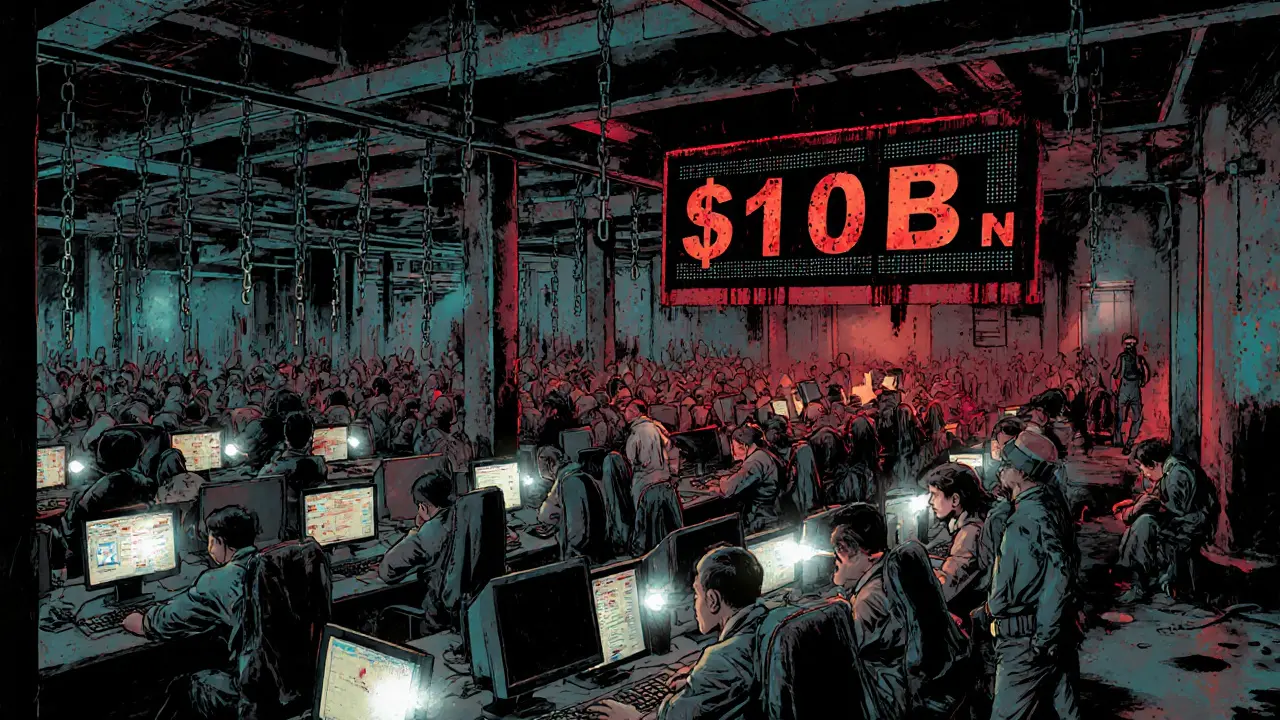

Myanmar Crypto Scam Networks: How $10 Billion in Fraud Operations Operate and Who’s Behind Them

Over $10 billion vanished from American bank accounts in 2024-not through hacking, not through market crashes, but through carefully crafted lies told over text messages and dating apps. The money didn’t disappear into thin air. It flowed into criminal networks based in Shwe Kokko, a lawless border town in Myanmar, where thousands of people are forced to run scams under threat of violence. This isn’t some underground operation. It’s a multi-billion-dollar industry, protected by armed militias, fueled by cryptocurrency, and now targeted by the U.S. government like a war zone.

How the Scams Work: Love, Trust, and Then the Bitcoin Request

It starts with a message. A photo of someone attractive. A kind word. A shared interest. Maybe it’s on Tinder. Maybe it’s WhatsApp. Maybe it’s a Facebook message from someone who claims to be a military engineer or a cryptocurrency trader living abroad. They build trust over weeks-sometimes months. They share stories. They listen. They make you feel seen.

Then comes the pitch.

