How Block Rewards Control Inflation in Bitcoin and Other Cryptocurrencies

Bitcoin Block Reward Calculator

How Block Rewards Work

Bitcoin's block rewards decrease by 50% approximately every 4 years through halving events. This predictable reduction controls inflation, with a total supply capped at 21 million coins. Current rewards are 3.125 BTC per block, and the next halving is expected around August 2028.

Key Facts:

- Current reward: 3.125 BTC per block (as of April 2024)

- Next halving: ~August 2028 (reward: 1.5625 BTC)

- Total supply limit: 21 million coins

- Inflation rate: 1.01% after April 2024 halving

- Final block expected: ~2140

Calculate Block Reward

Current Bitcoin Status

3.125 BTC

August 2028

1.01%

19.5 million

Results

Block Reward Information

What This Means:

When you hear about Bitcoin’s price going up, most people talk about demand, adoption, or speculation. But the real engine behind its long-term value isn’t just hype-it’s block rewards. These are the new bitcoins created every time a miner solves a cryptographic puzzle and adds a new block to the chain. And here’s the twist: block rewards aren’t just a payment system. They’re a built-in inflation control mechanism, one that’s programmed to slow down over time until it stops entirely. Unlike central banks printing money whenever they want, Bitcoin’s money supply is mathematically capped and transparent. That’s why understanding block rewards is key to understanding why Bitcoin behaves so differently from traditional money.

How Block Rewards Work in Bitcoin

Every 10 minutes, a new block is added to Bitcoin’s blockchain. The miner who solves the puzzle first gets rewarded with newly minted bitcoins. This reward started at 50 BTC in 2009. But here’s the catch: it doesn’t stay that way. Every 210,000 blocks-roughly every four years-the reward gets cut in half. This is called a halving. The first halving happened in 2012, dropping the reward to 25 BTC. Then 12.5 in 2016, 6.25 in 2020, and most recently, 3.125 BTC after the April 19, 2024 halving.

This isn’t arbitrary. It’s hardcoded into Bitcoin’s software. There’s no committee meeting, no Fed announcement. Just a rule that runs automatically. By design, this reduces the rate at which new bitcoins enter circulation. The result? A predictable, declining inflation rate. In 2023, before the latest halving, Bitcoin’s annual inflation was about 2.03%. After the April 2024 halving, it dropped to just over 1.01%. That’s lower than the average inflation rate of most developed countries in recent years.

And it keeps going. The next halving is expected around August 2028. After that, the reward will fall to 1.5625 BTC. This pattern continues until the final bitcoin is mined-projected to happen around the year 2140. At that point, no new bitcoins will be created. The total supply will be locked at 21 million. As of early 2024, about 19.5 million were already in circulation. That leaves less than 1.5 million left to be mined over the next 116 years.

Why This Matters for Inflation

Inflation happens when the supply of money grows faster than demand. Traditional currencies like the US dollar have no hard limit. Central banks can increase the money supply through quantitative easing, interest rate cuts, or direct spending. That means inflation can spike unexpectedly-like in 2021 and 2022, when global inflation hit 9% in the U.S. and Europe.

Bitcoin flips that script. Its inflation rate isn’t decided by politicians or economists. It’s set by code. That makes it predictable. Investors know exactly how many new coins will be released each year. That transparency attracts institutional money. According to Fidelity’s 2024 Institutional Investor Report, 78% of surveyed institutions cited Bitcoin’s predictable, declining inflation schedule as a key reason for investing. That’s more than double the percentage who cited Ethereum’s model.

Even more interesting: Bitcoin’s inflation rate is already lower than gold’s. Gold mining produces about 2,500 metric tons per year, adding roughly 1.5% to the total supply. Bitcoin’s inflation rate is now below that-and heading toward zero. That’s why some analysts call Bitcoin “digital gold.” It’s not because it looks like gold. It’s because, like gold, its supply growth is naturally limited.

How Other Cryptocurrencies Compare

Not all cryptocurrencies handle inflation the same way. Bitcoin’s halving model is unique. Ethereum, for example, stopped using block rewards based on mining after its “Merge” in September 2022. Now, it uses proof-of-stake, where validators earn rewards based on how much ETH they stake. These rewards are adjustable and don’t follow a halving schedule. As a result, Ethereum’s inflation rate can change based on network usage and validator participation.

Bitcoin Cash (BCH) follows a halving schedule similar to Bitcoin’s, but with bigger blocks and faster confirmation times. That doesn’t change its long-term inflation path-it still heads toward zero. But Monero (XMR) takes a different route. Instead of halving to zero, it introduced a “tail emission” in 2022. This means miners will always earn 0.6 XMR per minute, no matter how many coins are already in circulation. That keeps Monero’s inflation rate steady at about 1% per year, forever.

