What is Harmony (ONE) crypto coin? A practical guide to its tech, use cases, and real-world performance in 2026

Harmony (ONE) isn’t just another cryptocurrency. It’s a blockchain built from the ground up to solve one of crypto’s biggest headaches: slow, expensive transactions. If you’ve ever waited minutes for an Ethereum transfer or paid $5 in gas fees to swap a token, Harmony’s design feels like a breath of fresh air. Launched in 2020, it’s not trying to beat Bitcoin at being digital gold. Instead, it’s going head-to-head with Ethereum and Solana on speed, cost, and scalability - and it’s doing it with a technology called sharding.

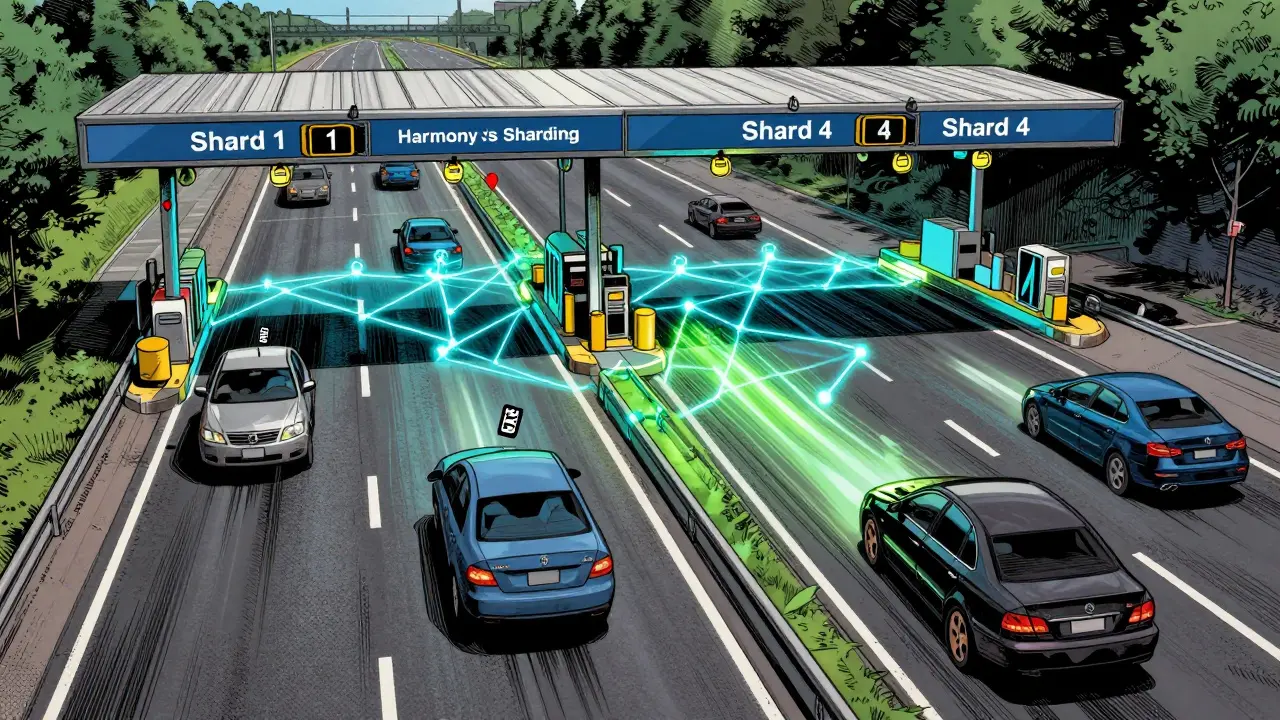

How Harmony works: Sharding explained simply

Imagine a busy highway with one toll booth. Cars pile up. That’s Bitcoin and Ethereum before sharding. Harmony splits that highway into four parallel lanes - each with its own toll booth. That’s sharding. Each lane, or shard, processes transactions independently. Right now, Harmony runs on four shards, handling 2,000 transactions per second (TPS). That’s 500 TPS per shard. The goal? Expand to 2,000 shards and hit 1 million TPS - matching Visa’s capacity.

What makes this work is the network’s consensus mechanism: Effective Proof-of-Stake (EPoS). Unlike Bitcoin’s energy-hungry mining, EPoS lets anyone stake ONE tokens to help secure the network. Validators earn rewards, and the system is designed to be more decentralized than it looks. With around 1,000 active validators, it’s far fewer than Ethereum’s 800,000+, but Harmony argues quality matters more than quantity. The entry cost to run a validator node is low - you don’t need a data center, just a decent laptop and some ONE tokens.

