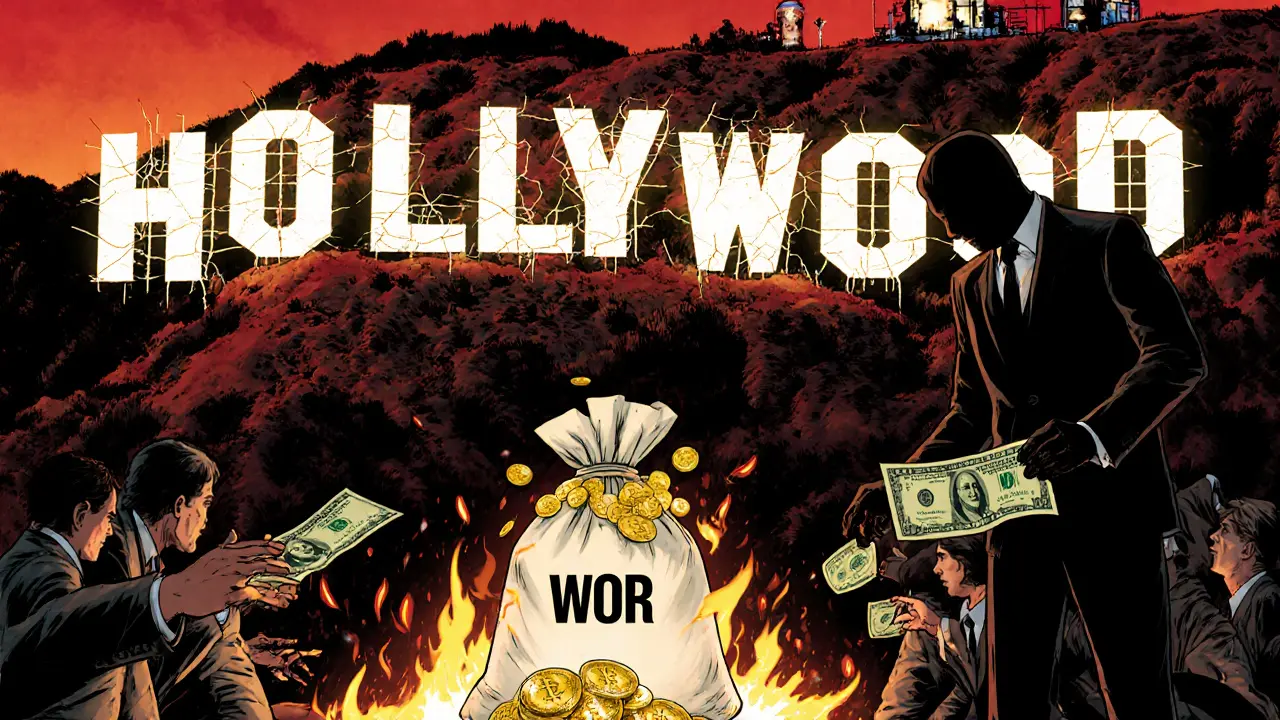

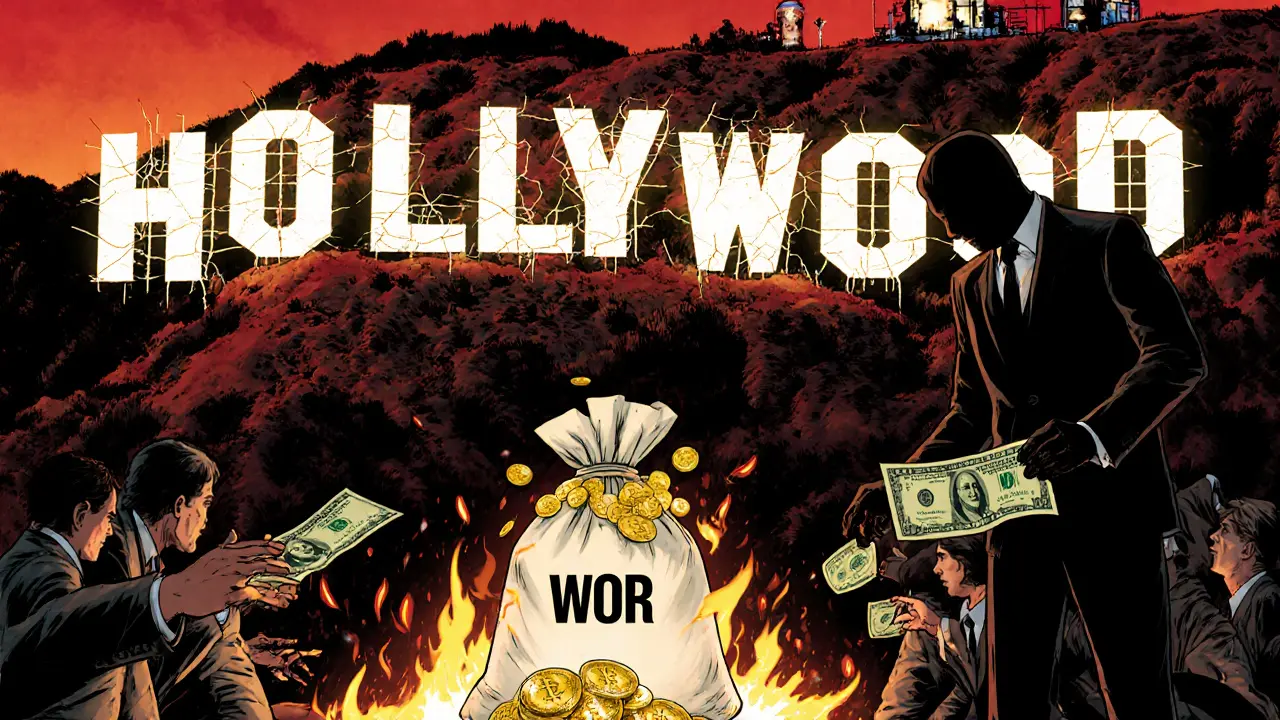

WOR Token: What It Is, How It Works, and Why It Matters

When you hold a WOR token, a digital asset designed to give holders decision-making power in a decentralized protocol. Also known as a governance token, it’s not just another coin—it’s a vote. Unlike tokens that only rise or fall in price, WOR lets you shape the future of the project you’re invested in. You can vote on fee changes, treasury spending, or even whether to merge with another protocol. This isn’t theoretical. Real people with real stakes use these tokens to block bad decisions or push for better ones.

Governance tokens like WOR are the backbone of DAOs, organizations run by code and community votes instead of CEOs. They replace top-down control with open participation. But here’s the catch: most holders don’t vote. They buy the token hoping for a price pump, then forget about it. That’s why projects with low voter turnout often end up controlled by a few whales. If you hold WOR, you’re not just a passive investor—you’re a stakeholder. Ignoring your vote means giving up your influence. And in DeFi, influence is power.