"I found a way to make 30% monthly returns on Bitcoin. It’s a private fund. Only a few people know about it. I’ll send you the link. Just invest $5,000 and see for yourself."

That link leads to a fake crypto platform. It looks real. The charts move. The balances update. You see your $5,000 grow to $6,500. Then $10,000. You invest more. $10,000. $50,000. Maybe even $200,000. You tell your friends. You borrow money. You sell your car. You think you’re smart. You think you’ve found a golden ticket.

Then the platform goes dark. The person you loved stops replying. Your money is gone.

This isn’t a one-off. The FBI says crypto scams jumped 66% in 2024, and nearly two-thirds of those losses came from Myanmar-based operations. These aren’t random hackers. They’re organized, trained, and supervised. The scam centers in Shwe Kokko operate like factories-with managers, call centers, and performance targets. Victims are assigned to teams. Scripts are updated weekly. Psychological profiling is used to pick the most vulnerable.

The Human Cost: Victims on Both Sides

Here’s what most people don’t realize: the scammers are also victims.

Thousands of people-mostly from China, Southeast Asia, and even the U.S.-are lured with fake job ads. "Work from home. High salary. No experience needed." They fly to Thailand, cross the border into Myanmar, and are handed a phone and a script. They’re told they’re working in tech support or marketing.

Then the doors lock.

They’re told they owe $10,000 for their flight, food, and "training." They’re beaten if they don’t meet daily quotas. They’re forced to sleep in crowded dorms. Some are threatened with sexual violence. Others are sold to other gangs. If they try to escape, their families are threatened. Many die trying to flee.

The U.S. Treasury calls this modern slavery. And they’re right. In September 2025, the U.S. imposed sanctions on 19 entities and individuals tied to these operations-not just for fraud, but for human trafficking, forced labor, and abuse. This is the first time the U.S. has used human rights sanctions to shut down a crypto scam network.

Who’s Running This? The Names Behind the Scams

The U.S. Treasury didn’t just freeze bank accounts. They named names.

Among the sanctioned: Tin Win, Saw Min Min Oo, and She Zhijang-key operators in the Shwe Kokko scam hubs. Also targeted: companies like Chit Linn Myaing Co., Yatai International Holdings Group, and Myanmar Yatai International Holding Group Co. These aren’t shell companies. They own buildings, vehicles, and even luxury hotels in the area. They launder money through fake mining operations, car dealerships, and casinos.

The Karen National Army (KNA), a rebel group controlling the Shwe Kokko region, protects these operations. In exchange for cash payments and weapons, the KNA provides security, blocks police raids, and ensures no one escapes. This isn’t corruption. It’s a business partnership between criminals and armed insurgents.

Compare this to North Korean crypto hackers or Nigerian romance scammers. Those groups are brutal-but they’re decentralized. Myanmar’s operation is industrialized. It’s a state-within-a-state. And it’s growing.

Why Myanmar? The Perfect Storm

Why here? Why now?

After the 2021 military coup, Myanmar collapsed into chaos. The government lost control of large border regions. The KNA filled the vacuum. With no police, no courts, no taxes, and no oversight, criminals moved in. The region became a haven.

Plus, the geography helps. Shwe Kokko sits right on the Thai border. Workers are smuggled in from Thailand. Money flows out through Thai banks. Crypto exchanges in Singapore and Dubai process the transactions. The U.S. can sanction a company in Myanmar-but it can’t shut down a server in Dubai or freeze a Thai bank account without international cooperation.

And cryptocurrency? It’s the perfect tool. No ID needed. No paper trail. Instant global transfer. Once the money leaves a victim’s account, it’s split across dozens of wallets, mixed through tumblers, and converted into stablecoins. Tracing it is nearly impossible.

What the U.S. Did-and What’s Still Missing

The September 2025 sanctions were historic. For the first time, the U.S. used four different executive orders at once:

- E.O. 13851-to target transnational criminal organizations

- E.O. 13694-to punish malicious cyber activity

- E.O. 13818-to punish human rights abusers

- E.O. 14014-to address threats to Burma’s stability

They froze assets. Blocked U.S. transactions. Cut off access to the global financial system.

