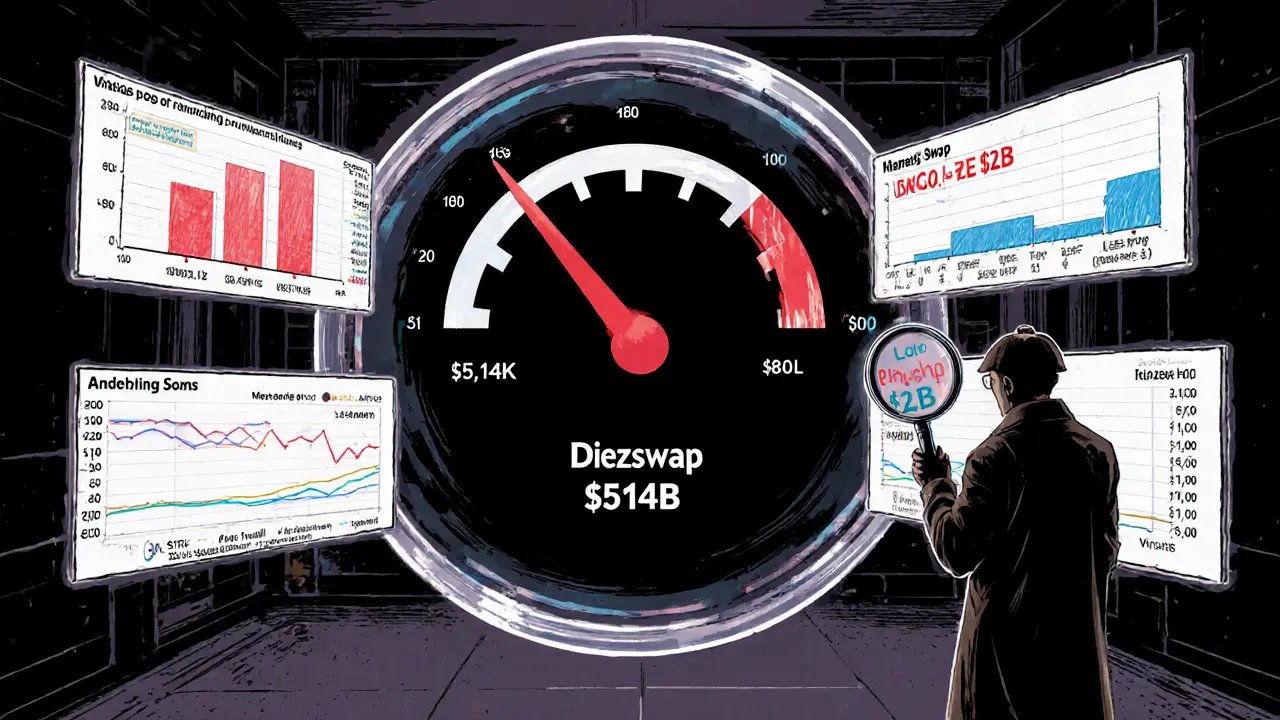

Dezswap Crypto Exchange Review: Is This Low‑Liquidity DEX Worth Your Trade?

Dezswap Liquidity & Risk Calculator

Dezswap TVL

$514K

Total Value LockedUniswap TVL

$4B+

Total Value LockedDezswap's TVL of $514K is significantly lower than top DEXs like Uniswap ($4B+) and PancakeSwap ($2B+). This indicates potentially higher slippage and reduced trading efficiency.

The ratio shows how much smaller Dezswap's liquidity is compared to Uniswap.

- No public security audit

- Single-chain support

- No governance token

- Untracked on major exchanges

- Simple UI

- Low friction for small trades

- Potential early adopter rewards

Estimate potential slippage impact based on trade size versus Dezswap's TVL:

Impact Analysis

Important Note

Dezswap's low liquidity means that even small trades can experience significant slippage. For large transactions, consider using established DEXs with higher liquidity pools.