The same logic applies to DeFi, financial systems built on blockchain that let you lend, borrow, or trade without banks. Many DeFi protocols issue governance tokens to align incentives. Holders get rewarded not just with potential price gains, but with say over how the system evolves. That’s why some tokens with tiny market caps still matter—they’re the only voice left in a shrinking ecosystem. WOR could be one of them. Or it could fade away if no one uses it. The difference? Participation.

You’ll find posts here that dig into how governance tokens like WOR compare to others—what makes some succeed while others die. Some explain how to actually vote, what to look for in a proposal, and how to avoid being outmaneuvered by big holders. Others show you how airdrops, like those for XCV or SAKE, often tie into governance token distribution. And there are warnings: tokens with zero circulating supply, dead teams, or fake airdrops are everywhere. WOR isn’t safe just because it exists. It’s safe only if people care enough to use it.

What you’ll find below isn’t a list of hype. It’s a collection of real breakdowns, red flags, and practical guides—every post rooted in what’s actually happening, not what’s being promised. Whether you’re holding WOR right now or just curious, these articles will help you decide if it’s worth your time, your vote, or your money.

WOR crypto is a fraudulent token pretending to revolutionize film with blockchain. It has no real team, no partnerships, and a 99.5% price crash. Experts call it a scam. Avoid it.

Continue Reading