Priority Fee: What It Is and Why It Matters in Crypto and Blockchain Transactions

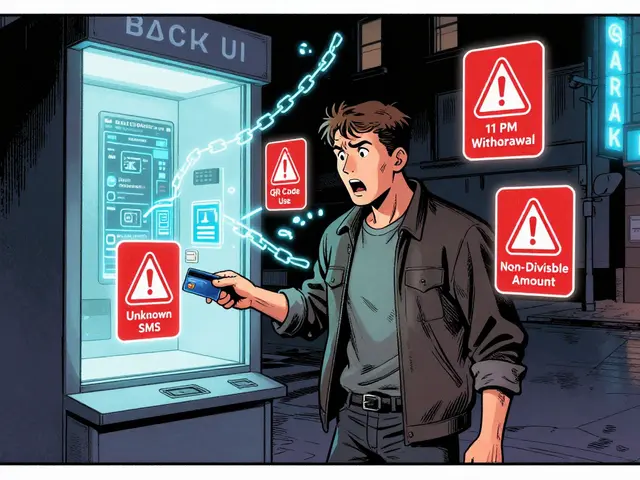

When you send crypto, your transaction doesn’t just jump to the front of the line—it priority fee, a supplemental payment users offer to incentivize miners or validators to include their transaction in the next block. Also known as a tip, it’s what keeps transactions moving when the network gets busy. Without it, your swap, stake, or airdrop claim can sit for hours—or even days—while others pay more to jump ahead.

This isn’t just about speed. The priority fee, a supplemental payment users offer to incentivize miners or validators to include their transaction in the next block. Also known as tip, it’s what keeps transactions moving when the network gets busy. This isn’t just about speed. The Ethereum gas fees, the cost of executing smart contracts or transferring tokens on the Ethereum network, composed of base fee and priority fee system uses priority fees to balance demand. When everyone’s trading DeFi tokens like SAKE or swapping on Velodrome v3, the base fee stays fixed, but the priority fee spikes. That’s why some users pay $5 to claim an airdrop while others wait for the rush to die down. It’s not greed—it’s economics.

And it’s not just Ethereum. On chains where validators choose which transactions to include, MEV, Maximal Extractable Value, the profit miners or validators can make by reordering or censoring transactions becomes a factor. Front-running, sandwich attacks, and arbitrage bots all rely on users paying higher priority fees to get their trades processed first. That’s why some airdrops—like the XCV or HC NFT drops—require you to time your claim perfectly, or risk missing out because someone else paid more to sneak ahead.

Even in places like Venezuela, where mining is state-controlled, the idea of paying more to get priority still applies. Miners there don’t compete for block rewards—they follow government rules. But on open networks, you’re always competing. The priority fee is your leverage. Pay too little, and your transaction gets stuck. Pay too much, and you’re throwing money away. The trick? Know when to pay, when to wait, and how much is enough.

That’s what you’ll find in these posts: real examples of how priority fees affect everything from DeFi swaps on SushiSwap V3 to claiming NFTs on CoinMarketCap. Some users paid extra to get in early. Others lost out because they didn’t understand the system. You’ll see how it works in practice—no theory, no fluff, just what happens when the network gets crowded and someone’s willing to pay more to get ahead.

Learn how priority fees and miner tips affect your blockchain transaction speed. Understand Ethereum’s EIP-1559 system, Bitcoin’s fee model, and how to set the right tip to avoid delays and wasted money.

Continue Reading