DeFi crypto: What it is, how it works, and why it’s changing finance

When you hear DeFi crypto, short for decentralized finance, it means financial services built on blockchain that don’t need banks or brokers. Also known as decentralized finance, it lets you lend, borrow, trade, and earn interest—all through code running on networks like Ethereum or Optimism. No middlemen. No paperwork. Just smart contracts doing the work.

That’s why smart contracts, self-executing agreements coded directly into blockchain. Also known as on-chain logic, they automatically handle trades, loans, and rewards when conditions are met are the backbone of DeFi. Platforms like Velodrome v3, a leading decentralized exchange on Optimism. Also known as Optimism DEX, it offers near-zero fees and high yields by using advanced liquidity models or SushiSwap V3, a top DeFi exchange with $4 billion locked in liquidity. Also known as AMM crypto, it lets users earn rewards just by providing trading pairs don’t hold your money—they just connect you to others who want to trade or lend. Your crypto stays in your wallet. That’s the whole point.

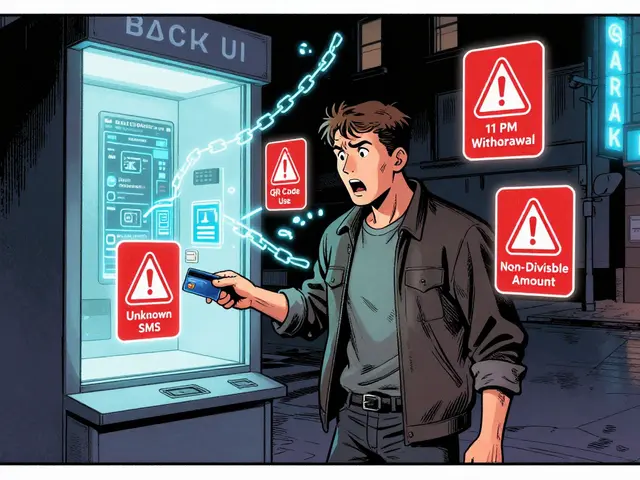

But DeFi isn’t all smooth sailing. You’ve got platforms like Parallel Finance, a Polkadot-based DeFi project that shut down and left users’ assets frozen. Also known as Polkadot exchange, it’s now a warning sign for anyone chasing high yields without checking the team’s track record. And then there are rug pulls, scams where developers vanish after pumping a token’s price. Also known as crypto exit scam, they’re why you need to check liquidity, team history, and audit reports before putting in a dime. DeFi gives you control—but only if you know what you’re doing.

This collection of posts cuts through the noise. You’ll find real reviews of DeFi exchanges, breakdowns of how yield works, and hard truths about failed projects. Some posts show you how to spot fake airdrops pretending to be DeFi rewards. Others explain why a token with zero circulating supply isn’t a coin—it’s a ghost. There’s no fluff here. Just what’s working, what’s broken, and what you need to know before you click ‘approve’ on your next transaction.

HUNNY FINANCE (HUNNY) was once a top DeFi yield optimizer on Binance Smart Chain, but its price has crashed over 99% since its peak. Learn its current status, risks, and why it's no longer a viable investment.

Continue Reading