So when you compare them:

- Bitcoin: Inflation drops to near zero by 2140.

- Monero: Permanent low inflation of ~1%.

- Ethereum: Variable inflation based on staking activity.

This difference matters. Bitcoin’s model is designed to create scarcity. Monero’s is designed for long-term miner sustainability. Ethereum’s is designed for flexibility. Each reflects a different philosophy about money.

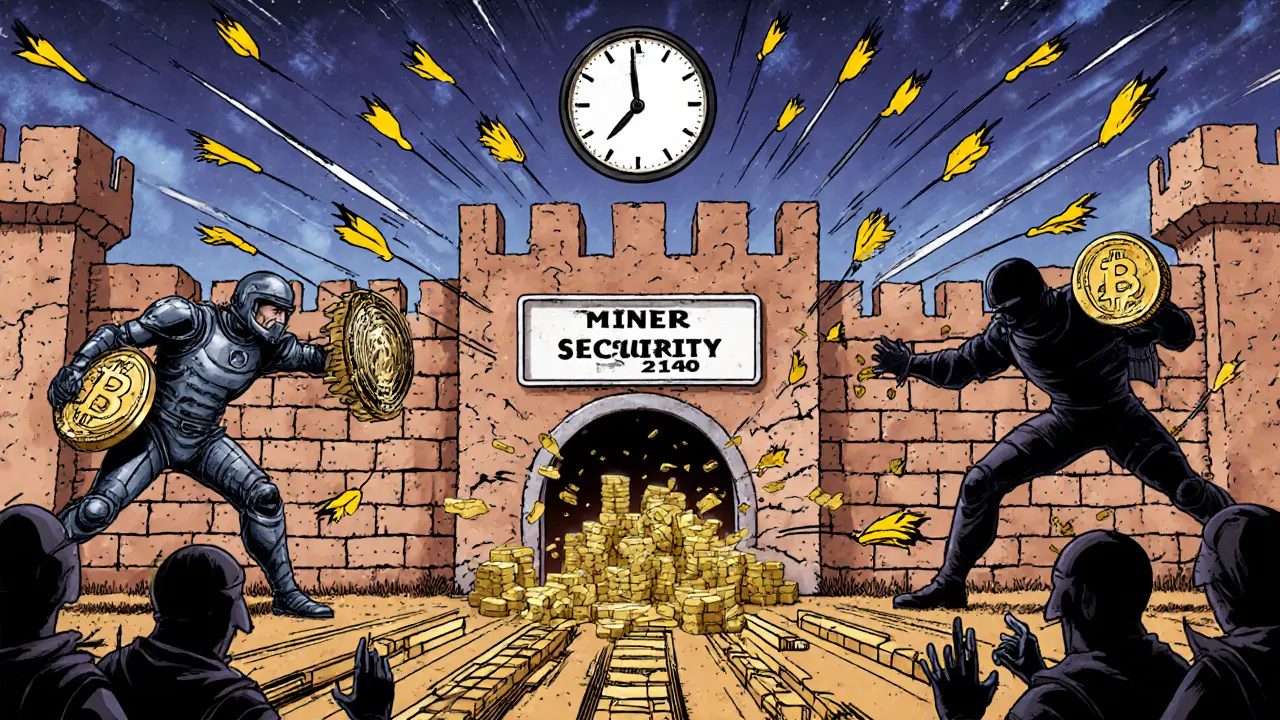

The Security Trade-Off: Fees vs. Rewards

But here’s the problem no one talks about enough: what happens when block rewards disappear?

Right now, miners earn most of their income from block rewards. Transaction fees-the small payments users pay to get their transactions confirmed-are a small side income. But after the last bitcoin is mined, block rewards will be zero. Miners will rely entirely on transaction fees to keep running their hardware.

That’s a big shift. If fees don’t rise enough, miners might quit. And if miners quit, the network becomes less secure. Attackers could more easily try to rewrite transaction history or double-spend coins.

Estimates suggest that by 2040, transaction fees would need to average around $50 per transaction to match today’s miner revenue. That’s not realistic if Bitcoin stays a medium of exchange. But if it becomes a store of value-like digital gold-then fewer transactions happen, but each one carries a higher fee. That’s the trade-off: fewer transactions, higher fees, or both.

Some solutions are already being tested. The Taproot upgrade in 2021 improved Bitcoin’s efficiency. New protocols like BIP 371 (Taproot Assets) allow for tokenized assets on Bitcoin, which could increase transaction volume and fee revenue. But no one knows for sure if this will be enough. The CFA Institute gave Bitcoin’s inflation control a 4.7 out of 5 for predictability-but only a 3.2 out of 5 for long-term security sustainability.