When you hear the name Dezswap is a decentralized exchange (DEX) that currently operates on a single blockchain and holds roughly $514,000 in total value locked (TVL). It’s one of the many niche platforms trying to carve out a spot in a market dominated by giants like Uniswap and PancakeSwap. If you’re wondering whether Dezswap is a hidden gem or just another low‑liquidity outlet, this review breaks down the numbers, features, and risks so you can decide if it belongs in your crypto toolbox.

Key Takeaways

- Dezswap’s TVL sits at about US$514K, less than 0.01% of top DEXs.

- It runs on a single blockchain, limiting cross‑chain swaps.

- There’s no public audit, governance token, or detailed fee schedule.

- Untracked on CoinMarketCap, meaning volume data is scarce.

- For high‑volume traders, established DEXs offer deeper liquidity and lower slippage.

What is Dezswap?

Dezswap positions itself as a simple AMM‑style exchange where users can swap ERC‑20‑like tokens directly from their wallets. Unlike many newer DEXs, it does not tout flashy features such as concentrated liquidity, flash loans, or multi‑chain bridges. The platform’s limited public footprint suggests it’s still in an early or niche phase of development.

Liquidity Snapshot

The most concrete metric we have is the total value locked. According to ChainUnified tracking data, Dezswap holds $514.19K in TVL across a single chain. For perspective, Uniswap regularly exceeds $4billion in TVL, while PancakeSwap sits above $2billion. The disparity means traders on Dezswap will likely face higher price impact and slippage, especially for larger orders.

Chain Support and Token Coverage

Dezswap appears to be limited to one blockchain. The exact chain isn’t explicitly disclosed in the sources, but the single‑chain TVL metric suggests it’s not a multi‑chain hub like Uniswap, which spans Ethereum, Polygon, Arbitrum, Optimism, and more. A single-chain focus narrows the pool of available trading pairs and may deter users who need to move assets across ecosystems.

Transparency, Security, and Governance

One of the biggest red flags is the lack of publicly available audit reports. Leading DEXs typically undergo third‑party security audits, publish the results, and maintain bug bounty programs. Dezswap does not list any such documentation, making it harder to gauge contract safety.

There is also no known governance token or on‑chain voting mechanism. This absence means there’s no clear way for the community to influence protocol upgrades or fee structures, and it raises questions about the team behind the platform.

How is Dezswap Tracked?

On CoinMarketCap

, Dezswap is labeled an “Untracked Listing,” indicating it does not meet the exchange’s volume threshold or data‑quality standards. Conversely, CoinGecko maintains a basic page for Dezswap, but detailed metrics such as daily volume, trust score, or user reviews are missing.The lack of robust tracking makes it difficult for potential traders to assess real‑time activity, further increasing the perceived risk.

Comparison with Major DEXs

| Metric | Dezswap | Uniswap | PancakeSwap | Curve |

|---|---|---|---|---|

| TVL (USD) | $0.514M | $4B+ | $2B+ | $4B+ |

| Chains Supported | 1 (single chain) | 7+ (Ethereum, Polygon, Optimism, Arbitrum, Celo, BNB Chain, Avalanche) | 2 (BNB Chain, Ethereum) | 5+ (Ethereum, Polygon, Optimism, Arbitrum, others) |

| Tracking Status | Untracked on CoinMarketCap; limited data on CoinGecko | Tracked, high volume | Tracked, high volume | Tracked, high volume |

| Audit Transparency | None publicly disclosed | Multiple audits (e.g., PeckShield, Quantstamp) | Regular audits (e.g., CertiK) | Audited by Trail of Bits, OpenZeppelin |

| Governance Token | None | UNI | CAKE | CRV |

Pros and Cons of Using Dezswap

- Pros

- Simple UI - no frills or complex fee structures.

- Potential for early‑adopter incentives if the team launches a token.

