Order Book Spoofing: How Fake Orders Manipulate Crypto and Stock Markets

When you look at a trading screen, you see buy and sell orders stacked up like a ladder—that’s the order book, a live list of all pending buy and sell orders for a specific asset, showing what traders are willing to pay or accept. It’s supposed to reflect real market demand. But what if half of those orders weren’t real? That’s order book spoofing, a manipulative tactic where traders place large fake orders to trick others into buying or selling, then cancel them before they’re filled. Also known as spoofing, it’s a form of market manipulation that’s been banned in the U.S. since 2010, yet it still thrives in crypto markets where oversight is weak.

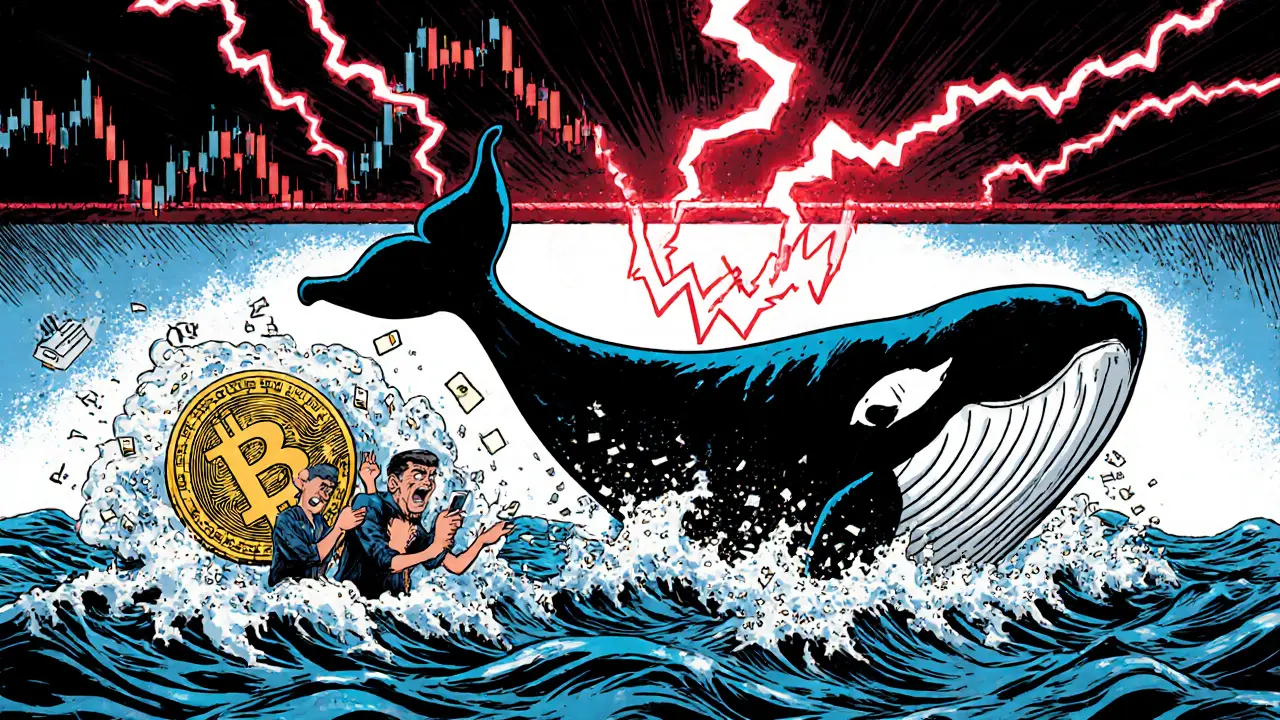

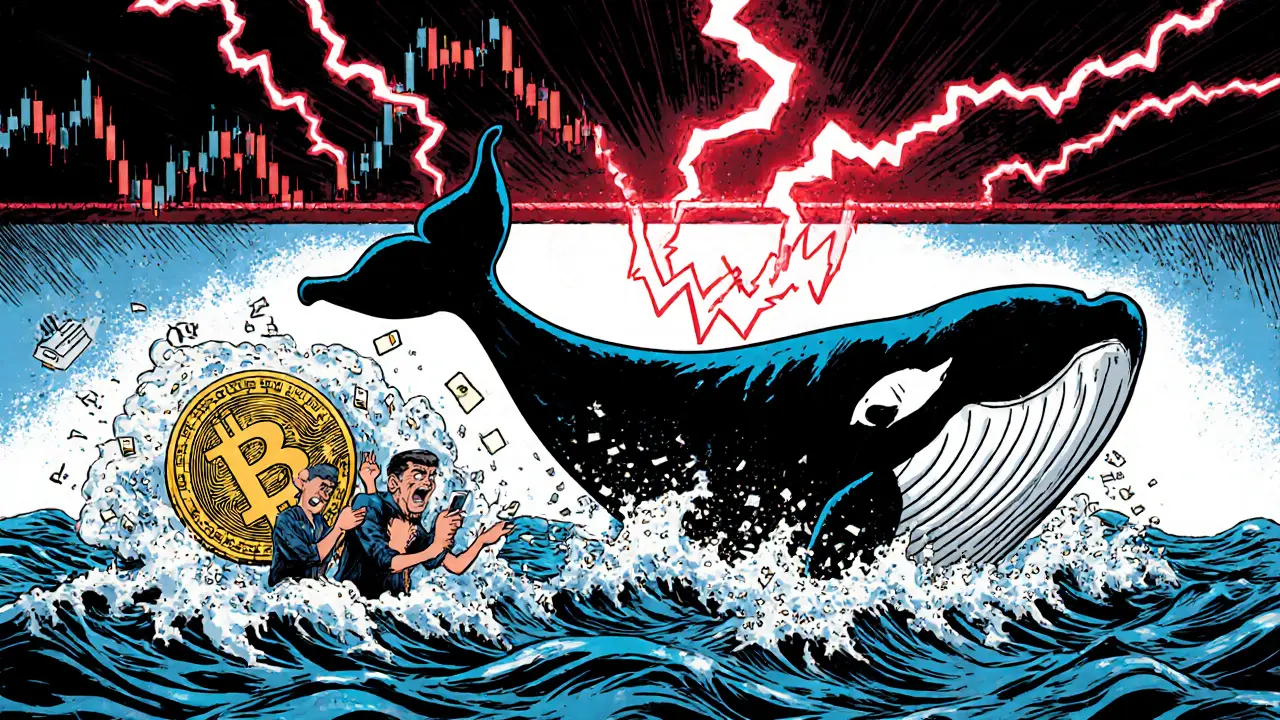

Here’s how it plays out: a trader puts up a massive sell order at $50,000 for Bitcoin, making it look like big players are dumping. Panic spreads. Others rush to sell too, dragging the price down. Once the price drops, the spoofer cancels their fake order and buys Bitcoin at the lower price. Same thing happens on the buy side—fake bids create artificial demand, lure in buyers, then vanish. It’s not magic. It’s psychology. And it works because most traders don’t question the order book. They assume it’s honest. The market manipulation, the deliberate distortion of asset prices through deceitful trading practices. Also known as price manipulation, it includes tactics like pump-and-dump schemes