But here’s the problem: the scammers don’t need U.S. banks. They use Chinese payment apps, Thai crypto kiosks, and offshore exchanges in the Caribbean. The real money isn’t in the U.S. It’s in crypto wallets controlled by people in Cambodia, Laos, and the Philippines.

And the victims? They’re still trapped. The U.S. can’t send troops into Myanmar. They can’t raid compounds. They can’t rescue the workers. All they can do is cut off money-and hope it hurts enough to make the operators run.

Experts say the sanctions will slow things down-but not stop them. The networks will just move. Maybe to Cambodia. Maybe to Laos. Maybe to a new town in Myanmar. The business model is too profitable. And the demand? Still growing.

How to Protect Yourself

Here’s the hard truth: no app, no filter, no algorithm can stop a scammer who spends six months building your trust.

But you can protect yourself:

- Never invest based on a message from someone you met online. Not even if they seem real. Not even if they send you screenshots.

- Verify every crypto platform. If it’s not on CoinMarketCap or CoinGecko, it’s fake.

- Ask yourself: Why would a stranger tell you about a secret investment? If it were real, they’d keep it to themselves.

- Watch for pressure tactics. "This offer expires in 24 hours." "Only 3 spots left." That’s how they trigger fear and greed.

- Report it. If you think you’ve been targeted, go to IC3.gov and file a report. Even if you didn’t lose money yet.

And if someone you know is sending money to a crypto site they met online? Talk to them. Not with anger. Not with judgment. With concern. Because the scammers don’t just steal money. They steal trust. And that’s harder to get back.

What Comes Next?

The U.S. says more sanctions are coming. Thailand is under pressure to crack down on border crossings. The Financial Crimes Enforcement Network (FinCEN) is preparing rules to label Cambodia as a high-risk money laundering zone.

But real change won’t come from sanctions alone. It’ll come when countries stop treating this as a cybercrime issue and start treating it as a humanitarian crisis. When banks stop ignoring transactions from known scam zones. When tech companies stop letting fake profiles thrive on their platforms. When people stop believing that love can be found on a dating app-and then turned into a payday.

For now, the $10 billion is gone. The scammers are still operating. And the workers? They’re still locked inside.

How much money have Myanmar crypto scams stolen from Americans?

In 2024 alone, victims in the U.S. lost nearly $10 billion to cryptocurrency scams run from Myanmar, according to the FBI and U.S. Treasury. That’s a 66% increase from the year before, making it the largest source of crypto fraud globally.

Where are these scam operations located?

The main hub is Shwe Kokko, a town on Myanmar’s border with Thailand. This area is controlled by the Karen National Army, which protects the scam centers in exchange for payments and weapons. Similar operations exist in other border zones and in neighboring Cambodia.

Are the scammers themselves victims?

Yes. Thousands of people are lured with fake job offers, then forced to run scams under threats of violence, debt bondage, and sexual abuse. The U.S. government has sanctioned these operations not just for fraud, but for human trafficking and forced labor.

What did the U.S. government do about it?

In September 2025, the U.S. Treasury’s OFAC imposed sanctions on 19 individuals and companies linked to the scams, including key operators like She Zhijang and Chit Linn Myaing Co. They froze assets, blocked U.S. transactions, and used human rights laws to target the abuse of workers.

Can I recover my money if I’ve been scammed?

It’s extremely rare. Cryptocurrency transactions are irreversible. Once funds leave your wallet and enter the scam network’s system, they’re quickly moved, mixed, and converted across multiple wallets and jurisdictions. Reporting the scam to IC3.gov helps authorities track patterns-but recovery is unlikely.

How do I know if a crypto investment is real?

Real investments don’t come from strangers on dating apps. Check if the platform is listed on CoinMarketCap or CoinGecko. Look for audits from reputable firms like CertiK or SlowMist. Never invest based on promises of guaranteed returns. If it sounds too good to be true, it is.

Why hasn’t Myanmar shut these operations down?

