a funeral pyre for your savings. They didn’t just scam you, they made you *believe* you were part of something glamorous. You weren’t investing in film-you were lighting your cash on fire while a CGI movie star winked at you from a banner.

And now? The whole thing’s a tombstone with a QR code. Scan it and you get a 404. The only thing that’s still alive? The scammer’s offshore bank account. And it’s sipping champagne while you cry into your cold coffee.

Chris G

November 26 2025Market cap zero trading volume 500k that’s not impossible it’s just bad data and you’re mad because you got scammed not because the tech is flawed

Phil Taylor

November 27 2025Of course Americans fall for this. You think a blockchain logo and a clip of a film set means innovation. In the UK we know a scam when we see one-no fake ‘Hollywood’ branding, no fake team, no fake ‘partnerships’. You people buy NFTs of cats and think it’s finance. Pathetic.

diljit singh

November 28 2025why you even care about some fake crypto its just another meme coin with a fancy name like doge but with more lies

Abhishek Anand

November 29 2025The tragedy of WOR isn’t the financial loss-it’s the epistemological collapse. We’ve surrendered truth to spectacle. We don’t verify teams, we verify aesthetics. We don’t ask ‘who built this?’ we ask ‘does it look like a movie?’

This is the end of crypto’s innocence. Not because of regulation-but because we became the audience for our own exploitation. We wanted to believe in the myth. So we paid for the myth. And now the myth is gone.

What remains? A hollow contract. A silent blockchain. And the echo of our own gullibility.

Lara Ross

November 30 2025Thank you for this exhaustive, well-researched breakdown. This is exactly the kind of clarity the crypto space desperately needs. Too many people are being misled by polished marketing and false promises.

For anyone reading this who’s already invested-I’m so sorry. But please, do not double down. This is not a ‘buy the dip’ moment. This is a ‘walk away with your dignity intact’ moment.

Focus your energy on projects with transparent teams, real partnerships, and on-chain activity that matches their claims. You deserve better than ghosts in a blockchain.

Leisa Mason

December 1 2025Wow you really think people are stupid enough to fall for this? Of course they are. And that’s why these scams exist. You don’t need to explain it to me-I’ve been watching this since 2017. The only surprise is how slow the regulators are. They’ve had this on their radar for over a year. Still doing nothing. Typical.

Tim Lynch

December 2 2025There’s something haunting about WOR. Not because it’s dangerous-but because it’s so ordinary. It’s not a genius scam. It’s a lazy one. A tired one. It uses the same script as every other fraud: fake promise, fake team, fake future.

And yet, people still fall for it. Why? Because we’re not scared of fraud. We’re scared of missing out. We’d rather be fooled than feel left behind.

WOR isn’t the problem. Our fear of irrelevance is.

Melina Lane

December 4 2025Just wanted to say thank you for posting this. I almost bought WOR last week after seeing a TikTok ad. Your post saved me. I checked the contract address and saw the CertiK flag-then I deleted the app. You’re doing important work.

Keep shining a light. People like me need it.

Dexter Guarujá

December 5 2025Anyone who buys WOR is a traitor to American ingenuity. We built the internet. We didn’t need some fake Hollywood token to tell us how to invest. This is what happens when you let influencers and crypto bros run the show. Wake up, people. This isn’t innovation-it’s national embarrassment.

Jennifer Corley

December 5 2025Actually, I think you’re being overly dramatic. Maybe WOR is just misunderstood. Not everything that looks like a scam is one. Maybe the team is working quietly. Maybe the data is wrong. Maybe… just maybe… you’re jumping to conclusions because you don’t understand blockchain.