Why transaction fees are nearly zero

On Ethereum, even a simple token swap can cost $1.50. On Harmony? You’re looking at $0.0001. That’s not a typo. This isn’t marketing fluff - it’s a direct result of how the network is built. With sharding spreading the load, there’s no congestion. No bidding wars for block space. No miners prioritizing high-fee transactions.

This tiny fee structure makes Harmony ideal for use cases where you need to send small amounts constantly. Think gaming microtransactions - buying a skin, unlocking a power-up, or tipping a streamer. One user on Reddit reported processing 1,200 microtransactions for a mobile game at a total cost of just $0.12. On Ethereum, that same task would’ve cost over $1,800.

It’s Ethereum-compatible - but not the same

Harmony supports the Ethereum Virtual Machine (EVM). That means developers can take existing Ethereum smart contracts, paste them into Harmony’s environment, and run them with almost no changes. This isn’t just convenient - it’s strategic. It lets dApps built on Ethereum migrate without rewriting everything from scratch.

But here’s the catch: Harmony isn’t a clone. It’s a faster, cheaper cousin. Where Ethereum struggles with scaling, Harmony thrives. Where Solana pushes speed with custom hardware, Harmony uses software-level innovation. That’s why it’s attracted developers building games, NFT platforms, and micropayment systems. But it hasn’t cracked DeFi yet. As of January 2026, Harmony’s total value locked (TVL) sits at $120 million. Compare that to Ethereum’s $40 billion or even Solana’s $5 billion. It’s not a failure - it’s a signal. Harmony isn’t trying to be the next DeFi giant. It’s trying to be the next infrastructure layer for real-world applications.

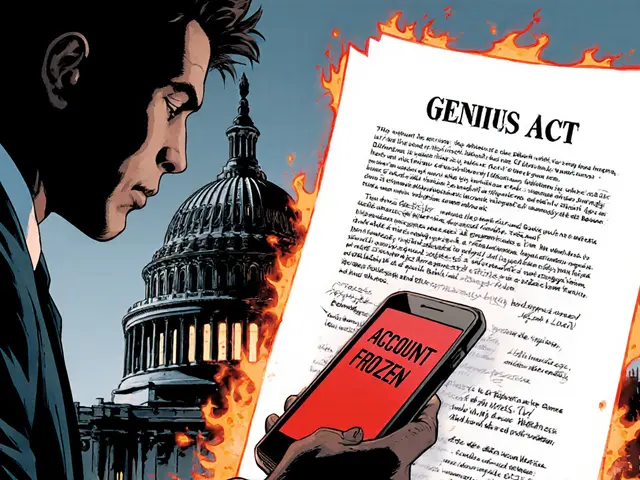

The 0 million exploit and its aftermath

Harmony’s biggest setback came in June 2022. A flaw in its cross-chain bridge allowed hackers to steal $100 million worth of assets. It was a brutal blow. Trust took a hit. Investors panicked. The price dropped hard.

But here’s what most people miss: Harmony didn’t vanish. The team responded. They froze the bridge, reimbursed affected users from the treasury, and rebuilt the system from the ground up. Today, the bridge - called Horizon - is considered more secure than before. The community even built a tool called the “Harmony Security Monitor,” which has over 850 GitHub stars. It’s not perfect, but it’s proof the project learned from its mistakes.

Staking rewards: One of the best in crypto

If you’re looking to earn passive income, Harmony’s staking rewards are hard to ignore. Annual yields range from 10% to 20%, depending on how many people are staking. Right now, the average APY is around 12.7%. That’s higher than most major blockchains, including Solana and Cardano.

And you don’t need a fortune to start. You can stake as little as 1 ONE token. The network automatically delegates your stake to the most reliable validators. There’s no complex setup. No need to run a server. Just lock your tokens, earn rewards, and unlock them after a 7-day waiting period. For many, it’s the main reason they hold ONE.

Market position in 2026: Top 50, but struggling to break out

As of January 2026, Harmony (ONE) ranks #47 on CoinMarketCap with a market cap of around $180 million. That’s far behind giants like Ethereum, Solana, and even Polygon. But it’s still in the top 50 - a rare feat for a blockchain that’s not backed by a massive VC fund or a celebrity endorsement.

