Inflation: How Rising Prices Shape Crypto, Stocks, and Your Wallet

When inflation, the rate at which the general level of prices for goods and services rises, reducing the purchasing power of currency. Also known as price erosion, it’s not just a number on a government report—it’s what makes your paycheck stretch less every year. If you held $100 in 2020, you could buy more than you can today. That’s inflation at work. And it’s not just affecting groceries and gas—it’s reshaping how people think about cryptocurrency, digital assets designed to operate without central control, often seen as a hedge against traditional monetary systems, stock market, the collection of exchanges where shares of publicly traded companies are bought and sold, and even how central banks, government institutions that manage a country’s money supply and interest rates make decisions that ripple through your portfolio.

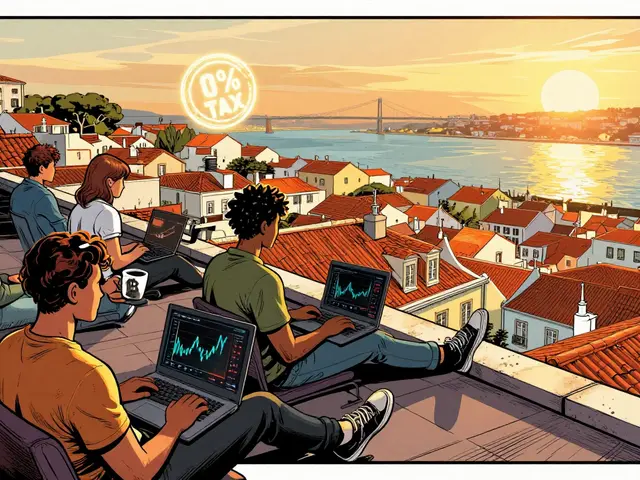

Inflation doesn’t hit everyone the same way. When prices rise, people look for places to store value. Some turn to gold. Others look at Bitcoin, hoping it’ll act like digital gold. But Bitcoin doesn’t always move with inflation—it moves with fear, hype, and liquidity. Meanwhile, stocks of companies that can raise prices faster than costs (like energy or food brands) often do better during inflationary periods. But if inflation gets too high, central banks raise interest rates to cool things down. That’s when tech stocks drop, crypto trading slows, and even the most promising DeFi projects struggle to attract users. It’s not magic. It’s math. And it’s happening right now.

What you’ll find here isn’t theory. It’s real cases: coins that crashed when inflation spiked, exchanges that lost users as rates climbed, and airdrops that vanished when funding dried up. You’ll see how HUNNY FINANCE collapsed not because of bad code—but because the money environment changed. You’ll see why OC Protocol never took off, even though it had a blockchain—it had no real-world demand. And you’ll see how countries like El Salvador and Turkey tried to use crypto to fight inflation, with mixed results. This isn’t about predicting the future. It’s about understanding the forces already moving your money.

Block rewards in Bitcoin are programmed to halve every four years, creating a predictable, declining inflation rate that contrasts sharply with fiat currencies. This mechanism is key to Bitcoin's value as a scarce digital asset.

Continue Reading