Kraken Blocked Jurisdictions: A Clear Overview

When dealing with Kraken blocked jurisdictions, the specific list of nations where Kraken cannot offer its services because local laws prohibit or heavily restrict crypto trading. Also known as Kraken prohibited regions, this classification helps the platform stay within the bounds of international compliance.

Understanding crypto exchange regulations, the rules that govern how digital asset platforms must operate in each jurisdiction is key to grasp why certain countries appear on Kraken’s block list. Regulations often demand KYC, AML, and licensing; if a country lacks a clear framework, Kraken opts out. In short, Kraken blocked jurisdictions are a direct result of these regulatory demands.

The concept of banned jurisdictions, areas where any major crypto exchange is barred from providing services due to sanctions or prohibitive laws expands beyond Kraken. Nations under international sanctions, such as North Korea or Iran, automatically fall into this category. This means that even if Kraken wanted to operate there, the global legal environment prevents it.

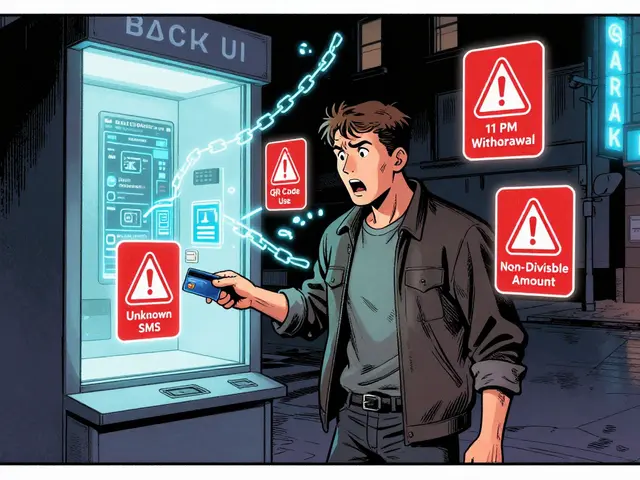

Another factor shaping the block list is the growing phenomenon of bank freezing crypto, financial institutions halting or seizing crypto‑related transactions under new AML rules. When banks in a jurisdiction start freezing crypto accounts, exchanges like Kraken must reassess risk and often preemptively block users from that region to avoid compliance breaches.

Tax compliance also plays a role. Countries with aggressive crypto tax enforcement or confusing reporting requirements, such as the United States' Form 1099‑DA rules, raise the compliance cost for exchanges. Kraken evaluates whether it can meet those tax obligations; if not, the jurisdiction ends up on the blocked list.

Security concerns add another layer. Some regions lack robust consumer protection or have high rates of cyber‑crime targeting crypto platforms. Kraken prefers to stay clear of such environments to safeguard user funds and its reputation.

All these elements—regulations, sanctions, bank actions, tax rules, and security posture—interact to form a dynamic map of blocked jurisdictions. As laws evolve, Kraken regularly updates its list to reflect the latest legal landscape.

Below you’ll find a curated set of articles that dive deeper into each of these topics, from enforcement actions and underground market premiums to practical workarounds for traders in restricted regions. Explore the collection to see how the broader crypto ecosystem navigates these challenges.

Learn which countries and regions Kraken blocks for crypto trading, understand US state-level token bans, the EU stablecoin delisting timeline, and how to stay compliant.

Continue Reading