Blockchain Interoperability: Connecting the Crypto Ecosystem

When working with blockchain interoperability, the ability of separate blockchain networks to exchange data and move assets while preserving each chain's security guarantees. Also known as cross‑chain compatibility, it turns isolated ledgers into a unified financial fabric.

A key enabler is the cross‑chain bridge, software that locks tokens on the source chain and mints wrapped equivalents on the destination chain. Bridges let you trade Bitcoin on an Ethereum‑based DEX, supply liquidity to a Polkadot parachain, or move stablecoins into a layer‑2 rollup without exiting the network. Another staple is the atomic swap, a trust‑less exchange protocol that swaps assets directly between chains using hash‑time‑locked contracts. Atomic swaps remove the need for third‑party custodians, making peer‑to‑peer transfers faster and cheaper.

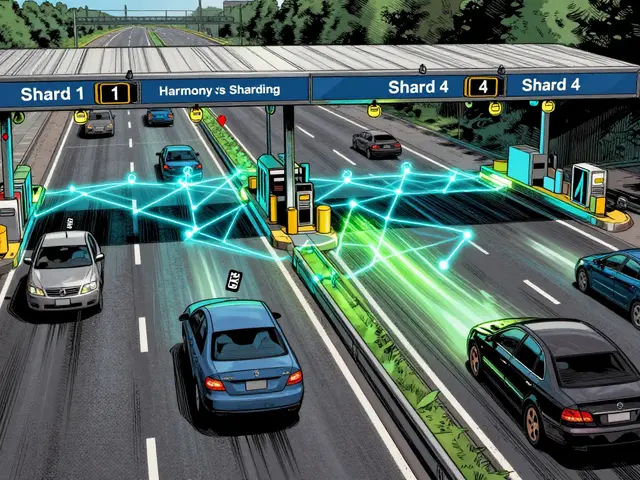

Layer‑2 scaling solutions such as rollups and sidechains also rely on interoperability. They batch transactions off‑chain, then post a concise proof to the main chain, so users can move funds between the base layer and the scaling layer instantly. This relationship creates a feedback loop: better interoperability fuels more robust layer‑2 adoption, and widespread layer‑2 use pushes developers to build richer bridge and swap mechanisms.

Why Interoperability Matters for DeFi, Exchanges and Developers

DeFi platforms thrive on liquidity, and liquidity lives where assets can flow freely. Without interoperability, a protocol on one chain would be limited to the users and tokens native to that chain, squeezing out potential trading volume. Cross‑chain bridges break that wall, allowing a Uniswap clone on Ethereum to accept wrapped Bitcoin from Binance Smart Chain, or a lending pool on Solana to accept collateral from a Cosmos hub. This boost in capital efficiency is why many investors prioritize projects that already support multiple networks.

Decentralized exchanges (DEXs) illustrate the practical payoff. A DEX that integrates atomic swaps can offer direct BTC‑ETH trades without routing through a central order book. When the DEX also connects to layer‑2 rollups, users enjoy sub‑second confirmations and lower fees, turning a sluggish experience into a seamless one. For traders, this means more opportunities, better pricing, and reduced exposure to network congestion.

Developers reap similar benefits. Standard protocols like Inter‑Blockchain Communication (IBC) from Cosmos or Polkadot’s relay chain provide ready‑made blueprints for building bridges. By adopting these standards, teams cut development time, inherit security audits, and gain instant access to an ecosystem of interoperable applications. The result is a vibrant “network of networks” where a single smart contract can trigger actions on several chains, opening doors to innovative use cases such as cross‑chain NFTs, multi‑chain governance, and unified identity solutions.

Security, however, stays front and center. Bridges have been high‑profile targets; a single vulnerability can expose billions in wrapped assets. Developers mitigate risk through formal verification, multi‑sig custodians, and time‑locked upgrades. Users protect themselves by diversifying across bridges, checking audit reports, and staying informed about the latest exploits.

Regulators are catching up, too. Some jurisdictions treat wrapped assets as derivatives, while others focus on the custody model of the bridge operator. Understanding the legal landscape is crucial for projects that plan to launch globally. Compliance tools now integrate directly with bridge protocols, offering automated reporting and KYC layers without breaking the trustless nature of the system.

All these pieces—bridges, atomic swaps, layer‑2 solutions, DEXs, standards, and compliance—form a tightly woven ecosystem. When one improves, the others gain strength, pushing the whole crypto world toward a more open, flexible, and user‑friendly future.

Below you’ll find a hand‑picked selection of articles that dig deeper into each of these components. From TVL trends in DeFi to detailed bridge security audits, the collection gives you the practical knowledge you need to navigate and profit from the ever‑expanding web of interconnected blockchains.

Quant (QNT) is a blockchain interoperability platform that uses the QNT token to connect private and public ledgers. Learn how Overledger works, its use cases, token economics, and how it stacks up against Polkadot, Cosmos, and Chainlink.

Continue Reading