Crypto ETF: What It Is, How It Works, and Why It Matters

When you hear crypto ETF, a regulated investment fund that tracks the price of one or more cryptocurrencies without requiring you to own the actual coins. Also known as exchange-traded fund for digital assets, it lets you buy exposure to Bitcoin or Ethereum like you would Apple or Tesla stock—no wallet, no private keys, no risk of losing access. This isn’t just a convenience. It’s a bridge between Wall Street and crypto, turning what was once a niche, risky bet into something banks, pensions, and everyday investors can actually add to their portfolios.

Behind every Bitcoin ETF, a financial product approved by the SEC that holds Bitcoin as its core asset is a complex setup. These funds don’t just buy Bitcoin and call it a day. They work with custodians like Coinbase or Fidelity to store the coins securely, track real-time prices, and issue shares that trade on major exchanges. That means you’re not holding crypto—you’re holding a share of a fund that holds crypto. And because these funds are regulated, they come with reporting, audits, and investor protections you won’t find on a decentralized exchange.

That’s why regulated crypto investing, the process of buying digital assets through approved financial instruments rather than unregulated platforms is growing fast. In 2024, the first U.S.-approved Bitcoin ETFs pulled in billions in just weeks. Investors who were scared off by hacks, scams, or the hassle of managing wallets suddenly had a simple way in. But it’s not all smooth sailing. These funds charge fees, track prices imperfectly, and still depend on the volatility of the underlying coins. And while a crypto exchange, a platform where digital assets are bought and sold, often used to acquire the underlying coins for ETFs might let you trade directly, an ETF removes the need to understand blockchain, gas fees, or cold storage.

What you’ll find in the posts below isn’t theory—it’s real analysis. You’ll see how crypto ETFs stack up against buying Bitcoin directly, which funds actually deliver on their promises, and why some regulators are still hesitant to approve Ethereum ETFs. There are also deep dives into how these funds are built, what fees you’re really paying, and which ones are safest for long-term holding. You won’t find hype. Just facts, comparisons, and the kind of clarity you need before putting real money on the line.

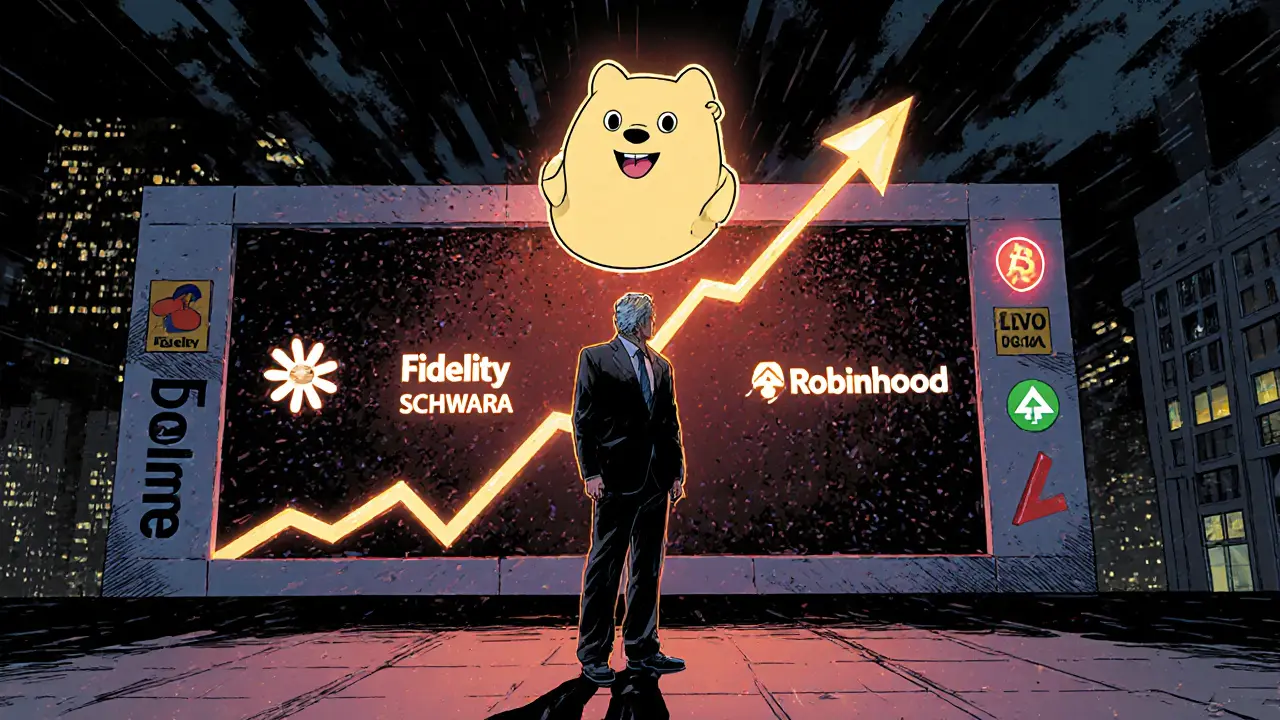

The DOGE ETF (DOJE) is the first regulated investment product that lets you track Dogecoin's price through your brokerage account. Learn how it works, its fees, risks, and why it matters for retail investors.

Continue Reading