How Tokenized Real Estate Creates Unprecedented Liquidity

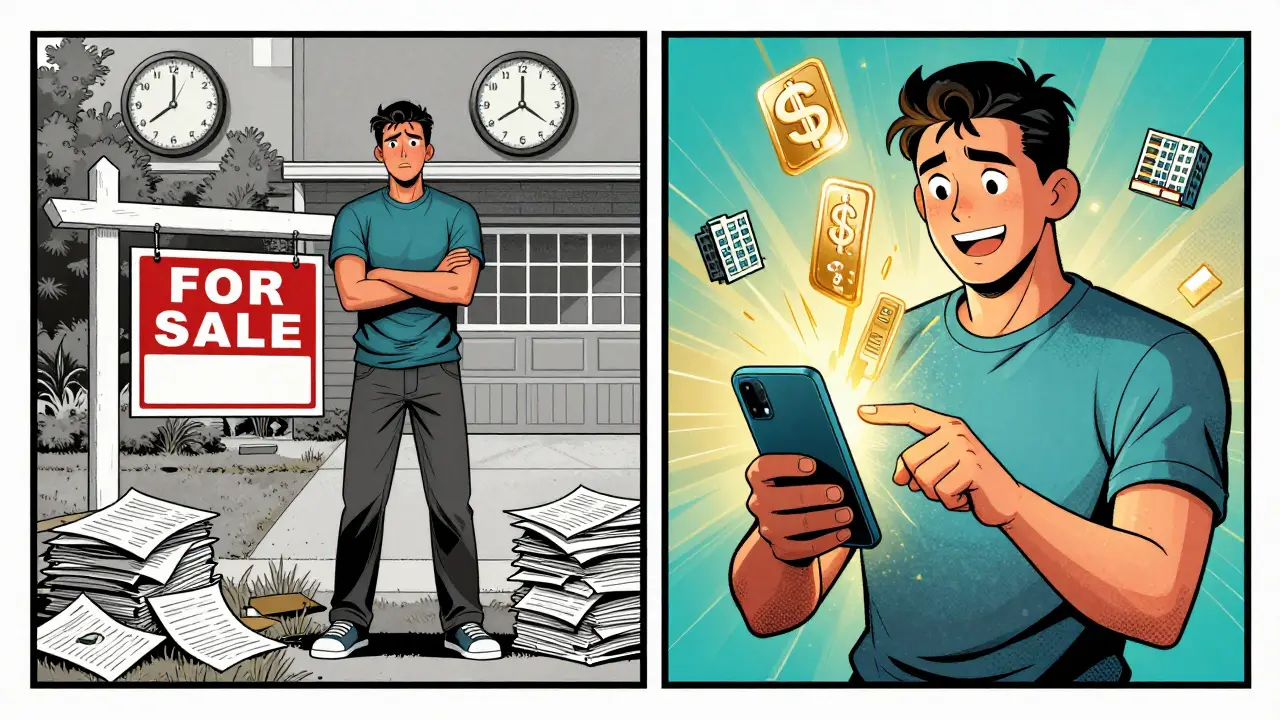

Imagine selling a piece of real estate in 22 minutes instead of waiting seven months. That’s not science fiction-it’s happening right now with tokenized real estate. For decades, owning property meant tying up tens or hundreds of thousands of dollars in an asset that couldn’t be sold quickly. If you needed cash for an emergency, a new business, or even just a better investment opportunity, you were stuck. But blockchain technology has changed that. Tokenized real estate turns physical properties into digital shares you can buy, sell, and trade like stocks-24 hours a day, 7 days a week.

What Exactly Is Tokenized Real Estate?

Tokenized real estate means breaking ownership of a building, apartment complex, or commercial space into small digital units called tokens. Each token represents a fraction of the property’s value. These tokens are recorded on a blockchain-like Ethereum, Polygon, or Polymesh-making them secure, transparent, and easy to transfer. You don’t need to buy an entire building anymore. Platforms like Lofty.ai let you invest as little as $50 in a single apartment in Miami or a warehouse in Atlanta.

