NAMA Protocol Airdrop by Nama Finance: What Actually Happened and Who Got Paid

There’s a lot of confusion online about a NAMA airdrop from Nama Finance. You’ve probably seen headlines, Twitter threads, or Discord posts claiming you missed out on free tokens. But here’s the truth: Nama Finance never ran a major airdrop. What you’re thinking of is probably Namada - a completely different project with a similar name, and a real, massive token distribution that’s already over.

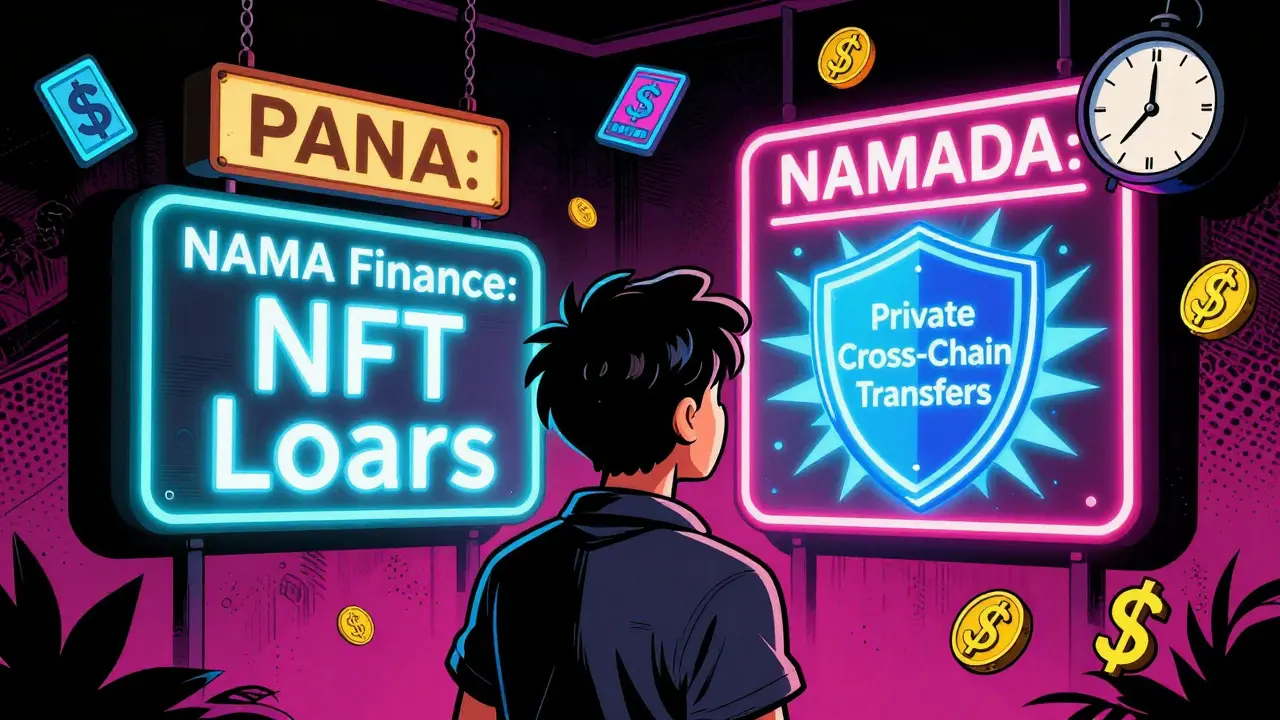

Why Everyone’s Mixing Up NAMA and NAM

The names are too close. Nama Finance. Namada. NAMA. NAM. It’s easy to typo, scroll past, or misremember. But these are two totally separate blockchains with different goals, teams, and token models.Nama Finance is an NFT lending protocol. Think of it like a pawn shop for digital art. If you own a BAYC or a Top Shot moment, you can lock it up as collateral and get a loan in USDC or DAI. The platform rewards lenders and borrowers with its own token, NAMA. But as of January 2026, NAMA has no trading volume. No price. No liquidity. CoinMarketCap lists it at $0. That doesn’t mean it’s dead - but it does mean there’s no public market for it, and no evidence of a broad airdrop ever happening.

