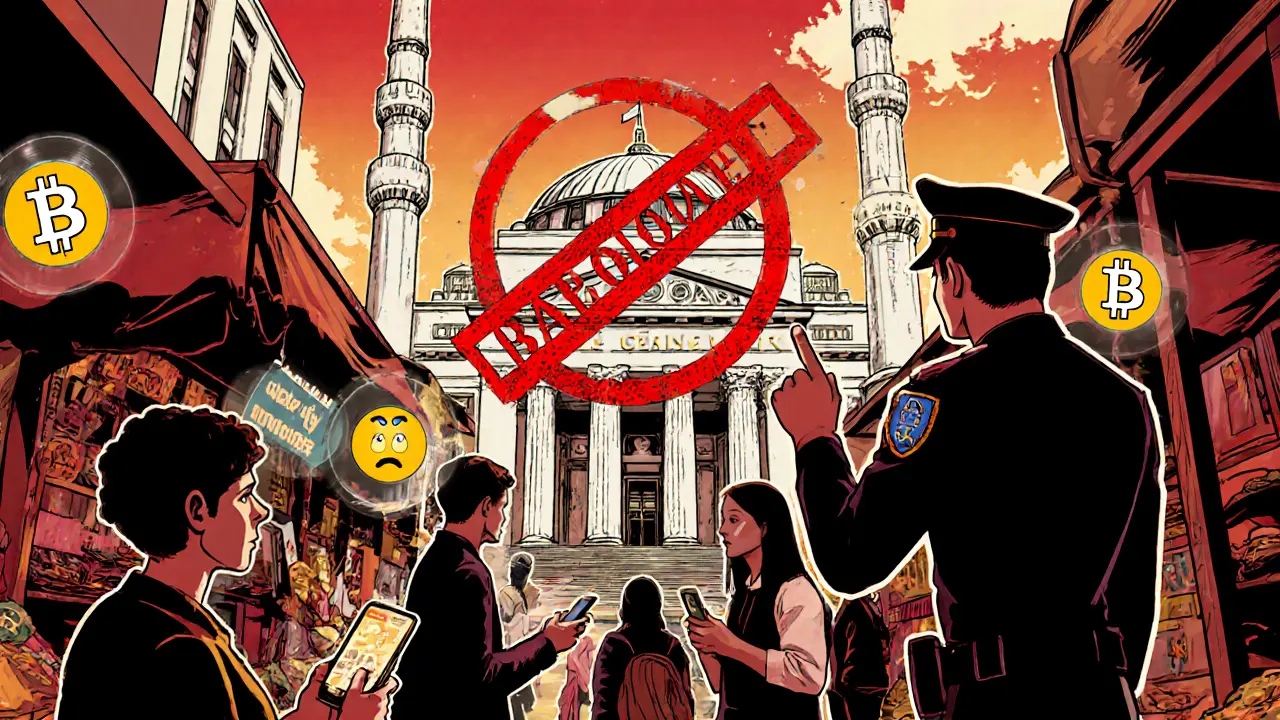

Turkey crypto regulation: how the 2024 law reshaped the market

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue ReadingWhen talking about Capital Markets Board, the official regulator that supervises securities, stock exchanges, and emerging crypto markets in many jurisdictions. Also known as CMB, it sets rules, enforces compliance, and protects investors. Securities Regulation is one of its core duties, meaning every public offering and trading activity must follow strict filing and disclosure standards. Financial Market Oversight expands that duty to include monitoring of market abuse, insider trading, and systemic risk across both traditional equities and digital assets. Finally, Crypto Exchange Compliance reflects the board’s growing focus on ensuring that decentralized platforms meet AML, KYC, and consumer protection rules. In short, the Capital Markets Board sits at the intersection of regulation, market integrity, and investor confidence.

The board’s mandate creates a clear chain of responsibility: it requires crypto exchanges to register, it influences securities firms to adopt transparent reporting, and it enables investors to trade with confidence. This three‑part relationship forms a semantic triple – Capital Markets Board enforces securities regulation, securities regulation guides market participants, and market participants benefit from financial market oversight. For example, when a new token launch seeks to be listed on a regulated exchange, the board checks that the token’s whitepaper meets disclosure standards, that the issuer passes AML screening, and that ongoing market surveillance will catch manipulation. The same logic applies to traditional stocks: any company filing for an IPO must submit audited financials, adhere to corporate governance codes, and accept periodic inspections.

Our collection below reflects how the board’s policies play out in real‑world scenarios. You’ll find reviews of crypto exchanges that have passed CMB compliance checks, deep dives into the latest securities regulation updates, and practical guides on meeting crypto‑exchange licensing requirements. Whether you’re a trader, a developer building a DeFi platform, or an investor curious about how regulation impacts price action, these pieces give you the context you need to navigate a regulated market landscape.

Explore how Turkey’s 2024 crypto law reshaped trading, licensing, and enforcement, and what it means for users and businesses.

Continue Reading