This isn’t just about lowering the entry barrier. It’s about fixing a deep flaw in traditional real estate: illiquidity. Historically, selling a property took 60 to 90 days. You needed agents, lawyers, title companies, inspections, appraisals, and bank approvals. Even after all that, you might still wait months to get paid. Tokenization cuts all that out. Settlements now happen in minutes, not months.

The Liquidity Advantage Over Traditional Real Estate

Traditional real estate investment trusts (REITs) and direct property ownership are slow. The National Association of Realtors says it takes 6 to 12 months on average to sell a house. Even REITs, which trade on stock exchanges, only allow trading during market hours and require minimum investments of $1,000 to $5,000. Tokenized real estate blows past both.

Here’s how the numbers stack up:

- Traditional property sale: 60-90 days to close

- Tokenized property sale: Under 15 minutes to settle

- Minimum investment for REITs: $1,000+

- Minimum investment for tokenized real estate: $50

- Trading hours for REITs: 9:30 AM - 4:00 PM EST

- Trading hours for tokenized real estate: 24/7

According to Deloitte’s 2025 report, tokenized real estate settles transactions 47 times faster than traditional methods. That’s not a small improvement-it’s a revolution. And it’s not theoretical. On Reddit’s r/RealEstateTokenization community, users regularly share stories of selling tokens during market dips and getting cash in their wallets within hours. One investor sold $3,200 worth of Miami apartment tokens in 22 minutes when prices dipped. In the past, they’d have waited seven months to sell their physical rental.

Why Liquidity Matters More Than You Think

Liquidity isn’t just about speed. It’s about control. When you own a physical property, you’re locked in. If interest rates rise and you want to move money into bonds, you can’t just click a button-you need to list, show, negotiate, and wait. With tokenized real estate, you can rebalance your portfolio in real time.

Institutional investors are already using this. BlackRock’s Alchemy Platform manages over $4.2 billion in tokenized real estate assets. Why? Because they can rotate positions quickly when markets shift. If the Fed raises rates, they don’t need to wait six months to exit. They sell tokens, buy fixed-income assets, and re-enter real estate later-all within days.

For everyday investors, this means flexibility. Need cash for medical bills? Tokenized real estate lets you access funds in 90 minutes, as one Trustpilot user reported. No more selling your home or taking out a second mortgage. You just sell a few tokens. That kind of liquidity turns real estate from a long-term hold into a dynamic asset class.

How It Works: From Property to Token

Turning a building into tokens isn’t magic-it’s a process. First, the property is legally structured as a limited liability company (LLC) or similar entity. Then, an appraiser values it. Next, a blockchain platform creates the tokens, usually following standards like ERC-1400 for security tokens. These tokens are then offered to investors through a regulated primary sale.

After the initial sale, the tokens go live on a secondary market. That’s where the real magic happens. Platforms like RETX in Singapore and Lofty.ai let buyers and sellers trade tokens anytime. Settlements are automated via smart contracts. No paperwork. No middlemen. Just a digital transfer.

To participate, you need a crypto wallet (like MetaMask or Ledger), complete KYC/AML checks (which take 24-72 hours), and sometimes link your bank account. Once set up, trading is as simple as buying a stock on Robinhood.

Where It’s Working-and Where It’s Not

Tokenized real estate isn’t legal everywhere. Regulations vary wildly. In the U.S., the SEC clarified in March 2025 that tokenized real estate counts as a security, meaning platforms must register. In the EU, MiCA (Markets in Crypto-Assets Regulation), which took effect in January 2025, created clear rules for digital asset offerings. That’s why 63% of all tokenized real estate activity happens in Switzerland, the UAE, Singapore, and U.S. states like Wyoming and Florida-places with clear, investor-friendly rules.

But in countries like Germany or Japan, fractional ownership is still restricted or banned. Even in the U.S., not all properties can be tokenized. High-value commercial buildings and luxury homes are the most common, simply because they attract enough buyers to create liquid markets. Rural properties or niche assets? Those can sit unsold for weeks. One Capterra user took 17 days to sell $850 worth of tokens for a small commercial property in rural Iowa-compared to 3 hours for a similar token in downtown Chicago.

The Downside: Risks and Limitations

It’s not all smooth sailing. Tokenized real estate still has risks. Smart contracts can be hacked if not audited properly. In 2024, a poorly coded token contract on a minor platform lost $1.2 million in investor funds. That’s why platforms like Polymesh use multi-signature wallets and time-locked transfers to prevent fraud.

