Hyperinflation Cryptocurrency: How Digital Assets Survive Currency Collapse

When a country’s money loses value faster than you can spend it, people don’t just panic—they look for something that won’t disappear overnight. That’s where hyperinflation cryptocurrency, digital assets used as a store of value when traditional money fails. Also known as crypto as a hedge, it’s not about speculation—it’s survival. Countries like Venezuela, Argentina, and Lebanon have seen citizens turn to Bitcoin, USDT, and other tokens not because they’re trendy, but because their local currency is worthless. Banks freeze accounts. Prices double in a week. And suddenly, a phone with a wallet app becomes the only thing keeping families fed.

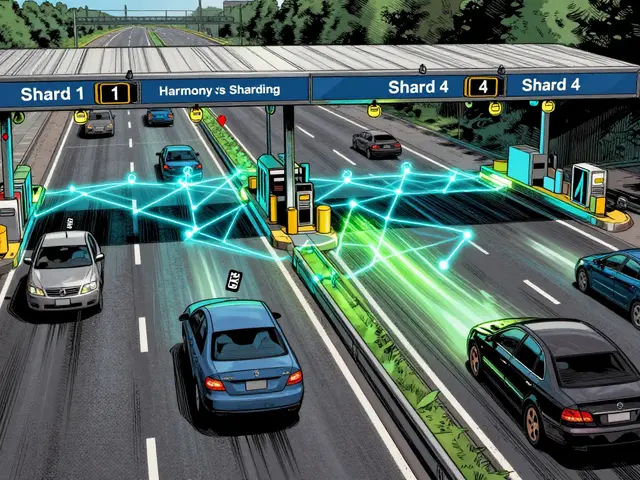

This isn’t theoretical. In 2024, Venezuelans used stablecoin, crypto tokens pegged to the U.S. dollar to preserve purchasing power. Also known as USD-pegged tokens, they let people pay for groceries, rent, and medicine without losing 50% of their cash by lunchtime. Projects like World Liberty Financial’s USD1 stablecoin—backed by U.S. Treasuries—show how crypto can step in where governments fail. But not all stablecoins are equal. Some are just scams pretending to be safe. That’s why knowing the difference between real ones and fake ones matters more than ever.

Bitcoin plays a different role. Unlike stablecoins, it doesn’t try to mimic the dollar—it fights the system that created it. Its fixed supply of 21 million coins means no central bank can print more to devalue it. Every four years, the block reward cuts in half, making it scarcer over time. That’s the opposite of inflation. In countries where the central bank prints money to cover debt, Bitcoin becomes the quiet alternative. It doesn’t need permission. It doesn’t ask for ID. And if your bank gets shut down, your Bitcoin still sits on your device.

But here’s the catch: crypto won’t fix hyperinflation. It just gives people a way out. If you’re living through it, you don’t care about NFTs, meme coins, or airdrops. You care about holding value. That’s why the posts below focus on real tools—stablecoins you can trust, how to store keys safely when the system’s collapsing, and which tokens actually move when money is falling apart. You’ll find warnings about fake airdrops like CAKEBANK and CKN that promise relief but deliver nothing. You’ll see how privacy coins like Monero might be banned just when you need them most. And you’ll learn why holding governance tokens or playing P2E games won’t save you—but owning Bitcoin or a real stablecoin just might.

In Venezuela, Bitcoin and USDT have become essential tools for survival amid hyperinflation and a collapsed currency. Millions use crypto daily to buy food, pay rent, and send remittances-bypassing a broken financial system.

Continue Reading