How El Salvador Uses Bitcoin for Its National Economy - And Why It Didn't Work as Planned

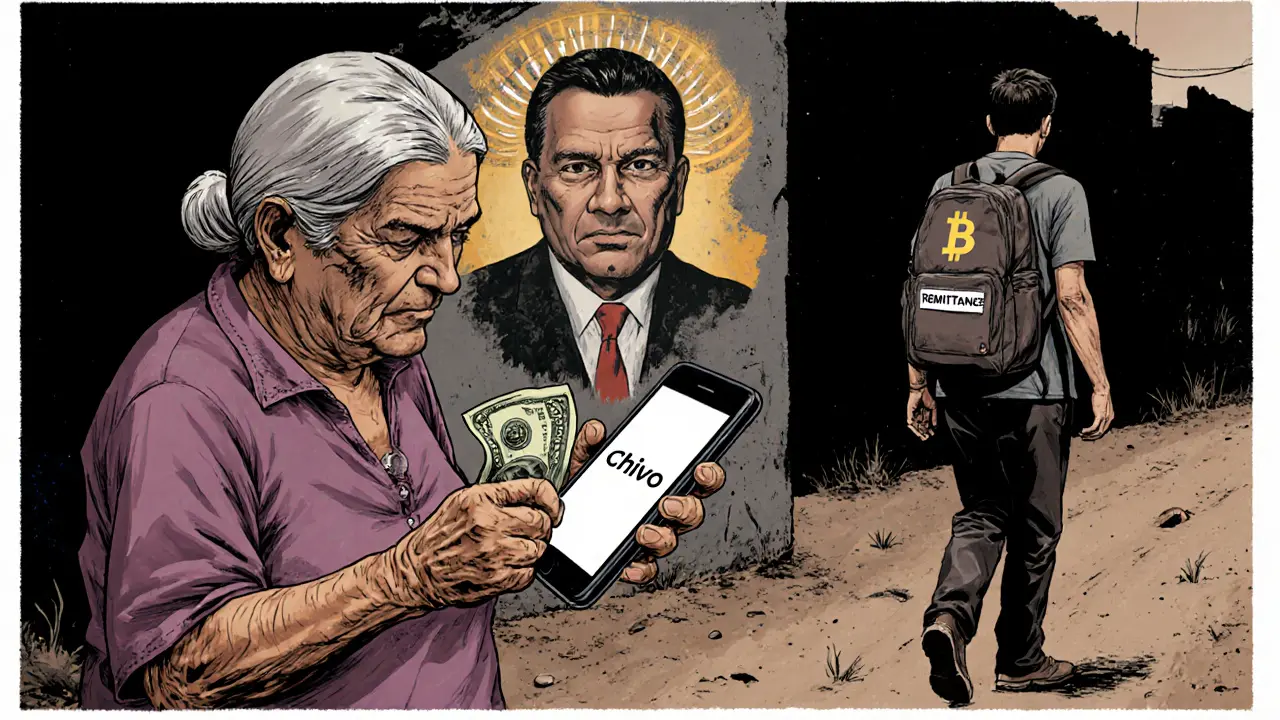

On September 7, 2021, El Salvador did something no country had ever done: it made Bitcoin legal tender alongside the U.S. dollar. President Nayib Bukele called it a revolution - a way to cut out middlemen, help the unbanked, and bring in foreign cash. The government gave every citizen $30 in Bitcoin just for downloading the Chivo wallet app. Gas stations offered discounts. Restaurants started accepting it. For a moment, the world watched. But three years later, the story isn’t about innovation. It’s about reality.