Another issue? Market depth. While daily trading volume for tokenized real estate hit $12.7 million in Q3 2025, that’s still tiny compared to the $1.3 billion traded daily for the VNQ ETF. If a large number of investors try to sell at once during a market panic, prices could swing wildly. EY’s October 2025 report found a 31% average price spread during the April 2025 market correction-compared to just 4% for NYSE-listed REITs.

And then there’s the learning curve. You need to understand wallets, private keys, gas fees, and regulatory rules. A September 2025 survey of 217 users found it took most people 3-4 weeks to feel confident. But once they did, they rarely went back.

What’s Next for Tokenized Real Estate?

The future looks bright. Fidelity just integrated tokenized real estate into its 401(k) platform, meaning U.S. workers can now invest in property through their retirement accounts. JPMorgan’s Onyx blockchain platform is expected to launch institutional custody solutions in Q2 2026. And Polymesh is building cross-chain interoperability to let tokens move between blockchains-something that could unlock even more liquidity.

By 2028, Deloitte predicts tokenized real estate liquidity will reach 85% of traditional REIT levels. By 2030, the historical 15-30% illiquidity discount could shrink to just 1-3%. That’s not speculation-it’s the trajectory we’re already on.

For investors, this isn’t about replacing traditional real estate. It’s about adding a new tool to the toolbox. Want to hold a home for decades? Keep doing it. Want to trade a slice of a New York office tower in under an hour? Now you can. That’s the real power of tokenization.

Frequently Asked Questions

Can I really invest in real estate with just $50?

Yes. Platforms like Lofty.ai and REENTAL allow you to buy fractional tokens starting at $50. These tokens represent ownership in a specific property, like an apartment in Atlanta or a warehouse in Dallas. You earn rental income proportional to your share, and you can sell your tokens anytime on the secondary market.

Is tokenized real estate safe?

It’s safer than it was two years ago. Leading platforms now use audited smart contracts, multi-signature wallets, and on-chain identity verification. Polymesh and Stellar have built-in compliance tools that block unauthorized transfers. But like any investment, risks remain-especially with smaller, unregulated platforms. Always choose platforms with SEC or MiCA compliance and public audit reports.

How do I get paid from tokenized real estate?

Rental income is distributed automatically via smart contracts, usually monthly. Payments go directly to your connected crypto wallet or bank account, depending on the platform. Some platforms, like Lofty.ai, even let you choose to reinvest dividends into more tokens.

Can I sell my tokens anytime?

You can list them for sale anytime, but finding a buyer depends on market demand. Tokens for properties in high-demand cities like Miami or Austin sell quickly-often within hours. Niche properties, like rural farmland or specialty retail spaces, may take days or weeks. Liquidity varies by location and asset type.

Are there taxes on tokenized real estate?

Yes. Tokenized real estate is treated as a security in most jurisdictions. You pay capital gains tax when you sell for a profit, and income tax on rental distributions. Platforms like Lofty.ai provide annual tax reports (Form 1099 in the U.S.), but it’s your responsibility to report them to your tax authority.

What happens if the platform shuts down?

Your tokens are stored on the blockchain, not on the platform’s servers. Even if Lofty.ai or REENTAL went offline, you could still access your tokens using your private key and trade them on decentralized exchanges or other compliant platforms. The property itself remains owned by the legal entity that holds it-you’re just holding the digital proof of your share.

20 Comments

Shaun Beckford

January 15 2026Let’s be real-this ‘liquidity revolution’ is just Wall Street repackaging gambling with blockchain buzzwords. $50 investments? More like $50 tickets to a Ponzi scheme where the only liquidity is when the platform vanishes with your crypto.

Bharat Kunduri

January 16 2026tokenized real estate sounds cool but who even cares if you can sell in 22 min when you cant even cash out without paying 15% in gas fees and taxes and platform cuts lol

Katherine Melgarejo

January 17 2026So now I’m supposed to trust a smart contract more than a title company? Cool. I’ll wait for the first major hack to be livestreamed on YouTube.

