FCA Crypto Authorization: A Clear Guide

When navigating the UK crypto scene, FCA crypto authorization, the formal approval from the Financial Conduct Authority that lets a crypto business operate legally in the United Kingdom. Also known as FCA crypto licence, it signals that a firm meets the regulator’s standards for consumer protection, anti‑money‑laundering (AML) controls, and market integrity. The Financial Conduct Authority, the UK’s financial watchdog responsible for overseeing markets, firms, and consumer safety issues this authorisation after a detailed review. A related concept is crypto regulation, the set of rules that govern how digital assets are created, traded, and managed, which shapes the whole licensing framework.

Why FCA Crypto Authorization Matters

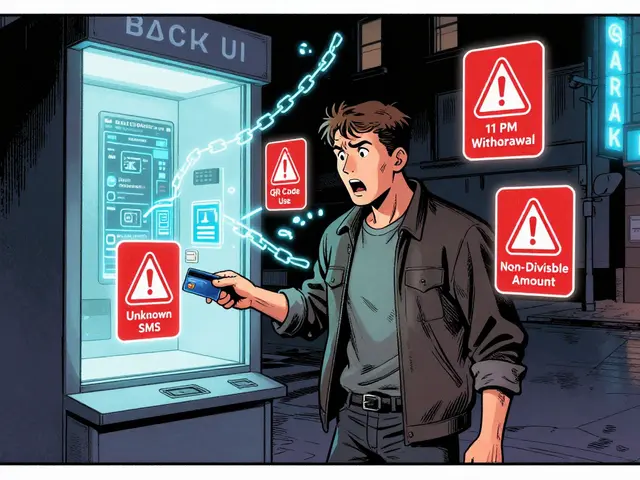

Knowing FCA crypto authorization is the first step toward a smooth market entry. The process encompasses document submission, compliance testing, and ongoing reporting. FCA crypto authorization requires firms to file a business plan, AML policy, and capital adequacy proof—those are the core attributes that the regulator checks. If a firm satisfies these, the FCA issues a licence, which then enables the company to offer services like exchange trading, custodial solutions, or token issuance to UK customers. In practice, a company that secures this approval can advertise its status, attract investors, and avoid costly enforcement actions. The UK crypto market is influenced by each new authorisation because it raises the overall trust level and pushes competitors to upgrade their own compliance standards. For traders, this means more reliable platforms; for developers, it opens doors to bank partnerships and institutional funding.

What you’ll find in the articles below is a practical mix of regulatory deep‑dives, step‑by‑step guides, and real‑world case studies. Some pieces break down the exact documents the FCA asks for, while others compare the UK approach to regimes in Japan or the US. A few posts explore how crypto firms can maintain compliance after the licence is granted, covering everything from AML monitoring to consumer complaint handling. Whether you’re a startup founder, an exchange operator, or just a curious investor, the collection gives you actionable insights to navigate the FCA landscape without getting lost in legal jargon. Ready to see how the authorization process works in detail and what it means for your crypto ambitions? Dive into the posts and start building a compliant, trustworthy crypto venture today.

A clear guide on what the UK FCA requires from crypto exchanges, covering current MLR registration, upcoming FSMA authorisation, territorial rules, stablecoin and custody standards, plus a practical compliance checklist.

Continue Reading