How Saudis Access Cryptocurrency Exchanges Despite Restrictions

Over 4 million Saudis own cryptocurrency-even though the government hasn’t legalized it. That’s not a glitch. It’s a reality shaped by tech-savvy users, global platforms, and a regulatory gray zone that’s more confusing than it is clear. If you’re one of them, you’re probably not waiting for permission. You’re finding ways in. Here’s how.

There’s No Legal Path-So People Build Their Own

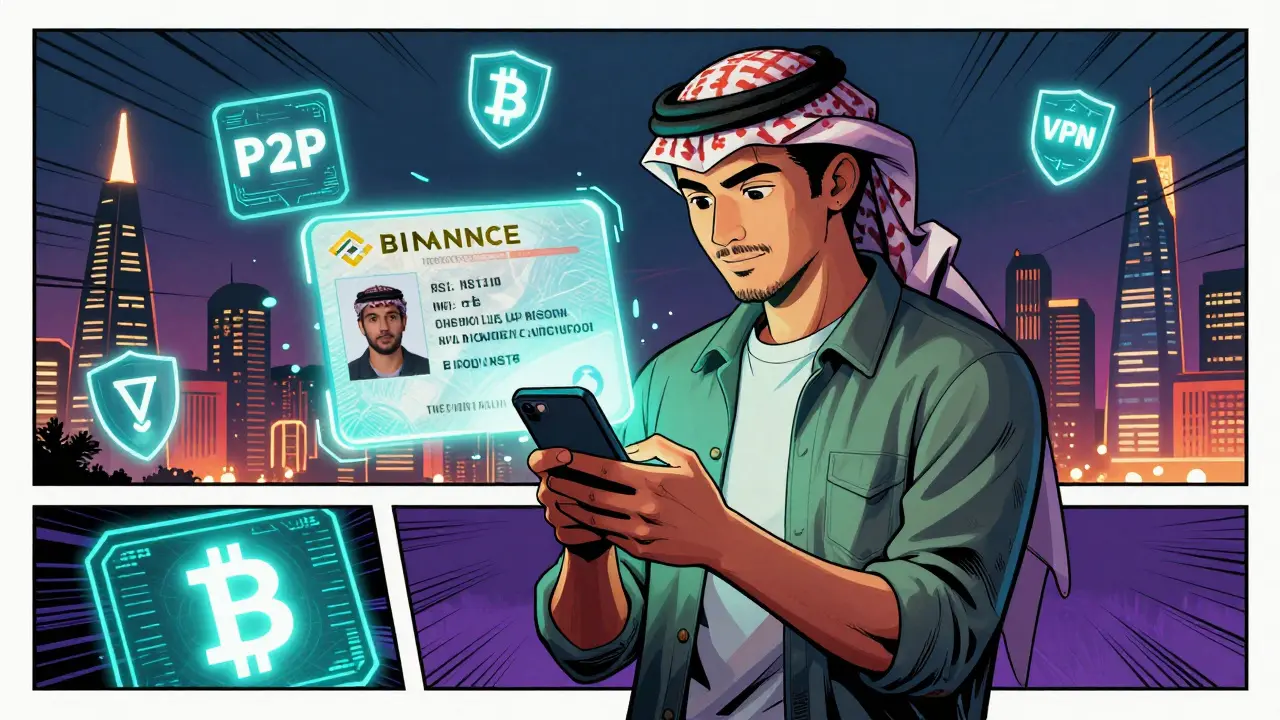

The Saudi Central Bank (SAMA) says banks can’t touch crypto unless they get special approval. That approval hasn’t been given to any local exchange. No licensed crypto platform exists inside the Kingdom. Yet, in 2024, Saudis traded $31 billion in cryptocurrency. That’s up 153% from the year before. How? They’re using international exchanges-Binance, Bybit, OKX-directly from their phones.

You don’t need a Saudi-based account to sign up. You just need your national ID, a selfie, and sometimes proof of address. Over 68% of Saudis who’ve tried it successfully verified their identity on global exchanges using only their Saudi ID. It’s not always smooth-some accounts get flagged-but enough people get through to make it worth the effort.

How They Fund Their Accounts (Without Banks)

Here’s the real challenge: Saudi banks won’t process crypto deposits. So how do you get money in? Most Saudis use three workarounds.

- Peer-to-peer (P2P) trading accounts for 37% of all fiat-to-crypto conversions. Platforms like Paxful and LocalBitcoins connect buyers and sellers directly. You pay via bank transfer to someone in Riyadh or Jeddah, and they send you Bitcoin or USDT. Alinma and Al Rajhi banks are commonly used because they rarely block these transfers.