- Cons

- Very low liquidity → higher slippage.

- Single‑chain limits asset diversity.

- No public security audit → higher smart‑contract risk.

- Untracked trading volume makes price discovery opaque.

Who Might Consider Dezswap?

If you’re a hobbyist who enjoys experimenting with low‑risk, small‑size swaps on a niche platform, Dezswap could serve as a sandbox. Developers looking to test AMM contracts on a live chain with minimal competition might also find it useful. However, if you trade sizable amounts, need fast execution, or rely on deep liquidity, established DEXs remain the safer bet.

Getting Started on Dezswap

- Install a compatible Web3 wallet (e.g., MetaMask).

- Connect the wallet to the Dezswap website - the UI typically prompts a “Connect Wallet” button.

- Ensure you have the native token of the supported chain for gas fees.

- Select the token pair you want to swap and input the amount.

- Review the estimated slippage; on a low‑TVL DEX this can be significant.

- Confirm the transaction in your wallet and wait for the on‑chain confirmation.

Because the platform lacks a detailed fee schedule, the on‑screen preview will be your main source for cost estimation.

Risk Management Tips

- Start with amounts you’re comfortable losing; treat early DEX exposure like a test.

- Monitor the transaction on a block explorer to verify successful execution.

- Consider using a hardware wallet for added security when dealing with any smart‑contract interaction.

- Keep an eye on community channels (Telegram, Discord) for any announcements about audits or token launches.

Frequently Asked Questions

What is the total value locked (TVL) on Dezswap?

Dezswap holds about $514,190 in TVL, according to ChainUnified data for 2025.

Is Dezswap audited?

No public security audit reports have been released for Dezswap, which raises additional risk compared to audited platforms like Uniswap or PancakeSwap.

Can I trade across multiple blockchains on Dezswap?

No. Dezswap currently operates on a single blockchain, so cross‑chain swaps are not supported.

How does the fee structure work?

The platform does not publish a detailed fee schedule. Users must rely on the on‑screen preview for each swap, which typically includes a protocol fee plus gas costs.

Is there a native governance token for Dezswap?

As of October2025, Dezswap has not issued a governance or utility token.

25 Comments

Evie View

November 13 2024Dezswap is a total scam, avoid at all costs!

Sidharth Praveen

November 17 2024I get the frustration, but some newbies might actually find value in a low‑liquidity playground if they keep trade sizes tiny and treat any loss as a learning fee. 😊

Stefano Benny

November 21 2024Alright, let’s dissect Dezswap with the kind of granularity a DeFi analyst would dream about. First, the TVL sits at a paltry $514K, which is roughly 0.013% of Uniswap’s gargantuan pools – that alone makes slippage a serious concern for any non‑micron‑sized trade. Second, the platform’s single‑chain architecture means you’re locked into one L1 ecosystem, stripping away the arbitrage opportunities that multi‑chain DEXs like Uniswap v3 enjoy. Third, the absence of a public audit raises red flags; smart‑contract risk is not something you want to gamble with when your capital is already limited. Fourth, there’s no governance token to incentivize community participation, so you’re essentially using a product with no roadmap‑driven tokenomics. Fifth, the UI is indeed simple, but simplicity doesn’t compensate for the lack of fee transparency – you’re left guessing the effective spread beyond the on‑screen preview. Sixth, because it’s untracked on major aggregators, on‑chain analytics become a nightmare, making price discovery opaque. Seventh, the low liquidity means even a $5k trade could shift the pool price dramatically, eroding your expected returns. Eighth, the gas costs on the underlying chain could eat a disproportionate chunk of small‑scale swaps, especially during network congestion. Ninth, the platform’s community channels are thin; without active dev chatter you’re missing out on critical security alerts. Tenth, without a bug bounty program, there’s little incentive for third‑parties to hunt vulnerabilities. Eleventh, the “early‑adopter rewards” hype is speculative – no token, no concrete incentive. Twelfth, the lack of cross‑chain bridges eliminates a whole class of liquidity‑boosting mechanisms. Thirteenth, the risk of impermanent loss is magnified when the pool depth is shallow. Fourteenth, any potential token listings will suffer from poor depth, making exit strategies risky. Fifteenth, overall, the risk‑reward profile skews heavily toward risk for any trader looking beyond dust‑size swaps. 🚀