Why Bitcoin Was Chosen

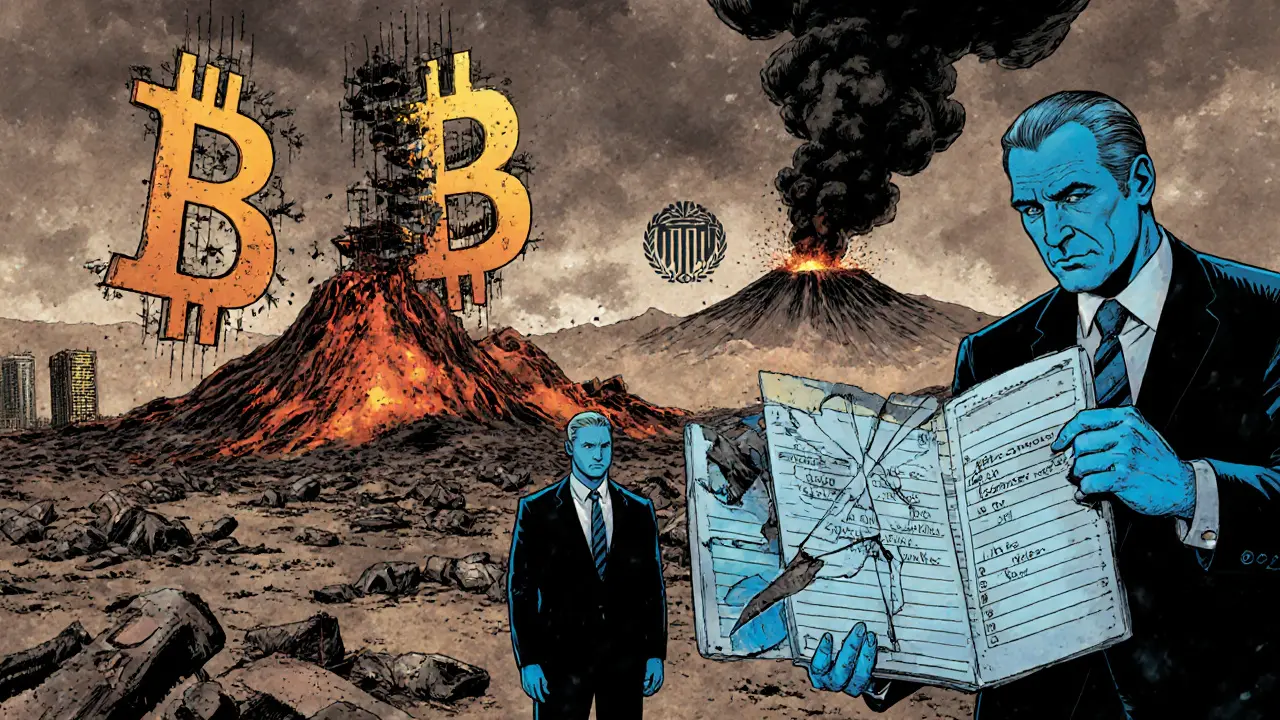

El Salvador’s economy has been stuck for decades. Growth is slow. Public debt is high. And more than 20% of its GDP comes from remittances - money sent home by Salvadorans living abroad, mostly in the U.S. Sending that money through Western Union or MoneyGram cost up to 10% in fees. For families living paycheck to paycheck, that’s a huge chunk of income lost. The government claimed Bitcoin could fix this. No banks. No intermediaries. Just direct peer-to-peer transfers. The idea was simple: if you’re sending money from Los Angeles to San Miguel, why pay $30 to a middleman when you can send it in seconds for under $1 using Bitcoin? And if you don’t have a bank account - which nearly half of Salvadorans didn’t - Bitcoin could be your wallet. The government also hoped to attract tech investors, startups, and even crypto-friendly tourists. They built Bitcoin City near a volcano, planned to power it with geothermal energy, and promised tax breaks for anyone using Bitcoin. It sounded like a future that had already arrived.The Plan: How Bitcoin Was Supposed to Work

The Bitcoin Law didn’t just allow Bitcoin payments - it made them mandatory. Businesses had to accept it. Taxes could be paid in it. Debts could be settled in it. The government set up an automatic conversion system: if you paid for a meal in Bitcoin, the merchant instantly got U.S. dollars. No risk. No volatility. Or so they said. The Chivo wallet was the centerpiece. Free Bitcoin. Free transfers. Gas discounts. The app even let you pay for bus rides and public utilities. By early 2022, over 40% of Salvadorans had downloaded it. On paper, it was a massive success. But here’s the catch: most people didn’t use it.The Reality: Low Adoption, High Confusion

A 2023 study by the National Bureau of Economic Research surveyed 1,800 Salvadoran households. The results were clear: 60% of people who downloaded the app never made a single transaction after spending their free $30. One in five still hadn’t touched their bonus Bitcoin. The people who actually used it regularly? Young, educated, male, and already banked. Not the unbanked poor the program was meant to help. Why? Because Bitcoin isn’t easy. Setting up a wallet, understanding private keys, dealing with transaction delays, and handling price swings - these aren’t small hurdles. For someone who’s never used a smartphone to pay for groceries, it’s overwhelming. Rural communities, older adults, and low-income families didn’t have the tech skills, the stable internet, or the trust to make it work. The app itself was buggy at launch. Transactions failed. Balances disappeared. People lost money. The government had to scramble to fix it - but by then, trust was already broken.