- Cryptocurrency payment processors like NOWPayments handle 58% of transactions. You buy crypto using your credit card or local bank account through them, and they convert it into a digital asset you can move to an exchange.

- Gift cards and remittance apps like Wise and Revolut let Saudis buy crypto indirectly. Buy a $100 Amazon gift card, sell it on a P2P platform for USDT, and you’ve moved value without touching a bank’s crypto policy.

A common tactic? Use SaudiCrypto, a local P2P hub, to convert SAR to USDT at a 1.8% fee, then send it to Binance. It’s not official. It’s not regulated. But it works-and thousands do it every day.

VPNs, Mobile Apps, and the Younger Generation

Internet restrictions aren’t officially enforced for crypto, but some users still use VPNs to avoid potential blocks. NordVPN reported a 28% jump in Saudi subscriptions in late 2024-many users admitted it was for crypto access.

But the real story is mobile. Sixty-three percent of Saudis under 30 use apps as their primary way to trade. That’s not surprising when you consider over 60% of the country’s population is under 30. The average Saudi crypto user is male, aged 18-35, and tech-comfortable. They don’t wait for permission. They download, verify, and trade.

Why It’s Risky (And Why People Still Do It)

There’s no safety net. If an exchange freezes your account-like one Binance user whose $40,000 was locked for 87 days after a SAMA inquiry-you’re on your own. In 2024, Saudi authorities recorded 1,842 crypto fraud cases totaling $320 million. Scammers pose as traders, fake KYC services, or phishing sites. The lack of legal recourse is real.

But the upside? Access to global markets. Binance alone saw $850 million in daily trading volume from Saudi users in Q2 2024. That’s liquidity, price depth, and 24/7 trading you can’t get anywhere else in the region. Plus, a 2023 religious ruling confirmed Bitcoin trading aligns with Sharia law. For many, that’s enough moral justification.

What’s Different About Saudi Arabia vs. Its Neighbors

Compare Saudi Arabia to the UAE. Dubai has the Virtual Assets Regulatory Authority (VARA). Abu Dhabi has clear licensing. Qatar is finalizing its rules in 2025. Bahrain has partnered with JP Morgan on blockchain projects.

Saudi Arabia? It’s running a dual game. On one hand, it’s building its own CBDC-mBridge-with China, Thailand, Hong Kong, and the UAE. On the other, it’s warning citizens not to trade crypto. The result? A thriving underground market with no official oversight.

That’s why experts say Saudi Arabia is creating “regulatory arbitrage”-a space where rules are unclear enough for savvy users to exploit them. And they are.

What’s Coming Next

SAMA is expected to release draft crypto regulations by Q3 2025. The Capital Market Authority (CMA) is already discussing how to classify digital assets. Three crypto-related startups were accepted into SAMA’s fintech sandbox in early 2025-including a blockchain KYC provider.

But here’s the thing: even if regulations come, they won’t shut down the market. They’ll just formalize it. The 7.4 million Saudis already using crypto aren’t going away. They’ll adapt.

What’s clear? The future isn’t about banning crypto. It’s about controlling it. And right now, the control is in the hands of users-not the government.

How to Start (If You’re New)

If you’re trying this for the first time, here’s what actually works based on real Saudi user reports:

- Download a global exchange app-Binance or Bybit. Skip local platforms; they’re often scams.

- Use your Saudi national ID for KYC. Upload a clear photo and a live selfie. Be honest. Lying gets you flagged.

- Start with P2P. Find a seller on Paxful who accepts Al Rajhi or Alinma bank transfers. Buy a small amount-say, $50 in USDT.

- Once you have crypto in your wallet, transfer it to your exchange account.

- Enable two-factor authentication (2FA). 92% of successful users say this is non-negotiable.

- Join the Saudi Crypto Traders Telegram group. It’s got 12,500 members. Questions get answered in under 15 minutes.

Don’t try to use your Saudi bank account to deposit directly. It won’t work. Don’t trust “guaranteed” exchange services promising instant withdrawals. They’re usually fronts.

The learning curve takes 2-3 weeks. Most users who succeed spend that time watching YouTube tutorials in Arabic, reading Reddit threads on r/CryptoSaudi, and testing small amounts before going big.

What You Should Know Before You Start

- No capital gains tax on personal crypto holdings (as of January 2024). But if you’re running a business, you pay 15% tax and 2.5% zakat.