Meanwhile, Namada (NAM) is a privacy-focused blockchain built to let you send any asset - Bitcoin, Ethereum, Cosmos tokens, even NFTs - completely anonymously across chains. It uses advanced zero-knowledge tech to hide transaction details. In late 2024, they ran one of the biggest retroactive airdrops in crypto history: 65 million NAM tokens, worth roughly $130 million at the time, went to developers, researchers, Gitcoin donors, and even people who staked ATOM or OSMO before November 1, 2024.

If you held a BadKid NFT by November 14, 2024, you got between $200 and $300 in NAM tokens. If you contributed to Zcash or Rust open-source projects, you were eligible. The deadline to claim? December 28, 2024. It’s closed. No extensions. No second chances.

What Nama Finance Actually Offers (No Airdrop)

Nama Finance isn’t trying to give away tokens for free. It’s trying to build a market for NFT loans. Here’s how it works:- Borrowers: Lock up your ERC-721 or ERC-1155 NFTs (like CryptoPunks, Doodles, or Uniswap V3 LP tokens) and get a loan starting at $500. Interest rates begin at 5% per year. You keep your NFT until you repay.

- Lenders: Stake USDT, USDC, or DAI into lending pools. Earn interest from borrowers, plus bonus NAMA tokens as rewards. Some reports suggest up to 35% APY if you lend to high-demand NFTs.

- Repayment: Pay back the loan + interest, get your NFT back. Miss the deadline? Your NFT gets auctioned off.

The NAMA token is used for governance - if you hold it, you vote on interest rates, supported chains, and new NFT collections. But here’s the catch: you can’t buy it. You can’t trade it. You can only earn it by participating in the protocol. And even then, the token supply is locked. No public sale. No exchange listings. No liquidity.

The Namada Airdrop: Real, Big, and Finished

If you’re looking for a real airdrop story, look no further than Namada. Here’s what actually happened:- Token: NAM (not NAMA)

- Total Distributed: 65 million tokens (6.5% of total supply)

- Deadline: December 28, 2024 - now closed

- Eligibility: Open-source contributors to Zcash, Rust, ZKP, IBC, Gitcoin donors to privacy projects, ATOM/OSMO stakers with $100+ stake by November 1, BadKid NFT holders by November 14, and participants in the Namada Trusted Setup.

- Technology: Multi-Asset Shielded Pool (MASP) lets you send ANY asset privately across Cosmos, Ethereum, and beyond. Uses Cubic Proof-of-Stake to punish malicious validators with exponentially rising penalties.

Namada’s airdrop wasn’t a marketing gimmick. It was a direct payment to the people who built the tech. Christopher Goes, co-founder, said it was about "giving ownership back to the creators and supporters of those goods." That’s rare in crypto. Most airdrops go to wallet addresses with no real contribution. Namada paid builders.

What You Should Do Now

If you’re waiting for a Nama Finance airdrop - stop. There isn’t one. The project is still active, but its token isn’t tradable. Your only way to get NAMA is to lend or borrow on their platform. And even then, you’re not getting cash. You’re getting governance rights in a protocol with zero market value.If you missed the Namada airdrop? Too late. But you can still use Namada’s network. Download the wallet. Stake ATOM or OSMO. Send privacy-protected transactions. The protocol is live. The tech is real. The tokens are out there - just not free anymore.

Don’t fall for scam sites claiming to "claim your NAMA airdrop" or asking for your seed phrase. Those are phishing traps. Nama Finance doesn’t ask for private keys. Namada’s official claiming portal (rpgfdrop.namada.net) has been offline since December 2024. Any site offering to claim tokens now is a scam.

Key Takeaways

- Nama Finance (NAMA) has no public airdrop. Its token is not listed or traded.

- Namada (NAM) ran a 65M token airdrop - deadline passed on December 28, 2024.

- Don’t confuse NAMA with NAM. They’re different projects, different teams, different blockchains.

- Any website offering to help you claim NAMA tokens now is likely a scam.

- Namada’s tech is still active - you can use it to send private cross-chain transactions.

- Nama Finance’s NAMA token can only be earned by using its lending platform - not bought or traded.

What’s Next?

If you’re interested in NFT lending, watch Nama Finance. If you care about privacy on multi-chain networks, watch Namada. Neither is a quick cash grab. But one of them actually gave away real value to real contributors - and that’s worth remembering.Don’t chase airdrops that don’t exist. Focus on protocols that reward real work. That’s where the real long-term value is.