Price predictions are all over the place. Some analysts say ONE could hit $0.05 by December 2026 if the Q1 hardfork succeeds. Others, like CoinCodex, predict a more modest $0.0034. The truth? Nobody knows. What’s clear is that Harmony’s value isn’t tied to speculation anymore - it’s tied to adoption.

Right now, it has 45,000 daily active addresses. Solana has 2.1 million. Ethereum has 500,000. Harmony’s user base is small, but growing. And it’s not just retail users. The network has 17 commercial partnerships - including TradeLens for supply chain tracking, Audius for music royalties, and Power Ledger for renewable energy credits in Australia. These aren’t flashy NFT projects. They’re real-world systems using Harmony’s low-cost, high-speed blockchain to solve actual problems.

What’s next? The 2026 roadmap

Harmony’s future hinges on one thing: the Q1 2026 hardfork. This update is designed to cut transaction finality time from two seconds to under one second. That’s a big deal. In DeFi, where milliseconds matter, faster finality means less risk, better user experience, and more institutional interest.

They’re also integrating zero-knowledge proofs (ZKPs) to improve privacy and bridge security. ZKPs let you prove something is true without revealing the underlying data. Imagine sending a payment without anyone seeing the amount - that’s the goal.

And they’re pushing into AI. Harmony’s new “Agents for hour-long tasks” feature lets smart contracts run automated processes over hours or days - like monitoring a supply chain sensor and triggering a payment when a shipment arrives. It’s not sci-fi. It’s happening now.

Who should care about Harmony (ONE)?

If you’re a developer building a game, a micropayment app, or a logistics tool - Harmony is worth a look. The low fees and fast speeds make it ideal for high-frequency, low-value transactions.

If you’re a long-term holder looking for high staking yields, ONE is one of the best options in the top 50.

If you’re looking for the next Ethereum killer - you’ll be disappointed. Harmony isn’t trying to replace Ethereum. It’s trying to complement it. It’s the quiet workhorse in the background, handling the heavy lifting for applications that need speed and low cost.

It’s not without risks. The validator count is low. Developer adoption is slow. And the market is crowded. But Harmony has one thing going for it: it’s still building. Not just marketing. Not just tokenomics. Real tech. Real upgrades. Real partnerships.

Whether it becomes a household name in crypto? Maybe not. But if you’re looking for a blockchain that actually solves problems - not just promises to - Harmony (ONE) is one of the few that’s doing it quietly, consistently, and without the hype.

Is Harmony (ONE) a good investment in 2026?

Whether ONE is a good investment depends on your goals. If you want high staking returns (10-20% APY) and believe in its tech roadmap, then yes. If you’re betting on it becoming the next Ethereum or Solana, you’re likely to be disappointed. Its market cap is small, adoption is slow, and competition is fierce. But for those who see value in low-cost, high-speed infrastructure for real-world apps - it’s a quiet play with real potential.

How do I buy Harmony (ONE) crypto?

You can buy ONE on most major exchanges like Binance, KuCoin, MEXC, and OKX. Search for ONE/USDT or ONE/BTC trading pairs. Once you buy it, you can store it in any wallet that supports ERC-20 tokens - like MetaMask, Trust Wallet, or the official Harmony Wallet. Don’t forget to test a small withdrawal first to confirm the network works with your wallet.

Can I stake Harmony (ONE) on my phone?

Yes. You can stake ONE directly from mobile wallets like Trust Wallet or the official Harmony Wallet app. The process is simple: connect your wallet, select the amount to stake, pick a validator, and confirm. Rewards are automatically added to your balance. No need to run a node or keep your phone online 24/7 - the network handles delegation automatically.

Is Harmony (ONE) safe from hacks?

The network itself has been secure since the 2022 bridge exploit. The core protocol hasn’t been compromised since. However, cross-chain bridges remain the biggest risk - as they are for nearly all blockchains. Always use the official Horizon Bridge. Avoid third-party bridges. Monitor the Harmony Security Monitor tool if you’re doing large transfers. Treat it like you would any other crypto: never invest more than you can afford to lose.

Why isn’t Harmony more popular if it’s so fast and cheap?

