Crypto Compliance Indonesia: Rules, Risks, and Practical Guidance

When navigating crypto compliance Indonesia, the set of legal and regulatory rules that govern crypto activities within the Indonesian jurisdiction. Also known as Indonesian crypto regulation, it demands strict anti‑money‑laundering (AML) procedures, tax reporting, and exchange licensing. AML requirements, mandatory customer due‑diligence and transaction monitoring are a core pillar, while exchange licensing, the government‑issued permit for operating a digital asset platform defines who can legally trade. Crypto tax obligations, annual reporting of gains and losses to the tax office complete the compliance picture. Understanding crypto compliance Indonesia is essential for anyone dealing with digital assets here.

Key Elements of Indonesian Crypto Compliance

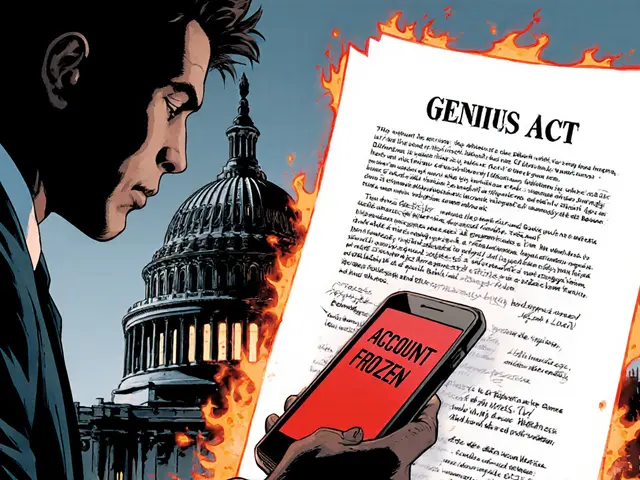

Indonesia’s primary regulator for digital assets is BAPPEBTI, the Commodity Futures Trading Authority. BAPPEBTI sets the licensing framework, enforces AML standards aligned with the Financial Action Task Force, and issues periodic guidance on tax treatment. For a crypto exchange, the compliance checklist starts with obtaining a valid BAPPEBTI license, implementing KYC (Know‑Your‑Customer) checks that capture identity, source of funds, and residence, and integrating real‑time transaction monitoring to flag suspicious activity. On the tax front, the Ministry of Finance requires every trader to report crypto gains on their annual tax return, using the same rates applied to other capital assets. Failure to file triggers fines that can reach up to 2% of the undeclared amount per month. Companies that overlook these steps often face shutdown orders, frozen accounts, or hefty penalties, proving that robust compliance is not optional but a business‑critical shield.

Beyond the mandatory rules, many projects adopt best‑practice standards to stay ahead of regulatory changes. This includes hiring a dedicated compliance officer, conducting periodic internal audits, and using third‑party AML SaaS tools that automate watch‑list screening and risk scoring. As Indonesia prepares to roll out a digital asset tax framework in 2026, staying informed now can save time and money later. Below you’ll find articles that break down each component—exchange licensing details, step‑by‑step AML implementation, tax filing guides, and real‑world case studies of Indonesian platforms that navigated the compliance maze successfully. Dive in to see how you can turn these requirements into a competitive advantage.

A detailed guide on Indonesia's 2025 crypto exchange licensing, covering the OJK regulatory shift, capital thresholds, step‑by‑step application, compliance, taxation, and future outlook.

Continue Reading