Myanmar has been in chaos since the 2021 military coup. The central government doesn’t control large parts of the country, especially border regions like Shwe Kokko. These areas are run by armed groups like the Karen National Army, which profit from the scams and actively block any attempts to shut them down.

29 Comments

Matthew Affrunti

November 2 2025This is one of the most important stories I've read all year. Not just because of the money lost, but because of the human cost. These aren't just 'scams'-they're modern slavery operations disguised as romance. We need to treat this like a public health crisis, not just a financial one.

Education is our best defense. Teach people how these scams work in schools. Talk about emotional manipulation like we talk about phishing emails. The scammers win because they exploit loneliness, not ignorance.

And if you know someone who's been targeted? Don't shame them. Sit with them. Listen. Recovery starts with compassion, not blame.

Masechaba Setona

November 3 2025Oh please. 😒 Like the U.S. has clean hands here. You sanction a few bad actors while your own banks launder billions through shell companies in Delaware and Nevada. You call this slavery? What about the prison-industrial complex? The wage theft? The opioid epidemic you let fester for decades?

This is just a distraction. A shiny object so you don’t have to look at your own house on fire. 🤷♀️

mark Hayes

November 3 2025Man. I just read this and my chest feels tight.

These people running the scams? They're trapped too. That’s the real horror. It’s not just victims and villains-it’s victims all around.

And the fact that the U.S. used human rights sanctions? That’s huge. Maybe this is the start of something real. We need more pressure on Thailand, Cambodia, and the crypto exchanges that turn a blind eye.

Also-please, if you’re reading this and you’ve ever sent crypto to someone you met online… you’re not alone. Talk to someone. You’re not stupid. You were manipulated. 💔

Derek Hardman

November 4 2025This is a chilling and meticulously documented account. The convergence of transnational crime, humanitarian abuse, and cryptographic anonymity represents one of the most complex challenges of the 21st century. The use of multiple executive orders to target both financial and human rights violations is legally unprecedented and morally necessary.

However, the efficacy of sanctions remains questionable without multilateral enforcement. The absence of cooperation from regional actors-particularly Thailand and Cambodia-undermines the entire strategy. Diplomatic pressure must now be paired with technical intervention: blockchain analysis, KYC enforcement on non-U.S. exchanges, and coordinated asset recovery protocols.

Eliane Karp Toledo

November 5 2025Wait-so the U.S. government is suddenly concerned about 'human trafficking'? 🤔

Let me guess… this is all just a cover to justify more surveillance, more sanctions, more war in Southeast Asia. You think they didn't know about this for years? They knew. They let it grow. Why? Because crypto scams are a perfect excuse to destabilize China's influence in the region. The 'victims' are pawns. The real game is geopolitical.

And don't tell me about 'sanctions'-those only hurt ordinary people. The real operators? They've got Swiss accounts, Panamanian trusts, and backdoors in every major exchange. This is theater. 💀

Phyllis Nordquist

November 6 2025Thank you for this comprehensive and sobering analysis. The integration of psychological manipulation with technological infrastructure is a disturbing evolution of fraud. The fact that victims are coerced into becoming perpetrators creates a tragic cycle that demands a multidisciplinary response: law enforcement, mental health support, international financial regulation, and digital literacy initiatives.

It is imperative that platforms like WhatsApp, Facebook, and Tinder implement real-time behavioral detection algorithms-not just keyword filters-to identify grooming patterns. The responsibility extends beyond individual vigilance to systemic accountability.

Additionally, the lack of recovery mechanisms for victims underscores the urgent need for a global crypto insurance fund, backed by regulated exchanges and supported by sovereign states.

Eric Redman

November 6 2025Bro. I just saw a post on TikTok where some girl said her boyfriend 'invested $200k in Bitcoin' and then vanished. She’s 19. She thought he was her soulmate.

And now? She’s crying in a DM asking if she can get it back.

It’s not just 'scams.' It’s emotional terrorism. These people don’t just steal money-they steal your belief in love. And that’s worse.

Also-why is no one talking about how the U.S. government lets crypto exchanges operate like the Wild West? If this was a bank, they’d be shut down in a week.

