$SUP Token – All You Need to Know

When talking about $SUP token, a community‑driven utility token on the Binance Smart Chain that rewards holders through staking and fee sharing. Also known as SUP, it encompasses tokenomics, the supply limits, distribution schedule, and reward formulas that shape a token’s economic behavior. Understanding these tokenomics is crucial because they determine how price signals react to market demand. Airdrop, a free distribution event that uses smart contracts to allocate tokens to eligible wallets is the next big move for $SUP, and it requires clear eligibility rules and a secure claim process. Meanwhile, crypto tax, the legal framework that governs how token gains are reported and taxed influences every holder’s decision to claim or trade. In short, the $SUP token sits at the intersection of tokenomics, airdrop mechanics, and tax compliance, creating a web of relationships that any investor should map out before jumping in.

How Tokenomics, Airdrops, and Tax Rules Interact

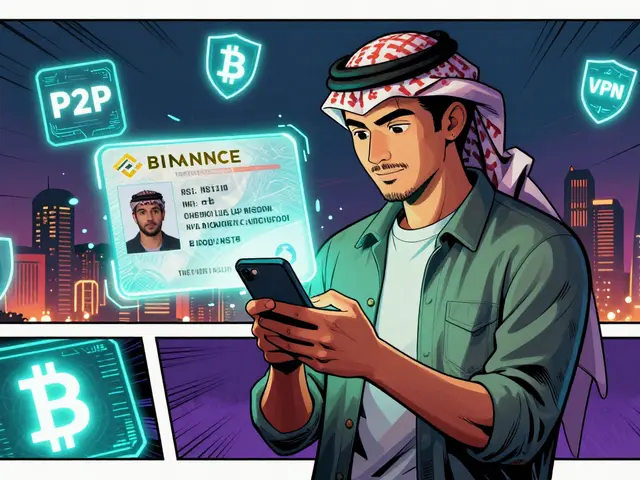

The core of $SUP’s value lies in its tokenomics. A capped supply of 100 million tokens, a 2% weekly rebase, and a 5% fee on each transfer that feeds a reward pool create a predictable inflation model. This model influences the airdrop size because the same fee pool can be earmarked for future free token drops, giving early participants a larger slice. Conversely, a poorly designed airdrop can flood the market, diluting token value and upsetting the rebase schedule. That’s why the upcoming airdrop, planned for Q4 2025 and targeting holders with a minimum of 500 $SUP incorporates a lock‑up period to protect the rebase equilibrium. On the tax side, crypto tax, rules such as the 2025 Form 1099‑DA in the US that require reporting of airdrop receipts as ordinary income add another layer of complexity. If you claim the airdrop, you’ll need to record the fair market value on the claim date, which then feeds into your annual tax return. Ignoring this step can trigger penalties, so many savvy traders use tax‑tracking software to automatically capture airdrop events and adjust their cost basis for future trades.

Beyond tokenomics, airdrop mechanics, and tax compliance, the $SUP ecosystem also touches on blockchain privacy, techniques like address mixing and zero‑knowledge proofs that hide transaction details. Privacy tools can mask airdrop receipts, but regulators are tightening rules around anonymous transfers, making transparency a must‑have for tax reporting. Likewise, exchange fees, the cost structure of platforms where $SUP trades directly affect net returns after airdrop rewards are added. Lower fees mean higher effective yields from the rebase, while high fees can erode the advantage of the token’s built‑in reward system. All these pieces—tokenomics, airdrop scheduling, tax obligations, privacy considerations, and exchange costs—form a tightly knit network that defines the real value you can extract from $SUP. Below you’ll find a curated set of articles that dive deeper into each of these topics, giving you the tools to make informed decisions and maximize your stake in the $SUP community.

An in‑depth review of Superp crypto exchange covering its perpetual products, $SUP token utility, ultra‑high leverage, risk‑management, and how it stacks up against rivals.

Continue Reading