Cryptify AI Tokenomics: How the Token Works, Who Controls It, and What It Really Offers

When you hear Cryptify AI tokenomics, the economic design behind a cryptocurrency token powered by artificial intelligence. Also known as AI-driven token structure, it defines how tokens are created, distributed, and used within a network. Unlike simple coins that just move value, tokenomics answers the hard questions: Who gets the tokens? How are they earned? What happens when demand changes? And most importantly—does this system actually work, or is it just a marketing slide?

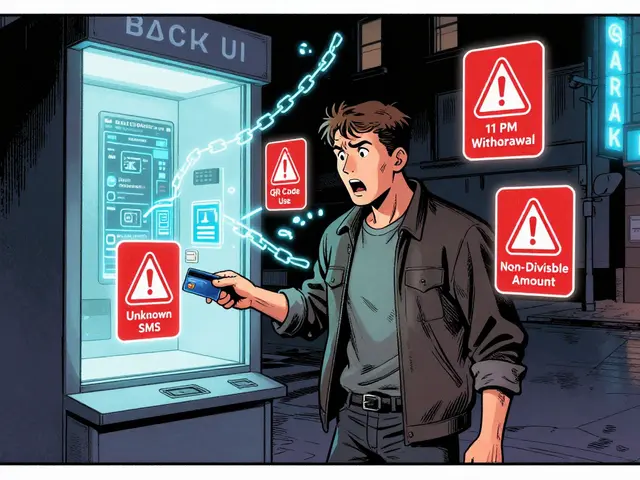

Most AI crypto projects claim to be revolutionary, but their tokenomics often reveal the truth. Take token distribution, how tokens are allocated among founders, investors, and the public. Also known as token allocation, it’s the first red flag or green light. If 40% goes to insiders with no vesting, you’re not investing in tech—you’re funding a private sale. token utility, what the token actually does inside the platform. Also known as functional token use, it’s what separates real projects from vaporware. Does it pay for AI processing? Vote on model updates? Access premium tools? Or is it just a placeholder for speculation? Real utility means the token isn’t just a ticker symbol—it’s a key to the system.

Then there’s crypto governance, who gets to decide changes to the protocol through token voting. Also known as token-based decision making, it’s the heartbeat of decentralized projects. If governance is locked in the hands of five wallets, it’s not decentralized—it’s a controlled experiment. Look for clear voting rules, proposal thresholds, and active participation. If no one’s voting, the system is dead on arrival. Cryptify AI’s tokenomics should show how these pieces fit: distribution that’s fair, utility that’s necessary, and governance that’s open. Without all three, you’re not holding a token—you’re holding a gamble.

What you’ll find below are real breakdowns of tokens that got it right—and those that didn’t. From hidden lockups to fake demand signals, these posts cut through the noise. You’ll see how whale wallets move markets, why zero-circulating-supply tokens are dead ends, and how governance tokens can actually give you power. This isn’t theory. It’s what’s happening in the wild. And if you’re thinking about Cryptify AI—or any AI crypto token—you need to know what’s underneath the hype.

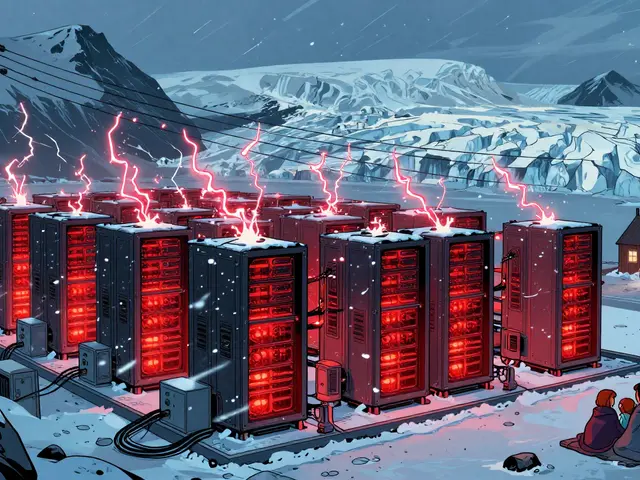

Cryptify AI (CRAI) is an Ethereum-based token powering an AI platform that tracks influencer marketing ROI in crypto. With renounced contract, staking rewards, and monthly buybacks, it's a high-risk, niche project with real utility but low adoption so far.

Continue Reading