Jason Coe

November 6 2025Look, I’ve worked in fintech for over a decade. I’ve seen this coming for years. The real issue isn’t Myanmar-it’s the global crypto ecosystem’s complete lack of accountability. Every exchange that allows anonymous deposits, every wallet provider that doesn’t require KYC, every stablecoin issuer that operates in offshore zones-they’re all enablers.

The scammers aren’t geniuses. They’re just exploiting a system designed to be opaque. The U.S. sanctions are symbolic. Real change would mean forcing every crypto platform-no matter where they’re based-to comply with FATF guidelines. That’s it. No more loopholes.

And the people inside those compounds? They need more than sanctions. They need rescue missions. Humanitarian corridors. International pressure on the Karen National Army isn’t enough-it needs to be backed by real action. Not just words on a press release.

We keep treating this like a crime problem. It’s a war. And we’re losing because we won’t admit it.

Brett Benton

November 7 2025I’ve been to Thailand. I’ve seen the border towns. The vibe? Pure chaos. No cops. No rules. Just dudes in flip-flops running crypto kiosks next to noodle stalls.

And here’s the thing-most Americans have no idea how easy it is to get into Myanmar now. Fake visas. Smugglers. $500 and a passport photo and boom-you’re in a cage with 12 other people, forced to text strangers for 16 hours a day.

These aren’t just 'scammers.' They’re indentured laborers. And the fact that the U.S. finally called it slavery? That’s a win. But it’s too late for most of them.

Also-why is no one talking about how TikTok and Instagram algorithms push these scams to lonely people? The scammers don’t even need to be smart. They just need to be in the right feed.

David Roberts

November 9 2025The structural analysis here is superficial. The core issue is the failure of the Bretton Woods 2.0 architecture to accommodate decentralized asset flows. The USD’s hegemony is being undermined by non-sovereign crypto ecosystems, and the U.S. response is reactive, not systemic.

Furthermore, the Karen National Army’s role is not merely protective-it’s symbiotic. Their governance model is proto-state capitalism: extractive, violent, and institutionally embedded. The sanctions target symptoms, not the epistemic framework enabling the operation.

Until we address the ontological shift from fiat to algorithmic trust, this will metastasize. The problem isn’t Myanmar. It’s the collapse of institutional legitimacy in the digital age.

Monty Tran

November 9 2025Everyone’s acting like this is new. It’s not. This has been happening since 2018. The FBI had reports. The Treasury knew. But nobody wanted to touch it because it involved China. Now they’re making it a 'human rights' issue to look good.

And don’t get me started on the 'love scam' narrative. People get scammed because they’re gullible. Stop pretending it’s not their fault. If you send money to someone you met online-you’re not a victim. You’re a liability.

Sanctions won’t fix this. Education won’t fix this. Only consequences will. And we’re not giving any.

Beth Devine

November 11 2025I work with survivors of financial abuse. What struck me most is how the language of love is weaponized. The scammers don’t just take money-they take identity. Victims often feel ashamed, isolated, and broken. They don’t come forward because they think they’re the problem.

We need crisis centers that specialize in crypto trauma. Not just financial advice. Therapy. Community. A place where people can say, 'I believed someone who lied to me'-and not be judged.

This isn’t just about Bitcoin. It’s about how lonely we’ve become in a world that sells connection as a product.

Brian McElfresh

November 12 2025Here’s what no one’s saying: the U.S. government is using this to justify a military presence in Southeast Asia. Sanctions? That’s just the first step. Next they’ll send 'advisors.' Then drones. Then special ops.

And the real target? China. They’re blaming Myanmar because they can’t touch Beijing. This is all about containment. The 'slavery' angle? Just propaganda to get public support.

Also-did you know most of these 'victims' are Chinese nationals? That’s why China won’t say a word. They don’t want to admit their own citizens are involved. And the U.S.? They’re happy to let them suffer.

Hanna Kruizinga

November 12 2025Ugh. I’m so tired of this. Why do we keep acting like this is some new phenomenon? Romance scams have been around since the 1980s. First it was letters. Then emails. Then Facebook. Now it’s dating apps.