Volatility Hit Hard

Bitcoin isn’t stable. In 2021, it hit $68,000. By 2022, it dropped below $20,000. The Salvadoran government bought Bitcoin when prices were high - spending $150 million of public money. When the price crashed, they lost millions. That’s not speculation. That’s public funds gone. The IMF, the World Bank, and credit agencies like Moody’s warned about this. They said holding Bitcoin as a reserve asset was like keeping cash in a rollercoaster. One day, your treasury is worth $150 million. The next, it’s $80 million. That’s not policy - it’s gambling with national finances.The IMF Step In

By 2024, El Salvador was in trouble. The economy was struggling. Inflation was rising. The country needed a $1.4 billion loan from the IMF to stay afloat. But the IMF wouldn’t lend unless El Salvador changed course. The deal? Scale back Bitcoin’s role. Stop buying more Bitcoin. Stop using it for public spending. Stop pretending it’s a stable currency. The government agreed. It was a quiet surrender. The Bitcoin Law is still on the books. But in practice, the state no longer pushes it. No more free Bitcoin. No more gas discounts. The Chivo wallet still exists - but it’s mostly used by tourists and crypto enthusiasts.

What Actually Changed?

Remittances? They’re still mostly sent through traditional services. Fees haven’t dropped. Speed hasn’t improved. Financial inclusion? The number of unbanked Salvadorans hasn’t changed. People still rely on cash. Foreign investment? Very little came in. Most investors didn’t want to deal with a country whose currency policy looks unstable. The only real change? El Salvador became the world’s most talked-about Bitcoin experiment. And now, it’s the most cautionary tale.What’s Next?

The government still says Bitcoin is legal. But they’re no longer trying to make it the future. They’re trying to survive. Some local businesses still accept it - mostly in tourist areas like El Tunco or San Salvador’s downtown. But even there, most customers pay in dollars. The Bitcoin option is there, but it’s ignored. The Chivo wallet still exists. But it’s now just another app - like a weather app or a bus schedule. No one uses it to pay for bread. The dream of a Bitcoin-powered economy didn’t die. It just faded. Slowly. Quietly. Like a signal lost in the mountains.The Bigger Lesson

El Salvador didn’t fail because Bitcoin is bad. It failed because it tried to force a tool designed for speculators into the backbone of a developing nation’s economy. You can’t fix poverty with a cryptocurrency. You can’t fix financial exclusion with a free bonus. You can’t fix unstable banking with a volatile asset. Real change comes from infrastructure - bank branches in villages, low-cost mobile payments, reliable internet, financial education. Not Bitcoin wallets. El Salvador’s experiment didn’t prove Bitcoin could work as money. It proved that money is more than code. It’s trust. It’s stability. It’s systems people understand. The world watched. Now, it’s watching something else: how a bold idea, without real planning, can cost a country more than it gains.Is Bitcoin still legal tender in El Salvador?

Yes, Bitcoin is still legal tender under the 2021 Bitcoin Law. But in practice, the government no longer promotes it. Public agencies no longer use it for payments, and businesses rarely accept it outside of tourist spots. The law exists, but the policy has quietly shifted.

Did El Salvador make money from Bitcoin?

No. The government spent $150 million buying Bitcoin when prices were high. When the price dropped, those holdings lost value. By 2024, the country had lost hundreds of millions of dollars on its Bitcoin investments. The free Bitcoin given to citizens cost the state more than $100 million - and most of it went unused.

Why didn’t Salvadorans use Bitcoin for remittances?

Because most people sending money from the U.S. don’t use Bitcoin. They use Western Union, Wise, or bank transfers - services their families already know and trust. Even if Bitcoin was cheaper, the recipient would still need to convert it to cash. That’s not easier. It’s more steps. And many don’t have smartphones or internet.

What happened to the Chivo wallet?

The Chivo wallet still exists, but it’s mostly inactive. After the initial surge of downloads in 2021, usage dropped sharply. Most users never made a transaction after spending their free Bitcoin. The app is still on phones, but it’s treated like an old game - downloaded, forgotten, and rarely opened.

Is El Salvador still trying to use Bitcoin?