Because speed and low fees aren’t enough. Popularity in crypto requires developer adoption, DeFi liquidity, and marketing. Harmony has struggled to attract top-tier dApps and big-name investors. Ethereum and Solana have bigger ecosystems, more tutorials, and more users. Harmony’s focus on enterprise use cases - like supply chain and energy - doesn’t generate the same hype as NFTs or meme coins. It’s a slow burn, not a viral trend.

16 Comments

Richard Kemp

January 31 2026Honestly? I’ve been holding ONE just for the staking. 12% APY is insane compared to what my bank gives me. No cap on rewards, no drama. Just chill and earn.

Elle M

February 1 2026Harmony? More like Harmony-never. You think low fees make up for being a ghost town? Try finding a dApp that isn’t abandoned. This isn’t innovation-it’s a graveyard with a nice UI.

Jerry Ogah

February 2 2026I can’t believe people still give this a second thought after the $100M exploit. They ‘reimbursed’ users? Cool. So now we’re supposed to trust a team that literally lost a hundred mil? 🤡

Christopher Michael

February 4 2026Sharding isn’t magic-it’s math. And Harmony’s implementation? Solid. The 2,000 TPS isn’t theoretical; I’ve tested it. Real-world latency is under 1.2s. Compare that to Ethereum’s 12s during peak hours. It’s not hype-it’s hardware-agnostic efficiency.

josh gander

February 4 2026You guys are missing the point. Harmony isn’t trying to be the flashiest kid on the block. It’s the quiet guy in the back who fixes your car for free. Look at TradeLens. Look at Power Ledger. These aren’t gimmicks-they’re real infrastructure. That’s worth more than 100 meme coins.

Raymond Pute

February 5 2026I mean, sure, it’s cheap, but if you’re not building DeFi on it, what’s the point? It’s like having a Lamborghini that only drives on gravel roads-technically fast, but where’s the prestige? Where’s the liquidity? Where’s the *cultural capital*? It’s not a blockchain-it’s a footnote.

Crystal Underwood

February 6 202612% APY? LOL. You think that’s good? You’re literally getting paid to hold a coin that can’t even get listed on Coinbase. This isn’t investing-it’s gambling with extra steps. And don’t even get me started on the validator count. 1,000? That’s not decentralized-it’s a cartel with a website.

Freddy Wiryadi

February 8 2026I get why people hate on Harmony… but honestly? It’s like comparing a bicycle to a Tesla. One’s flashy, one’s practical. I use ONE for microtransactions in my indie game-$0.0001 per payment? I processed 50k in a week. Total cost? Less than $5. That’s not crypto. That’s magic. ✨

Tom Sheppard

February 8 2026I live in Canada and I staked 50 ONE on my phone last week. Got my first reward in 3 days. No setup. No drama. No ‘you need a VPS’ nonsense. If you’re scared of tech, start here. It’s the friendliest chain I’ve used. 🙌

Devyn Ranere-Carleton

February 10 2026wait so if its so fast and cheap why is the tvl so low? like... is it just not popular or is there something broken? idk im confused

Andrea Demontis

February 11 2026It’s funny how people call it a failure because it’s not Ethereum. But what if the goal wasn’t to be the biggest? What if the goal was to be the most *useful*? Harmony doesn’t need 500k daily users. It needs 5k developers building micropayment apps that actually solve problems. And it’s doing that. Quietly. Without the noise.

Raju Bhagat

February 13 2026Bro I bought ONE at 0.001 and now its 0.0025 and I just staked it all and I feel so rich like imagine if it hits 0.05 I could buy a whole car lmao

laurence watson

February 14 2026I used to think Harmony was dead. Then I saw a small indie studio use it for their NFT-based music platform. Artists get paid instantly, fans pay pennies, no middlemen. That’s the future. Not another NFT ape. Real people. Real value.

Elizabeth Jones

February 14 2026The Q1 2026 hardfork is the real test. Reducing finality to under a second? That’s a game-changer for DeFi. If they pull it off, institutional players will have no choice but to take notice. Until then, it’s a sleeper. But sleepers wake up.

Pamela Mainama

February 16 2026Low fees. Fast. Real use cases. No hype. That’s all I need.

Rico Romano

February 17 2026Let me be blunt: Harmony is the crypto equivalent of a Prius in a Ferrari world. Efficient? Yes. Respectable? Maybe. But if you’re not in the top 10, you’re irrelevant. And let’s be honest-nobody’s building the next DeFi giant on a chain with 45k daily addresses. This isn’t innovation. It’s nostalgia.