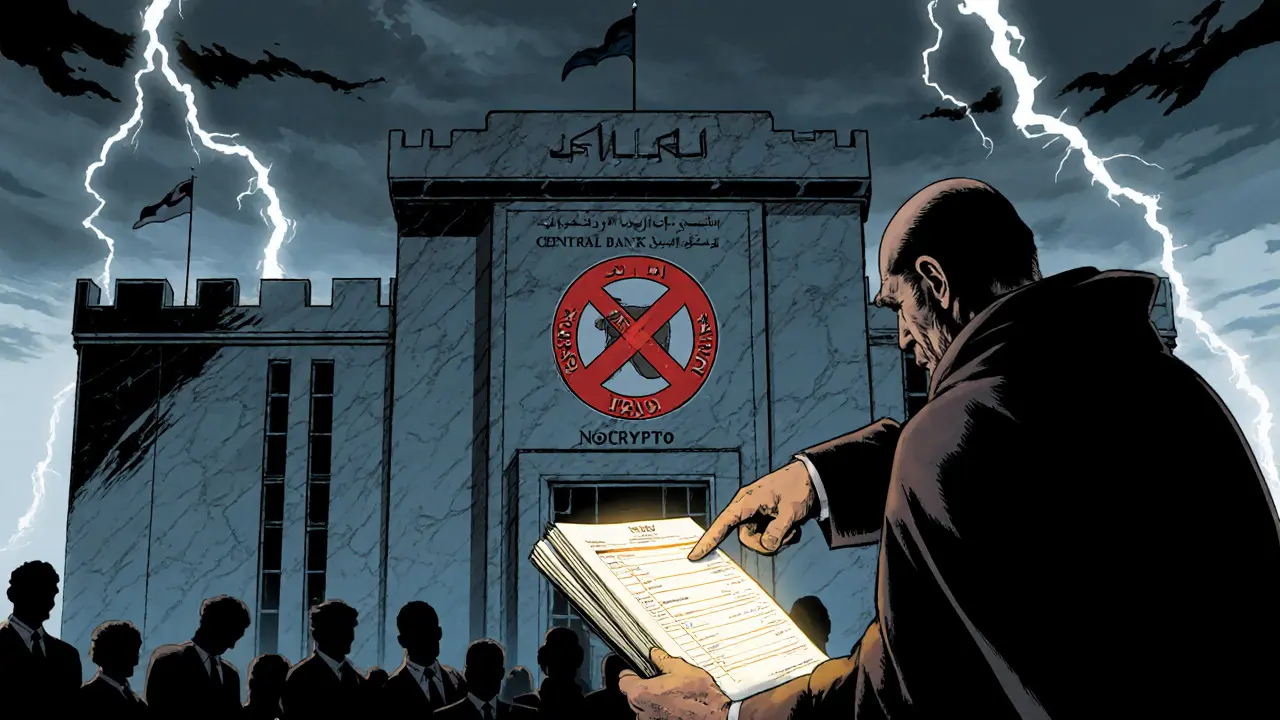

Understanding the Central Bank of Iraq's Crypto Restrictions and Future CBDC Plans

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue ReadingWhen you think about Central Bank of Iraq, the government institution responsible for issuing the Iraqi dinar and controlling monetary policy in Iraq. Also known as CBI, it sets interest rates, manages foreign reserves, and oversees commercial banks in a country where cash still dominates but digital currency interest is rising. Unlike the U.S. Federal Reserve or the European Central Bank, the CBI operates in a region with deep political shifts, sanctions history, and a population increasingly curious about alternatives to traditional banking.

While the Iraqi dinar remains the only legal tender, the CBI has repeatedly warned against cryptocurrency use, calling it risky and unregulated. Yet, in cities like Baghdad and Erbil, people still trade Bitcoin and Ethereum through peer-to-peer networks, often bypassing official channels. The CBI’s stance is clear: no crypto exchange is licensed, and banks are barred from handling digital asset transactions. This creates a gap between official policy and real-world behavior — a pattern seen in other emerging economies, like Turkey or Nigeria, where crypto adoption outpaces regulation.

What makes the CBI unique is its tight control over foreign currency inflows, especially from oil exports. It holds billions in U.S. dollars and euros, using them to stabilize the dinar’s value. But as global inflation and geopolitical tensions grow, pressure mounts to modernize. Some analysts believe the CBI may one day explore a central bank digital currency (CBDC), similar to what China or Nigeria are testing. Until then, the CBI remains a gatekeeper — not just of money, but of financial freedom for millions.

What you’ll find in the posts below isn’t a direct look at the CBI’s internal meetings — it’s the ripple effect of its policies. You’ll see how crypto traders in Iraq navigate its restrictions, how regional regulators like the FSA or SEC influence its thinking, and how global trends in blockchain and fiat control are shaping the next decade of finance in the Middle East. This isn’t just about one bank. It’s about how power, technology, and survival intersect in a country trying to hold onto its currency while the world moves on.

Explore Iraq's total crypto ban, the legal framework behind it, enforcement gaps, and the Central Bank's upcoming digital currency plans.

Continue Reading