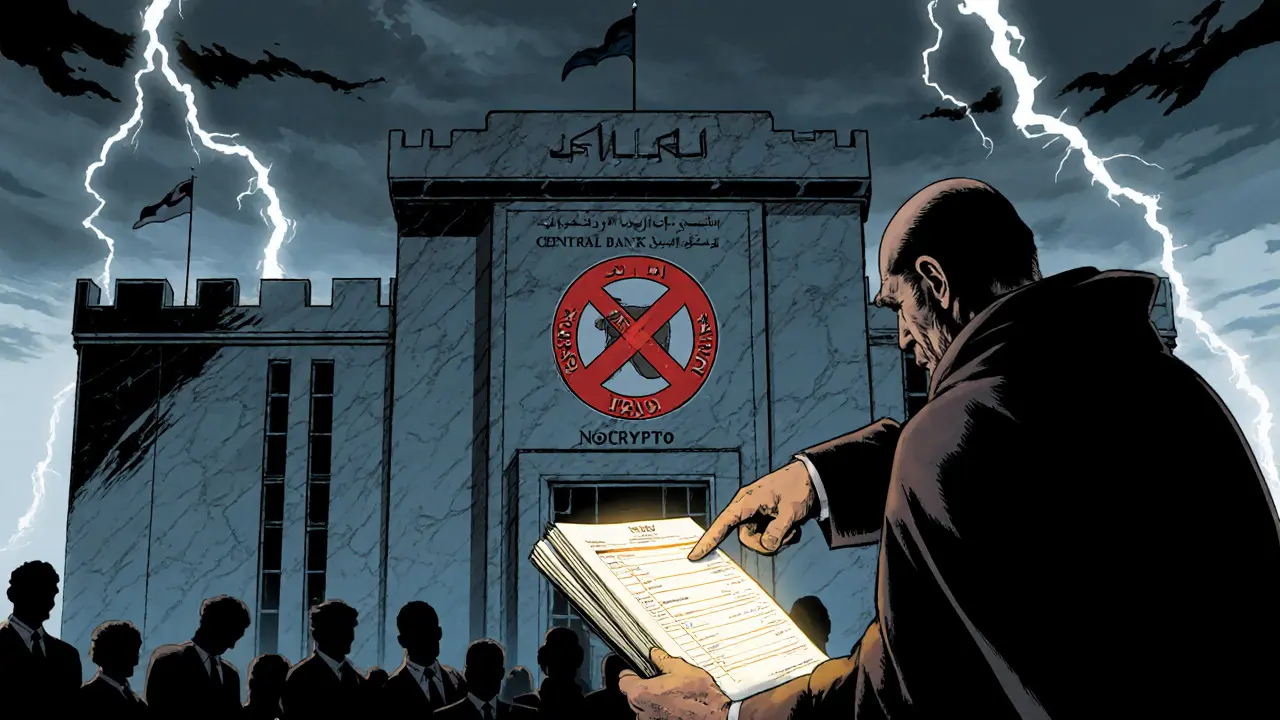

Understanding the Central Bank of Iraq's Crypto Restrictions and Future CBDC Plans

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue ReadingWhen Iraq cryptocurrency ban, a 2024 government order prohibiting all cryptocurrency transactions and exchanges. Also known as crypto prohibition in Iraq, it was a direct response to rising unregulated digital asset use, money laundering risks, and pressure from the Central Bank of Iraq. This wasn’t just a technical rule—it was a political move aimed at protecting the Iraqi dinar and stopping capital flight. The ban made it illegal for banks, businesses, and individuals to buy, sell, or hold Bitcoin, Ethereum, or any other crypto asset. Violators faced fines and possible jail time.

The ban didn’t come out of nowhere. It followed similar actions in countries like Turkey, which introduced strict licensing rules for crypto service providers in 2024, and Philippines, where the SEC cracked down on unregistered exchanges and imposed heavy fines. But unlike Turkey, which tried to regulate crypto instead of banning it, Iraq chose total restriction. Why? Because Iraq’s financial system is fragile, and crypto use was growing fast among young people using peer-to-peer platforms to send money abroad or avoid inflation. The government saw it as a threat to control, not innovation.

What’s often missed is how this ban connects to broader global patterns. Countries with weak financial oversight or high inflation—like Nigeria, Argentina, and now Iraq—see crypto as both a lifeline and a danger. The crypto regulation, the legal framework governments use to control digital asset markets varies wildly. Some places, like Japan and the UK, build clear rules for exchanges. Others, like Iraq, shut it all down. And then there are places like El Salvador, which tried to make Bitcoin legal tender—only to see adoption fail. These aren’t random choices. They’re reactions to local economic stress, political power, and public trust in traditional banks.

Underneath all this is a simple truth: when people can’t trust their currency or banking system, they turn to crypto. Iraq’s ban didn’t stop that—it just pushed it underground. Today, crypto trades still happen there, mostly through Telegram groups and local traders using cash. The ban didn’t kill demand. It just made it riskier. And that’s the pattern we see everywhere: crackdowns don’t erase crypto use. They just make it harder to track, more expensive, and more dangerous for regular users.

What you’ll find below are real stories from countries that tried to control crypto—some succeeded, most didn’t. You’ll see how regulation shapes markets, how enforcement backfires, and why banning Bitcoin doesn’t stop people from using it. Whether you’re in Iraq, Turkey, or anywhere else, these lessons matter. Because if you’re holding crypto, you’re already part of this global experiment. And knowing how governments react tells you where the next risks—and opportunities—are hiding.

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue Reading