The only thing that changed is the money. Back then you lost $500. Now you lose $200k because crypto is easy to move and impossible to trace.

And the real tragedy? The people running the scams are just as trapped as the victims. It’s not evil. It’s desperation. The system is rigged. Everyone’s a pawn.

But we keep blaming the victims. And the scammers. And the governments. Nobody wants to look at the real culprit: capitalism.

David James

November 14 2025I’ve been in the military. I’ve seen what happens when a place falls apart. No government. No police. No rules. That’s when the monsters come out.

This isn’t just about crypto. It’s about what happens when a country collapses. The U.S. can’t fix Myanmar. But we can help Thailand crack down on border crossings. We can pressure Singapore to audit crypto flows. We can fund NGOs that rescue people from these compounds.

And if you’re reading this and you’ve ever sent money to someone online? You’re not alone. Talk to someone. You didn’t fail. You were targeted.

Let’s stop shaming. Let’s start saving.

Kaela Coren

November 15 2025The ethical dimensions of this crisis are profound. The weaponization of intimacy as a vector for financial exploitation represents a radical reconfiguration of trust economies in the digital age. The psychological profiling techniques employed mirror those used in intelligence operations, suggesting a level of institutional sophistication previously unseen in non-state criminal enterprises.

Furthermore, the use of cryptocurrency as a laundering mechanism is not incidental-it is structural. The absence of centralized control enables operational resilience. This necessitates a paradigm shift from reactive law enforcement to preemptive cryptographic forensics.

It is imperative that academic institutions establish interdisciplinary research programs to model the sociotechnical architecture of these networks. Without such analysis, policy responses will remain fragmented and ineffective.

alvin Bachtiar

November 17 2025Let’s be real. These scammers are the ultimate predators. They don’t just steal money-they steal your future. They make you feel like you’re the smartest person in the room while they’re counting your cash. And then? They ghost you.

But here’s the twist: the people trapped in those compounds? They’re not monsters. They’re broken. Beaten. Forced to lie to strangers every day. Some of them are teenagers. Some are ex-military. Some are college grads tricked with fake job offers.

And the U.S.? They’re still treating this like a financial crime. It’s not. It’s a psychological war. And we’re losing because we refuse to see the human cost.

Also-why are we still letting exchanges like Binance and KuCoin operate without KYC? That’s the real loophole. Fix that, and you cut the head off the snake.

Josh Serum

November 17 2025People are so naive. You think a stranger on Tinder is going to share a secret investment with you? That’s not romance-that’s stupidity. You get scammed because you want to believe. You want to be rich. You want to be loved. So you ignore every red flag.

And now you want the government to fix it? Nah. You need to fix yourself. Stop chasing get-rich-quick schemes. Stop trusting people you met online. Stop being a sucker.

And for the love of God, if you’ve lost money? Don’t cry on Reddit. Learn. Grow. Move on.

There’s no victim here. Just bad decisions.

DeeDee Kallam

November 18 2025i just lost 80k and i feel so dumb but like… i thought he was my soulmate 😭 he said he was a crypto trader and he loved me and now he’s gone and i don’t know if he was real or not or if he was even real or just a bot??

can someone help me?? i just want to cry and not feel alone

Helen Hardman

November 18 2025I want to say something real: if you’ve been scammed, you’re not weak. You’re human.

I’ve worked in tech for 15 years. I’ve seen people lose everything-not because they were greedy, but because they were lonely. The scammers don’t target the rich. They target the quiet ones. The ones who work late. The ones who don’t have friends. The ones who just want someone to say, 'I see you.'

And now? You feel ashamed. Like you should’ve known.

But here’s the truth: you didn’t fail. You were targeted by a machine designed to break you.

Don’t hide. Don’t silence yourself. Talk to someone. Join a support group. You’re not alone. And this? This isn’t your fault.

And to the people trapped in those compounds? We see you. We’re fighting for you too.

Elizabeth Melendez

November 18 2025This is the most important article I’ve read in years. The fact that the U.S. used human rights sanctions to target a crypto scam network? That’s historic. It means they finally understand: this isn’t just fraud. It’s slavery.