and wash trading behind spoofing is often tied to low-liquidity assets—exactly the kind of tokens you’ll find in posts about Bullit (BULT), WOR, or NBX. These coins have tiny trading volumes, so a few fake orders can swing prices 20%, 50%, even 100%. That’s why so many of the scams we cover here rely on spoofing to create false momentum before the rug pull.

Spotting spoofing isn’t hard if you know what to look for. Watch for orders that are way bigger than normal, especially near key price levels. If they disappear the second the price moves, that’s a red flag. Check the time and sales feed—do trades happen right after the big order vanishes? That’s the spoofer jumping in. Tools like volume profile and depth charts help, but the best defense is skepticism. Don’t chase price spikes fueled by sudden order book changes. And never trust a coin that’s moving fast with no real volume or team behind it—those are the ones most likely being manipulated. The posts below show real examples: tokens that looked like they were surging, only to collapse once the fake orders vanished. You’ll see how spoofing connects to rug pulls, zero-liquidity coins, and even state-backed crypto frauds. This isn’t theory. It’s happening every day—and you can learn to see it before it’s too late.

Learn how to identify whale manipulation in crypto markets-spot spoofing, stop hunting, and fake breakouts before they wipe out your positions. Understand the tactics big players use and how to protect yourself.

Continue Reading