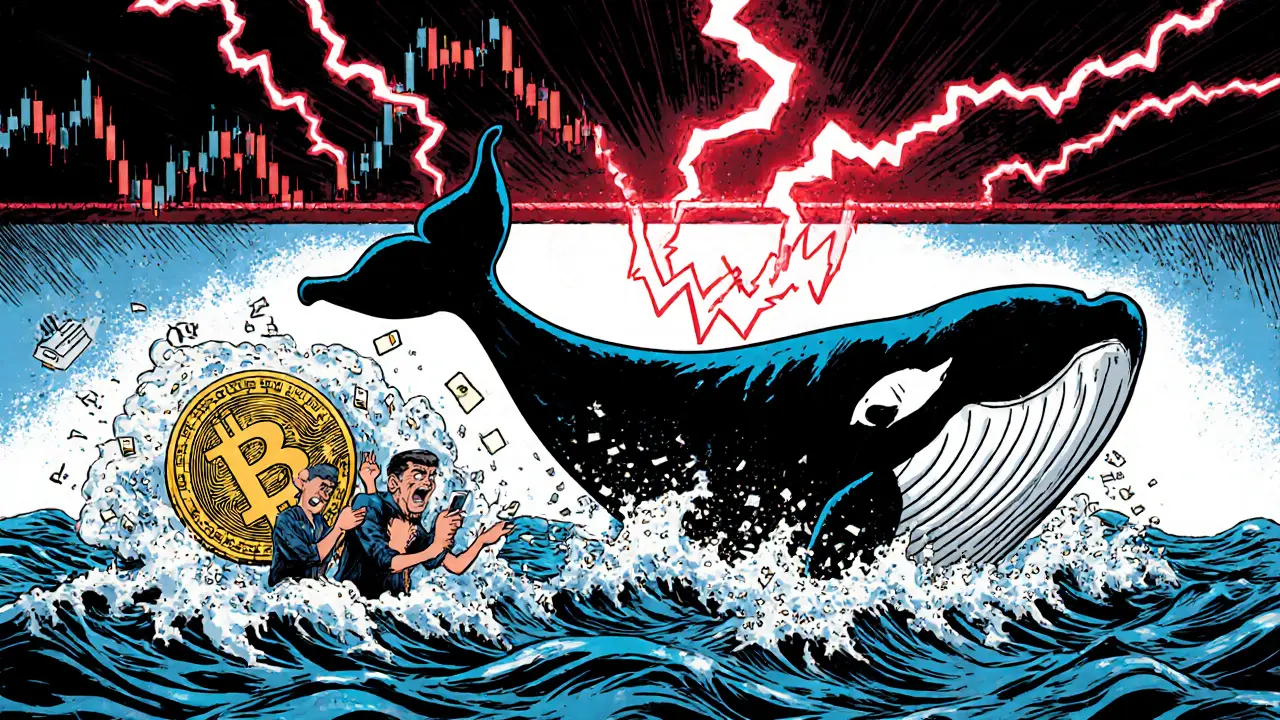

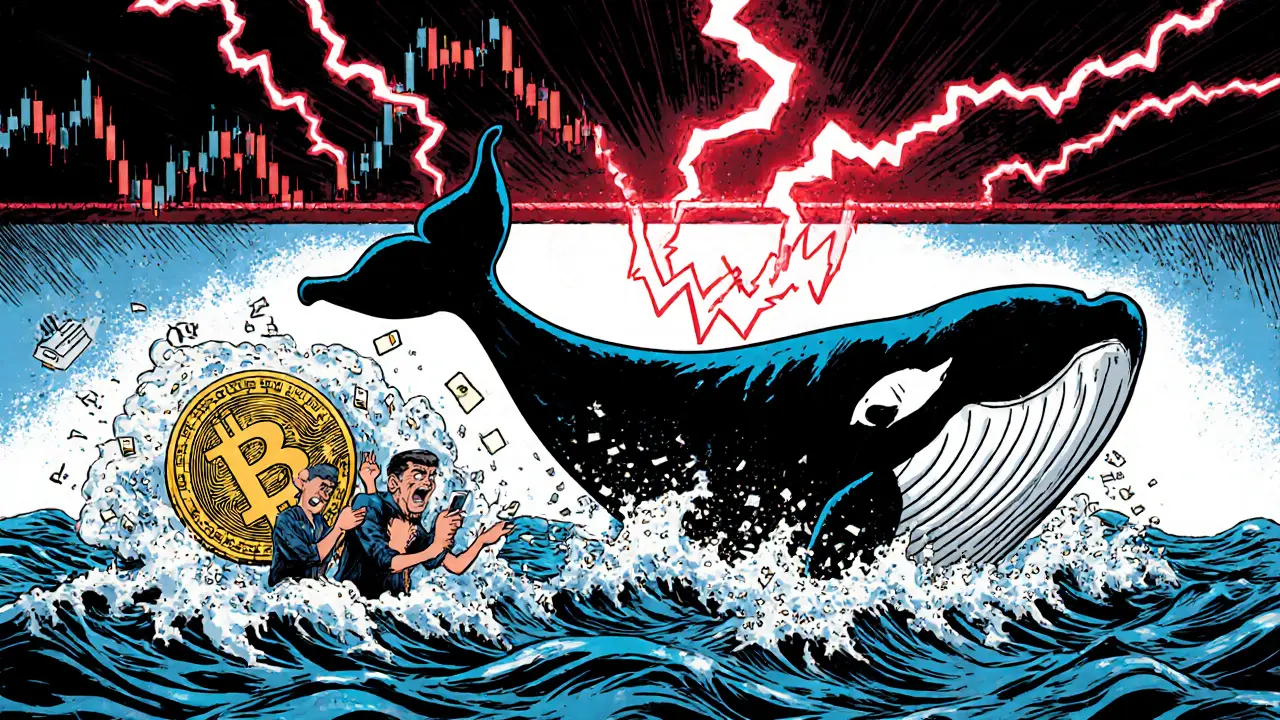

Crypto Whales: How Big Players Move Markets and What It Means for You

When we talk about crypto whales, large holders of cryptocurrency who control enough assets to influence market prices. Also known as big holders, they’re the unseen force behind sudden price spikes and crashes you see on your chart. These aren’t just rich individuals—they’re institutions, early investors, and sometimes even anonymous wallets holding millions in Bitcoin, Ethereum, or altcoins. One move from a single whale wallet can trigger a cascade of buys or sells, especially in smaller markets where liquidity is thin.

Whales don’t operate in a vacuum. Their actions connect directly to blockchain liquidity, the ease with which assets can be bought or sold without affecting price. When a whale dumps 500 BTC on an exchange, it floods the market. Sellers panic. Buyers wait. Prices drop. The opposite happens when they accumulate—buying quietly over weeks, hiding their intent behind smaller trades. This is why you’ll see sudden volume spikes on CoinMarketCap or unusual order book behavior before a big move. It’s not luck. It’s strategy.

These players also rely on whale manipulation, the practice of artificially inflating or deflating a token’s price to trap retail traders. Look at the posts below—projects like Bullit (BULT) and Hollywood Capital Group WARRIOR (WOR) didn’t crash because of bad news. They crashed because whales pumped them, lured in new buyers, then vanished with the funds. That’s a rug pull with whale backing. Meanwhile, tokens like RDNT or SUSHI have whale support because they’re part of real DeFi ecosystems. The difference? One has utility and long-term holders. The other is a temporary casino.

You can’t stop whales. But you can learn to read their fingerprints. Watch for large on-chain transfers, sudden spikes in trading volume on low-cap coins, and wallets that suddenly appear out of nowhere with millions. Track wallets using blockchain explorers. Follow whale alerts from trusted sources. And never chase a coin just because it’s rising fast—chances are, the whale is already planning its exit.

The posts here don’t just list scams or exchanges. They show you the real patterns behind the noise. You’ll find deep dives into tokens that were manipulated by whales, exchanges where big players move their assets, and how governance tokens give you a voice against their power. Whether you’re holding Bitcoin or chasing an airdrop, understanding crypto whales isn’t optional—it’s how you stop being the target and start making smarter moves.

Learn how to identify whale manipulation in crypto markets-spot spoofing, stop hunting, and fake breakouts before they wipe out your positions. Understand the tactics big players use and how to protect yourself.

Continue Reading