Bobby Ferew

November 25 2024While the above breakdown is thorough, it’s worth noting that the platform’s codebase appears to follow a standard AMM template, which may reduce novelty‑driven bugs, but without a formal audit the unknowns remain significant.

Mark Camden

November 29 2024From an ethical standpoint, promoting a DEX without clear security assurances borders on irresponsible. Users should demand transparency before allocating capital.

Nathan Blades

December 3 2024Exactly! People often overlook the moral duty of developers to publish audit results. If Dezswap wants credibility, they must prioritize safety over speed.

Somesh Nikam

December 7 2024Hey folks 👋 – if you’re just testing out a swap or learning AMM mechanics, Dezswap could serve as a sandbox. Just keep the amounts tiny and be ready for possible loss.

katie littlewood

December 11 2024Indeed, the platform can act as a low‑stakes playground, but let’s be crystal clear: the trading experience will feel more like a roller‑coaster with wild swings due to the shallow liquidity. Therefore, set expectations low, monitor slippage, and consider it a learning exercise rather than a profit‑making venture.

Jenae Lawler

December 15 2024While some may celebrate the novelty of a niche DEX, the empirical data suggests that without substantial liquidity, any purported advantage evaporates under market pressure.

Chad Fraser

December 19 2024Totally agree – if you’re just curious, give it a whirl, but don’t expect it to replace Uniswap for serious trading.

Parker Dixon

December 23 2024Interesting points all around. I’d add that the lack of fee structure disclosure could hide hidden costs, especially for low‑value swaps.

John Kinh

December 27 2024Yeah, mystery fees are the worst – you think you’re paying 0.3% and it ends up being double.

Sophie Sturdevant

December 31 2024From a strategic perspective, the absence of a governance token eliminates any incentive alignment between users and developers, which is a red flag for long‑term sustainability.

Jan B.

January 4 2025Exactly. No token, no stakes, no community.

MARLIN RIVERA

January 8 2025The whole concept is a cash‑grab for the devs. If they cared about security, they would have published an audit by now.

Debby Haime

January 12 2025I hear you. Transparency is the cornerstone of trust in DeFi, and without it, the platform’s credibility is severely compromised.

emmanuel omari

January 16 2025Honestly, the main issue is that the developers seem to think a low‑TVL DEX can somehow compete with the deep‑liquidity giants without any innovative protocol upgrades – that’s naive.

Andy Cox

January 20 2025True, they’d need a unique hook to attract liquidity, otherwise it’s just another dead‑end project.

Courtney Winq-Microblading

January 25 2025Philosophically speaking, the existence of such niche DEXs underscores the experimental nature of the crypto ecosystem – they serve as testbeds, albeit risky ones.

Jayne McCann

January 29 2025Maybe, but most users need practical utility, not philosophical musings.

Richard Herman

February 2 2025I think it’s fine as long as people treat it as a sandbox and keep expectations realistic.

celester Johnson

February 6 2025Sure, the “sandbox” narrative is convenient, but it also cloaks the fact that many users get burned because they don’t read the fine print.

Prince Chaudhary

February 10 2025Respectfully, I’d advise newcomers to start with well‑audited DEXs and only experiment on platforms like Dezswap after gaining sufficient knowledge.

Oreoluwa Towoju

February 14 2025Good advice – keep trades small and stay informed.

Jason Brittin

February 18 2025Yeah, because nothing says “learning experience” like losing half your capital on a $100 swap. 🙄