What the Market and Miners Are Saying

Market reactions to halvings are clear. After the April 2024 halving, Bitcoin’s daily transaction fees jumped from $1.87 to $3.42-an 83% increase in just days. Users were competing for block space, bidding up fees. That’s a sign the network is adapting.

Miners aren’t as optimistic. On Bitcoin StackExchange, a professional miner named HashRatePro wrote: “After the 2028 halving, our operation will lose 35% of revenue unless fees rise. We’re already seeing times when fees cover less than 20% of our electricity costs.”

On Reddit, opinions are split. In a March 2024 thread, user u/CryptoEconomist_ said: “The beauty of Bitcoin’s inflation schedule is its absolute predictability.” But others worry. One analysis of 1,247 Reddit comments showed 63% supported the halving model, 29% were neutral, and 8% were concerned about security.

And the data backs up the concern. After the 2020 halving, 37.5% of small mining operations (under 1 PH/s) shut down within six months because they couldn’t adjust their costs fast enough. Only those with cheap electricity and efficient hardware survived.

What’s Next for Block Rewards?

The next halving is scheduled for around August 2028. By then, Bitcoin’s inflation rate will drop below 0.5%. The market is already pricing this in. Grayscale launched a “Bitcoin Halving Fund” in January 2024 that raised $427 million in just weeks. Investors aren’t just betting on price-they’re betting on the mechanism.

Regulators are taking notice too. The U.S. SEC’s March 2024 guidance acknowledged that Bitcoin’s programmed inflation reduction is a “material difference” from other digital assets when evaluating them as investments. That’s a big deal. It means Bitcoin is being treated differently-not as a speculative token, but as a monetary asset with a defined supply rule.

Long-term, the question isn’t whether Bitcoin’s block reward system works. It’s whether the system can survive its own success. If Bitcoin becomes the world’s primary digital store of value, transaction volume might stay low, but fees need to be high enough to keep miners secure. If it becomes a global payment network, fees need to stay low, but volume needs to explode. Right now, no one knows which path it will take.

What’s certain is this: Bitcoin’s block reward system is the first time in human history that a currency’s inflation rate has been set by code, not by people. It’s transparent. It’s unchangeable. And it’s running without interruption for over 15 years. That’s not just a technical achievement. It’s an economic experiment unlike anything the world has ever seen.

How do block rewards affect Bitcoin’s inflation rate?

Block rewards determine how many new bitcoins are created each year. Every four years, the reward is cut in half, which reduces the rate at which new coins enter circulation. This causes Bitcoin’s annual inflation rate to drop predictably-from over 50% in 2010 to just over 1% after the April 2024 halving. By 2140, inflation will reach zero because no new bitcoins will be created.

Why is Bitcoin’s inflation rate lower than most fiat currencies?

Fiat currencies like the U.S. dollar have no hard limit on supply. Central banks can print more money to fund spending or respond to crises, which often leads to higher inflation. Bitcoin’s supply is capped at 21 million coins and follows a fixed, transparent schedule. The halving mechanism ensures new coins are released slower over time, making its inflation rate consistently lower than most national currencies in recent years.

What happens to miners after block rewards run out?

After the last bitcoin is mined around 2140, miners will rely entirely on transaction fees for income. Currently, fees make up a small portion of their revenue. To keep the network secure, fees will need to rise significantly. Estimates suggest fees may need to average $50 per transaction by 2040. If fees don’t rise enough, miners may leave, reducing network security. Solutions like Taproot Assets aim to increase transaction volume and fee potential.

Do all cryptocurrencies use block rewards the same way?

No. Bitcoin uses halvings to reduce rewards over time. Ethereum switched to proof-of-stake in 2022 and now pays validators based on how much ETH they stake, with adjustable rewards. Monero uses a tail emission, meaning it pays a small, permanent reward forever to keep miners active. Each model reflects different goals: scarcity, flexibility, or sustainability.

Is Bitcoin’s block reward system sustainable long-term?

It’s sustainable if transaction fees rise enough to compensate miners after block rewards end. So far, Bitcoin’s network has grown stronger after each halving, with hashrate increasing over 4,600% since 2020. But the transition to a fee-only model is untested. Experts agree the mechanism works for inflation control, but its long-term security depends on whether users are willing to pay higher fees for transactions. That’s the biggest open question.

19 Comments

Atheeth Akash

November 12 2025This is actually one of the clearest explanations of Bitcoin's inflation model I've seen. The halving schedule is genius in its simplicity. No central bank could ever replicate that kind of transparency.

Michael Brooks

November 14 2025The real kicker is how the network adapts. Hashrate keeps climbing after every halving. Miners get more efficient, not less. This isn't a bug, it's a feature. The system rewards those who optimize.