Anna Gringhuis

January 19 2026They say ‘liquidity’ like it’s a virtue. Meanwhile, the guy who bought $3,200 in Miami tokens in 22 minutes? He’s probably the same guy who sold his Tesla at $180k in 2022 because he ‘needed cash.’ Real liquidity isn’t speed-it’s having the discipline to hold.

Chris Evans

January 19 2026This isn’t tokenization-it’s financialization. You’re not owning real estate anymore, you’re owning a derivative of a derivative of a legal entity that holds the asset. The blockchain doesn’t change the underlying risk-it just adds layers of opacity wrapped in crypto-speak.

nathan yeung

January 20 2026bro i tried investing 50 bucks on lofity.ai and the interface crashed 3 times before i could even sign in. then they asked for my passport and a selfie with a handwritten note. 72 hours later i gave up. this is not for regular people

CHISOM UCHE

January 21 2026Deloitte’s 2025 report? That’s not a report-it’s a marketing deck. The $12.7M daily volume is less than 1% of the VNQ ETF. This isn’t a revolution. It’s a whisper in a hurricane.

Chidimma Okafor

January 22 2026As a Nigerian investor, I find this fascinating-yet terrifying. In my country, we’ve seen too many ‘innovations’ that vanish with our life savings. If the SEC regulates this, then perhaps it’s worth a small allocation. But never more than 5%.

Patricia Chakeres

January 23 2026Mark my words: this is the first step toward a global financial surveillance state. Every tokenized asset will be tracked, taxed, and controlled by central authorities under the guise of ‘compliance.’ Welcome to the blockchain dystopia.

Nishakar Rath

January 24 2026Why are you all so obsessed with liquidity? Real wealth is built by holding assets for decades not flipping them like crypto memes. This is why America is broke-everyone wants to trade, no one wants to own

Telleen Anderson-Lozano

January 25 2026There’s a quiet elegance in the idea-breaking down monumental, monolithic assets into digestible, tradable fragments. But we must ask: Who benefits? The retail investor? Or the institutional players who already control the liquidity pools, the custody solutions, and the regulatory loopholes? The democratization is performative.

Deb Svanefelt

January 26 2026Imagine a world where your grandmother, who inherited a house in Kansas, can sell 2% of it to a student in Bangalore without lawyers, without notaries, without waiting six months. That’s not finance-it’s human connection, encoded. The technology is crude, the regulation is messy, but the possibility? That’s poetry.

Stephen Gaskell

January 27 2026Tokenization is just another way for the rich to get richer. You think a $50 investment makes you an owner? Nah. You’re a data point. The real owners are the ones who built the platform.

Lauren Bontje

January 28 2026Why are Americans so obsessed with selling everything? In Europe, we hold property for generations. This isn’t progress-it’s cultural decay dressed up in blockchain.

Anthony Ventresque

January 29 2026What happens when the blockchain goes down? Or when the platform’s API breaks? Or when the smart contract has a bug? Is your $50 investment just frozen forever? I’m not saying it won’t work-I’m saying we haven’t tested the edges yet.

Rod Petrik

January 30 2026They say 24/7 trading but did you know most tokenized properties have zero buyers for 90% of the day? It’s all fake volume. The platform bots are the only ones trading. I checked the order book. It’s a ghost town. And they call this liquidity? LOL 🤡

Michael Jones

January 30 2026Don’t let the hype blind you. If you’re new to this, start with 1-2% of your portfolio. Learn how wallets work. Read the audit reports. Don’t trust the marketing. And never, ever share your seed phrase. You’re not just investing-you’re learning a new financial language.

Stephanie BASILIEN

February 1 2026While the technological underpinnings are undeniably elegant, one must consider the epistemological implications: if ownership is mediated through cryptographic proofs rather than physical possession, does the concept of ‘property’ retain its ontological integrity? Or has it been reduced to a mere algorithmic abstraction?

Jason Zhang

February 2 2026They tout ‘22 minutes’ like it’s magic. But what’s the spread? What’s the slippage? What’s the fee structure? You think you’re getting liquidity? You’re getting a 15% haircut and a tax bill you didn’t see coming.

Anna Gringhuis

February 4 2026That guy who sold $3,200 in 22 minutes? He’s probably the same one who bought Bitcoin at $68k and cried when it hit $30k. Speed isn’t wisdom. It’s just faster regret.