SakePerp Trading: What It Is and How It Fits Into Crypto Derivatives

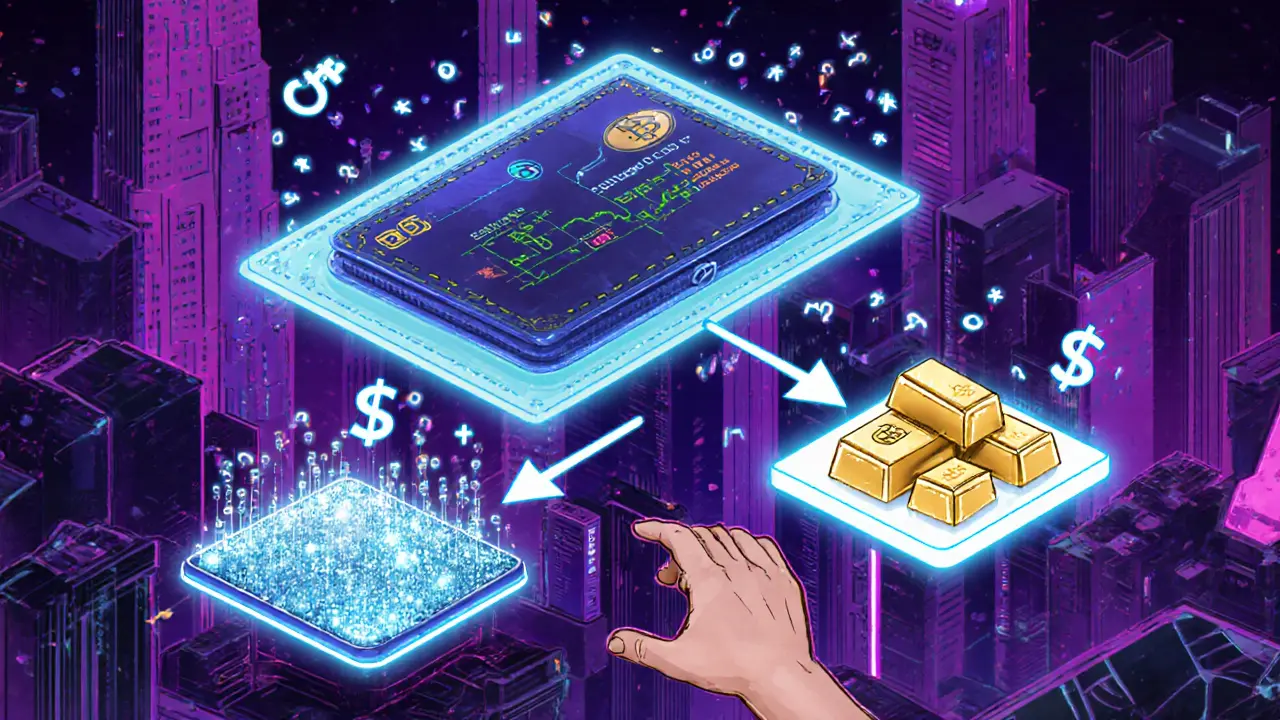

When you trade SakePerp, a decentralized perpetual futures protocol built for crypto traders. Also known as SakePerp perpetuals, it lets you take long or short positions on assets like Bitcoin and Ethereum without owning them—just like trading futures on Wall Street, but without middlemen. Unlike traditional exchanges, SakePerp runs on blockchain networks like Arbitrum and Optimism, so your trades settle directly between users, not through a company holding your money.

This kind of trading falls under crypto derivatives, financial contracts whose value is tied to an underlying asset like Bitcoin or a token. Perpetual contracts, the core product of SakePerp, don’t expire. That means you can hold a position for days, weeks, or even months—no need to roll over contracts like on centralized platforms. What keeps these contracts tracking the real price of Bitcoin? Funding rates. Every eight hours, longs pay shorts (or vice versa) based on market imbalance. If demand for longs is high, they pay a fee to keep their positions open. It’s a simple but powerful mechanism that keeps prices aligned.

Why do traders use SakePerp? Because it’s cheap, fast, and open to anyone. You don’t need to pass KYC. You don’t need to wait for withdrawal approvals. You just connect your wallet, deposit collateral, and start trading with up to 20x leverage. But that same freedom comes with risk. A 10% move against your position can wipe you out if you’re using 20x leverage. That’s why most experienced traders use stop-losses, avoid over-leveraging, and never risk more than they can afford to lose. SakePerp doesn’t protect you from bad decisions—it just gives you the tools to make them.

Related tools like DeFi trading, using decentralized platforms to trade crypto without intermediaries, have exploded because people want control. They don’t trust exchanges that freeze accounts or disappear overnight. SakePerp fits right into that movement. It’s not for beginners who just want to buy Bitcoin and hold. It’s for people who understand price action, know how funding rates work, and are ready to manage their own risk.

What you’ll find below are real posts about trading systems, exchange comparisons, and crypto risks—some of them directly tied to how traders use platforms like SakePerp. You’ll see how leverage can turn small gains into big wins—or wipe out entire portfolios. You’ll learn how to spot when a protocol is risky, how to read funding rates, and why some traders avoid certain markets entirely. This isn’t theory. It’s what’s happening right now on-chain, in real time, with real money at stake.

Earn SAKE tokens by trading on SakePerp, lending on Sake Finance, and engaging with the community. Learn how SakePoints work, how to maximize rewards, and what to avoid before the official token launch.

Continue Reading