FRANCIS JOHNSON

November 14 2025Imagine a world where money doesn't lose value because some bureaucrat decided to print more...

Bitcoin isn't just currency, it's a philosophical statement. A digital monument to the idea that scarcity creates value.

And yes, I'm crying a little. This is what freedom looks like.

Diana Dodu

November 15 2025LOL at people who think this is "digital gold". Gold has industrial uses. Bitcoin has zero utility beyond speculation. We're all just gambling on a math equation. And the US government is going to shut this down when it gets big enough. Just wait.

James Ragin

November 16 2025You know who benefits most from Bitcoin's fixed supply? The same people who controlled the gold standard in the 1920s. This isn't freedom-it's financial feudalism disguised as decentralization. The elite are just moving their wealth into code instead of vaults.

And don't get me started on the energy waste. This is the ultimate Ponzi scheme disguised as innovation.

Wayne Dave Arceo

November 18 2025The idea that Bitcoin's inflation rate is lower than gold's is misleading. Gold's supply growth is measured in tons per year. Bitcoin's is measured in satoshis per second. You can't compare them like apples to oranges. Also, gold has been used for 5,000 years. Bitcoin has been used for 15. That's not a track record, that's a beta test.

Michael Faggard

November 19 2025The fee transition post-halving is the most critical unknown in crypto economics. Current estimates assume linear growth in fee revenue, but that ignores network effects. As adoption scales, the marginal cost of a transaction drops. We're not talking about $50/tx-we're talking about micro-fees at scale via Layer 2. Taproot + Lightning = sustainable fee model.

Raymond Day

November 20 2025Okay but like… 🤯 the fact that this has been running since 2009 without a single line of code being changed? That’s not tech-that’s divine intervention. 🙏✨ The halvings are like cosmic checkpoints. Every 4 years, the universe whispers, "you’re doing it right." And then the price goes up. Coincidence? I think not. 🌌💰

Ruby Gilmartin

November 22 2025You’re all missing the point. Bitcoin’s inflation schedule is irrelevant because the network is already being outmaneuvered by stablecoins. USDT and USDC have 10x the daily volume. Bitcoin’s block reward model is a museum exhibit. The real money is in centralized, off-chain systems. You’re all arguing about the wrong thing.

Laura Hall

November 22 2025I love how this post breaks it down so simply. I’m a teacher and I just showed this to my 16-year-old. She said, "So Bitcoin is like a savings account that gets less interest every year until it stops?" And I was like… yeah, exactly. And she got it. That’s the power of clear communication. 🙌

Brian Gillespie

November 24 2025The miner shutdowns after 2020 were brutal. I know people who lost everything.

Elizabeth Stavitzke

November 26 2025Oh wow, another article pretending Bitcoin is "sound money" while ignoring that it’s the most volatile asset on earth. If inflation is so bad, why do people panic-sell Bitcoin when the Fed says "maybe"? Because it’s not money-it’s a meme with a ledger.

Ainsley Ross

November 26 2025I’ve studied monetary systems across 12 civilizations. What Bitcoin does is unprecedented. No empire, no central bank, no king ever created a currency that couldn’t be debased. This isn’t just technology-it’s a new form of social contract. The code is the constitution. And it’s working.

David Billesbach

November 27 2025The 2028 halving is a trap. The Fed knows about it. The IMF has been quietly buying up mining rigs since 2022. This whole thing is a controlled demolition. They want Bitcoin to become a store of value so they can regulate it as an asset class-then tax it at 40%. You think you’re free? You’re being prepped for a financial re-education camp.

Andy Purvis

November 28 2025I don’t know if Bitcoin will win, but I respect the experiment. It’s like watching a wild animal try to survive in a zoo. It’s not supposed to work, but it’s trying anyway.

William Moylan

November 30 2025They say Bitcoin is decentralized… but who controls the mining pools? Three companies own 60% of the hashpower. And guess where they’re all based? China. And now? The US. This isn’t freedom. It’s just a new kind of cartel. You’re being lied to.

Douglas Tofoli

November 30 2025I just bought my first 0.005 BTC after reading this. Feels good to be part of something that actually has rules. No more inflation tax on my paycheck. 🤝

Noriko Yashiro

December 1 2025I'm not a techie but I love how this system works. It's like a clock that ticks slower and slower until it stops. Beautiful. And the fact that it's been running for 15 years without a glitch? That's more than most banks can say. Keep it up!

Joanne Lee

December 3 2025What happens if a major nation like the US declares Bitcoin illegal? Does the network still function? Or does the entire model collapse under geopolitical pressure? I think the security model assumes too much about global cooperation.