Not actively. The government stopped buying Bitcoin in 2023. It no longer promotes the Chivo wallet. Bitcoin City’s construction stalled. The focus has shifted to stabilizing the economy, paying off IMF loans, and rebuilding trust with international lenders. Bitcoin is no longer a priority - it’s a footnote.

15 Comments

Steve Roberts

September 23 2025Let’s be real - nobody in El Salvador wanted Bitcoin. The government just wanted a viral headline so they could flex on the IMF. They didn’t fix remittances, they didn’t help the poor, they just turned a national economic crisis into a crypto circus. And now they’re begging for a loan like nothing happened. Classic.

John Dixon

September 24 2025Ohhh, so now it’s ‘a cautionary tale’? Wow. Groundbreaking. I mean, who could’ve predicted that forcing a hyper-volatile, energy-guzzling, speculator’s toy on a country with spotty internet and zero financial literacy would… fail? I’m shocked. Truly. Where’s the Nobel Prize for obviousness?

Brody Dixon

September 25 2025I get why people are skeptical, but I also feel bad for the Salvadorans who were just trying to make things better. The idea wasn’t stupid - it was the execution. They skipped the basics: education, infrastructure, patience. You don’t hand someone a Ferrari and say ‘drive to work’ without teaching them how to use the pedals first.

Mike Kimberly

September 25 2025It’s important to recognize that El Salvador’s experiment, while flawed, was an act of economic sovereignty - a desperate, bold attempt to bypass centuries of colonial financial structures that kept them dependent on U.S. dollar inflows and Western Union’s predatory fees. Bitcoin wasn’t the solution, but the desire to innovate outside the system? That was noble. The tragedy isn’t that Bitcoin failed - it’s that the world refused to help them build a better system, so they grabbed the shiniest tool they could find.

angela sastre

September 26 2025Look - if you don’t have a phone or don’t know how to use one, Bitcoin isn’t going to help. Real change is simple: cheap mobile money apps, cash-in/cash-out kiosks at corner stores, and training people how to use them. No blockchain needed. Just good, old-fashioned, human-centered design.

Aniket Sable

September 26 2025bitcoin was cool idea but people in village dont even know what is wallet.. they just want to get money fast and safe.. government should focus on that not crypto hype

Santosh harnaval

September 27 2025The lesson here is simple: technology doesn’t solve human problems. Systems do.

Claymore girl Claymoreanime

September 27 2025Of course it failed. You can’t replace a currency with a speculative asset owned by billionaires who trade it on Binance like it’s a video game. This wasn’t economic reform - it was a billionaire’s wet dream dressed up as socialism. And now the poor are stuck with a broken app and a national debt. Typical.

Will Atkinson

September 28 2025I think people are missing the real win here: El Salvador forced the world to pay attention. Before this, nobody cared about remittance fees or financial exclusion in Latin America. Now, companies like Wise and PayPal are rolling out cheaper options - because they had to. Sometimes you need a messy, loud experiment to spark real change. The Bitcoin part failed, but the spotlight? That stuck.

Laura Herrelop

September 28 2025Let’s be honest - this was all a distraction. The IMF, the World Bank, the U.S. government - they didn’t want El Salvador to succeed. Bitcoin was the perfect excuse to destabilize them. The whole thing was engineered to make them look foolish so they’d beg for austerity. And now? They’re signing away their sovereignty. Coincidence? I think not.

Petrina Baldwin

September 29 2025They should’ve just used Venmo.

Ralph Nicolay

September 29 2025It is imperative to underscore that the implementation of a non-sovereign, non-stable, and non-regulated digital asset as legal tender constitutes a material deviation from internationally recognized monetary policy frameworks, thereby introducing systemic risk to fiscal governance and macroeconomic stability.

sundar M

September 30 2025Bro, I live in India and we had the same problem with UPI - people didn’t trust it at first. But slowly, with good design, local language support, and community help, it became normal. El Salvador didn’t do that. They gave free Bitcoin and vanished. If they’d had local volunteers teaching grandma how to send money? Maybe it would’ve worked.

Nick Carey

September 30 2025So… they spent $150M on Bitcoin and now it’s worth less than a Tesla? Classic.

Sonu Singh

February 16 2026bitcoin is not money its a speculaton tool.. real solution is mobile banking with low cost.. and yes chivo wallet was buggy as hell.. i saw my cousin lose 50$ becuz of it..