- Withdrawals can be slow. 41% of users report delays. Have patience. Document everything.

- Use a hardware wallet for long-term storage. Exchanges get hacked. Your private keys should be yours.

- Don’t use public Wi-Fi for trading. Use your mobile data. It’s safer.

- Track your transactions. Even if the government doesn’t tax you now, they might later. Keep records.

The market is growing fast. From $23.1 billion in 2024 to an estimated $45.9 billion by 2033. That’s not a prediction. It’s a trend. And it’s being driven by people-not policy.

Is it legal to use Binance in Saudi Arabia?

There’s no specific law banning Binance or any other international exchange. But SAMA prohibits banks from processing crypto transactions, and the Ministry of Finance issued a warning against virtual currencies in 2019. That means while you can use Binance, you’re doing so at your own risk. Your funds aren’t protected by Saudi law, and your account could be frozen if flagged by regulators.

Can I use my Saudi bank account to buy crypto?

Direct deposits from Saudi banks to crypto exchanges are blocked. But you can use P2P platforms to trade with individuals who accept bank transfers. Many Saudis use Alinma or Al Rajhi to send money to sellers on Paxful or LocalBitcoins. The bank doesn’t know it’s for crypto-they just see a transfer to another person.

Do I need a VPN to access crypto exchanges in Saudi Arabia?

Not officially. Most exchanges like Binance and Bybit are accessible without a VPN. But some users use them to avoid potential future restrictions or if they’ve been blocked before. NordVPN and ExpressVPN are commonly used. It’s not required, but it adds a layer of privacy.

Are cryptocurrency ATMs available in Saudi Arabia?

Yes. As of September 2024, there are 127 crypto ATMs across Riyadh, Jeddah, and Dammam. They let you buy Bitcoin and Ethereum with cash. Most are operated by third-party companies and charge fees between 5% and 10%. They’re a good option if you want to avoid digital transfers entirely.

Is crypto trading halal in Saudi Arabia?

In 2023, the Permanent Committee for Scholarly Research and Ifta ruled that trading Bitcoin and other cryptocurrencies is permissible under Sharia law, as long as it’s not used for gambling or fraud. This religious approval is a major reason why over 78% of Saudi crypto users say faith influenced their decision to participate.

What happens if my crypto account gets frozen?

If an exchange freezes your account-usually due to a regulatory inquiry-you’ll need to contact their support team and provide documentation. There’s no Saudi government body to appeal to. Resolution times vary: some accounts are unlocked in weeks, others take months. One user reported an $40,000 freeze lasting 87 days. Keep records of all transactions and communications.

Will Saudi Arabia ban crypto in the future?

A full ban is unlikely. The country is actively developing its own CBDC and has accepted crypto-related fintech startups into its sandbox. Instead of banning, Saudi Arabia is likely to regulate-requiring licensing, KYC, and reporting. The market will shift from underground to official, but access won’t disappear.

How many Saudis use crypto?

As of 2025, approximately 7.4 million Saudis-about 19% of the population-have used cryptocurrency in some form. Around 4 million actively hold assets, and 11.4% of the population owns crypto, according to CoinLaw’s 2025 report. Usage is highest among those aged 18-35.

22 Comments

Bill Sloan

January 17 2026This is wild 😍 I live in the US and I still can't believe Saudis are pulling this off without banks. P2P is the real MVP. I've tried sending USDT to friends overseas and it's a nightmare-these guys are legends. 🚀

Lauren Bontje

January 17 2026Of course they're doing this. It's a sign of cultural decay. You don't just bypass your own government's rules because you feel like it. This isn't freedom-it's chaos wrapped in a crypto hoodie.

Stephanie BASILIEN

January 18 2026One must consider the epistemological implications of regulatory arbitrage as a sociotechnical phenomenon. The Kingdom's simultaneous pursuit of CBDC infrastructure while actively discouraging decentralized assets reveals a profound tension between state sovereignty and emergent digital sovereignty. One wonders if this is not, in fact, a controlled demolition of financial orthodoxy.

Deb Svanefelt

January 20 2026There's something deeply human about this. People aren't waiting for permission to build something better. They're using their IDs, their phones, their networks-no permission slips, no bureaucracy. It’s not rebellion, it’s resilience. And the fact that it aligns with Sharia? That’s poetry. The future doesn’t ask for approval. It just shows up.