17 Comments

steven sun

January 22 2026bro i thought i got the nama airdrop but turns out i just misspelled namada again 😅

Arielle Hernandez

January 22 2026It is imperative to distinguish between these two distinct protocols, as the conflation of NAMA and Namada has led to widespread misinformation within the cryptocurrency community. Namada's retroactive airdrop was a landmark event in decentralized governance, whereas Nama Finance operates under a fundamentally different economic model with no public token distribution.

Mathew Finch

January 23 2026Of course the Americans are confused. You can't even spell 'privacy' without a dictionary. Namada's tech is years ahead of this NFT pawn shop nonsense.

Roshmi Chatterjee

January 25 2026I staked OSMO back in 2024 and got 200 NAM! It was life-changing. I bought my first laptop with it. But now I'm trying to figure out if Nama Finance is worth trying for lending. Anyone used it?

Deepu Verma

January 25 2026Hey Roshmi, if you're thinking about lending on Nama Finance, just start small. I lent 500 USDC on their platform last month and got 12 NAMA tokens as rewards. Not cash, but it feels good to support a real protocol. The interface is smooth too.

MICHELLE REICHARD

January 26 2026Of course someone would confuse NAMA with NAM. It’s the same reason people think Bitcoin is a currency and not a speculative asset. People don’t read. They just click 'claim now' on shady sites.

Bonnie Sands

January 27 2026This whole thing is a Fed operation. Nama Finance is a decoy to distract us from the real airdrop that got buried. Namada? Nah. That was a psyop to get people to stake ATOM so they could monitor wallets. They’re tracking everyone.

Jennifer Duke

January 29 2026I mean, I get why people mix them up - the names are so similar. But honestly, if you can’t tell the difference between a privacy chain and an NFT lending protocol, maybe you shouldn’t be in crypto at all. Just saying.

Andy Marsland

January 30 2026Let’s be real - the entire crypto space is a pyramid scheme built on name confusion. Nama Finance? Namada? NAM? NAMA? It’s all the same. They just rebrand every six months and call it innovation. The real winners are the devs who cashed out during the 2021 hype, not the people who got ‘airdropped’ tokens they can’t trade. This post is just another attempt to make people feel dumb so they’ll keep chasing the next fake opportunity. Wake up.

Jeffrey Dufoe

February 1 2026So Namada paid people for helping build it? That’s actually cool. I’d rather earn something for real work than get free tokens just for having a wallet.

Jonny Lindva

February 2 2026Yeah, I tried Nama Finance last month. Borrowed against a CryptoPunk and got a loan in USDC. The interest was fine, and I got 8 NAMA tokens. No way to sell them yet, but I’m holding. At least it’s not a scam.

Jen Allanson

February 3 2026The ethical implications of token distribution in decentralized finance require rigorous scrutiny. Namada’s model, predicated upon meritocratic contribution, represents a normative ideal. Conversely, Nama Finance’s tokenomics, while technically sound, lack market liquidity and thus fail to achieve functional utility. One must ask: Is governance without liquidity truly governance?

Dave Ellender

February 5 2026I appreciate the clarity here. I almost sent my seed phrase to some site claiming to ‘claim NAMA.’ Glad I checked first.

Adam Fularz

February 6 2026Lmao. Nama Finance? Sounds like a startup that got funded by a guy who thought 'NFT' was a type of coffee. And Namada? More like Namada-something-else. Who even names these things?

Adam Lewkovitz

February 7 2026If you’re not American, you probably know the difference. We’re too busy scrolling TikTok to read whitepapers. Namada? Yeah, that’s the one the Europeans use. NAMA? That’s the one our uncle bought with his retirement money.

Barbara Rousseau-Osborn

February 8 2026I KNOW THIS IS A SCAM. They’re using the name confusion to steal wallets. I’ve seen 3 different phishing sites in the last week. They all say 'claim your NAMA' but the domain is namafinance[.]xyz - not even .io. They’re harvesting keys. DON’T CLICK ANYTHING.

Arnaud Landry

February 10 2026I don’t trust any of this. The whole crypto world is a CIA psyop. Namada’s ‘privacy tech’? That’s just a backdoor for surveillance. They’re tracking who held OSMO and now they’re targeting the ‘contributors.’ You think you got paid? You got tagged.