But here’s what’s missing: the victims need legal representation. They need pathways to citizenship. They need trauma-informed care. Sanctions don’t bring people home. They don’t heal broken minds.

What we need is a global task force-not just to freeze assets, but to rescue people. To give them shelter. To help them rebuild. Because money can be replaced. Trust can’t.

And if you’re reading this and you’ve ever been lied to by someone you loved? You’re not broken. You’re brave. Keep going.

Genevieve Rachal

November 20 2025Oh wow. Another 'human trafficking' narrative to make you feel guilty for using crypto. 🙄

Let’s be honest: 90% of these 'victims' are middle-aged men who fell for a hot girl on Tinder. And the 'scammers'? They’re just poor people trying to survive in a broken system. You think they want to do this? No. But they’re trapped. Just like the people who lost money.

So who’s the real villain? The guy texting 'I love you' to make rent? Or the system that made him choose between starvation and lies?

Stop pretending this is about justice. It’s about control. And you’re just the pawn.

Debby Ananda

November 21 2025How quaint. The U.S. finally deigns to care about 'human rights'-but only when it intersects with crypto. How very… performative. 🫠

Meanwhile, the real atrocities? The ones in Gaza. The ones in Sudan. The ones where children are dying from starvation because of Western arms deals? No sanctions there. No headlines.

This is not justice. It’s aesthetic outrage. A PR campaign dressed in ethical language to make you feel like you’re part of something noble.

Meanwhile, the scammers? They’re just doing business. And the real power? They’re still laughing.

Vicki Fletcher

November 21 2025Thank you for writing this with such care. The emotional intelligence in this piece is rare. I’ve worked with survivors of domestic abuse, and the parallels are chilling: isolation, gaslighting, escalating dependency, then sudden disappearance.

The only difference? This abuse happens over a screen.

I’m sharing this with every community group I know. We need to teach digital emotional literacy. Not just 'don’t click links'-but 'how to recognize when someone is trying to own your heart.'

And to anyone reading this who’s been hurt: you are not broken. You are beloved. And you are not alone.

Nadiya Edwards

November 22 2025Let’s not pretend this is about 'love.' This is about American entitlement. People think they deserve to be rich without working. So they fall for 'guaranteed returns' from strangers. And now they want the government to bail them out?

Meanwhile, real Americans are working two jobs, paying for healthcare, and trying to raise kids. And you’re crying because you sent $50k to a 'crypto trader' you met on Instagram?

Stop acting like a victim. Start acting like an adult.

And if you think the U.S. should send troops into Myanmar? You’re delusional. This isn’t a war. It’s a consequence.

Matthew Affrunti

November 23 2025I just read the comment from the person who lost $80k. I’m so sorry. You didn’t do anything wrong. You believed in love. That’s not stupid. That’s brave.

And to everyone else: if you’re judging them-you’ve never been lonely. Not really.

We need to stop calling them 'victims' like it’s a weakness. They’re survivors. And we owe them more than pity. We owe them action.

Eric Redman

November 25 2025That’s the thing no one says: the scammers are the ones who get paid in food and a cot. The victims? They’re the ones who lose everything.

And the people who say 'they should’ve known'? You’ve never been alone. You’ve never been told you’re special. You’ve never been lied to by someone who made you feel like you mattered.

That’s the real crime.

Beth Devine

November 25 2025Thank you for saying that. I’ve been there. I lost $120k. I thought I was falling in love. I didn’t realize I was being groomed like a hostage.

It took me two years to stop blaming myself. And now? I run a support group for survivors. We meet every Tuesday. No judgment. Just listening.

You’re not alone. I promise.

Phyllis Nordquist

November 25 2025It’s not enough to feel sorry. We need systemic change. Financial institutions must be required to flag and freeze transactions that match known scam patterns-regardless of jurisdiction. Crypto exchanges must be held liable for facilitating transactions from sanctioned zones.

And we must fund international task forces with real authority-not just symbolic sanctions. Rescue operations require boots on the ground, intelligence sharing, and diplomatic leverage.

This is not a criminal justice issue. It is a moral imperative.