Haley Hebert

January 21 2026I just want to say how inspiring this is. I’m 42 and I’ve been scared of crypto for years, but reading about how young Saudis are figuring this out on their own… it makes me want to try again. Maybe I’ll start with $20. Just to see. No pressure. Just curiosity. 🌱

Dustin Secrest

January 22 2026The real story here isn’t the tech. It’s the quiet revolution of agency. When institutions fail to adapt, individuals become the architecture. This isn’t circumvention-it’s evolution. And evolution doesn’t need a permit.

Ashlea Zirk

January 24 2026The data presented is statistically significant and methodologically sound. However, one must exercise caution in extrapolating behavioral patterns without accounting for potential selection bias in self-reported usage. The 7.4 million figure may include inactive or one-time users. Further longitudinal analysis is warranted.

Hannah Campbell

January 25 2026So let me get this straight… Saudis are risking their life savings because they can’t wait for the government to catch up? 😭 Meanwhile in America we’re still arguing if Bitcoin is money or a meme. The world is on fire and we’re all just watching the livestream.

Bryan Muñoz

January 26 2026VPN + P2P + Saudi ID = the new black ops toolkit 🤫 They’re not trading crypto-they’re running a shadow banking network. SAMA knows. The CIA knows. The whole damn world knows. And they’re still letting it happen. Coincidence? I think not. 🧠

Rod Petrik

January 27 2026They’re using Al Rajhi bank transfers? That’s not a loophole. That’s a backdoor into the global financial system. And if you think the Saudis don’t track this… you’re naive. This is how they’re building a digital surveillance state. Every transfer is logged. Every selfie is stored. You think you’re free? You’re being mapped.

Pramod Sharma

January 28 2026Smart. Simple. Effective.

Bharat Kunduri

January 29 2026bro i tried to buy btc with my saudi account and my bank froze my card for 3 weeks then called me asking if i was 'in contact with foreign entities' lmao i told them i was buying a laptop and they hung up. this is a mess.

Kelly Post

January 30 2026I’ve been following crypto for a decade and I’ve never seen anything like this. It’s not just about money-it’s about autonomy. These users aren’t just bypassing rules; they’re rewriting the contract between citizen and state. And they’re doing it quietly, safely, and with incredible discipline.

Tony Loneman

January 30 2026Let me guess-next they’ll be using crypto to pay for hajj. Oh wait, they already are. And you know what? The Saudis are so busy pretending this isn’t happening that they’ve created the most decentralized financial system on Earth. Congrats, you’ve accidentally built a crypto utopia.

Jason Zhang

February 1 2026The 153% growth is real, but the fraud stats are terrifying. $320 million lost? That’s not a market-it’s a feeding frenzy. And the fact that people are using gift cards to move value? That’s not innovation. That’s desperation.

Katherine Melgarejo

February 2 2026So… Saudis are basically doing the same thing as everyone else-just with better wifi and less drama. I mean, I use Binance too. I just don’t pretend it’s some grand rebellion. It’s just… trading. Chill out.

Patricia Chakeres

February 3 2026This is exactly how authoritarian regimes collapse. Not with tanks, but with P2P transactions and VPNs. The state thinks it’s in control, but it’s just a puppet theater. The real power is in the hands of the 18-year-old in Jeddah who just bought $200 of USDT with his mom’s Alinma card.

kristina tina

February 3 2026I just want to hug every single person who figured this out. You’re not criminals-you’re pioneers. And yes, it’s risky. But you’re not just surviving-you’re building something real. Keep going. We’re all rooting for you. 💪❤️

Telleen Anderson-Lozano

February 5 2026I love how this isn’t about rebellion-it’s about pragmatism. People aren’t trying to overthrow the system; they’re just trying to get access to tools that work. And when you combine Sharia compliance with mobile-first tech and a young, tech-savvy population? You get something beautiful. It’s not perfect. But it’s alive.

CHISOM UCHE

February 5 2026The P2P infrastructure is a decentralized financial mesh network operating at the edge of state control. The use of local bank accounts as liquidity conduits represents a novel form of informal capital circulation. The absence of formal intermediaries creates a Pareto-optimal outcome for user autonomy despite regulatory friction.

Shaun Beckford

February 6 2026This is the most fascinating case study in financial defiance I’ve seen in a decade. The Saudis didn’t wait for permission. They didn’t lobby. They didn’t protest. They just… did it. And now the world has to reckon with the fact that regulation can’t keep up with human ingenuity.

Chris Evans

February 7 2026The CBDC is the Trojan horse. They’re building their own digital currency while letting the people play with crypto to test the infrastructure, gather behavioral data, and normalize digital finance. This isn’t a gray zone-it’s a lab. And we’re all just watching the experiment unfold.